In January 2026, the Ethereum ecosystem witnessed a surge in Staking activity, with many indicators reaching all-time highs. These record-breaking levels could reduce the supply of liquidation ETH and support a stronger ETH breakout in the near future.

Although ETH price has fluctuated below $3,500 for the past two months, many analysts believe a significant price surge could be imminent thanks to positive on chain signals.

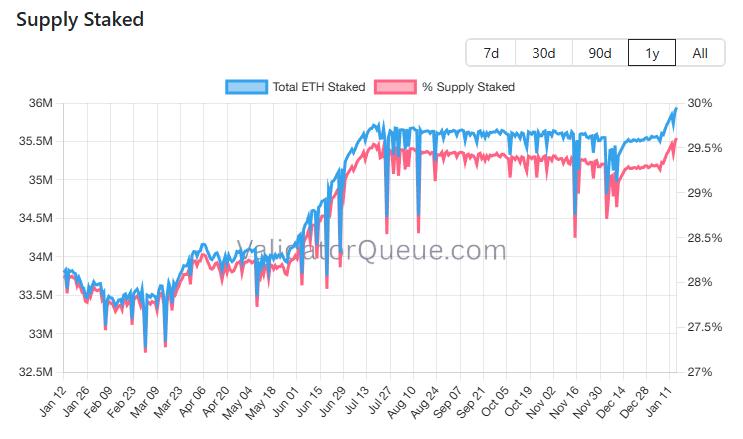

Nearly 36 million ETH have been Stake, representing almost 30% of the total supply.

According to data from ValidatorQueue, the amount of ETH currently Staking has reached 35.9 million, equivalent to 29.6% of the total circulating supply. At the current price, this amount of ETH is worth over $119 billion.

Total ETH Staking and percentage of supply Staking. Source: ValidatorQueue

Total ETH Staking and percentage of supply Staking. Source: ValidatorQueueThe chart shows that the amount of ETH Staking has surged significantly since the beginning of January. The number of ETH Staking has increased from 35.5 million to 35.9 million, marking the end of a sideways trading period that lasted from last August.

This growth occurred despite ETH prices having fallen by more than 30% since August. This demonstrates strong long-term confidence among investors and further reinforces the security and stability of the Ethereum network.

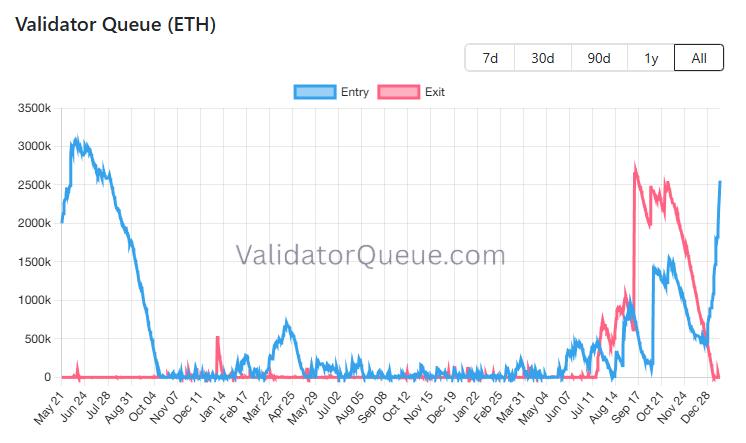

Additionally, as of January 15, 2026, the ETH Staking queue exceeded 2.5 million ETH – the highest level since August 2023. Meanwhile, the unstaking queue has decreased to zero.

Ethereum Validator Queue .

Ethereum Validator Queue .These record-breaking signals largely stem from the Staking activity of large institutions and publicly listed companies holding Digital Asset Treasuries (DATs).

Arkham reports that Tom Lee's company, Bitmine, has just Staking an additional 186,500 ETH – worth over $600 million. This brings their total ETH Staking to 1.53 million , worth over $5 billion. Thus, Tom Lee alone has Staking more than 1% of Ethereum's total ETH supply.

“Tom Lee is Staking billions of USD worth of ETH. He certainly knows more than we do.” — CryptoGoos commented .

Meanwhile, SharpLink (SBET) – the first publicly traded company to use Ethereum as its primary fund asset – reported that its Staking operations have generated over $32 million since June. The total accumulated rewards now amount to 11,157 ETH.

Ethereum also reached a new milestone in January with user activity hitting an All-Time-High . This trend is evident in the number of stablecoin transactions and activity on the Ethereum network's DeFi protocols.

With such optimistic signals, analysts predict that Ethereum could soon break through the current resistance level of $3,450 and head towards $4,000 . This forecast is further reinforced by the short-term "cup-and-handle " pattern that is forming.