[Blockchain Today Reporter Jihye Han] While the price of Bitcoin has fallen to its lowest level since the end of February and is undergoing a correction, analysts believe that the cause of this decline is not due to leveraged derivatives.

On the 2nd (local time), the price of Bitcoin is at $59,589, down 7.21% from a week ago on CoinMarketCap, a cryptocurrency market site. A day earlier, on the 1st, it sank below $57,000, a nine-week low, experiencing a decline of about 11% compared to a week ago.

Citing Glassnode analyst James Check, CryptoPotato reported that market declines and liquidations of cryptocurrency assets are not uncommon, but this time things are different.

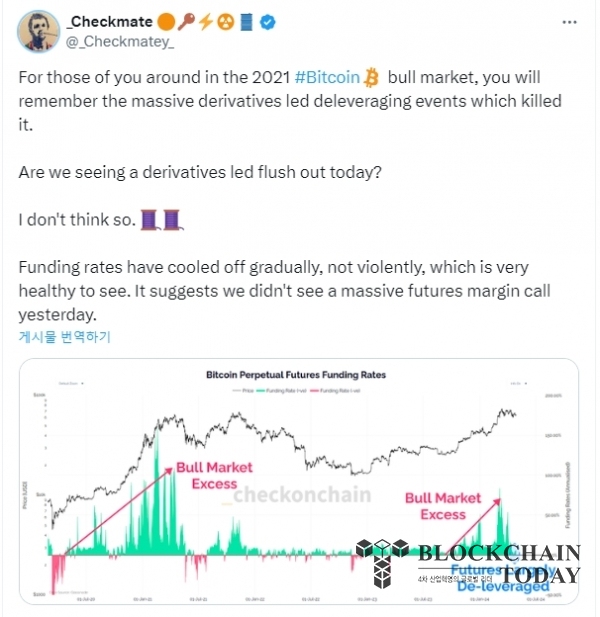

Large-scale derivatives-led leveraged liquidations have previously been a major feature of the 2021 bull market, and have occurred several times this year, most recently in mid-April.

However, in his X post, Chek analyzed that this was not what caused this week's cryptocurrency crash. He claimed, “The funding ratio is showing a very healthy trend, cooling down gradually rather than rapidly. This suggests that no large-scale futures margin call occurred yesterday (the 1st).”

He then presented another chart showing that open interest (OI) in Bitcoin futures has decreased in BTC terms over the past year, adding, “This shows a decrease in leverage relative to open interest compared to market size.”

The funding rate is a fee set by the derivatives exchange to maintain a balance between the contract price and the price of the underlying asset, while open interest represents the number of cryptocurrency derivatives contracts that have not yet been settled.

“Again, I don’t feel like derivatives were the main factor in this Bitcoin selloff. I think it was primarily a result of spot-led weakness, short-term selling and weak demand rather than derivatives-led selling,” Chek explained.

According to Deribit, open interest for the Bitcoin options expiration event on the 26th was approximately $1.3 billion, indicating that demand for derivatives remains healthy.

hjh@blockchaintoday.co.kr