Q1/2024 recorded the return of investment activity from funds into Crypto projects after more than a year of quiet. Especially in March, it was noted the acceleration of funds in selecting and deciding to quickly invest in projects to keep up with the market's trend of interest.

The following are the latest assessments from BeInCrypto on VC investment trends from the YTD.

The number of Capital calls is increasing, but the money is not much

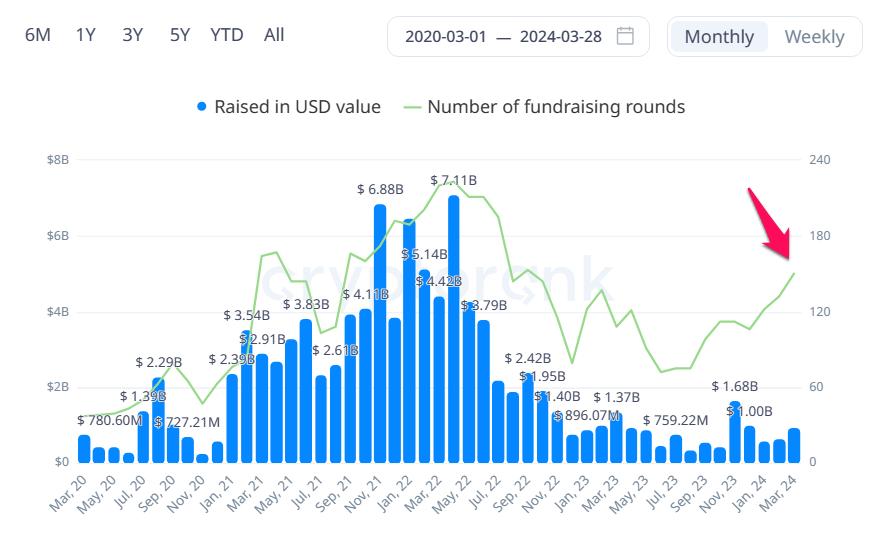

Using data compiled by Cryptorank over the years on the amount of money raised and the number of Capital calls in the entire Crypto market, it can be concluded that: in Q1/2024, the number of Capital calls increased sharply and set a high level, But the amount of money called is not much.

Total number of Capital calls and total amount raised. Source: Cryptorank.

Total number of Capital calls and total amount raised. Source: Cryptorank.- In Q1/2024 alone, there were nearly 300 Capital calls conducted with a total amount raised of nearly 2.2 billion USD. In March alone, there were 150 Capital calls made with a raised amount of nearly 1 billion USD. However, the amount of money raised in March is still far behind the $1.68 billion in December 2024.

- Looking at the graph, the blue line is the fluctuation in the number of successful Capital calls each month. It can be seen that the number of Capital calls has increased the highest since September 2022 until now. But if we look at the amount, the Medium monthly total is still at the low level of 2020.

If XEM this as an indicator to evaluate the market, the fact that BTC price set a new ATH does not make investment funds more generous like in previous uptrend seasons. The peak of Capital raising activities is when the amount mobilized in a month reaches 6 billion USD - 7 billion USD. From here we can draw some assessments as follows:

Some assessments of Capital raising activities in Q1/2024:

- Market Capital returned to a high level of over 2,500 billion USD but investment cash flow is still at the level of the 2020 downtrend, proving that VCs' expectations in the market are still not strong enough, or VCs themselves do not have much money left to invest. invest.

- The increasing number of Capital calls and projects shows that there are many ideas but a lack of Capital to implement them. This is also one of the reasons why narratives in the market appear continuously but are still difficult to explode (SocialFi, Bitcoin Layer 2, RWA, reStaking, DePin, GameFi,...).

What is the investment appetite of VCs in Q1/2024?

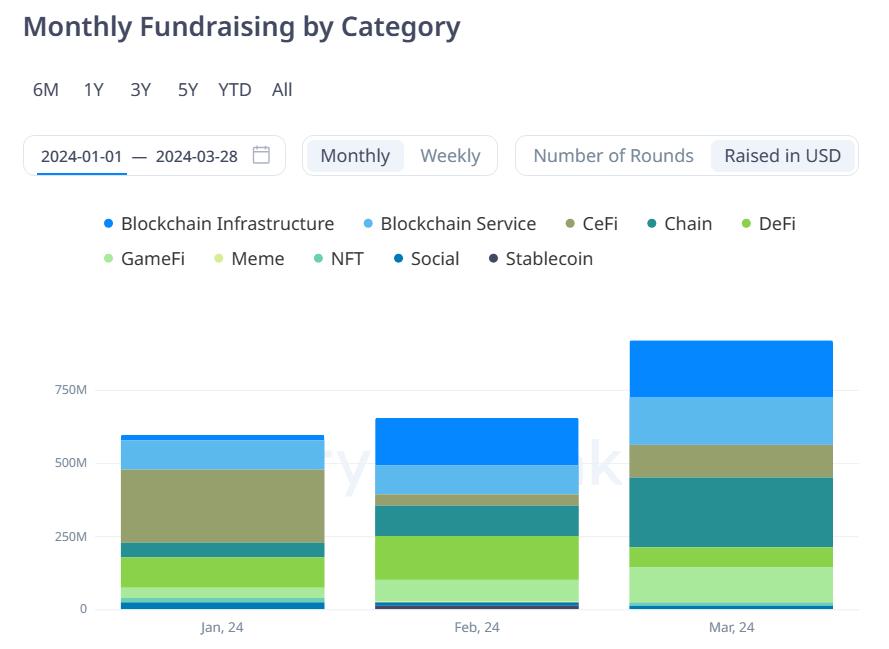

Which field receives the most Capital (among the small amount of Capital in Q1)? Statistical data from Cryptorank helps reveal the investment appetite and concerns of VCs as follows:

Investment portfolio is classified according to the amount of Capital raised. Source: Cryptorank.

Investment portfolio is classified according to the amount of Capital raised. Source: Cryptorank.- The fewest are projects in the Non-Fungible Token and SocialFi fields. It seems that this trend has passed and even individual investors do not spend as much time paying attention to it as in previous years. Besides, CeFi (Centralized Finance, centralized exchanges) also showed a decrease in proportion.

- The most significant increase in proportion is in the field that is Blockchain Infrastructure, this is the common name of trends such as DePin, AI, reStaking, ZkP... which have continuously captured the market's attention recently. Next is Chain, which means Layer 1 projects are the foundation on which ideas are deployed.

We can see a clear change in the investment appetite of VCs, instead of being interested in mass blockchain applications such as Non-Fungible Token, Social... they are turning to be interested in core technology and related applications. to AI and applications that bring the ability to create passive profits for investors.

What do you think about Capital mobilization activities in Q1/2024? Chia your comments now in our community Telegram chat | Telegram channel | Facebook fanpage .