JustLend DAO launches second round of buyback and burn: 525 million JST permanently burned, accelerating the deflationary engine.

525 million JST burned! JustLend DAO's deflationary mechanism delivers once again.

Abstract: Profit feedback and transparent token burning form a closed loop for JST's value growth, providing the DeFi market with a new paradigm where token value is driven by real yield.

On January 15, 2026, JST tokens officially completed their second large-scale buyback and burn. This burn not only demonstrated the project's firm commitment to the deflationary mechanism, but also showcased the strong profitability and financial health of the JUST ecosystem to the entire cryptocurrency market with the burning of 525,000,000 JST tokens (representing 5.3% of the total supply).

According to the official JustLend DAO announcement, the estimated value of the JST tokens destroyed in this round exceeds US$21 million. Combined with the first round of JST destruction, the cumulative JST tokens destroyed have reached 1,084,890,753, representing 10.96% of the total supply. This means that in less than three months, JST has achieved the permanent removal of more than one-tenth of the total supply, a remarkable deflationary speed.

From a broader perspective, this burn marks a fundamental evolution in JST's value narrative. It is transforming from a governance token into an equity asset anchored to the growth of ecosystem cash flow. This process not only enhances the scarcity and value foundation of the JST token but also provides a clear and traceable practical path for the decentralized finance sector, driving token value with real yield, demonstrating a transparent and sustainable new deflationary paradigm.

JustLend's DAO ecosystem is performing strongly, laying a solid financial foundation for large-scale buybacks.

Such a large-scale buyback and burn program inevitably requires a solid financial foundation. The announcement clearly reveals the dual pillars of its funding: a substantial $10,192,875 from JustLend DAO's net earnings in the fourth quarter of 2025, and another $10,340,249 from the project's accumulated earnings reserves . These two figures are themselves the strongest proof of its performance, pointing to a core fact: the JustLend DAO ecosystem not only possesses strong immediate profitability but also a robust financial structure and sustainable cash flow, which is the solid foundation supporting its commitment to buybacks and its deflationary strategy.

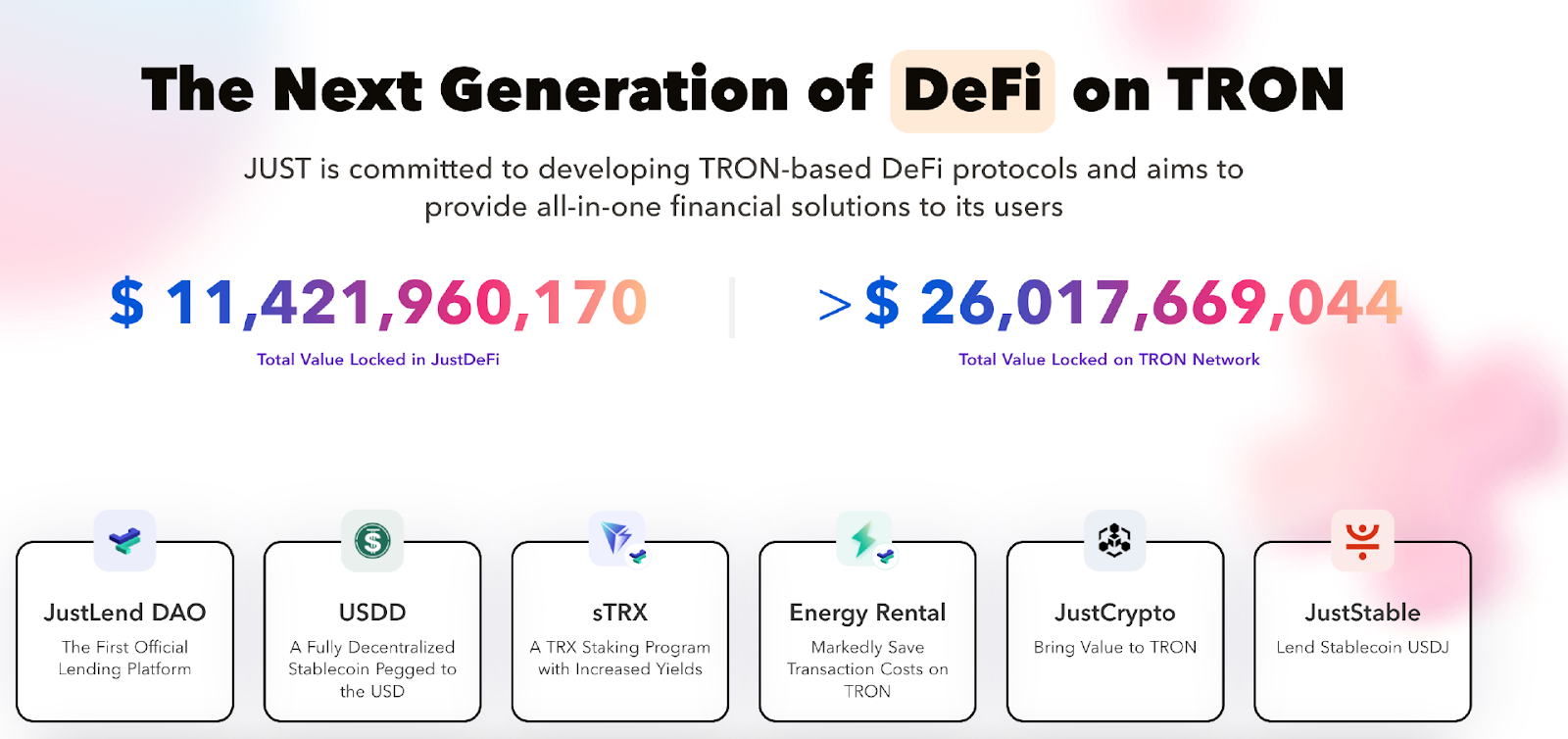

A deep analysis of JustLend DAO's performance in the fourth quarter of 2025 reveals several clear growth trends. First, as the flagship lending protocol of the JUST ecosystem, JustLend DAO benefited from the continuous improvement of TRON's infrastructure, with its total value locked (TVL) exceeding $7.08 billion in the fourth quarter and consistently ranking among the top three in the lending market. Its SBM market also saw lending activity climb to a new cyclical high.

It's worth noting that the $10,340,249 in outstanding profits, a significant portion of the repurchase funds, can be traced back to the reserve returns deposited into the SBM USDT market during JST's initial repurchase. This appreciation of funds is itself direct proof of the SBM market's strong profitability. It demonstrates JustLend DAO's ingenious financial operation model: strategically reusing ecosystem profits to allow them to continue "self-sustaining" within the protocol, thus providing an endogenous and sustainable source of funding for subsequent value returns.

Building on this foundation, JustLend DAO's revenue structure has become increasingly diversified. In addition to maintaining steady growth in its core traditional lending market, JustLend DAO has innovatively built a product matrix including sTRX (Staked TRX) and Energy Rental, greatly expanding the boundaries and depth of its value capture.

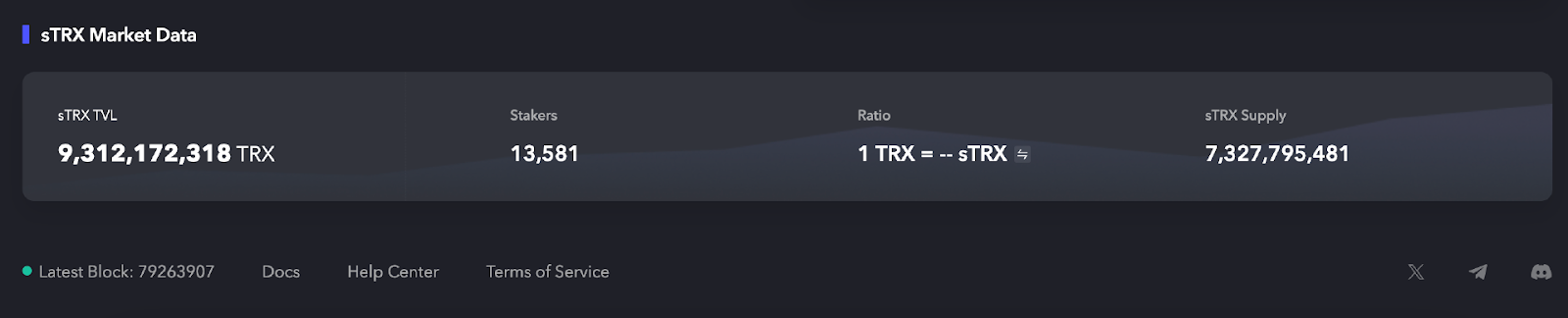

The sTRX service allows users to earn rewards by staking TRX while still flexibly participating in other DeFi activities. This innovative design significantly improves capital efficiency and user engagement. As of January 15, the platform's TRX staking volume has exceeded 9.3 billion. This astonishing figure not only reflects the community's extremely high recognition of the sTRX product but also brings it considerable and sustainable service revenue .

Meanwhile, the "Energy Leasing" service, designed to reduce on-chain operating costs for users, has also demonstrated strong market appeal through proactive fee optimization. Since September 2025, the service's base fee has been significantly reduced from 15% to a more competitive 8% . This fee optimization has directly stimulated market demand and transaction frequency, thereby creating robust incremental revenue for the protocol through a more active leasing business.

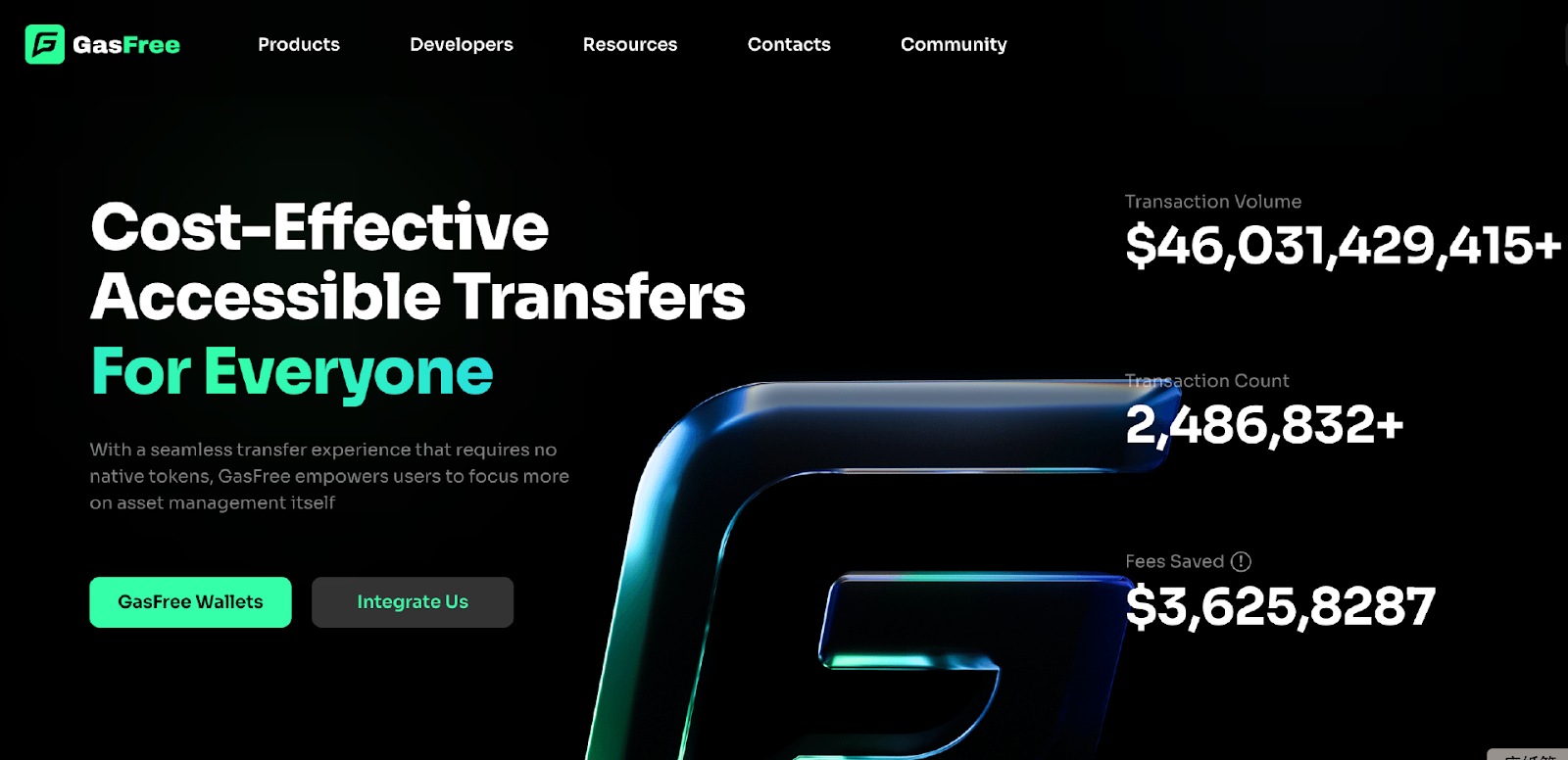

While continuously strengthening its core product portfolio, JustLend DAO focused on lowering the barrier to entry for general users. In March 2025, it innovatively launched the GasFree smart wallet. This feature completely broke down the long-standing barrier for novice users—the requirement to hold the native token (TRX) in advance to pay transaction fees—allowing users to directly deduct and pay network fees from their transferred token assets (such as USDT). This design not only achieves ultimate operational convenience but also fundamentally broadens the accessibility of blockchain finance.

To accelerate the adoption of this innovative feature, JustLend DAO simultaneously launched an attractive 90% transaction fee subsidy program. Under this program, users transferring USDT using the GasFree feature only incur a very low fee of approximately 1 USDT. This combined strategy quickly ignited market demand. As of January 15th, the total transaction volume driven by the GasFree smart wallet had exceeded $46 billion . This astonishing scale not only validates the market's strong desire for a frictionless trading experience but also directly saves users over $36.25 million in network fees . This innovation, by significantly reducing actual usage costs and the cognitive barrier, has brought a huge influx of new users and funds into the ecosystem, forming another strong growth engine for the platform's network effects and revenue potential.

Meanwhile, another funding channel in the buyback and burn program, namely the incremental revenue from the USDD multi-chain ecosystem (the portion exceeding $10 million), also constitutes a significant source of value. As the core decentralized stablecoin of the TRON ecosystem, USDD has achieved remarkable results with its multi-chain expansion strategy, successfully deploying on mainstream public chains such as Ethereum and BNB Chain, broadening its application scenarios and user base.

Its ecosystem value recently achieved a milestone leap, with USDD's TVL historically surpassing the $1 billion mark on January 14th. This means that in less than two months, USDD's TVL has achieved an astonishing 100% growth, and its expansion speed and market acceptance fully demonstrate the stablecoin's strong momentum and deep asset appeal within the multi-chain ecosystem. The rapid growth of its TVL and the continued prosperity of its ecosystem significantly enhance the future potential of this funding channel, providing a predictable source of value for JST's subsequent quarterly buyback and burn plans.

By deeply integrating with various DeFi protocols, USDD has not only solidified its anchor stability but also created a continuous inflow of value into the entire ecosystem. The JST buyback and burn program incorporates the excess revenue from the USDD ecosystem, constructing a value loop of "stablecoin + lending protocol + governance token." In this model, the expansion and prosperity of USDD and JustLend DAO directly fuels the deflation of JST, while the increase in JST's value, in turn, enhances the attractiveness and cohesion of the entire TRON DeFi ecosystem, forming a powerful internal synergy and value feedback effect.

Deepening the Deflation Mechanism: A Revolutionary Reshaping of the Value Foundation of JST

In conclusion, the significance of this buyback and burn has long surpassed the scope of simple price support; it is triggering a series of profound structural changes. Most fundamentally, it has reshaped the value support logic of JST. JST is no longer merely a "tool token" used to pay network fees or participate in governance voting; it has evolved into an "equity asset" directly pegged to the cash flow performance of JustLend DAO, USDD, and its associated ecosystem.

Through the buyback and burn mechanism, the ecosystem's profit growth is continuously injected into the value foundation of the JST token, making holding JST equivalent to holding a certificate of rights to share in the ecosystem's future profit growth. On January 8th, CoinMarketCap data showed that JST's market capitalization historically surpassed the $400 million mark . This is not only a numerical leap but also a substantial recognition of its new positioning by the market. Accompanying the rise in market capitalization is increased trading activity. On January 8th, its 24-hour trading volume increased significantly by 21.92%, reaching $31.49 million, and its price has also steadily risen by 10.82% in the past month, with a daily increase of 3.1%.

The simultaneous expansion of trading volume and market capitalization at key junctures is not a random market fluctuation, but rather a clear "vote of confidence" cast by funds in the positive fundamentals of the JUST ecosystem, especially the profitability and value return mechanism demonstrated by the buyback and burn mechanism.

Secondly, the JST buyback and burn also brings a substantial increase in governance power. As the total supply of tokens irreversibly decreases, the governance weight represented by each JST remaining in the market will increase accordingly. This means that long-term holders not only enjoy the economic benefits of increased value, but their voice in key community decisions (such as parameter adjustments, new product launches, and the use of treasury funds) is also amplified. This design deeply binds the interests of core community members to the long-term success of the protocol, greatly enhancing community stability and participation.

From a broader industry perspective, JST's buyback and burn practices provide a clear and exemplary new paradigm for token economics in the DeFi field. Removing 10.96% of the total supply in a very short time through two rounds of burning not only demonstrates efficient execution, but more importantly, it deeply binds the protocol's financial success with the interests of token holders, thus establishing a virtuous cycle of "value creation - value return."

This model fundamentally reverses the old logic of token value relying on speculative narratives, shifting towards a sustainable path driven by protocol fundamental cash flow, and providing a solid and credible case study on how the industry can build an economic model with substantial value support.

Looking ahead, as JST's quarterly share buybacks and burns become routine, a clear and predictable deflationary path has been laid, and JST's scarcity will be a definite narrative that strengthens over time. Each quarterly report and the subsequent burn will act as a catalyst for reassessing its intrinsic value. This burn is not the end, but the beginning of a more magnificent chapter of value accumulation—a value revolution supported by ecosystem profitability and driven by product synergy has already been accelerated.