Author: IGNAS | DEFI RESEARCH Translation: Shan Opa, Jinse Finance

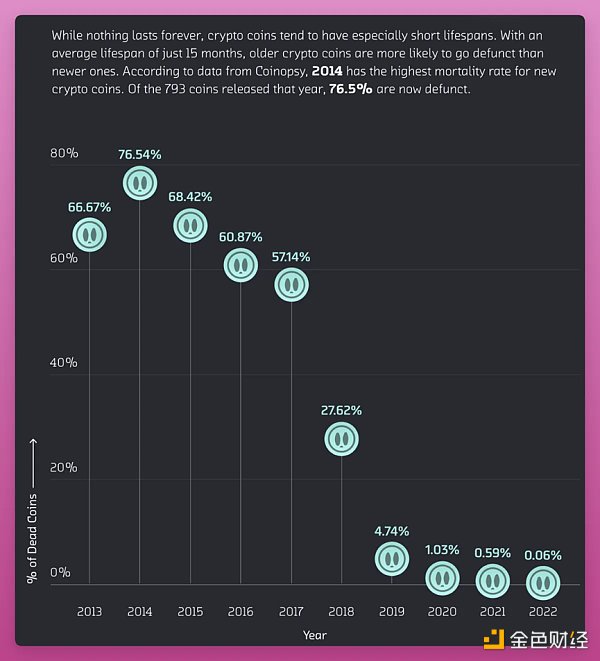

Research shows that 91% of the coins that were part of the 2014 cryptocurrency crash are now dead. It is estimated that nine out of ten blockchain projects will also fail, with the average token lifespan being only 15 months.

With success rates so low, I wanted to share my thoughts on identifying projects that are likely to survive and thrive.

The problem is - there are too many projects, but our time and energy are limited. It's great to spend a few days researching a coin, but cryptocurrencies evolve quickly, so save some energy for your decision-making.

That’s why I focus on the really important part of token economics.

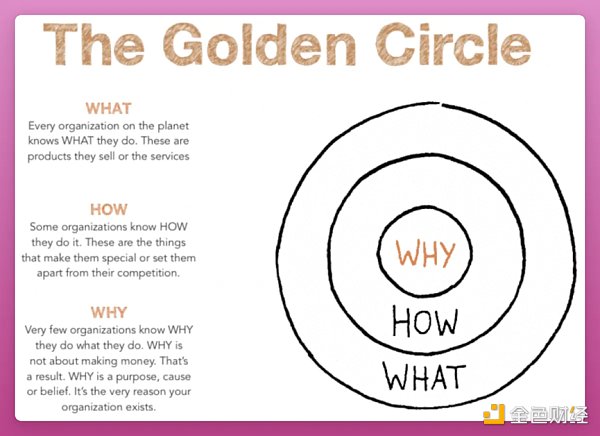

Start with "Why"

According to Signac, "Few people or companies can clearly articulate why they do something."

This applies more to crypto projects and their tokens. It seems like projects are emerging every day based on the dominant narrative of the day.

I believe it is important to take some time to understand why a project is issuing a token before investing in it.

This can be broken down into three questions:

1. Why does the project issue tokens?

2. How does it work?

3. What functions does it have?

Finding the real reason a coin exists

In fact, I believe most projects don't require tokens at all to run. Think about it: do the following projects really require tokens to run?

DEX and DEX aggregators

Collateralized Stablecoin

loan agreement

revenue aggregator

wallet

For example, a vampire attack on SushiSwap could force Uniswap to issue their own token. $UNI has been feeling cumbersome for a while, but thanks to potential revenue sharing finally kicking in, UNI is starting to make sense.

Most projects issue tokens anyway. The reason is obvious:

Fundraising

build community

guide liquidity

Many protocols view tokens solely as fundraising tools (obviously, they won’t say this publicly).

But the great projects are the ones that have a deeper raison d’être for their tokens. These are well thought out features that are not so obvious:

Distribute ownership and power (who decides which tokens are included in Aave or where/how rewards are distributed?)

Risk management (who assesses risk and who is liable if the agreement becomes insolvent?)

Future utility options (initially launched as a community/fundraising tool, but functionality will be added to decentralize the protocol and transfer ownership to the community in a planned way).

Before investing, understand the real reason a project is issuing a token, and it’s not just for fundraising goals.

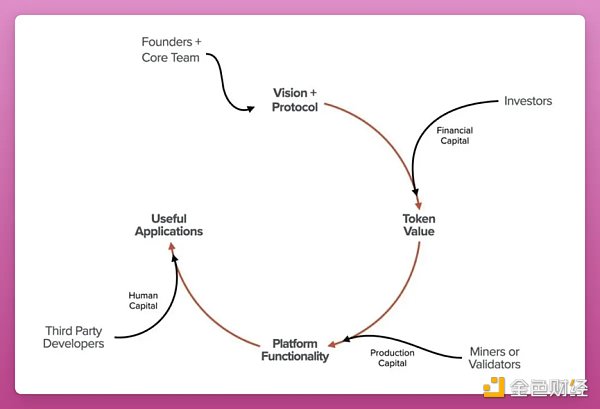

Analyze how the token ecosystem works

The “how” part can be complex, especially for projects using innovative game theory.

Each project provides an explanation of token economics in its documentation section. It’s easy to figure out “how” it works, more challenging to understand.

I believe that the best token designs have a flywheel effect - a virtuous cycle that drives adoption, usage and appreciation of the token.

This creates a positive feedback loop that strengthens the token’s ecosystem.

Curve’s veTokenomics is probably one of the most copied designs: veCRV encourages long-term holding, incentivizes liquidity, and attracts other protocols to build on Curve.

However, keep in mind that token designs vary in complexity, with some being intentionally complex to deceive investors, while others offer unique innovation and create value.

Your challenge is to differentiate between the two.

After all, “ If you don’t know where the revenue comes from, then you are the revenue. ”

Staking is probably the simplest and arguably most useful feature of a coin. If the project manages to reward the user ecosystem with airdropped tokens, then this would be a strong value proposition. For example, consider Celestia's TIA or Cosmos' ATOM.

However, sometimes a coin comes along that is so unique and different that it changes the trajectory of an industry. Originality in token economics can drive the industry forward and start a new bull market.

Find tokens that are valuable to holders

After understanding the fundamental reason why a token exists and how it operates, it is now time to find out how the token creates value for investors. We don’t want a token that doesn’t have any use case.

example:

Pay the fee

revenue sharing

fee discount

Governance Agreement

for liquidity/risk management

The most popular example is agreement fee revenue sharing. Or some projects have integrated the token into the core functionality of the protocol.

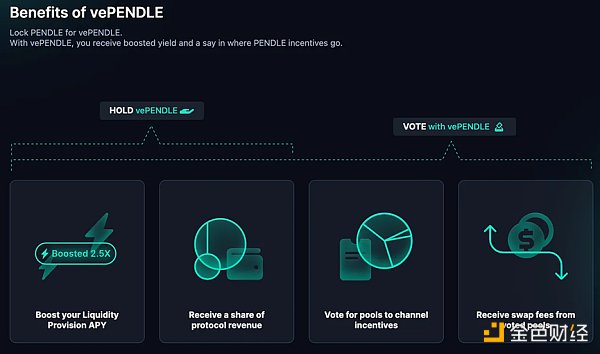

For example, Pendle and its vePendle design are on the rise. vePENDLE rewards users with increased LP APY and part of the protocol revenue. And since Pendle has successfully positioned itself as a revenue/points mining hub for DeFi, the token has benefited from growth in adoption/TVL and other metrics.

vePENDLE also gives users voting rights to determine incentive distribution. All in all, vePENDLE’s token economics are simple in design and value growth is straightforward.

Assess demand and supply mechanisms

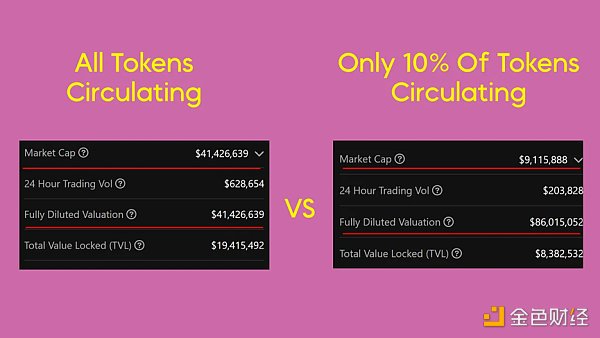

Evaluate the ratio of market capitalization (MC) to fully diluted valuation (FDV).

A low market cap/fully diluted valuation ratio means more tokens will be released into the market, putting downward pressure on the price.

Consider who will buy these newly issued tokens!

I agree that FDV will be a popular meme in the short term. Just look at Worldcoin’s recent surge!

But you probably don’t want to hold onto these coins when a bear market hits. Eventually, real demand should offset the increase in supply.

My current thinking on this cycle is short to medium term: as long as the main unlock is 6 months or more away, market cap is more important than FDV.

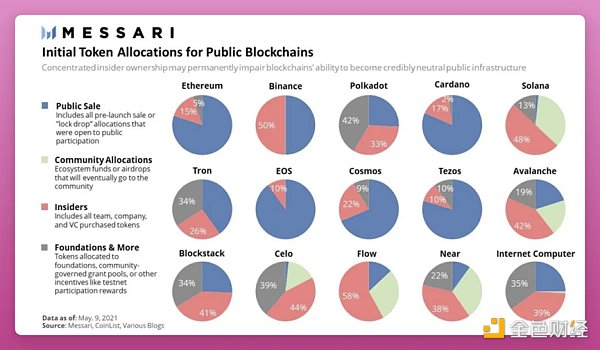

Evaluate token allocation

Assess the long-term potential of a token by understanding its allocation. There is no simple answer to what is the best allocation ratio. It varies depending on the project and the dominant narrative at the time.

Remember those teams allocating 0% of their “fair launch” tokens?

Everyone focuses on the fact that too many team allocations can lead to sell-offs.

However, there is a problem with assigning too few teams: too few can undermine the financial incentive to build a team.

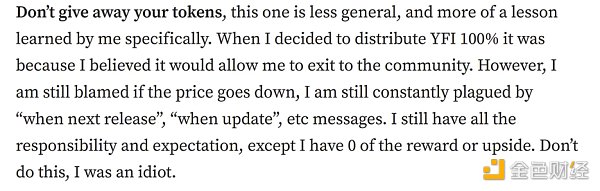

Andre Cronje wrote in his blog post “Building in Defi Sucks (Part 2)” that giving 100% of the tokens to the community was a mistake.

I had no rewards or benefits other than responsibilities and expectations. Don't do this, I'm stupid. -Andre Cronje

It seems that the “fair start” trend is now outdated. The most recent attempt was the BRC20 token, but 99% of them quickly inflated and disappeared…

Long-term and short-term holding methods

I focus on medium to long-term holdings, so I look for coins with a long-term linear unlocking schedule (no big cliff unlocks) and a MC/FDV ratio above 0.8. The team and VC allocate about 30%.

If your focus is on short-term trading, you should master coin analysis tools:

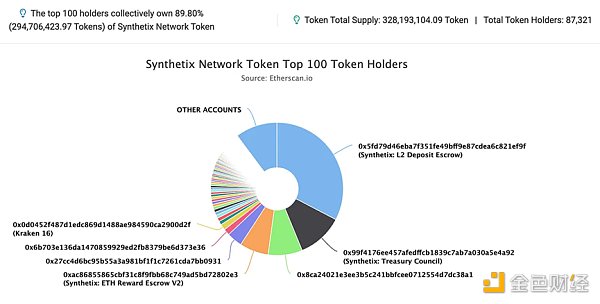

••Etherscan: Check the proportion of tokens held by whales. You should also check if the tokens are locked in a smart contract or held in a single wallet address.

(Example: The top 100 holders hold a total of 89% of SNX, but 32% is actually locked in staking)

•Dune: For dedicated project dashboards or community-built dashboards, like what DeFi Mochi does.

•Nansen: Find out who holds the tokens and where they are going.

Assess actual liquidity

Check if there is real demand for the coin and if it can be purchased.

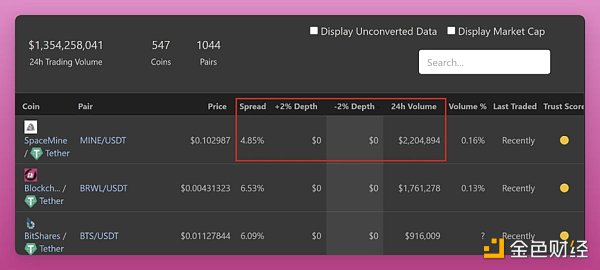

Don’t rely solely on trading volume, as cryptocurrency exchanges are notorious for “wash trading” – buying and selling coins from themselves to create an illusion of demand.

Check liquidity depth on Coingecko or Coinmarketcap to assess true liquidity.

Sometimes there are unique token designs, but low liquidity, which means large investors who could push the price can't get in.

Token functionality comes last

The “what” part is simple – it’s the functionality of the token, such as voting, staking, VIP access, in-app payments, or burning per transaction.

In my experience, projects that don't know "why they do it" are usually focused on providing as much functionality as possible. The website is filled with intricate graphics and designs that entice you to buy immediately.

However, don’t be fooled by simple marketing – look at how these features support the growth of the protocol and create real value for token holders.

I like Crypto Linn’s simple approach of investing in protocols that make users rich. A simple yet powerful framework.

You only need one to three killer use cases.

simplified approach

Discovering the next great coin can be a challenging task, especially with so many new ones emerging every day.

It’s difficult to keep up with all the new projects and research each one thoroughly.

That's why I've kept this guide short and easy to understand - it can be summed up in 6 actionable points:

Goal: Understand why the token exists and whether it is worth your time.

Function: Examine the flywheel effect and potential for long-term success.

Value: Don’t just look at the bells and whistles, but focus on the actual value to token holders.

Dynamics: Consider token allocations, market cap/fully diluted valuation ratios, unlocks and buying pressure.

Liquidity: Examine liquidity depth and demand to assess token value and growth.

Analysis: Master the tools to make informed decisions about investing and selling.