Bitcoin held firm above the $90,000 mark on Friday after the latest US labor market report showed a slowdown in hiring but no signs of a serious economic recession.

This report has eliminated a major risk to the crypto market. However, it has not yet paved the way for Bitcoin to quickly rebound to the $100,000 mark.

Labor data helps reduce the risk of a US economic recession.

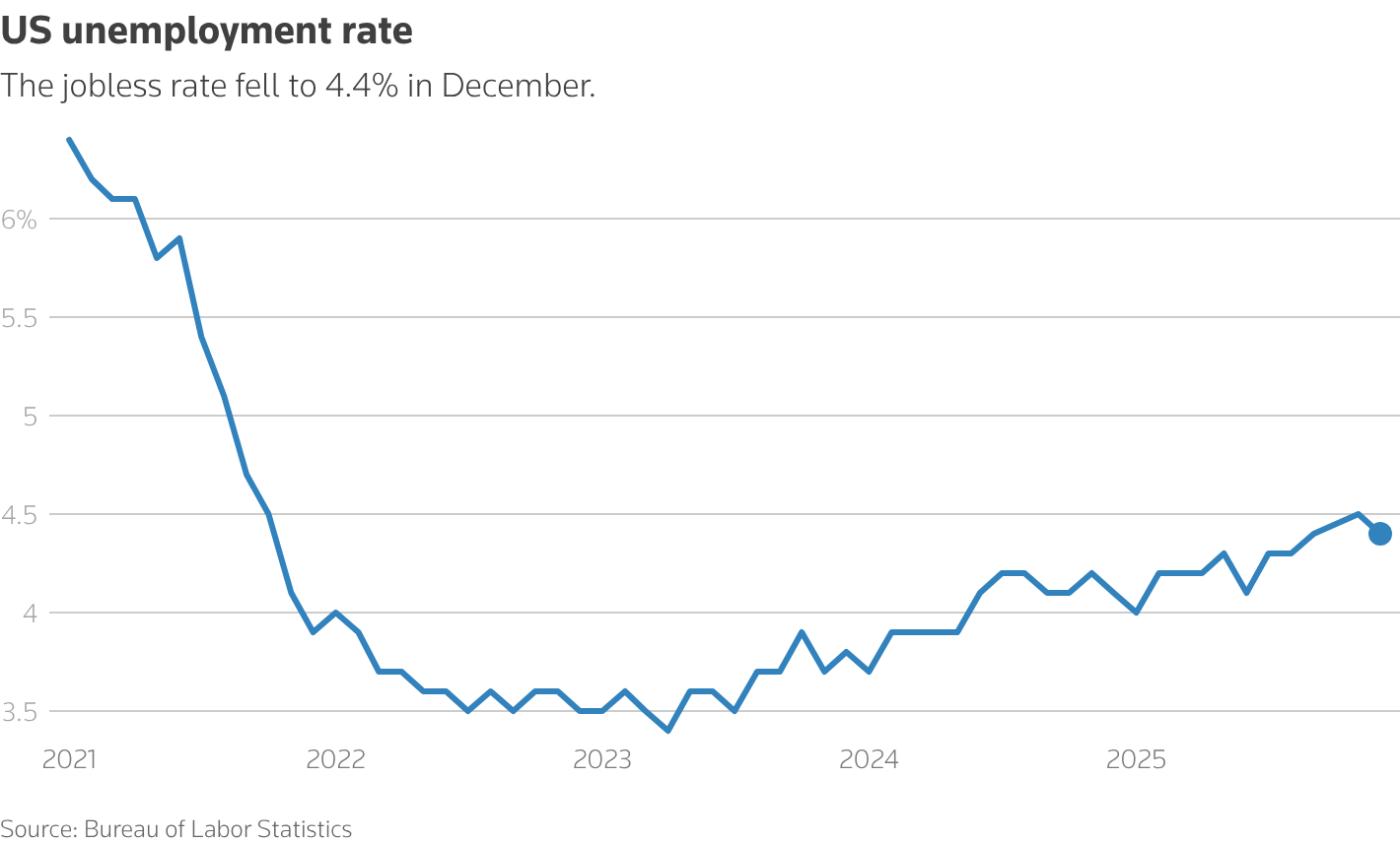

The US economy added 50,000 new jobs in December, the lowest increase in years. At the same time, the unemployment rate fell to 4.4%, and wage growth remained steady at 3.8% year-on-year.

Unemployment rate in the US has fallen. Source: Reuters

Unemployment rate in the US has fallen. Source: ReutersThe market interpreted this data as indicating a cooling, not a collapse, of the labor market. The value of risky assets, including Bitcoin, remained stable, fluctuating between $89,000 and $92,000 throughout the trading session.

Weak job growth has eased concerns that the US economy is overheating, potentially leading to tighter monetary policy. At the same time, the risk of a sudden slowdown in growth resulting in a sharp market sell-off has also decreased.

This is crucial for Bitcoin. Over the past year, every time the crypto market has experienced a sharp decline, it has been due to signs of rising inflation or a sudden economic slowdown. But Friday's data suggests that neither of these scenarios has occurred yet.

Unemployment has only fallen slightly, while the rate of job growth has slowed. This suggests that the US economy is showing signs of slowing down but remains stable. Overall, the prospect of a "soft landing" is more favorable than the possibility of a recession.

Therefore, Bitcoin avoided a sharp sell-off that could have dragged the price back down to the lows above $80,000.

“Bitcoin has surged over 7% in just the first few days of 2026, so the most likely scenario now is a move toward the psychological $100,000 mark. If unemployment holds while inflation continues to fall, we expect a clear breakout above $100,000 and a retest of the psychological $110,000 level – a former historical peak. This is a crucial area, as it's a former peak and will Vai as significant resistance; Bitcoin needs to overcome this to reinforce investor confidence that higher prices are still possible.” Matt Mena, Crypto Research Strategist at 21shares.

Why Bitcoin reaching $100,000 is still difficult in the short term.

Although this report eliminated a downside risk, it has not yet created new upward momentum for the market.

Wage growth at 3.8% remains high, making it difficult for inflation in the services sector to decrease. This allows the Federal Reserve (Fed) to keep interest rates unchanged and not rush to lower them.

Bitcoin experienced its biggest surge during this cycle as the market anticipated lower interest rates and more abundant liquidity. However, Friday's data failed to bolster those expectations.

Conversely, the market is favoring the Fed maintaining stable interest rates for longer. This reduces the likelihood of a sharp price surge driven by new capital inflows, preventing Bitcoin from rapidly rising to $100,000.

Currently, the path for Bitcoin to return to six digits no longer depends heavily on employment data, but primarily on Capital flows and interest rate expectations .

Large inflows into spot Bitcoin ETFs will be a crucial driving force helping Bitcoin break through the $95,000 resistance level. Additionally, clearer signals from the Fed regarding its interest rate cut plans will also support market sentiment.

Currently, the jobs report has helped Bitcoin remain stable above $90,000 . Thus, the risk of a sudden macroeconomic shock has been eliminated. However, the signal for Bitcoin to break through to $100,000 is still not entirely clear.