Author: HTX Ventures

With the approval of the BTC spot ETF, major institutions and individuals around the world are continuously increasing their positions in BTC, and the price of BTC has also risen accordingly. It has now risen to the top ten assets in the world by market capitalization. In this market cycle, BTC inscription and BTC expansion are two subdivided tracks that have attracted great attention from the market. The exploration of diversified income from BTC ecological assets is attracting the attention of the crypto market.

So, which solution will be the optimal solution to solve the problems of Bitcoin asset interest generation, network confirmation delays, lack of smart contracts, and excessive gas fees?

Currently, there are two main solutions to address the ecological prosperity of Bitcoin: Layer 2 and side chains.

As one of the investors in BounceBit's $6 million financing, HTX Ventures sees BounceBits and its CeFi+DeFi product model as a potential innovative solution to open up the Bitcoin ecosystem and gain more applications. This research report takes an in-depth look at BounceBit, outlining its product design philosophy and HTX Ventures' investment philosophy.

What is BounceBit?

BounceBit is a BTC re-pledge chain designed specifically for Bitcoin. The BTC re-pledge infrastructure it built provides a base layer for different re-pledge products, which is guaranteed by the regulated custody of Mainnet Digital and Ceffu. It uses BTC+BounceBit hybrid PoS mechanism for verification.

BounceBit solves the trust problem of the underlying BTC assets through multi-party custody, and creates BBTC for DeFi interaction on the Bounce mainnet. Native BTC assets are used to participate in low-risk arbitrage strategies on various centralized exchanges. In addition, under the hybrid token staking mechanism, using BBTC+BB (BounceBit’s native token) for staking can generate LSD tokens and further obtain node staking rewards and re-staking benefits.

By combining centralized custody and side chains, BounceBit aims to solve the long-standing trust problem of side chains while revitalizing the BTC ecosystem, which will reduce transaction fees and release the financial potential of BTC, enabling it to be used in DeFi, games, social networking, and more applied in scenarios.

How does BounceBit work?

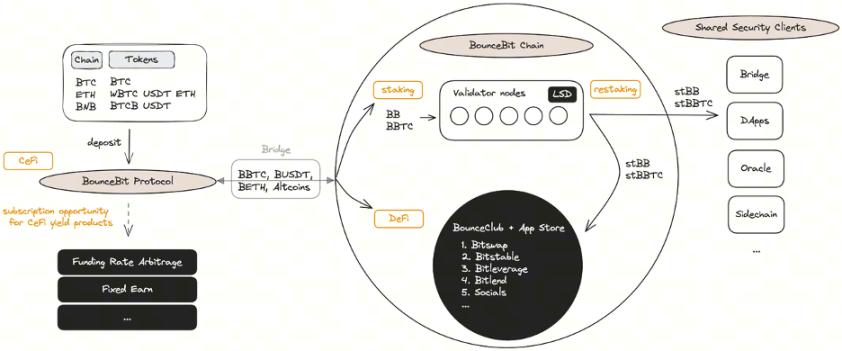

BounceBit’s product design is very clever, as shown in the picture below:

BounceBit operating mechanism and revenue source chart

Users can deposit various types of on-chain Bitcoin assets into the BounceBit protocol, which is actually supervised by the MPC wallet jointly managed by BounceBit, CEFFU and Mainnet Digital to solve the problem of trust mechanism and ensure the security of user assets.

- Through over-the-counter settlement (OES) solutions such as Ceffu's MirrorX, users are able to securely access the exchange's deep liquidity and earn income through diverse trading strategies, while funds remain securely in the MPC wallet on-chain . This wallet technology significantly reduces the risk of single points of failure (SPOF) by splitting private keys into multiple parts. In addition, because user funds are not actually stored in any centralized exchange, but are mirrored through Ceffu, counterparty risks are reduced.

- BounceBit works with a range of asset managers with a long track record of positive returns to trade via MirrorX. All these asset managers use funding rate arbitrage as their primary trading strategy. Funding interest rate arbitrage is a risk-free strategy that uses the difference in funding rates between different markets to obtain income.

- On the other hand, after users transfer their native assets to BounceBit, new B-Token assets will be minted. Taking BTC as an example, after users deposit BTC, they will receive BBTC assets operating on the BounceBit main network. Currently, this asset can be used for two main on-chain activities: First, in BounceBit's hybrid staking mode, use BBTC+BB to participate in node staking, and the LST tokens generated at the same time can be used for further re-staking activities to Amplify staking returns; second, BBTC can be used for various DeFi interactions on the chain. BounceBit also launched BounceClub, a platform for developers and users that allows users to increase the earning potential of BTC assets by participating in diverse DeFi activities and revenue generation activities on the BounceBit mainnet.

BounceBit product design concept, source: https://x.com/bounce_bit/status/1771481179683692656?s=46&t=ODDW1eIwucwwKwUR-9MGBg

In terms of income sources, by participating in BounceBit’s staking and on-chain financial interaction, users can obtain asset income from multiple channels:

- CeFi income obtained through the native assets of the centralized exchange sub-account.

- DeFi income obtained through interaction on the BounceBit chain.

- Use BBTC+BB for staking and the re-staking income of LST generated after staking.

In short, BounceBit provides diversified income generation methods while ensuring the security of assets through multi-party custody.

Why did HTX Ventures invest in BounceBit?

As one of the major investors of BounceBit, HTX Ventures firmly believes that BounceBit can effectively meet the actual needs of the market through its centralized custody model built on standard side chains.

The core goal of BounceBit is to solve the problems of interest generation on Bitcoin assets, inefficient use of idle BTC, lack of innovation and high gas fees. Its fundamental purpose is to provide diversified revenue channels, thereby alleviating the challenge of Bitcoin's lack of smart contract functionality. Current solutions to enhance the BTC ecosystem mainly include Layer-2 and side chain technology.

The main solution of Layer2 is to execute Bitcoin transactions off-chain to increase transaction speed. The current layer2 is mainly divided into two solutions: state channel and Rollups. Typical projects for state channels are Lightning Network, but their scalable functions are very limited. Currently, Lightning Network mainly aims to increase the speed of point-to-point transactions, making it difficult to deploy Ethereum-level smart contracts; in terms of Rollups’ second-layer solution, due to the underlying Regarding the problem of code and signature verification, the Bitcoin second-layer solution cannot be verified by the mainnet when returning the ledger, so it is difficult to achieve sufficient trust guarantee. The most promising method at present is: based on the new Taproot protocol. On the other hand, Bitcoin upgrades the BIP layer, and miners update the underlying code to support OP/ZKP verification and calculation execution by Bitcoin miners. However, there may still be a long way to go before the implementation of rollup.

The side chain is equivalent to a completely independent chain. Usually, the mapping and application of native assets are achieved by mapping the Bitcoin of the mainnet to the side chain and issuing new assets. Usually, the side chain has better processing speed, but from the perspective of trust verification, it is a chain completely independent of the Bitcoin mainnet, so it has trust issues and consensus issues. At the same time, it is easier for project parties to commit evil, thus affecting the security of mapped assets. This is also the TVL dilemma currently faced by side chains.

BounceBit adopts a unique approach to solve some challenges in the Bitcoin ecosystem by establishing an independent PoS layer chain. Under this framework, nodes ensure the security of the chain by staking BTC and BounceBit tokens. The connection between BounceBit and BTC is established at the asset level, not the protocol level.

By combining centralized custody and sidechain technology, BounceBit attempts to overcome the consensus and trust issues of sidechains. In the current environment, this hybrid model of centralization and decentralization may provide a compromise solution to technical and trust issues. BounceBit’s design philosophy and development team’s background give it an edge over the competition, opening up space to explore new opportunities.

Looking to the future

With the approval of the BTC spot ETF, major institutions and individuals around the world are continuously increasing their positions in BTC, and the price of BTC has also risen accordingly. It has now risen to the top ten assets in the world by market capitalization. At the same time, in this market cycle, BTC inscription and BTC expansion are two subdivided tracks that have attracted great attention from the market. Some of the progress of BTC have excited the market, attracting more people to pay attention to the BTC ecology, and realize the realization of BTC around BTC. More asset application scenarios and revenue possibilities have become content for developers and market participants to explore together.

As a Cefi+Defi product, BounceBit is innovative in its product model. Through the combination of centralized and decentralized mechanisms, it introduces the third-party custody mechanism into a trust solution and generates new EVM chain assets to revitalize native assets. financial attributes, or may become a solution for the new Bitcoin ecosystem.

HTX Ventures believes that in the future, there will be more and more technical developments and breakthroughs in the BTC ecosystem, and at the same time, more and more ecological projects will emerge. This is something worthy of excitement and anticipation in the entire encryption market. At this stage, BounceBit's Cefi+Defi mechanism has good TVL growth potential and is expected to realize the exploration of diversified returns on BTC ecological assets.