By Dylan LeClair & Bitcoin Magazine Pro

Compiled by: Felix, PANews

Bitcoin prices fell below $60,000 last weekend as the conflict between Iran and Israel sparked concerns that escalation could draw the West into a Middle East war — an all-too-common scenario in the 21st century, which would lead to higher inflationary pressures and disrupt global supply chains and commodity markets. While some skeptics mocked Bitcoin’s almost instant sell-off after news of the conflict broke, Bitcoin was ironically one of the only global assets to trade over the weekend, and stock, commodity and bond strategists turned their attention to Bitcoin as they tried to assess the potential damage to global markets on Sunday.

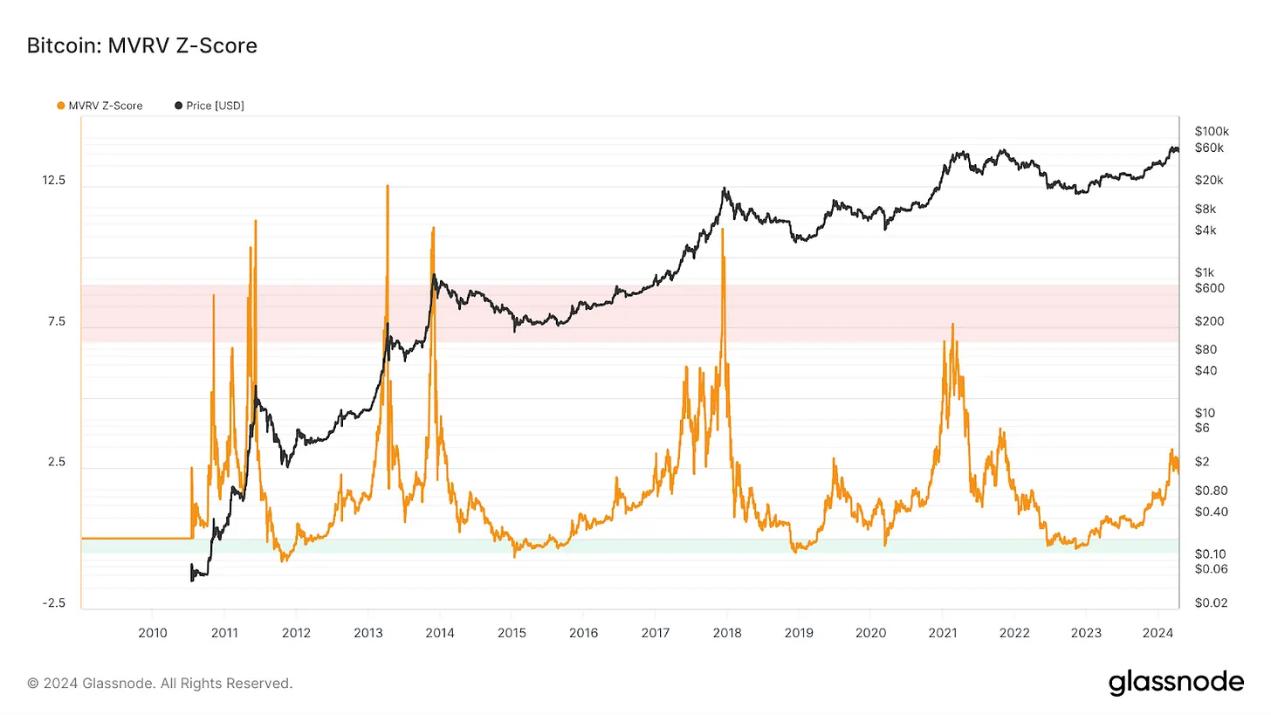

Geopolitics aside, this article will focus on the latest developments in on-chain behavior and Bitcoin derivatives markets to analyze whether the current decline from the high of $73,000 is a typical bull market correction or a cyclical peak.

With Bitcoin breaking new highs before the halving, many previous ideas about Bitcoin cycles may be outdated. Therefore, it is worth paying attention to assessing the current situation and how investor behavior will affect what may happen next.

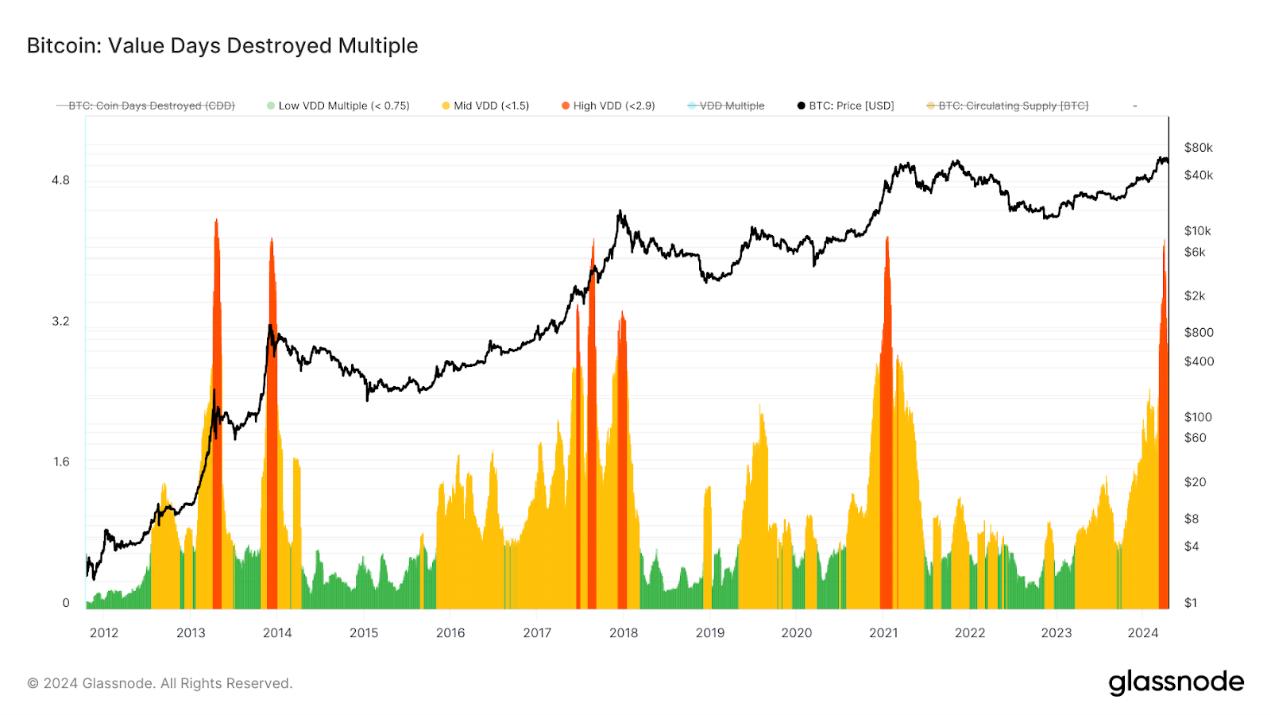

First, check the Value Days Destroyed Multiple. This indicator determines the market's hotness by dividing the market's short-term selling behavior by the market's long-term selling behavior. The higher the indicator value, the hotter the market; conversely, the lower the indicator value, the colder the market. This indicator shows that the bull market is progressing smoothly and may even have peaked.

The metric is calculated precisely as the ratio of two daily moving averages (30,365) of value destroyed (daily tokens destroyed * price), which is then adjusted for supply inflation to account for changes in consumer behavior over time.

About a third of the selling can be attributed to the simple transfer of tokens from the Grayscale Bitcoin Trust to new ETF participants such as BlackRock, Fidelity, and Bitwise. However, the raw data shows that there was a lot of selling as Bitcoin pushed to new highs.

But a closer look at this indicator shows that this selling activity is cooling, and there is a precedent for the market to set new highs during the bull market cycles in 2017 and 2021.

Next, we look at the interaction between holders and new entrants from the perspective of short-term and long-term holders. We can see that during a typical bull market, the price-cost movement of short-term holders is not only standard but also quite healthy.

Furthermore, this approximate price level is a typical feature of a bull market that supports the bear market. In a bear market, this short-term average holder price (cost basis) tends to be a great psychological and technical resistance. In today's bull market, this price level is approximately $58,500, which means that it is fully in line with the expectations of a bull market.

Turning our attention now to the derivatives markets, leverage and speculative froth are healthy across the board. Perpetual futures priced in Bitcoin are near their lowest levels since 2022, while futures have been trading at a slight discount to the spot market since the sharp drop over the weekend. While there is no guarantee that higher prices will be realized immediately, similar positioning has created conditions for higher prices in the past. This is a welcome development compared to the severe speculative froth that has emerged from the speculative premiums that have emerged in futures market prices over the past month or so.

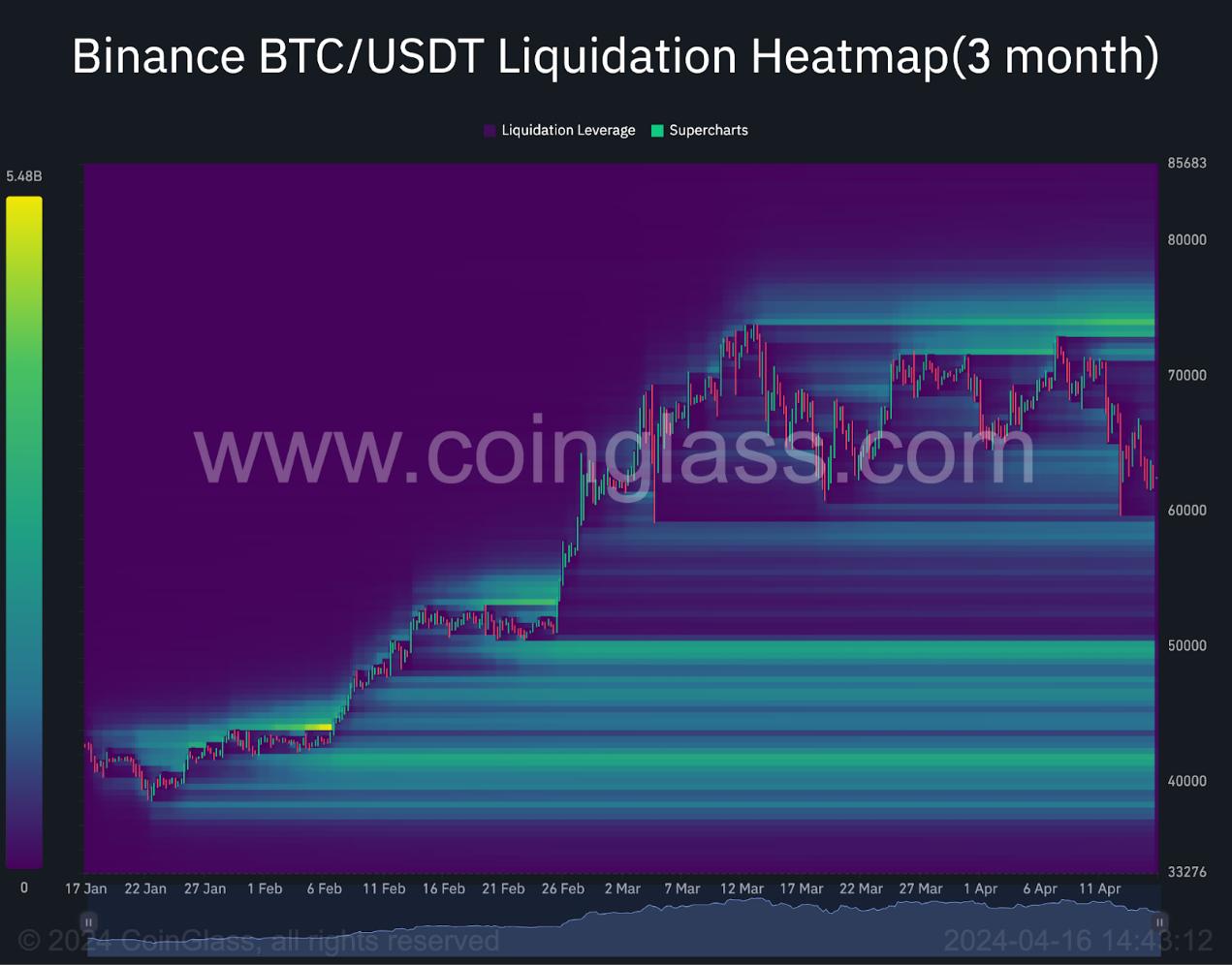

In terms of the derivatives outlook, the accumulation of liquidable leverage above $70,000 continues to grow, with shorts looking to push prices significantly below $60,000. While there is still some leverage to be cleared below the $60,000 level, the real profit level for shorts is below the $50,000 level.

While a 33% pullback from Bitcoin’s all-time high is a crazier thing to see, spot demand is likely to be strong from $50,000 onwards, with the disappearance of open interest and the onset of negative contango relative to the spot market suggesting that much of the pullback has already occurred. It would likely take a major macroeconomic risk-off moment for this to occur, and any declines would likely be short-lived given the chronic pace of fiscal deficit spending.

In summary, the current pullback from Bitcoin's highs and any future declines should be a welcome correction for investors who have a long enough vision to understand where all this is going. Bitcoin's fundamentals continue to improve, and in a long-term bull market, pullbacks help clear out leverage and short-sighted speculators during the long-term bull market.

Related reading: Geopolitics disturbs the crypto market, and the volatile market waits for the situation to ease