With the approval of the BTC spot ETF, major global institutions and individuals are continuously increasing their BTC holdings, driving up the price of BTC, which has now risen to become one of the top ten assets by market capitalization globally. In this market cycle, BTC inscription and BTC scaling are two sub-sectors that have received significant market attention. The exploration of diversified returns for BTC ecosystem assets is attracting the attention of the crypto market.

So, which solution will be the optimal one to address issues such as Bitcoin asset interest generation, network confirmation delays, lack of smart contracts, and excessively high gas fees?

Currently, there are two main solutions for improving the ecosystem of Bitcoin: Layer 2 and sidechains.

As one of the investors in BounceBit's $6 million funding round, HTX Ventures views BounceBit and its CeFi+DeFi product model as a potential innovative solution to unlock the Bitcoin ecosystem and enable wider adoption. This research report delves into BounceBit, outlining its product design philosophy and HTX Ventures' investment rationale.

HTX Ventures is the global investment arm of Huobi HTX, integrating investment, incubation, and research to identify the best and most promising teams globally. Currently, HTX Ventures supports over 200 projects across multiple blockchain sectors, with some high-quality projects already listed on Huobi HTX.

What is BounceBit?

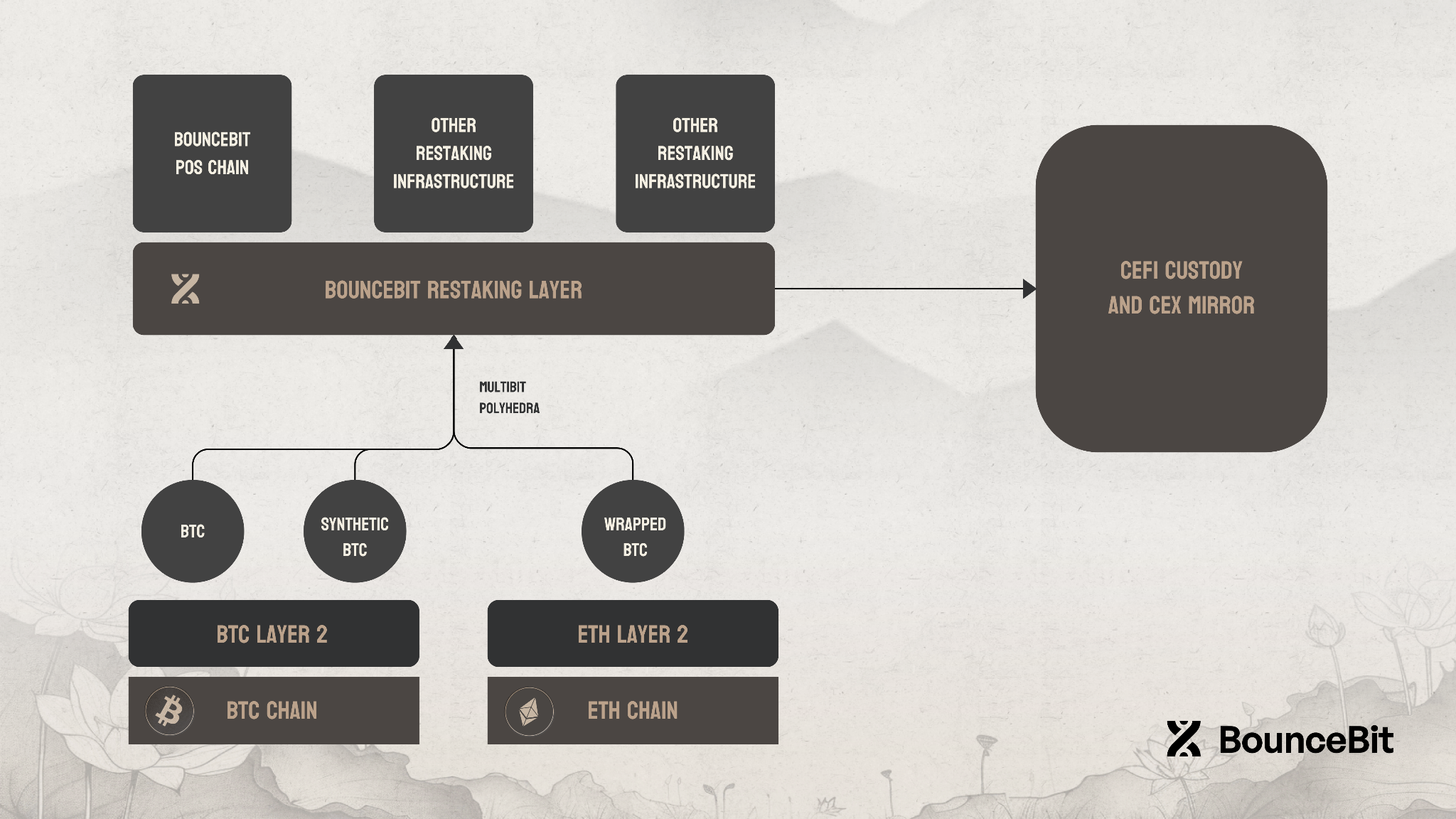

BounceBit is a BTC restaking chain designed specifically for Bitcoin. Its BTC restaking infrastructure provides a foundational layer for various restaking products, secured by regulated custody from Mainnet Digital and Ceffu. It employs a hybrid BTC+BounceBit PoS mechanism for verification.

BounceBit solves the trust issue of the underlying BTC assets through multi-party custody, creating BBTC for DeFi interaction on the Bounce mainnet. The native BTC assets are used to participate in low-risk arbitrage strategies on various centralized exchanges. In addition, under the hybrid token staking mechanism, staking BBTC+BB (BounceBit's native token) can generate LSD tokens, further earning node staking rewards and restaking income.

By combining centralized custody and sidechains, BounceBit aims to solve the long-standing trust issues of sidechains while revitalizing the BTC ecosystem. This will reduce transaction fees and unlock the financial potential of BTC, enabling its application in more scenarios such as DeFi, gaming, and social networking.

How does BounceBit work?

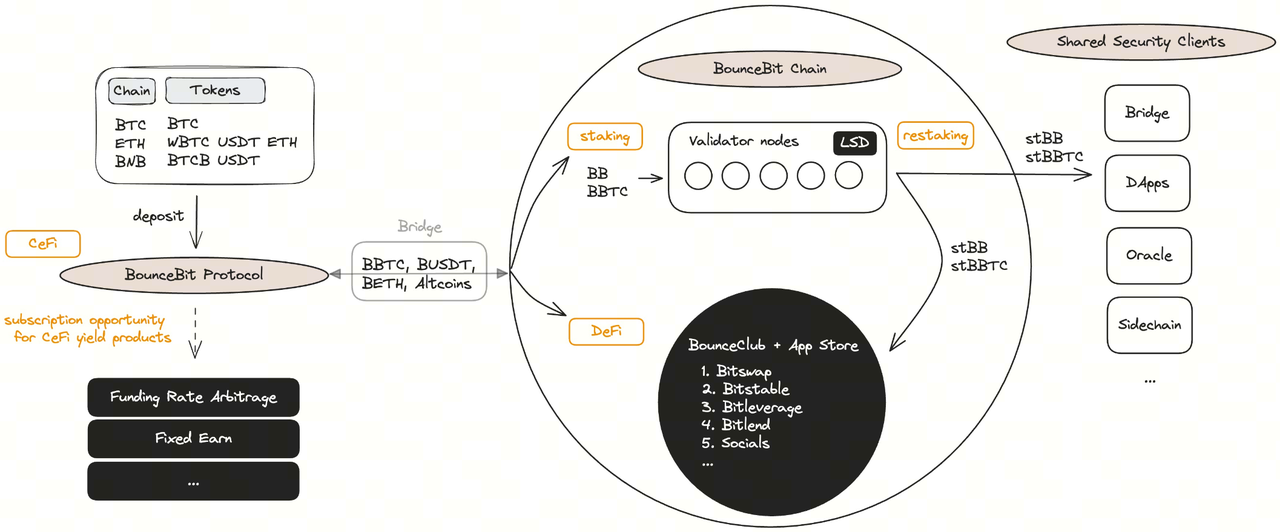

BounceBit's product design is very ingenious, as shown in the image below:

BounceBit's operating mechanism and revenue sources diagram

Users can deposit various types of on-chain Bitcoin assets into the BounceBit protocol, which is actually overseen by the MPC wallet jointly managed by BounceBit, CEFFU, and Mainnet Digital. This addresses the trust issue and ensures the security of user assets.

● Through Ceffu's OES (Over-the-Counter) settlement solutions such as MirrorX, users can securely access deep liquidity on exchanges and earn profits through diversified trading strategies, while their funds remain securely held in on-chain MPC wallets. This wallet technology significantly reduces the risk of single point of failure (SPOF) by splitting private keys into multiple parts. Furthermore, because user funds are not actually stored on any centralized exchange but are mirrored through Ceffu, counterparty risk is reduced.

● BounceBit partners with a range of asset managers with a long track record of positive returns, trading through MirrorX. All of these asset managers employ interest rate arbitrage as their primary trading strategy. Interest rate arbitrage is a risk-free strategy that profits from differences in interest rates between different markets.

● On the other hand, after users transfer their native assets to BounceBit, new B-Token assets will be minted. Taking BTC as an example, after a user deposits BTC, they will receive BBTC assets operating on the BounceBit mainnet. Currently, this asset can be used for two main on-chain activities: First, in BounceBit's hybrid staking model, users can participate in node staking using BBTC+BB, and the generated LST tokens can be used for further re-staking activities to amplify staking returns; second, BBTC can be used for various on-chain DeFi interactions. BounceBit has also launched BounceClub, a platform for developers and users where users can increase the yield potential of their BTC assets by participating in diverse DeFi activities and yield generation activities on the BounceBit mainnet.

BounceBit Product Design Philosophy

Source: https://x.com/bounce_bit/status/1771481179683692656?s=46&t=ODDW1eIwucwwKwUR-9MGBg

In terms of revenue sources, users can obtain asset returns from multiple channels by participating in BounceBit staking and on-chain financial interactions:

● CeFi yields earned through native assets in centralized exchange sub-accounts.

● DeFi yields earned through on-chain interactions with BounceBit.

● Use BBTC+BB for staking and the restaking yield of LST generated after staking.

In summary, BounceBit ensures asset security through multi-party custody while providing diversified ways to generate returns.

Why did HTX Ventures invest in BounceBit?

HTX Ventures, as one of BounceBit's major investors, firmly believes that BounceBit can effectively meet the actual needs of the market through its centralized custody model built on standard sidechains.

BounceBit's core objective is to address issues such as generating interest on Bitcoin assets, inefficient use of idle BTC, lack of innovation, and high gas fees. Its fundamental purpose is to provide diversified revenue streams, thereby alleviating the challenge of Bitcoin's lack of smart contract functionality. Currently, solutions to enhance the BTC ecosystem primarily include Layer-2 and sidechain technologies.

The primary Layer 2 solution is to execute Bitcoin transactions off-chain, thereby improving transaction speed. Currently, Layer 2 solutions mainly fall into two categories: state channels and rollups. A typical example of a state channel project is the Lightning Network, but its scalability is very limited. Currently, the Lightning Network primarily improves peer-to-peer transaction speed and struggles to deploy Ethereum-level smart contracts. Regarding rollups, due to issues with the underlying code and signature verification, Bitcoin's Layer 2 solutions cannot obtain mainnet verification when sending back the ledger, thus failing to provide sufficient trust guarantees. A more promising approach is to upgrade the Bitcoin IP layer based on the new Taproot protocol, with miners updating the underlying code to support OP/ZKP verification and Bitcoin miner computation execution. However, the implementation of rollups is still a long way off.

A sidechain is essentially a completely independent blockchain. Typically, it maps Bitcoin from the mainnet to the sidechain, allowing the issuance of new assets to achieve the mapping and application of the native asset. Sidechains usually offer faster processing speeds, but from a trust verification perspective, they are completely independent of the Bitcoin mainnet, thus facing trust and consensus issues. They are also more susceptible to malicious actions by project teams, which could compromise the security of the mapped assets. This is the TVL (Total Value Limit) dilemma commonly faced by sidechains.

BounceBit addresses some of the challenges in the Bitcoin ecosystem by establishing an independent PoS layer chain. Within this framework, nodes ensure chain security by staking BTC and BounceBit tokens; the connection between BounceBit and BTC is established at the asset level, not the protocol level.

By combining centralized custody and sidechain technology, BounceBit attempts to overcome the consensus and trust issues inherent in sidechains. In the current environment, this hybrid centralized-decentralized model may offer a compromise between technical and trust-related solutions. BounceBit's design philosophy and the background of its development team give it a competitive edge and open up space for exploring new opportunities.

Looking to the future

With the approval of the BTC spot ETF, major global institutions and individuals are continuously increasing their BTC holdings, causing the BTC price to rise accordingly. It has now risen to become one of the top ten assets by market capitalization globally. Meanwhile, in this market cycle, BTC inscription and BTC scaling are two highly watched sub-sectors. Some progress in BTC has excited the market, attracting more attention to the BTC ecosystem. Developing more asset applications and generating more returns around BTC has become a common focus for developers and market participants.

BounceBit, as a CeFi+DeFi product, is innovative in its product model. By combining centralized and decentralized mechanisms, it introduces a third-party custody mechanism into the trust solution, generating new EVM on-chain assets to revitalize the financial attributes of the original assets, which may become a new solution for the Bitcoin ecosystem.

HTX Ventures believes that the future will see more technological developments and breakthroughs in the BTC ecosystem, along with the emergence of more ecosystem projects, which is something the entire crypto market should be excited about and look forward to. At this stage, BounceBit's CeFi+DeFi mechanism has good TVL growth potential and is expected to explore diversified returns for BTC ecosystem assets.

*Special thanks to BounceBit for their support in writing this article.

About HTX Ventures

HTX Ventures is the global investment arm of Huobi HTX, integrating investment, incubation, and research to identify the best and most promising teams globally. As a pioneer in the blockchain industry for over a decade, HTX Ventures drives the development of cutting-edge technologies and emerging business models within the industry, providing comprehensive support to partner projects, including financing, resources, and strategic consulting, to build a long-term blockchain ecosystem. Currently, HTX Ventures supports over 200 projects across multiple blockchain sectors, with some high-quality projects already listed on Huobi HTX. Furthermore, HTX Ventures is one of the most active fund-of-funds (FOF) investors, collaborating with top global blockchain funds such as Bankless, IVC, Shima, and Animoca to build the blockchain ecosystem.