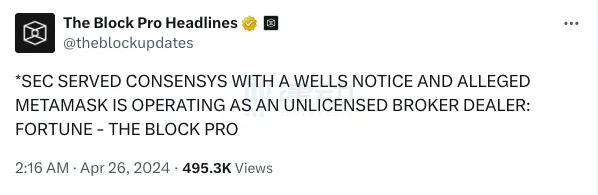

On April 10, the U.S. SEC issued a "Wells Notice" to Ethereum infrastructure development company ConsenSys, which means that the SEC provides the company with a last chance to refute any allegations. The SEC stated that by providing MetaMask wallet software, ConsenSys is acting as an unregistered securities broker.

In response, ConsenSys denied acting as a broker and said the wallet was "simple and user-friendly" and "neither holds customers' digital assets nor performs any trading functions."

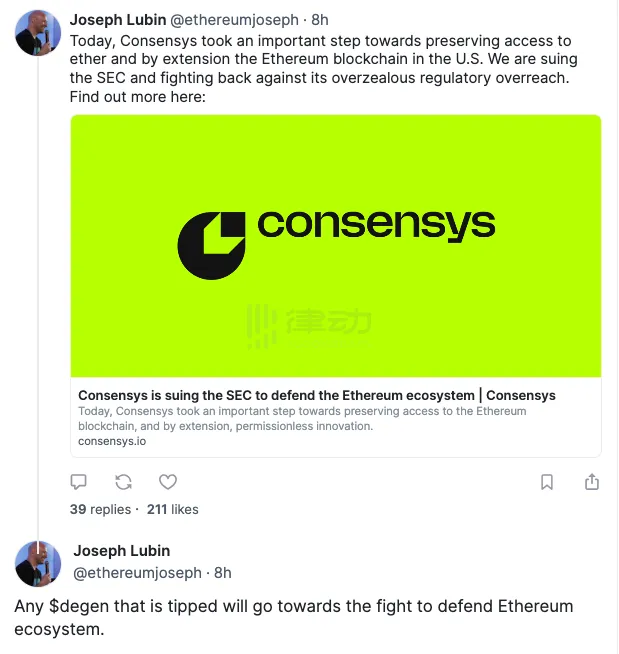

On April 26, ConsenSys decided to take the initiative and formallyfiled a lawsuit against the SEC, accusing it of "illegal power grabbing" of Ethereum. To this end, ConsenSys founder Joseph Lubin collected DEGEN on Farcaster and stated that any DEGEN tips received would be used to defend the Ethereum ecosystem. A large number of crypto community members participated in the reward to show their support.

The MetaMask wallet created by ConsenSys provides users with all the infrastructure they need to explore web3, from managing their identities, sending and receiving cryptocurrencies, to connecting to decentralized applications built on Ethereum. According to Consensys' lawsuit, applications like MetaMask that allow people to buy, sell and transfer Ethereum on their own are not securities brokers, and MetaMask's staking service does not violate securities laws.

At the same time, ConsenSys believes that declaring MetaMask a securities broker will effectively prevent web3 developers from continuing to build the next generation of applications themselves and will prohibit the SEC from investigating or taking enforcement actions related to MetaMask’s exchange or staking functions.

MetaMask was notified, which actually hinted at the DeFi crisis

The core point of contention in this regulatory storm is that MetaMask, as a wallet application, is defined as a securities broker by the SEC.

ConsenSys, the parent company behind MetaMask, also has product sections such as the development kit Infura, the smart contract audit service Diligence, Ethereum Layer 2 Linea, Ethereum clients Teku and Besu, etc. Perhaps it is precisely because ConsenSys founder Joseph Lubin is one of the co-founders of Ethereum that ConsenSys seems to have inherited some of Ethereum's genes and used the encryption vision as a compass for business layout.

In 2023, ConsenSys' Linea mainnet was launched, MetaMask Snaps was released, and activities such as the Web3 Fellowship program and Linea DeFi Voyage were launched. In September 2023, in order to better support Web3 builders, ConsenSys announced the closure of its development tools Truffle and Ganache, and shifted the focus of the Truffle team to expanding its Infura, MetaMask Snaps and SDK products.

It can be said that ConsenSys has built a basic framework for the crypto world. After several years of hard work, MetaMask has now become one of ConsenSys' most successful incubation projects and the wallet with the largest market share today.

But now that the SEC has taken action against MetaMask, it can be seen that the United States is gradually increasing its regulatory pressure on the entire crypto industry, especially DeFi. If MetaMask is labeled as "illegal", perhaps the entire DeFi industry will receive a more severe blow.

In addition, in recent months, the SEC has also filed lawsuits against cryptocurrency exchanges such as Binance.US, Binance and Kraken, and even Uniswap, the leading DEX, received a "Wells Notice" not long ago. Although Uniswap founder Hayden Adams promptly issued an open letter to fight back, the market was still very sensitive to the news, and the price of UNI fell instantly.

In the letter, Hayden mentioned that the team believes that the products they provide are legal, and specifically emphasized that Uniswap is an Internet company located in the United States to demonstrate its long-term adherence to the compliance development path. At the same time, Hayden also mentioned that this battle with the SEC will last for several years, and is ready to appeal to the Supreme Court.

ConsenSys was one step ahead and played the counterattack card to the SEC first. Subsequently, companies such as the Blockchain Association and Legit Exchange followed suit and filed similar preemptive lawsuits in an attempt to prevent the SEC from treating certain crypto companies or assets as securities.