On November 27, Blur's transaction volume surpassed that of Opensea. Many new NFT marketplaces have been created recently, but only now has one emerged with the intention of dominating it.

Original: Blur Overview (The Crypto Illuminati)

Author: Russian Defi

Compile: Zion

Editor in charge: karen

Cover: Blur

The current NFT market focuses too much on the retail experience and not enough on professional traders. Blur is working to address these issues and move the NFT space toward institutionalization while increasing decentralization.

Blur background

Blur is a new NFT marketplace backed by big-name investors like Paradigm, 6529, Cozomo Medici, and Bharat Krymo. The team consists of developers from well-known institutions such as MIT, Citadel, Five Rings Capital, Twitch, Brex, Square, and Y Combinator.

This new marketplace will remain in private development for approximately 276 days before its official launch on October 19, 2022. Blur’s aggregator already has the second-highest trading volume in the space: Blur celebrated the milestone on Twitter, saying it “became the #2 NFT marketplace by volume (excluding wash trading)!” and “ #1 NFT Aggregator".

Royalty mechanism and fee structure

Blur has no market fees, so you can make as many trades as you want without worrying about any commissions. Additionally, advanced trading tools on Blur are also free to users. Traders are encouraged to set royalties above zero, so they have the potential to earn more through incentivized AirDrop.

Blur's royalty mechanism is different from most NFT marketplaces. Here, NFT traders set their own royalties, which means that if the traders don't pay the royalties, the original creator can't get any income from the secondary sale. However, the incentive scheme benefits traders who use royalties: For example, those who pay a higher tax rate will receive more AirDrop.

It is important for traders to understand that those who set their royalties above 0.5% will receive a larger AirDrop than those who stick to the base rate of 0.5%.

Blur is a marketplace and aggregator in one

Based on Blur's private beta transaction data, the company claims its transactions are ten times faster than Gem.

According to a recent tweet from the Blur team, they are the largest aggregator by transaction volume.

Similar to other aggregation services, Blur is aimed at professional traders. Floor-sweeping (purchasing a large number of NFTs in a single transaction) is an everyday use case that requires fast transaction processing and avoiding fees in addition to buying NFTs in large quantities. This is usually done by whales and advanced traders before the project gains significant traction.

Blur's AirDrop

The two AirDrop announced by Blur are the main reasons for this growth. The first AirDrop is a love package that NFT traders must claim within 14 days of launch, and will only be available to those who have traded in the past six months.

These parcels include an undisclosed amount of BLUR tokens, which will be used as governance tokens. In order to obtain these packages, traders must list at least one NFT on the Blur marketplace. Users will not be able to earn rewards until January 2023 when BLUR tokens become available.

In November, Blur issued a second AirDrop for active traders. According to the Blur team, traders will likely be rewarded with more valuable BLUR if they list NFTs from well-known, reliable collections.

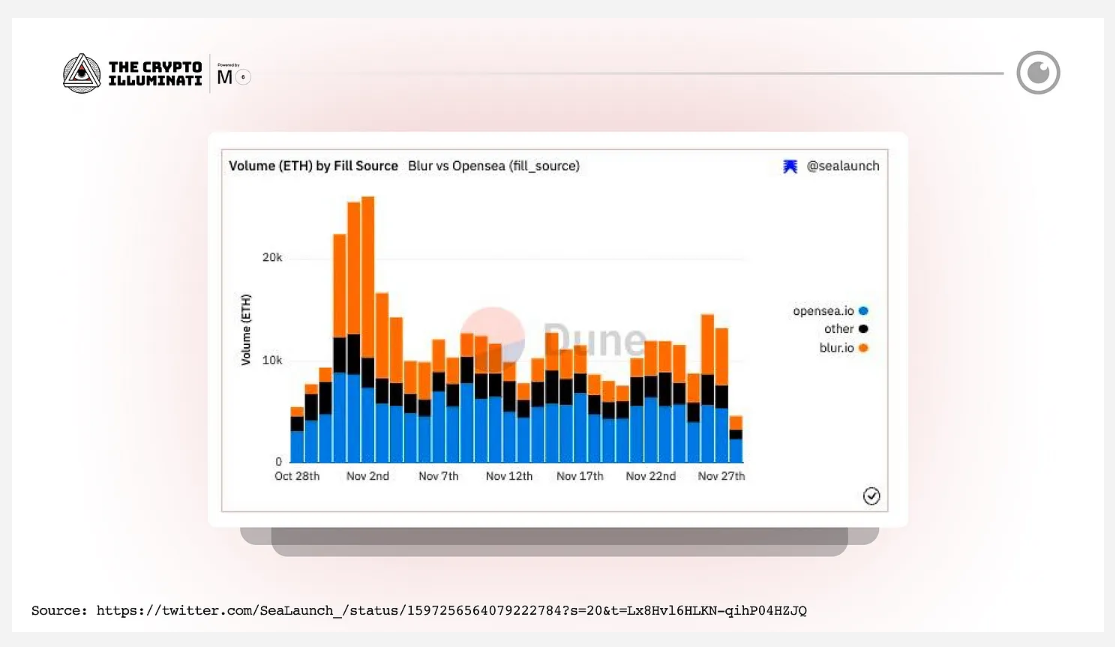

Blur's transaction volume surpasses OpenSea again

On November 27, Blur surpassed Opensea's 5.3K ETH with a transaction volume of 5.5K ETH .

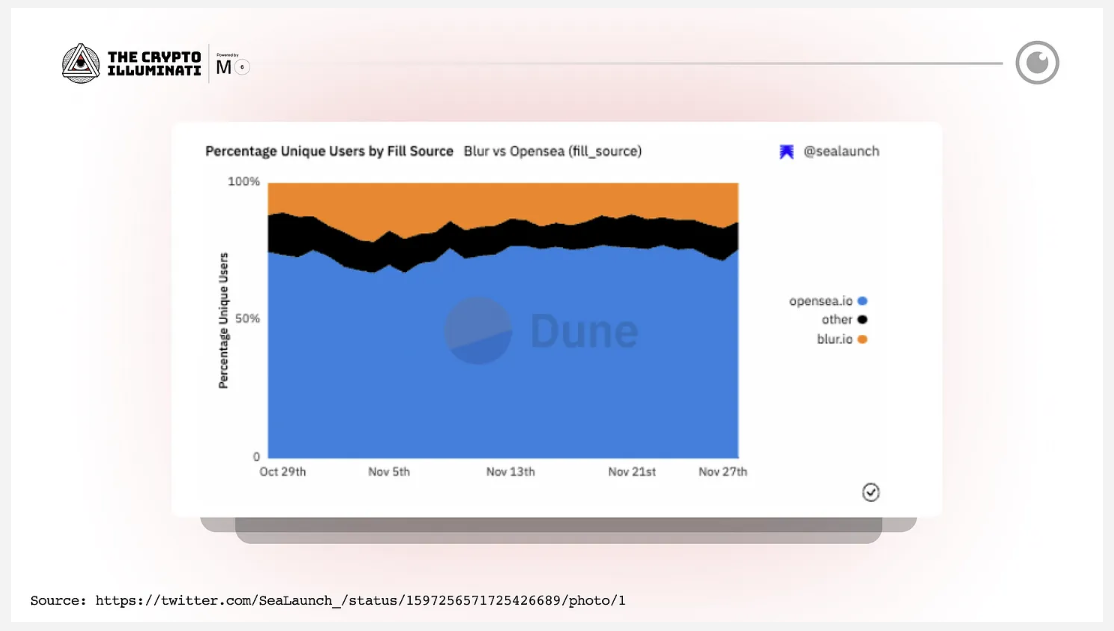

While OpenSea continues to dominate with over 70% market share, Blur has attracted many active traders, indicating a deep recognition of value.

What's wrong with Blur?

The downside of Blur, based on user feedback, is that it might not be as secure as it seems. For users to execute trades on marketplaces like OpenSea or LooksRare, a high level of trust is required. However, one Blur user discovered a major problem with the app.

The problem with this is that the same few lines of code in their system only show whether the caller is allowed to transfer tokens, which means whoever owns the smart contract can keep taking tokens and adding new addresses to the map.

As a recently established NFT marketplace, Blur doesn't have any guarantees yet.

summary

Time will tell what the future holds for this NFT trading platform, but Blur deserves credit for competing with industry giants like OpenSea. Its cutting-edge approach to enabling NFT transactions is a major reason for its success so far.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the authors and guests, and have nothing to do with Web3Caff's position. The information in the article is for reference only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of the country or region where you are located.