Amidst the turmoil, cryptocurrencies are becoming a safe haven for Iranians.

Written by: Chainalysis

Compiled by: Chopper, Foresight News

TL;DR

- In 2025, the size of Iran's crypto ecosystem exceeded $7.78 billion, with growth rates exceeding those of the previous year for most of the year.

- Cryptocurrency trading activity in Iran is highly correlated with domestic and international political events and conflicts.

- In the fourth quarter of 2025, the Islamic Revolutionary Guard Corps (IRGC) accounted for approximately 50% of the total on-chain transaction volume in Iran's crypto ecosystem, and its market share showed a steady upward trend, which is consistent with the organization's dominant position in Iran's overall economy.

- During the recent large-scale protests, Iranian citizens have significantly increased their withdrawals of Bitcoin from personal wallets, possibly as a safe haven for their assets amid the backdrop of currency collapse and political turmoil.

Amidst mounting internal and external pressures on the Iranian regime, cryptocurrencies have become a significant financial alternative for many Iranians. The current Iranian regime faces the impact of large-scale domestic protests and the potential threat of external military intervention; since 2018, the Iranian rial has plummeted by approximately 90%, and the rate of depreciation has accelerated further with escalating regional conflicts. For Iranians living in an economy with inflation rates as high as 40% to 50% and the government struggling to maintain economic stability, cryptocurrencies are not only a means of circumventing sanctions but also a way to escape the increasingly desperate and dysfunctional economic system controlled by the regime.

It's worth noting that it's not just ordinary Iranians turning to cryptocurrencies. The Islamic Revolutionary Guard Corps (IRGC) is also extensively utilizing crypto assets to fund its domestic activities and those conducted through its Middle East proxy network. This article will explore three key trends: the link between Iranian cryptocurrency activity and political events, the IRGC's growing dominance in Iran's crypto economy, and how Iranians have turned to Bitcoin as a safe-haven asset during recent protests.

Blockchain as a barometer: On-chain behavior characteristics under turbulent circumstances

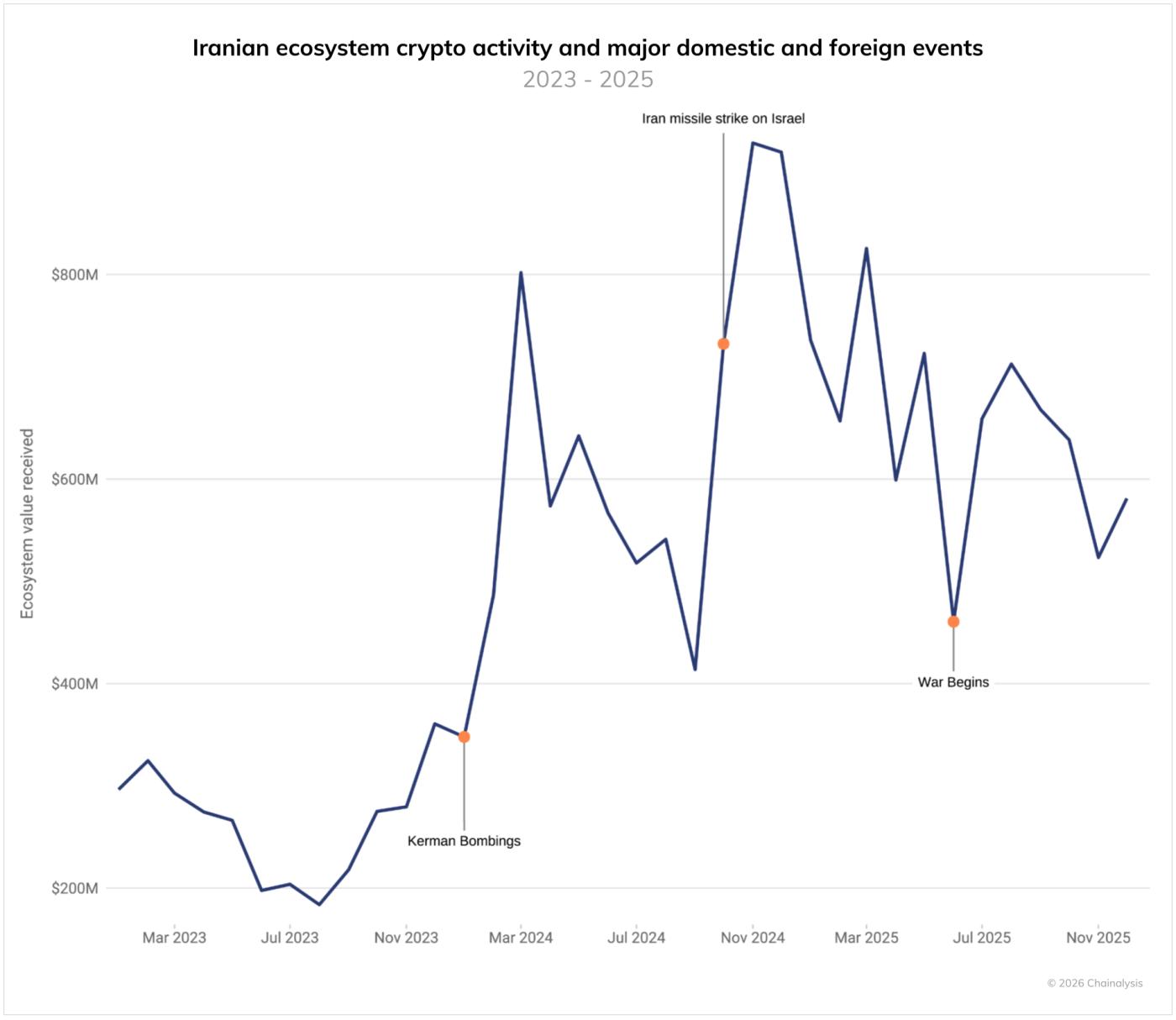

In 2025, Iran's crypto ecosystem surpassed $7.78 billion in size, with a growth rate significantly higher than the previous year. As shown in the chart below, combined with trend data from last year's Crypto Crime Report (https://www.chainalysis.com/blog/crypto-crime-sanctions-2025/), cryptocurrency trading activity in Iran saw significant surges during major domestic and geopolitical events.

These key events include:

- The Kerman bombing in January 2024: Nearly 100 people were killed at a memorial service for Qassem Soleimani, the former commander of the Quds Force of the Iranian Islamic Revolutionary Guard Corps.

- Iran's missile strikes against Israel in October 2024: This attack was in retaliation for the assassinations of Hamas leader Ismail Haniyeh in Tehran and Hezbollah Secretary-General Hassan Nasrallah in Beirut.

- The 12-day conflict in June 2025: The "shadow war" between Iran and Israel reaches its climax. This conflict not only triggered a joint US-Israeli strike against Iran's nuclear weapons and ballistic missile programs, but also led to cyberattacks on Nobitex, Iran's largest crypto exchage, and Sepa Bank, used by the Islamic Revolutionary Guard Corps. Hackers also breached Iranian state television, broadcasting footage of women protesting and calling on Iranians to take to the streets.

Correlation between Iranian cryptocurrency trading activity and major political events

The Islamic Revolutionary Guard Corps is gaining increasing influence in the cryptocurrency field.

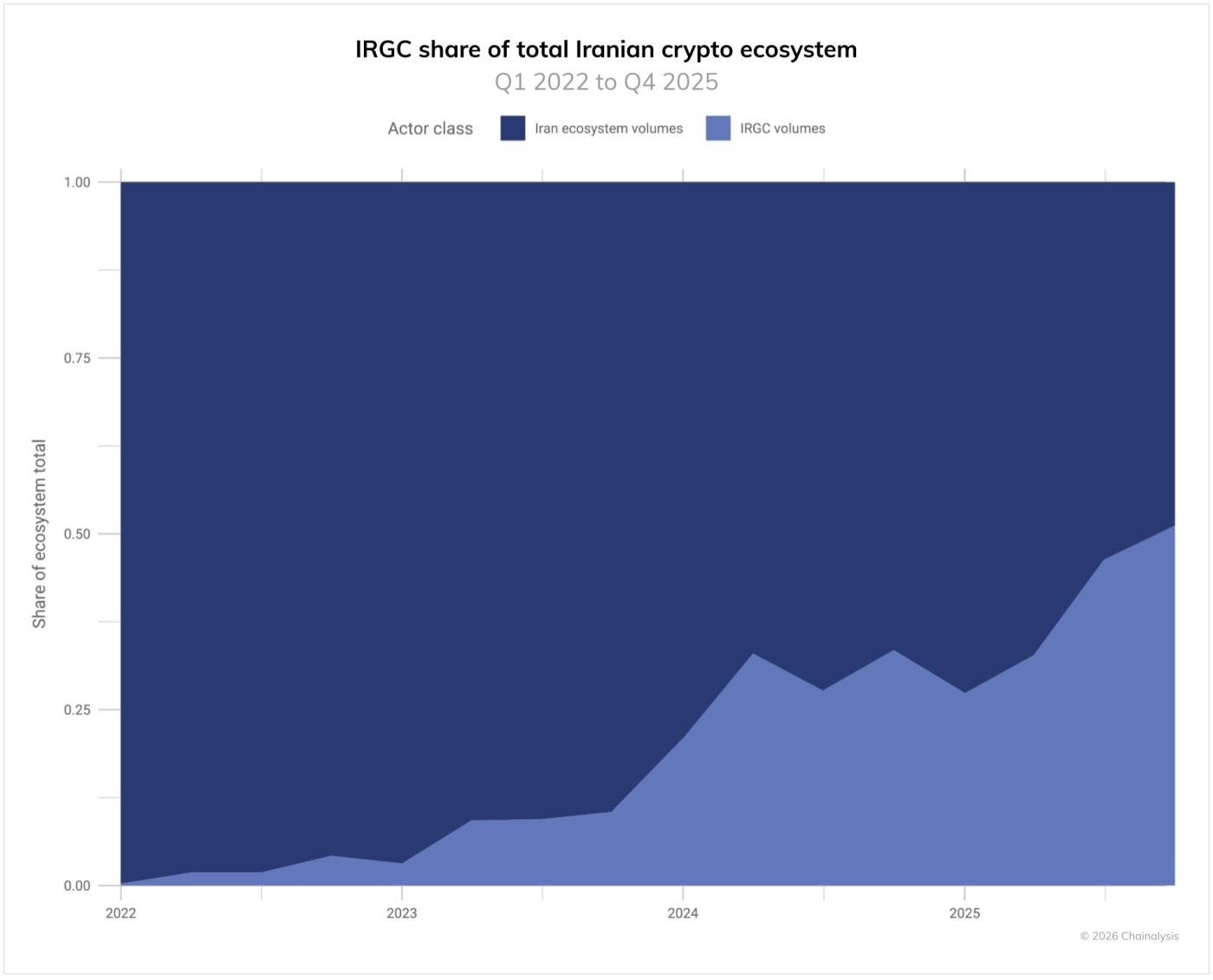

Of particular note is the continued rise in the Islamic Revolutionary Guard Corps' (IRGC) dominance in Iran's cryptocurrency sector. While transaction volumes of wallet addresses associated with the organization's vast transnational funding network have fluctuated in recent years, their share of Iran's overall crypto economy has steadily increased, as shown in the data below. In the fourth quarter of 2025, these addresses received over 50% of the total funds received in the Iranian crypto market. This trend is not isolated but aligns with the IRGC's expanding control over Iran's overall economic and political institutions. In 2024, on-chain funds received by addresses associated with the IRGC exceeded $2 billion, and in 2025, this surged to over $3 billion.

Importantly, even these staggering figures are only estimates, and the statistics only include a limited number of wallet addresses explicitly listed as controlled by the Islamic Revolutionary Guard Corps on the sanctions lists of the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) and the Israel National Counter-Terrorism Financing Authority (NBCTF). This data does not cover shell companies, financiers, and other wallet addresses that may be controlled by the organization but have not yet been identified.

We expect this number to rise further as more Islamic Revolutionary Guard Corps-linked wallets are publicly disclosed and more aspects of its money laundering network are exposed.

The changing trend of the Islamic Revolutionary Guard Corps' share in Iran's overall crypto ecosystem

Bitcoin as a tool of protest

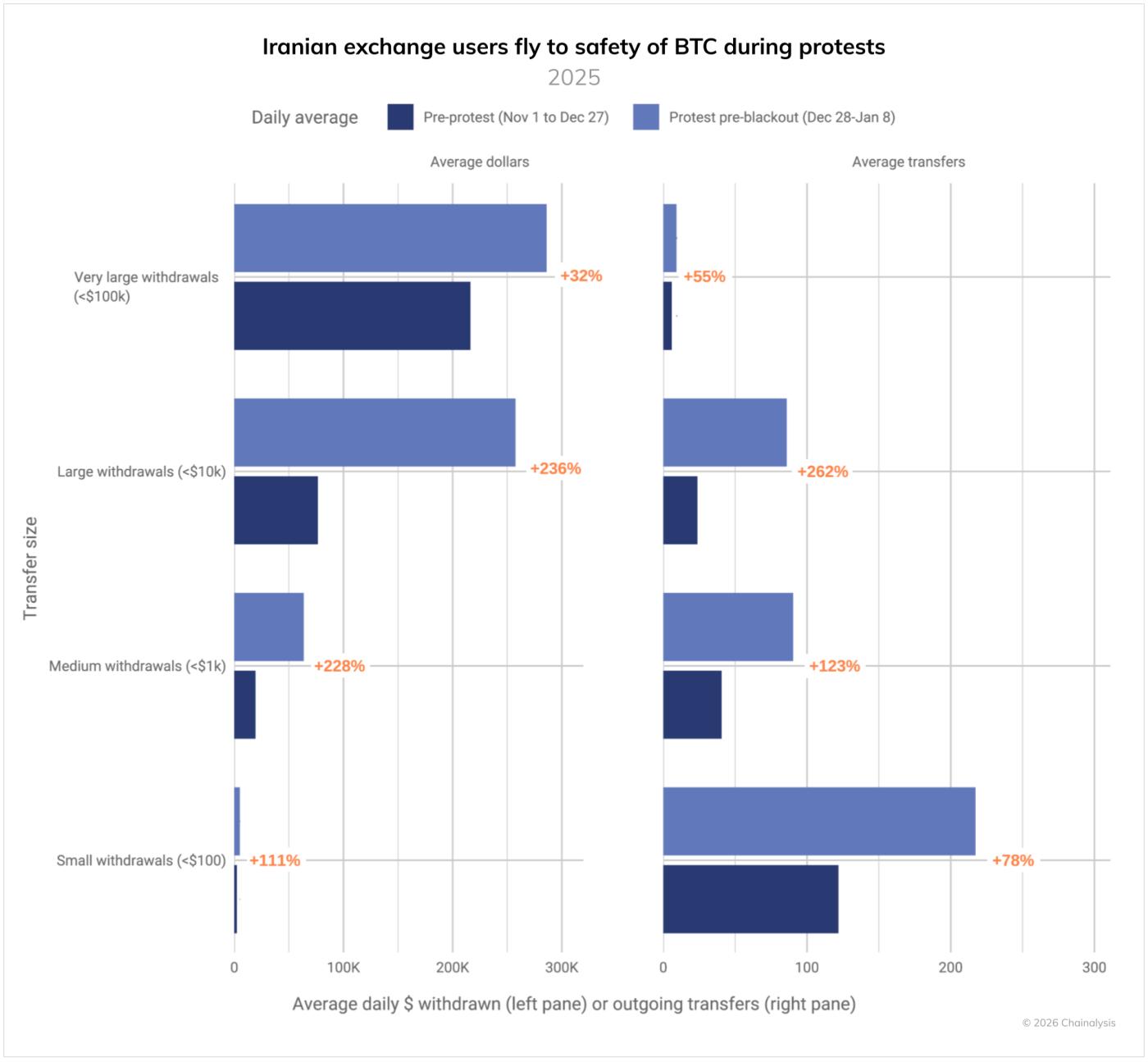

Latest data shows a significant shift in the on-chain behavior of Iranians during the current large-scale protests. Comparing on-chain data from the pre-protest window (November 1 to December 27, 2025) with that from the protest period (December 28, 2025 to January 8, 2026, when Iran begins a comprehensive internet shutdown), we found a substantial increase in both the average daily USD amount transferred to personal wallets and the average daily number of transactions. The most representative trend is the surge in withdrawals from Iranian crypto exchage to unclaimed personal Bitcoin wallets. This phenomenon indicates that the proportion of Bitcoin held by Iranians during the protests is far higher than before the protests.

This action is a rational response to the collapse of the Iranian rial, which is now almost worthless and has lost almost all value against major currencies such as the euro.

In this crisis, Bitcoin's role extends beyond simply preserving asset value. For many Iranians, cryptocurrency has become part of the resistance movement, providing liquidity and choice in an increasingly constrained economic environment. Unlike traditional assets that are illiquid and often government-controlled, Bitcoin's censorship-resistant and self-custodial nature offers financial flexibility. This is particularly valuable when individuals may need to flee their country or conduct economic activities outside of government-controlled financial channels. This increase in Bitcoin withdrawals during periods of high instability is consistent with trends observed in other regions experiencing war, economic turmoil, or government repression.

Iranian citizens withdraw Bitcoin en masse

As sanctions pressure and international condemnation intensify, and given Iran's continued economic instability, cryptocurrencies may remain a key tool for the Iranian people in their pursuit of financial sovereignty. The correlation between major political events and a surge in cryptocurrency trading activity reveals that cryptocurrencies are gradually evolving into a dual role in authoritarian economies, serving as both a financial lifeline and a potential tool of resistance.