River is hands down the hottest token of the year—no contest.

It’s pumped over 10x in a month, a masterclass in narrative-driven rallies.

Here’s my breakdown of what fueled this run: data, resources, and narrative.

When @RiverdotInc first launched, I told everyone to watch the project’s data closely. From December to January, TVL exploded from $300M to $600M.

But data is just one layer—the real magic is in River’s mechanism, that’s the true flywheel.

Resources and narrative are the wheels that keep the flywheel spinning, and they’re mission-critical. Strategic partnerships with SUI and an $8M investment from Justin Sun are prime examples of expanding value.

Token price is the ultimate answer to value.

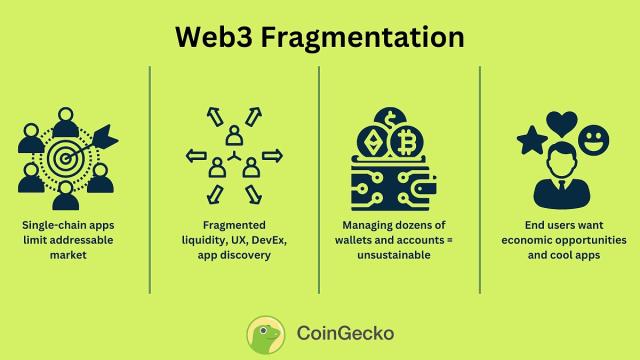

From the DeFi craze to the confusion around L2s, River entered the game with stablecoins, integrated 400+ Layer2s and major on-chain liquidity providers, and optimized everything to serve user needs and real-world scenarios.

River’s big vision is to be the bridge for assets—connecting banks, companies, institutions, and individuals worldwide to its ecosystem, building a shared economy on-chain.

Honestly, projects with tech, product, capital, resources, and strategy are the ones that become unicorns. River absolutely has that potential—don’t sleep on your bags.

I bought a ton on the secondary when it was still flat after launch, but basically sold too soon. Still holding my airdrop for the long haul.

If you’re bullish on a project, you gotta ape in with your focus—otherwise it’s hard to catch the real upside.

twitter.com/monkeyjiang/status...