This article will provide an in-depth analysis of the rise and evolution of the decentralized prediction market platform Polymarket and its potential to reshape the global information ecosystem.

Article author: Merrick, Stablehunter Contributors

Article source: ChainCatcher

I will attempt to deconstruct how Polymarket solved the core liquidity problem through its technological transformation from Automated Market Maker (AMM) to Central Limit Order Book (CLOB), and how it established its status as a "truth machine" by defeating mainstream polling organizations through the "Neighborhood Polling Act" in the 2024 US election.

What the market truly excels at is never providing a definitive "truth," but rather compressing a multitude of scattered information, emotions, stances, and interests into a constantly changing and readily applicable "price." Once this price can be referenced, it can, in turn, influence public opinion, behavior, and even, in certain scenarios, the course of events themselves.

I. Starting with Trump's election

In November 2024, FBI agents raided the home of Polymarket founder and CEO Shayne Coplan. This was because Polymarket had predicted Donald Trump's overwhelming victory in the 2024 US presidential election with almost defiant accuracy weeks in advance, while mainstream media polls were still incessantly emphasizing that the election was "close."

This move sent shockwaves through the cryptocurrency community and prediction market enthusiasts. More than just a law enforcement action, it was widely interpreted as a symbolic conflict: a political battle between the outgoing Biden administration and this emerging, uncontrolled "truth machine." Shayne Coplan later posted on X (formerly Twitter) with a typical Silicon Valley rebellious tone: "Being woken up that morning was frustrating… this is clearly political retaliation."

By then, Polymarket was no longer just a niche cryptocurrency gambling site. In 2024, it processed over $3.7 billion in election-related transactions, becoming an indispensable source of information for global political observers, Wall Street traders, and even ordinary voters. It represented the rise of a completely new epistemological system: a new order that no longer relied on expert interviews, telephone polls, or centralized media narratives, but rather on real money, distributed ledgers, and collective wisdom.

In this new order, the truth is not released by authoritative institutions, but rather "discovered" by thousands of dispersed individuals through buying and selling contracts. Every click of "Buy Yes" or "Sell No" is a vote on the future, a revision of one's understanding of reality. The rise of Polymarket is essentially an epic leap from theory to reality for the concept of "Info Finance."

II. The Pricing of Truth and the Epistemological Crisis

Prediction markets predate the internet by a long time. As early as the 16th century in Europe, betting on the outcomes of papal elections and wars of succession had already formed early informal markets in London and Paris through letters, leaflets, and tavern gossip. These early attempts revealed a simple truth: when stakeholders are involved, people's judgments about the future are often more accurate than official pronouncements.

In 1945, Hayek published his landmark paper, "The Use of Knowledge in Society." In it, Hayek proposed a revolutionary view: the core economic problem facing society is not the physical allocation of resources (which is an engineering problem), but rather "the use of knowledge." This knowledge is not concentrated in the hands of a single expert or planning bureau, but is dispersed in the minds of countless individuals—knowledge about specific times, places, personal preferences, hidden techniques, and rapidly changing market conditions.

Hayek argued that the price system is not merely a tool for allocating resources, but also an efficient information transmission mechanism. When the price of tin rises, whether due to a mining disaster or a surge in demand, only a very small number of people in this vast system need to know the specific reasons. For most users, the change in price alone is sufficient to convey all the necessary information: conserve tin.

The core philosophy of prediction markets is based on this: if prices reflect the supply and demand of goods, can we create a "synthetic asset" whose price specifically reflects "information"? If we can trade stocks that predict a Trump victory, then the price of that stock (e.g., $0.60) directly encapsulates fragmented information about the election held by thousands of participants—including insider information, grassroots observations, economic data models, and even casual conversations at gas stations in swing states. Polymarkets are essentially the 21st-century digital embodiment of Hayek's ideas.

The theoretical validation of modern prediction markets began with the establishment of the Iowa Electronic Markets (IEM) by the University of Iowa in 1988. IEM allowed users to trade political elections and economic indicators with very low limits (typically $500). Despite the negligible amount of capital, IEM demonstrated remarkable predictive power in successive US presidential elections, with its long-term accuracy significantly outperforming traditional Gallup polls. The existence of IEM proved the applicability of the efficient market hypothesis (EMH) in the field of political prediction, namely that market prices can aggregate information more effectively than any single expert.

Human society is currently facing a profound epistemological crisis. With the increasing information cocoon effect caused by social media algorithms and the pollution of the internet information ecosystem by AI-generated content, traditional consensus-building mechanisms—whether based on authoritative media institutions or statistical opinion polls—are showing unprecedented fragility. Against this backdrop, prediction markets, as an "epistemic technology," have returned to the historical spotlight. They should not be simply viewed as a lottery tool, but rather understood as a market-based epistemological mechanism based on Hayek's theory of knowledge dispersion: by requiring participants to bet with real money (skin in the game) on their beliefs, market prices can filter out cheap noise and aggregate private information scattered throughout society, thereby approximating the truth of the future through price discovery mechanisms.

III. Augur: An Experiment in Decentralized Fundamentalism

Launched in 2015, Augur was one of the earliest ICO projects on Ethereum, embodying the crypto community's entire fantasy of a "decentralized truth machine." Augur's design philosophy is complete decentralization, which is reflected in its dispute resolution mechanism.

Augur does not rely on centralized administrators to input match results. Instead, it uses a game theory-based mechanism: users holding REP tokens report results by staking them. If the reported results align with the consensus, they receive a reward; if they contradict the consensus (i.e., they attempt to lie), their REP tokens are forfeited.

Despite the technical decentralization achieved by Augur V1 and V2, their commercialization has been extremely poor because they ignored the basic principles of financial markets and user experience.

- High transaction costs and inefficient order books: Augur initially adopted an on-chain order book model. During 2017-2020, when Ethereum mainnet gas fees were high, creating, modifying, or canceling an order could incur fees of tens of dollars. This high friction cost made frequent trading and market making impossible, resulting in extreme market illiquidity.

- Lengthy resolution cycles: To ensure the security of decentralization, Augur's dispute resolution process is designed to be extremely lengthy. The final confirmation of a market's outcome can take weeks or even months. This capital tied up is unacceptable for users accustomed to instant settlement in sports betting.

- Complex entry barriers: Users not only need to hold highly volatile ETH as fuel, but also need to understand the staking mechanism of REP, which directly excludes the vast majority of ordinary users.

IV. The Explosion of Polymarket: A Synergy of Favorable Timing, Location, and Human Factors

Entering the 2020s, prediction markets finally ushered in their "iPhone moment." The rise of Polymarkets is not due to a single factor, but rather the result of the combined effects of iterative technological architecture, the maturity of payment infrastructure, and changes in the macro-social environment.

Early decentralized exchanges (DEXs) commonly used Automated Market Maker (AMM) mechanisms (such as Uniswap's CPMM or Gnosis's LMSR) because AMMs could provide basic liquidity in the absence of professional market makers. However, AMMs suffer from severe capital efficiency problems in prediction markets: when the probability of an outcome is close to 0 or 1, AMMs require extremely large pools of funds to maintain low slippage trading and cannot support complex strategies such as limit orders.

Polymarket made a key technical decision: abandoning AMM and switching to a hybrid decentralized Central Limit Order Book (CLOB) model.

- Off-chain matching, on-chain settlement: Polymarket's order matching is carried out on high-performance off-chain servers, which makes its trading experience (response speed, order cancellation) almost indistinguishable from centralized exchanges (such as Binance), completely avoiding the latency and gas fee issues of on-chain transactions.

- Non-custodial settlement: Although the matching process is centralized, the settlement and custody of funds are still executed atomically on the Polygon chain through smart contracts. This architecture retains both the smooth experience of Web2 and the asset security of Web3.

- Introducing professional market makers: The CLOB model allows professional market makers like Wintermute to access the market, providing deep liquidity. This enables Polymarket to handle single transactions of hundreds of thousands of dollars without significant slippage, paving the way for institutional funds to enter the market.

Another secret to Polymarket's success lies in its "hiding" of the underlying blockchain technology.

- USDC Standard: Polymarket has chosen USDC, a compliant US dollar stablecoin, as its settlement currency. This allows traders to base their profits and losses entirely on the accuracy of their judgments about events, without bearing the price risk inherent in the cryptocurrency itself.

- Polygon Layer 2's low cost: By building on the Polygon sidechain, Polymarket can subsidize gas fees for users through meta-transactions, achieving a "zero-gas" trading experience. Users are almost unaware of the blockchain's existence during operations, only needing to interact with the chain when depositing and withdrawing funds.

V. Evolution of Business Models and the Growth Flywheel

To sustain long-term operations and incentivize liquidity, Polymarket has begun adjusting its business model. According to data from early 2025, Polymarket has started introducing a "Taker-only" fee model in some short-term high-frequency markets, such as 15-minute cryptocurrency price predictions.

By charging fees to takers who withdraw liquidity (with the highest fees when the probability is close to 50%) and returning these fees to makers who provide liquidity, Polymarket effectively curbs delayed arbitrage bots targeting its zero-fee model while incentivizing deeper order books. This sophisticated economic model design marks its shift from "burning money to acquire customers" to "sustainable financial infrastructure."

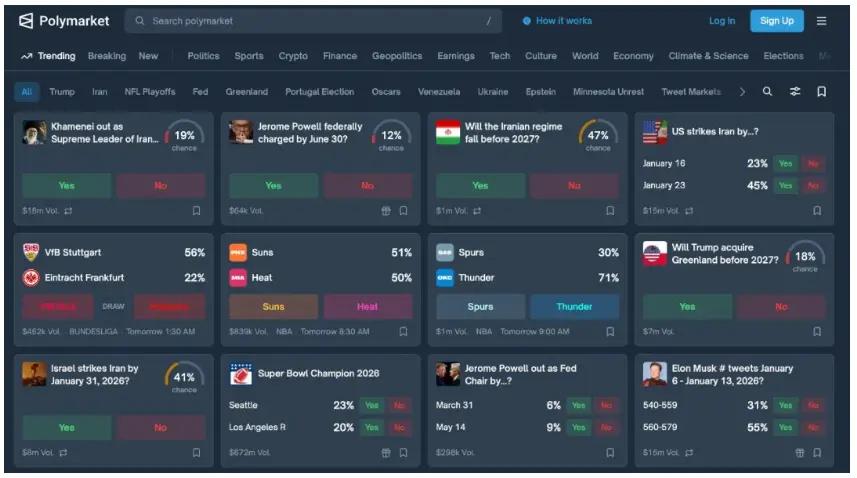

At the same time, its product form is essentially a "hot topic information stream": if you look closely at its interface, it doesn't resemble a trading terminal, but rather a "list page that turns world hot topics into tradable content".

Its growth flywheel is very clear:

Trending event emerges → Market creation → Price screenshots spread (this is crucial) → New users flood in → Liquidity deepens → Prices appear more "accurate" and more referable → Further dissemination

Currently, the situation is two-sided; there are also potential pitfalls within this flywheel:

- The credibility paradox: In 2025, the controversy surrounding whether trading volume was inflated poured cold water on the industry. If the popularity metric itself is fake, how much value does the platform's signal still have?

- Manipulating Risk: This is the most terrifying aspect—when prices can influence narratives, they attract funds to manipulate prices. For example, when an election is close, if a major investor deliberately dumps betting odds to lower the opponent's odds, creating the illusion that "the opponent has no chance," thereby cutting off the opponent's donation sources, the market ceases to be a "noise-reducing machine" and becomes a "battlefield of public opinion."

In addition, there is a very important attention factor here. In the attention age, the most common question is not "who is right", but "who does the market think has the best chance of winning now".

Polymarket's price curves are naturally perfect for screenshotting and sharing. It replaces complex situational analysis with a single number, making the discussion seem "decided." This is the real reason for its widespread popularity: it transforms complex narratives into a tradable and shareable curve.

VI. Evolution of the Market Landscape: The Dual Dominance of Polymarket and Kalshi

As prediction markets transitioned from a niche market to the mainstream, the market landscape underwent a dramatic shift between 2024 and 2025. Currently, a confrontation has emerged between the "offshore/decentralized" school, represented by Polymarket, and the "onshore/compliant" school, represented by Kalshi.

For most of 2024, Polymarket held over 95% market share thanks to its KYC-free operation, global accessibility (theoretically limited to US IP addresses), and a rich long-tail market. However, the situation reversed in 2025.

According to data from DeFiRate and Dune Analytics, by January 2025, Kalshi's weekly trading volume will exceed $2 billion, surpassing Polymarket's $1.5 billion, and its market share will climb to 60%.

Here, we must mention Kalshi's regulatory green light: After winning a crucial lawsuit against the CFTC, Kalshi was finally allowed to legally launch its election prediction contracts. This legal victory opened the door for compliant entry of US institutional funds.

- Polymarket’s strategy: continue to leverage its offshore advantages to offer more diversified, controversial, or long-tail markets (such as geopolitical conflicts and cryptocurrency technical details), and maintain community loyalty and speculative fervor through token issuance and airdrop expectations.

- Kalshi's strategy: Deepen its presence in the US compliant market, not only by establishing data partnerships with media outlets such as CNBC, but also by developing risk hedging products for businesses (such as inflation data forecast contracts), attempting to transform the forecast market into a legitimate financial derivatives exchange.

VII. In Conclusion

The ultimate goal of prediction markets is far more than just a "better casino." Ethereum founder Vitalik Buterin's concept of "Info Finance" paints a much grander picture: prediction markets will become the infrastructure for human society to obtain highly reliable information and will profoundly reshape media, research, and governance models.

Vitalik argues that information finance is the third social organization technology, following "markets (exchange of goods)" and "democracy (voting decision-making)." Its core lies in designing a market that incentivizes participants to reveal information, starting with facts you want to know.

In the future, AI agents based on Large Language Models (LLM) will become the main market makers and traders in prediction markets. AI can monitor millions of data sources around the world 24/7 and make millisecond-level bets in tens of thousands of micro-markets, such as "the probability of rain on a certain street next Tuesday".

From Intrade's regrettable exit to Augur's idealistic setbacks, and then to the rise of Polymarket and Kalshi, the evolution of prediction markets is a grand narrative of humanity's attempt to quantify the future and eliminate uncertainty through technological means. We are on the eve of the explosion of "information finance," and prediction markets are evolving from peripheral gambling tools into core cognitive infrastructure for human society. For entrepreneurs, this is not only about technological change, but also about profound insights into how to find new paradigms for value creation amidst the interplay of humanity, regulation, and truth.