1/n - My thoughts on why the next 6 months will be RELENTLESS UP ONLY.

2/n - At this point, im fully deployed. If things top out here or go down....then its time to get rekt for me >.<

3/n - So there's no wordplay...no shifting about. Chips are on the table and im about as ALL IN as i can. With MAXIMUM CONVICTION.

4/n - The reason is very simple. The US and China are both about to embark on massive stimulus and money printing.

5/n - In the case of the US - auntie yellen is about to embark on as MUCH printing as she is able to.

6/n - @CryptoHayes puts it - 1.4trn of liquidity into the system. twitter.com/CryptoHayes/status...

7/n - In the case of the Fed, the recent GDP print has a silver lining. The economy slowing down, removes ANY chance of a rate hike. In fact, rate cuts are still very much in the picture.

8/n - Powell's premature pivot in Dec 23 has already shown that he is WILLING TO DO what it takes to get Biden re-elected. And that means while the treasury is going full throttle, the FED is NOT going to take away the punch bowl. In fact they might spike it further

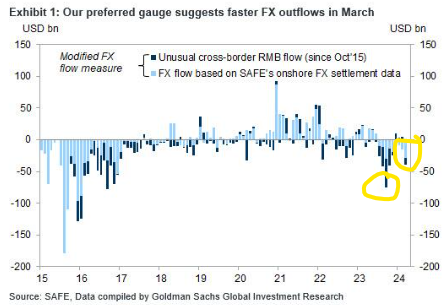

9/n - What about Choyna??? Well - First of all, the amount of money that is trying to escape from China is rapidly accelerating again.

10/n - This is currently escaping in multiple forms - Gold -which has been trading at a premium in Shanghai vs RoW. The last time outflows accelerated was in Oct'23 ....when BTC was at 30k....

11/n - Things in China do NOT look good. yields are dropping - an indication of the lacklustre performance of the economy. Xi is approaching a point where he has to ease policy. The economy is approaching its tolerance for common poverty.

12/n - Ideologies be damm. The primary objective of governance in China is social stability. China is approaching that point of easing. Otherwise the continuous outflow will do it for them.

13/n - TLDR - the twin engines of the world, China and the US both are going to embark on their respective expansionary fiscal/monetary policies. Inflation be dammed.

14/n - Trash is cash.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content