Source: The DeFi Report

Author: Michael Nadeau

Original title: Solana brought in year with a bang. How did it end it?

Compiled and edited by: BitpushNews

Solana kicked off 2025 with a bang, becoming Trump's preferred platform for launching Meme Coin and the first stop for most new users entering this cycle. However, how did 2025 actually end?

The Solana network appears to be entering a cyclical reset period. On-chain speculative demand continues to decline, and new use cases and traditional finance (TradFi) integration have yet to fill this gap. Q4 operating performance weakened significantly: total revenue (REV) fell 43% to its lowest level since Q3 2023; real on-chain yields fell 56% to 0.46%. Simultaneously, fundamentals deteriorated with declining user activity, and operating costs rose sharply relative to user fees.

This article will provide a comprehensive analysis of Solana's Q4 performance using data.

I. Operational Performance: Both Revenue and Profits Shrink

1. Real Economic Value (REV)

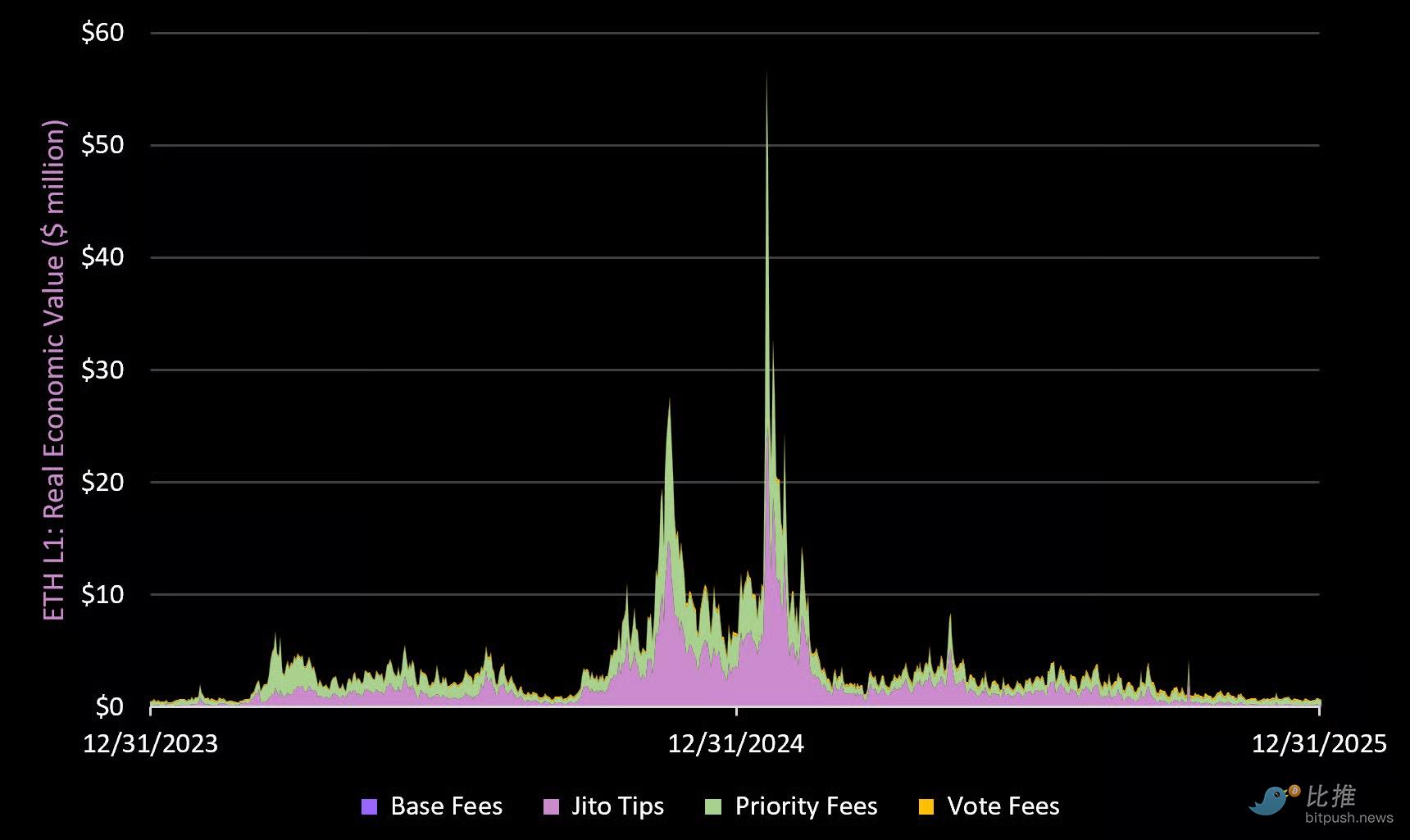

Note: REV includes the base fee, priority fee, MEV (Jito Tips), and voting fee. MEV is returned to SOL holders through staking.

The Solana network generated only $91.1 million in total fees in Q4, the lowest point since Q3 2023, and far below the $222.7 million in the previous quarter.

2025 Full Year Performance: Generates $1.4 billion in REV, down 1.4% from last year.

For comparison: Ethereum network fees were $141 million in Q4 and $763 million for the whole of 2025.

Data breakdown:

Base fees: down 32% in Q4 (but up 43% for the full year 2025)

Jito Tips (MEV): 75% plunge in Q4 (8% increase for full year 2025)

Priority fees: down 51% in Q4 (up 15% for full year 2025)

Voting fees: Down 27% in Q4 (Up 32% for full year 2025)

Key conclusions:

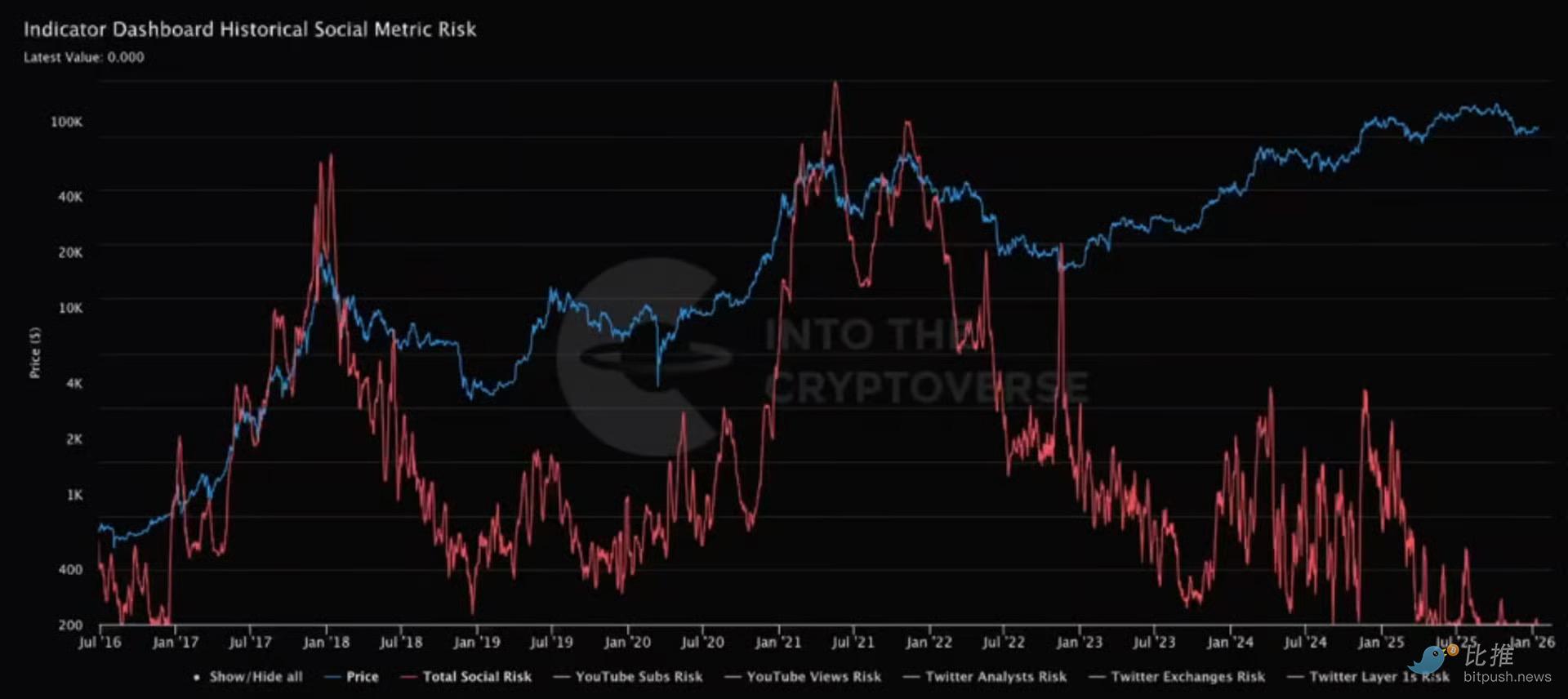

Solana was once the "speculative stronghold" of this cycle. The most powerful applications on the network (Pump.fun, Axiom, Raydium, Jupiter) all serve retail traders . This means that on-chain revenue is highly cyclical and extremely dependent on speculative desires. With the social buzz surrounding cryptocurrencies falling to a six-year low, this trend is unlikely to reverse in the short term.

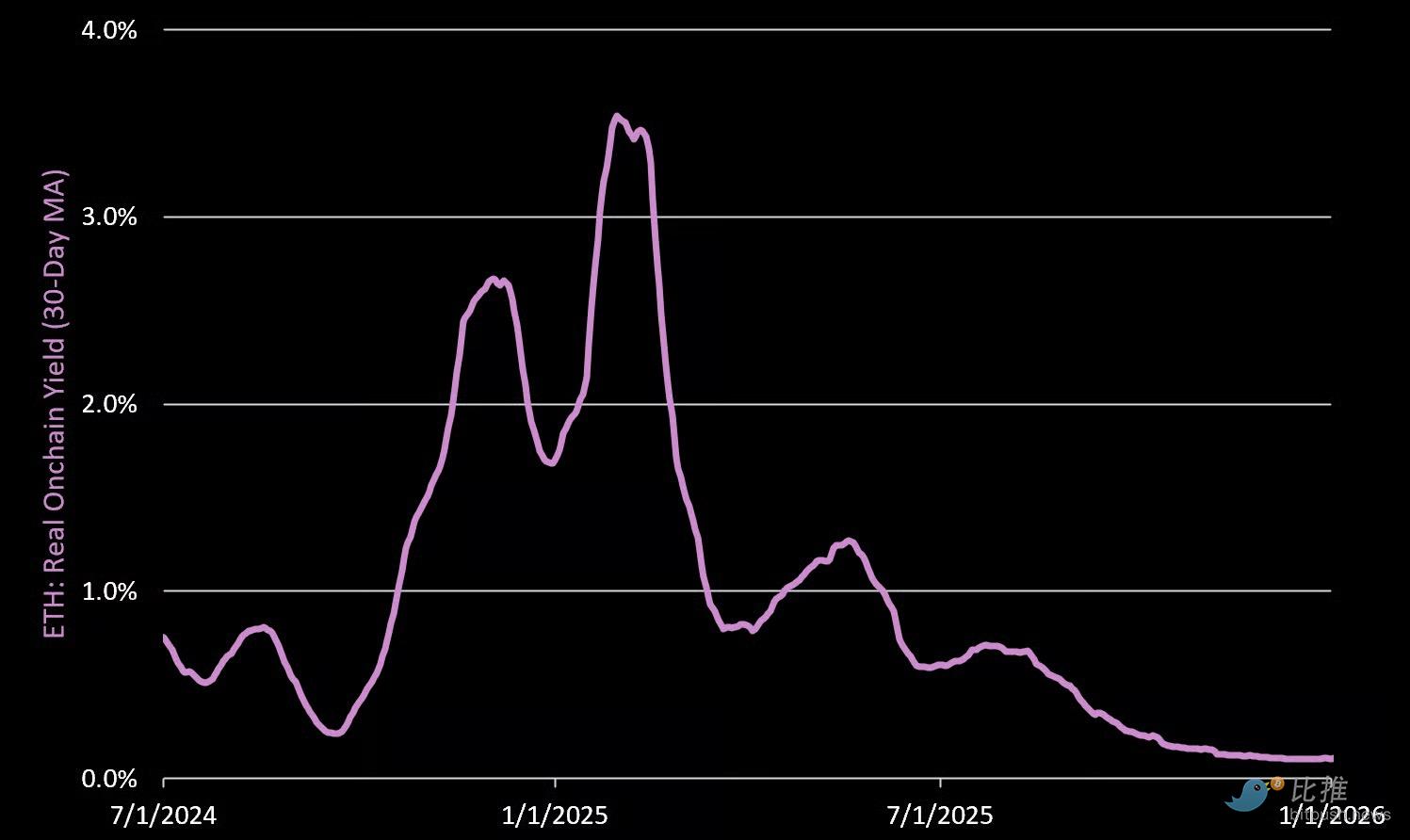

2. Actual on-chain yield

The actual on-chain yield (annualized) in Q4 was only 0.46%, a 56% decrease compared to the previous quarter. Of this, 72% came from priority fees and 28% from MEV. The decrease in the proportion of MEV reflects a significant weakening of on-chain competition (i.e., speculative demand) this quarter.

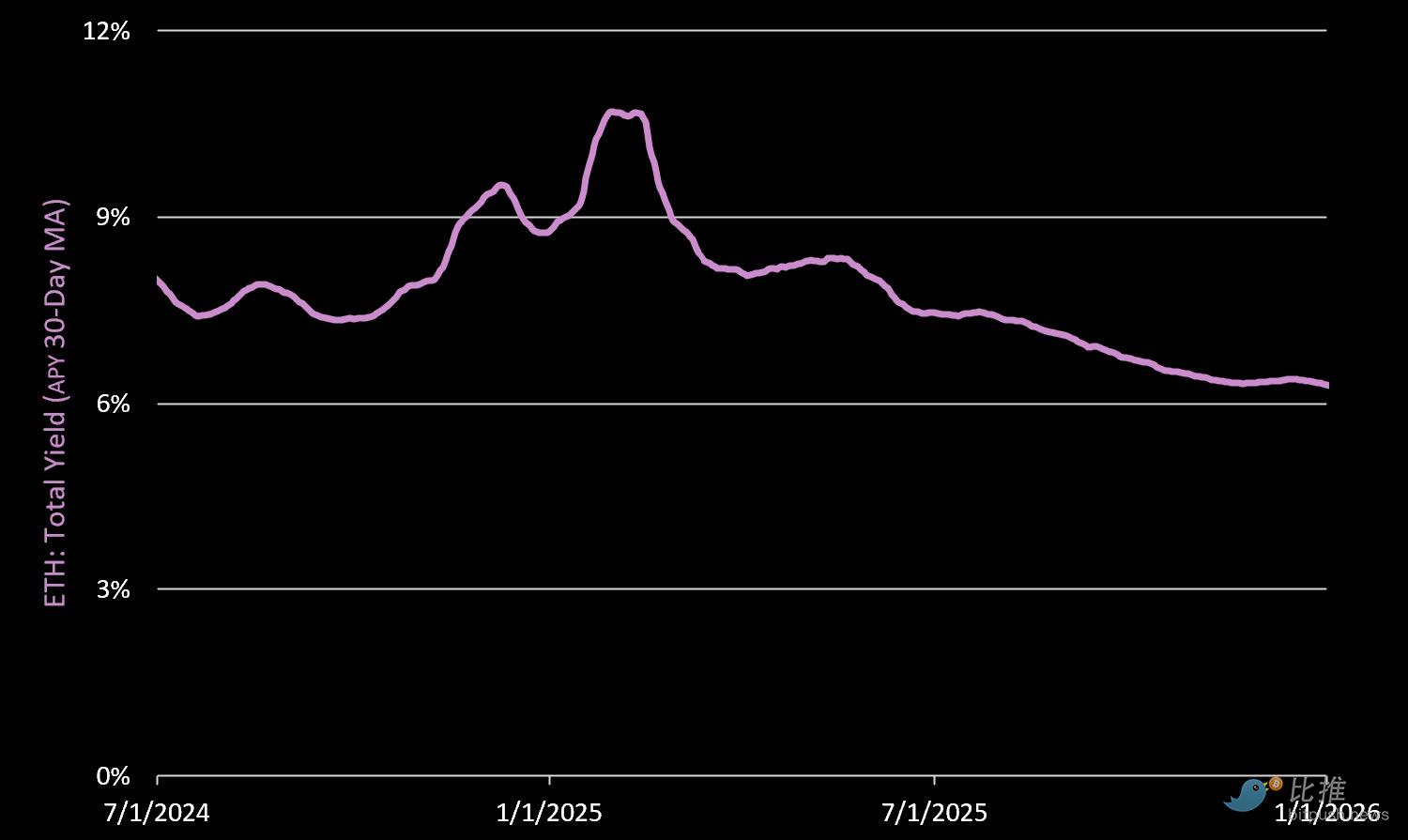

3. Total on-chain yield

The total annualized yield, including the protocol's new issuance rewards, is 6.7%. It's worth noting that 93% of this yield comes from the issuance of new SOL tokens. Due to a 55% decrease in priority fees and MEV, the total yield slipped from 7.64% in Q3.

II. Network Fundamentals: The Challenge of Efficiency

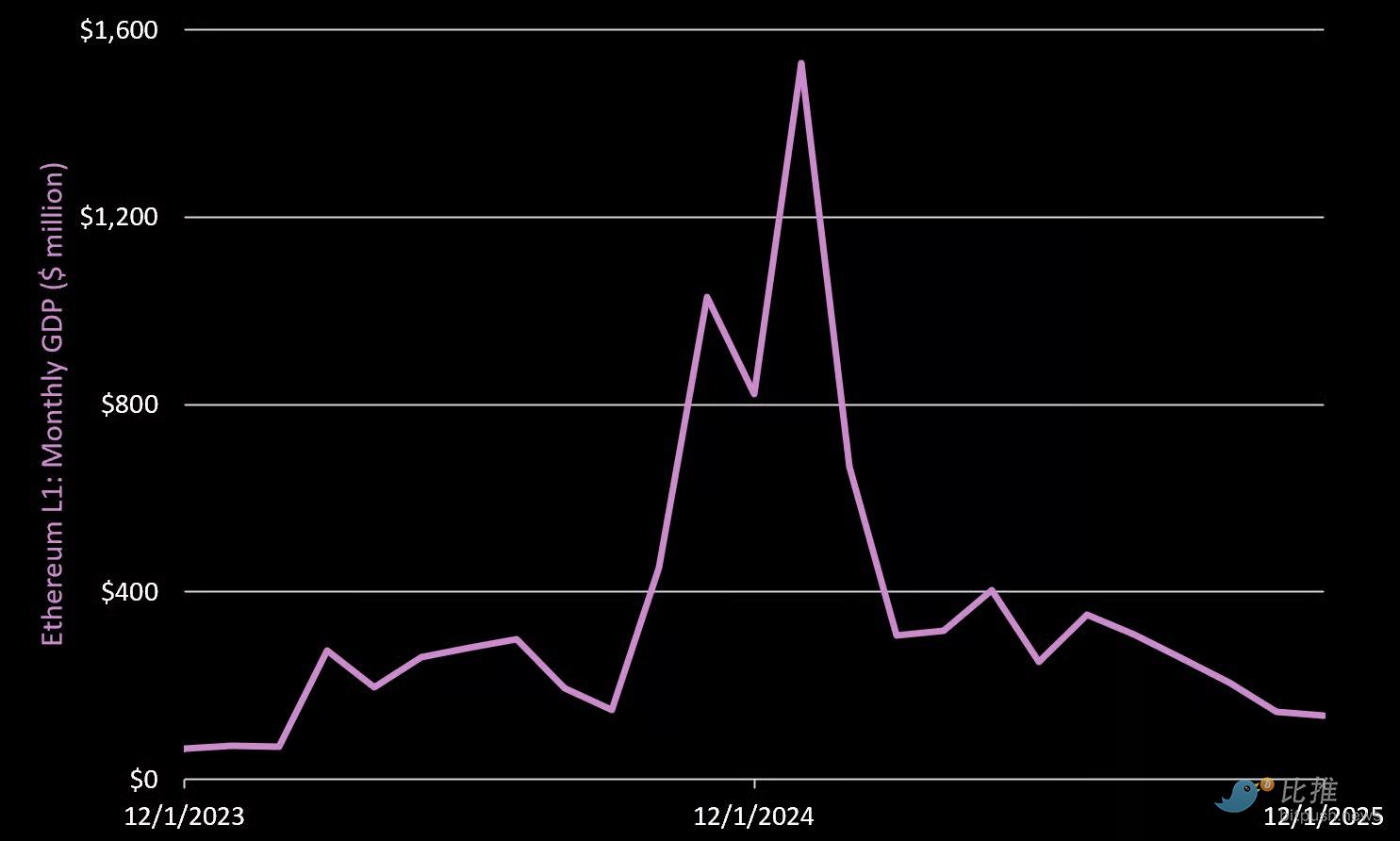

1. Monthly Internet GDP

Note: GDP refers to the total fees generated by top-level applications on the blockchain (excluding the fees of the public blockchain itself).

The GDP generated by top-tier applications in Q4 was $485 million, a 47% decrease compared to the previous quarter.

Pump.fun: $96 million (down 19% in Q4)

Circle: $85 million (up 6% in Q4)

Axiom: $55 million (down 61% in Q4)

Raydium: $31 million (down 79% in Q4)

In comparison, Ethereum L1 applications generated $2.3 billion in GDP in Q4.

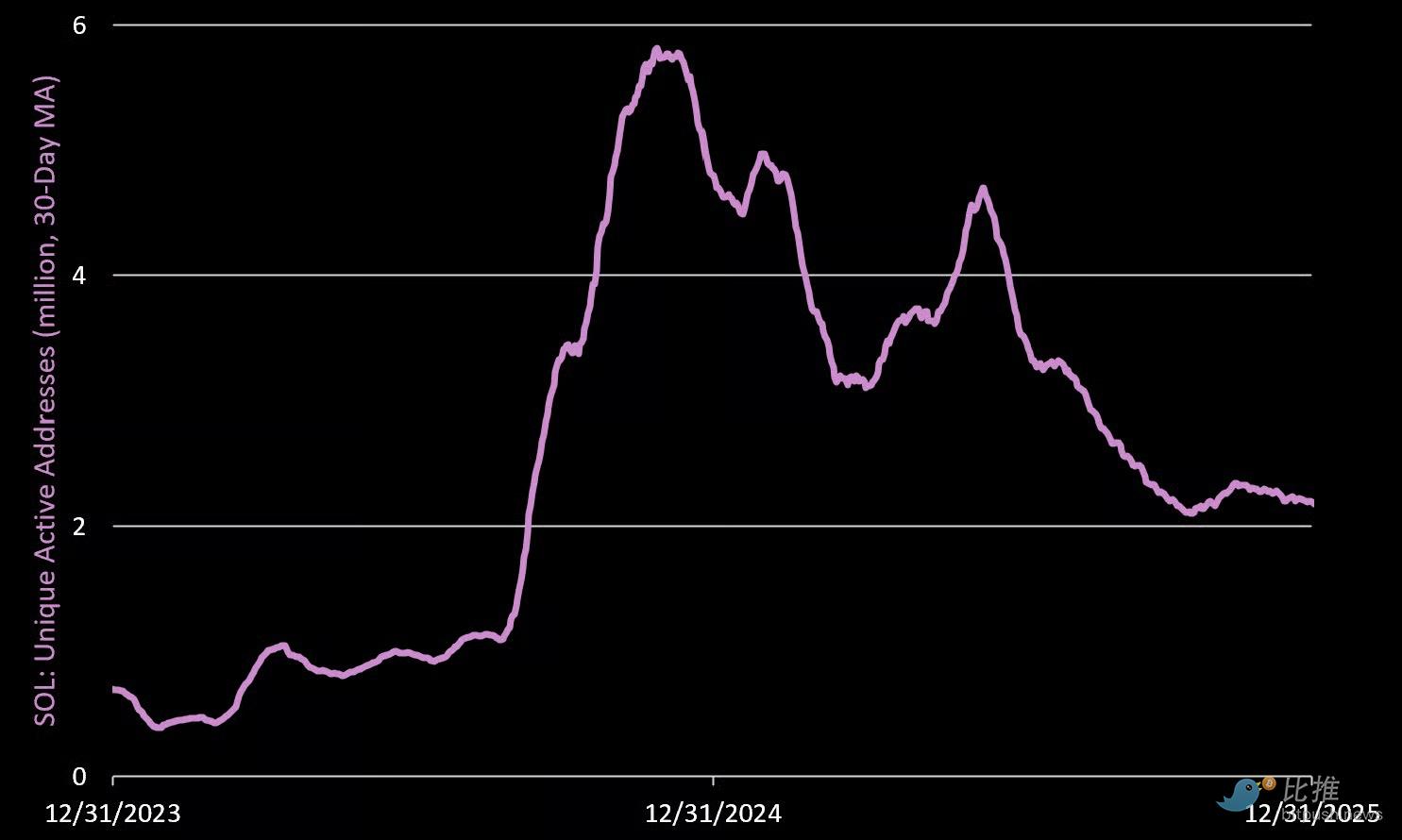

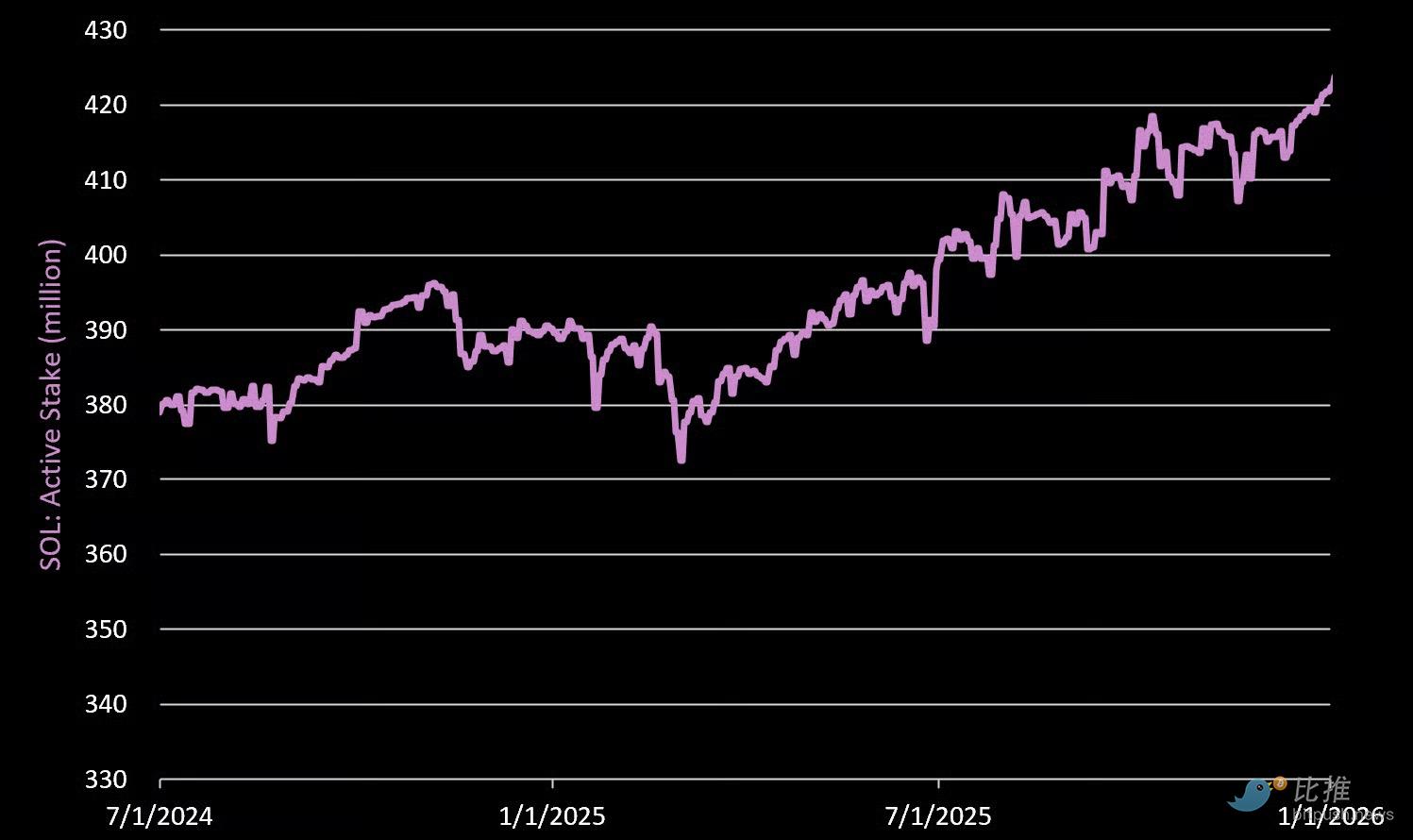

2. Active addresses and staking

Active addresses: The average daily active addresses in Q4 were 2.2 million, a decrease of 19% compared to the previous quarter.

Active staking: As of December 31, 2025, a total of 421.7 million SOL tokens were staked (75% of the circulating supply), representing a 3.5% increase compared to the previous period.

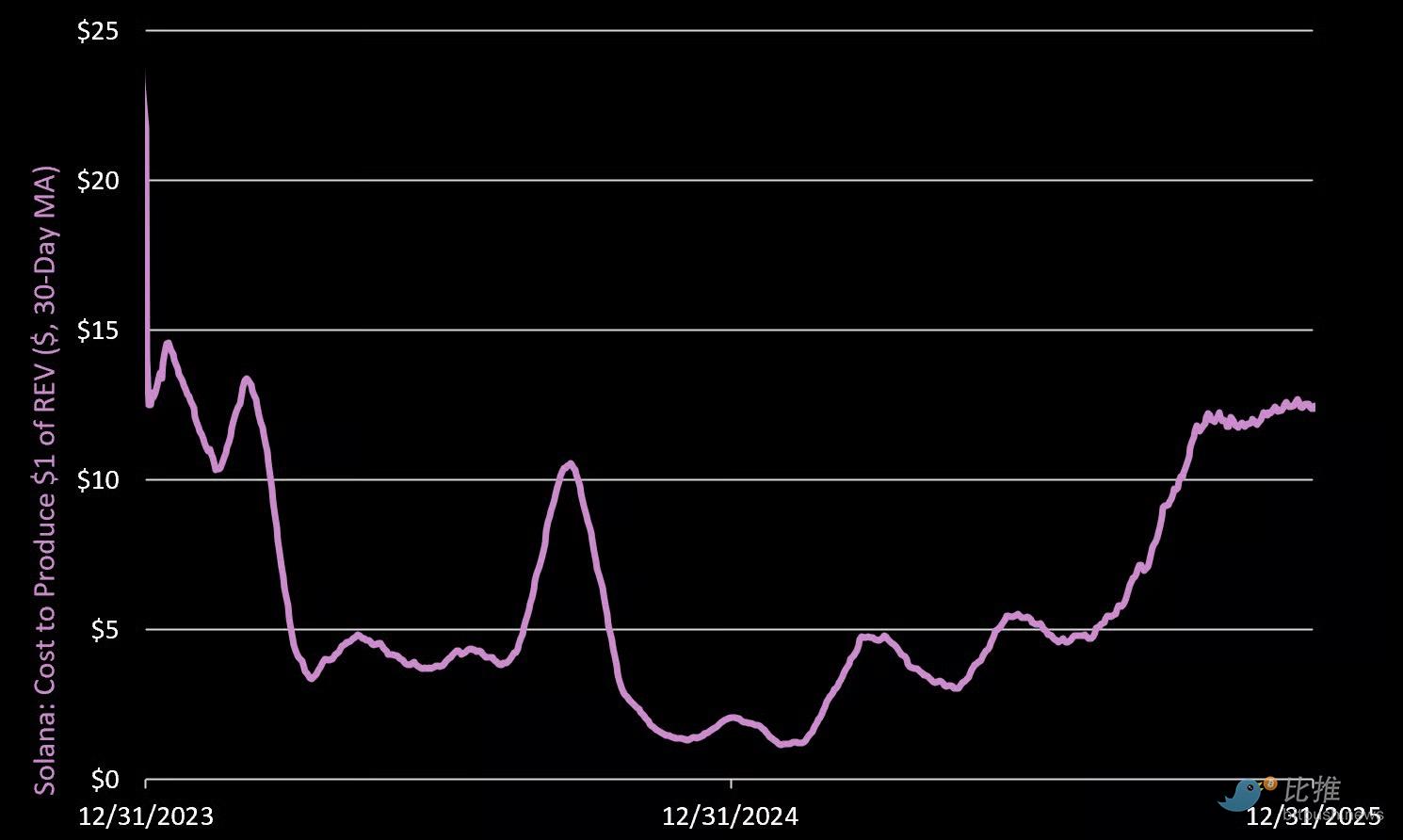

3. The cost of producing $1 REV

The average cost of generating $1 of real economic value rose to $11.76 in Q4, a surge of 105% quarter-over-quarter.

What does this mean? It shows that the inflationary cost (incremental issuance) of the network relative to its actual value is rising in order to maintain cybersecurity. If Solana were a company, it would be time to cut administrative costs and reduce expenses.

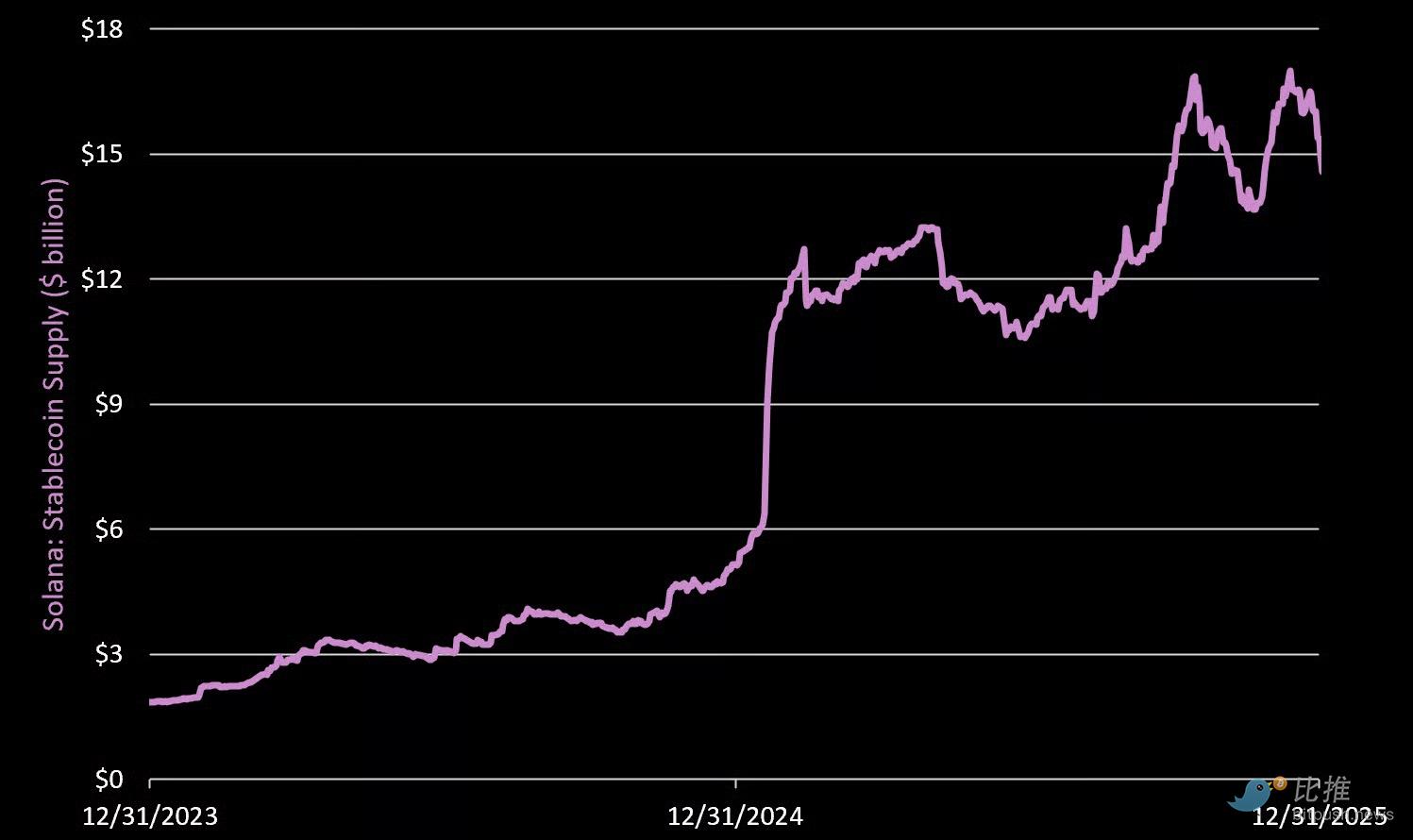

III. Stablecoins

Stablecoin supply

The total on-chain stablecoin supply reached $15.4 billion, a 4.4% increase month-over-month. This represents 5% of the total stablecoin supply in the crypto market, ranking after Ethereum, Tron, and BNB. Leading issuers:

Circle/USDC: $9.9 billion (down 1% in Q4)

Tether/USDT: $2.1 billion (down 10% in Q4)

PayPal/USDPY: $870 million (up 95% in Q4)

Paxos/USDG: $870 million (up 80% in Q4)

Solstice/USX: $306 million (up 83% in Q4)

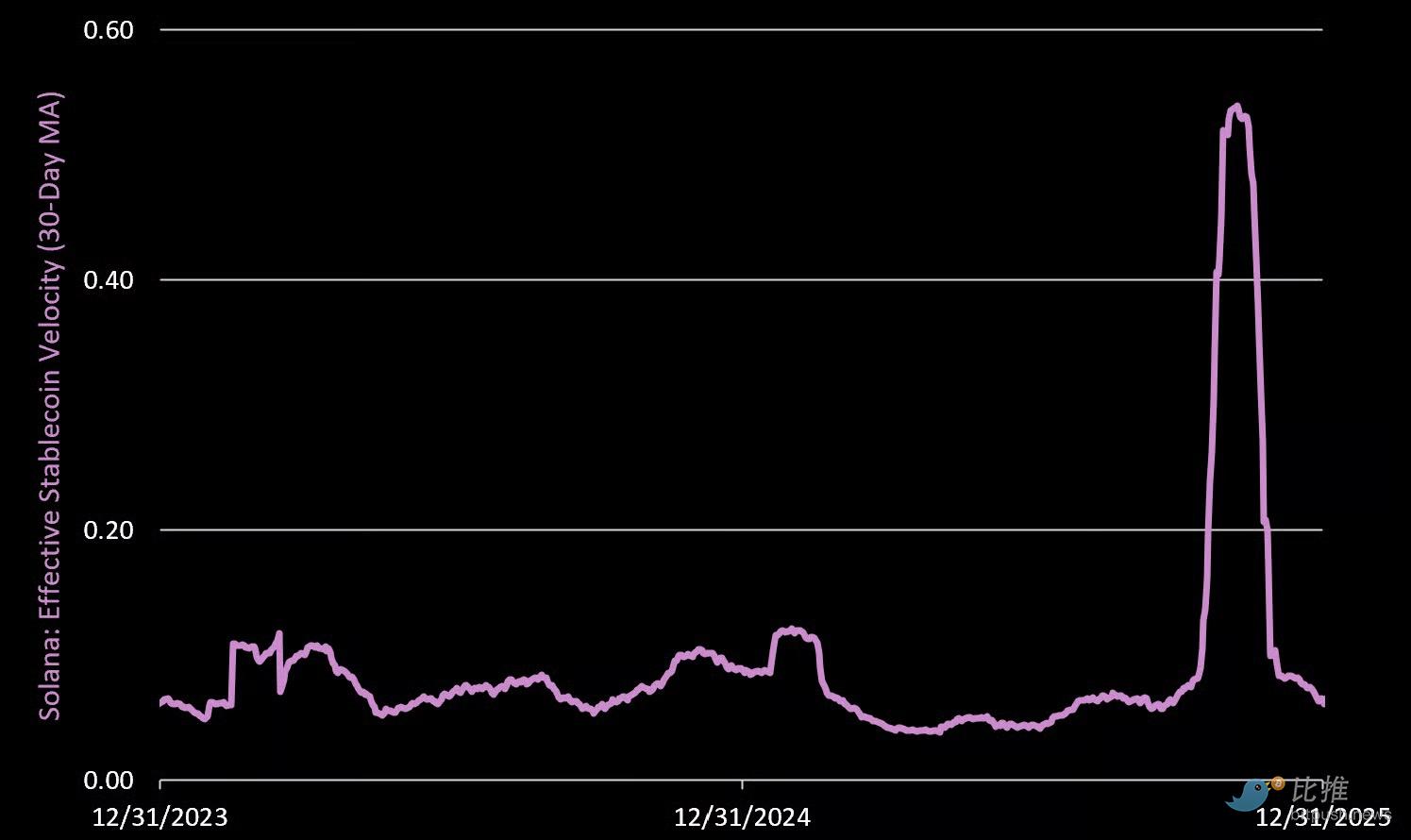

Effective stablecoin turnover rate

Effective stablecoin turnover measures the daily turnover rate of each USD stablecoin on-chain. This metric filters out noise from wash trading and recurring transactions, and is calculated as: Daily net USD transfers / Circulating supply. An increase in this value indicates increased economic activity.

The average turnover rate in Q4 was 0.22, a 282% increase compared to the previous quarter. However, this increase was largely attributed to the sharp fluctuations that occurred during the 10/10 liquidation event.

A reading of 0.22 means that 22% of the stablecoin supply turned over during the quarter. For reference, Ethereum L1 turnover was 3% in Q4, and Ethereum L2's overall turnover was 5%.

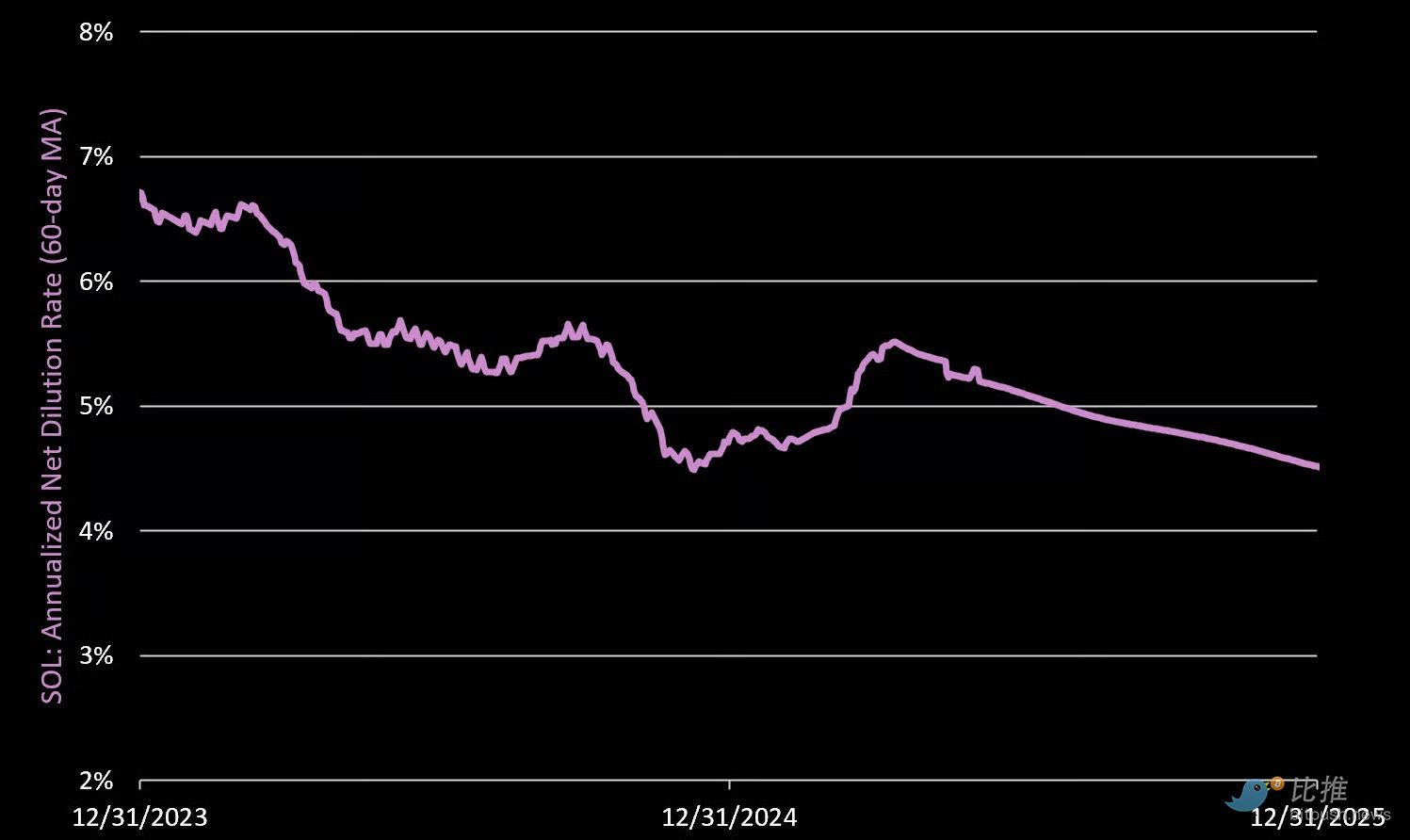

Net Dilution Rate

Net dilution rate = Daily issuance of new SOL minus SOL burned / Circulating supply (annualized). A positive value represents dilution to non-staking SOL holders.

Q4 annualized net dilution rate was 4.57%, a decrease of 5.5% quarter-over-quarter. Driving factors:

SOL issuance: 6.45 million units in Q4 (6.8 million units in Q3)

SOL burns: 63,764 in Q4 (76,247 in Q3)

Net Results: Q4 net increase of 6.38 million SOL tokens (annualized inflation rate of 4.57%)

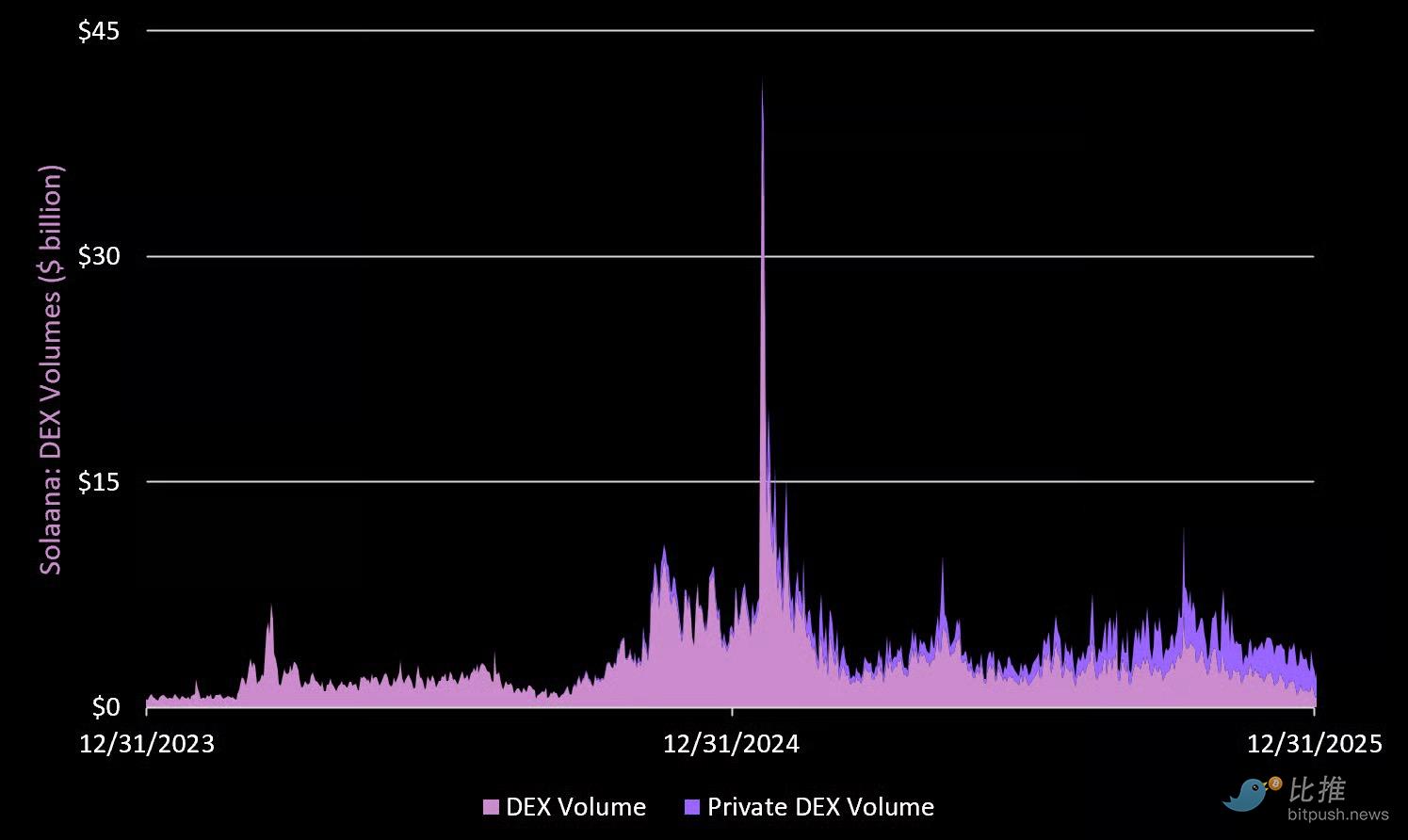

IV. DeFi : The Rise of Private DEXs

DEX trading volume

Private DEXs on Solana have witnessed tremendous growth. Daily trading volume reached $2.2 billion (48% of the total), a 50% increase compared to the previous period.

Meanwhile, the average daily trading volume of public DEXs in Q3 was $2.5 billion, a 5% increase quarter-over-quarter. Overall, total DEX trading volume grew by 15% this quarter. Top-ranked DEXs by trading volume:

HumidiFi (private): $1.4 billion/day (up 105% in Q4)

Raydium: $985 million/day (up 6% in Q4)

Meteora: $700 million/day (up 27% in Q4)

Orca: $473 million/day (down 24%)

Tessera (private): $303 million/day (up 57% in Q4)

Pump Fun: $88 million/day (down 24% in Q4)

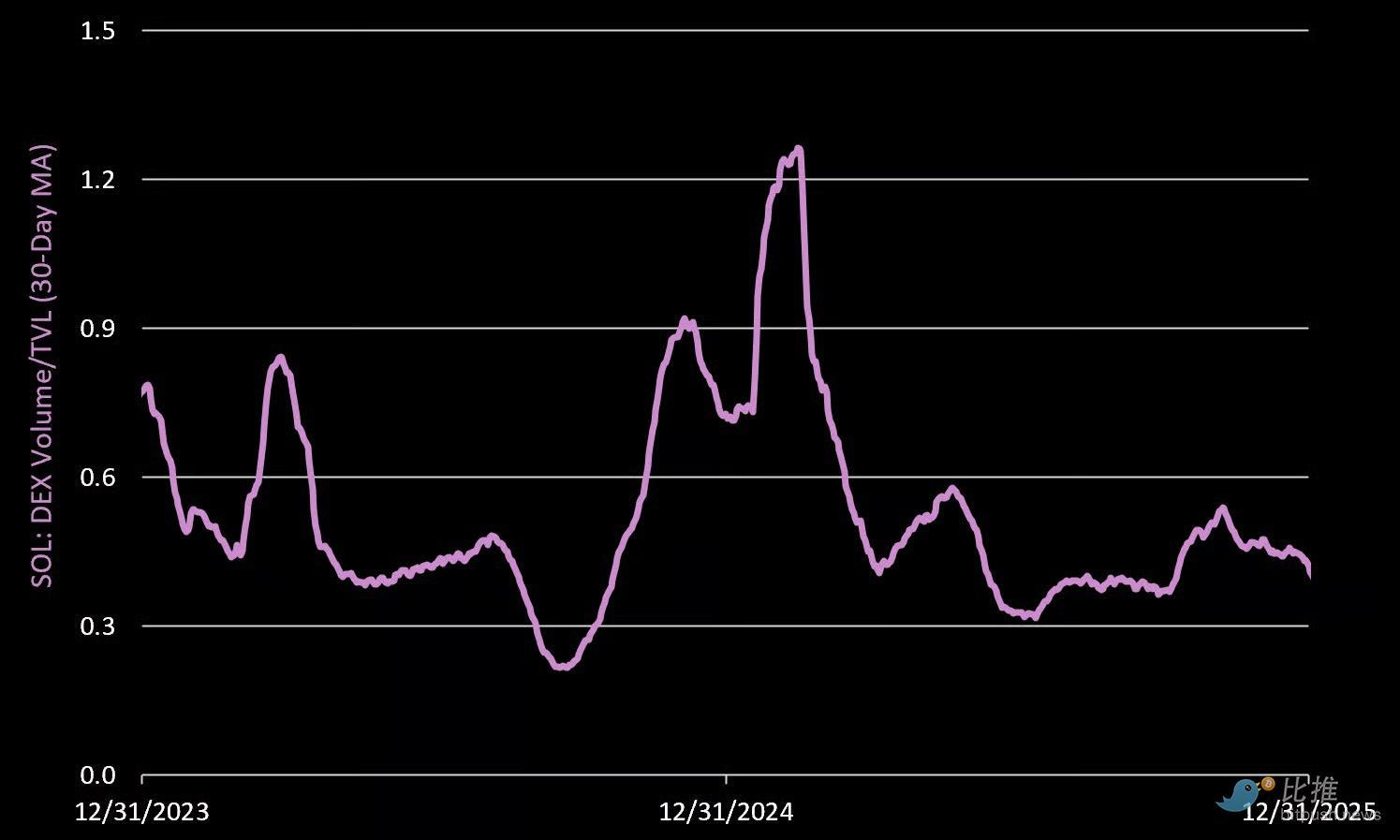

DeFi Velocity

This measures the turnover rate per dollar within DeFi protocols. The metric rose 22% in Q4, with the daily turnover rate averaging 46% of TVL. Much of this activity was attributed to the extreme volatility caused by 10/10 liquidation events.

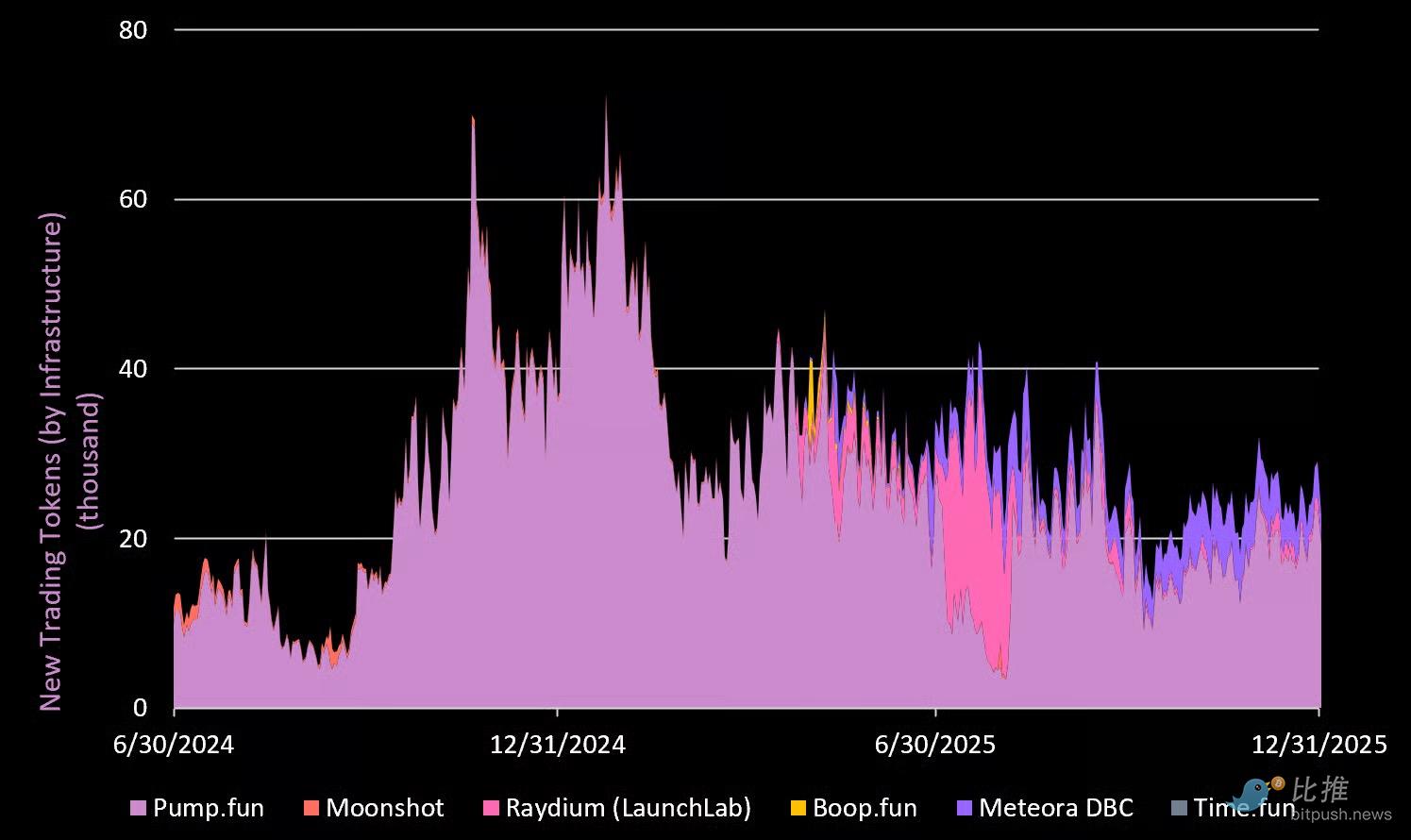

New trading tokens

In Q4, 2.1 million tokens were created on the Solana launch platform, a 24% decrease quarter-over-quarter. Pump Fun continued to lead with 1.6 million new tokens (75% market share). Meteora was a bright spot in Q4, growing by 18% and capturing 21% of the market share.

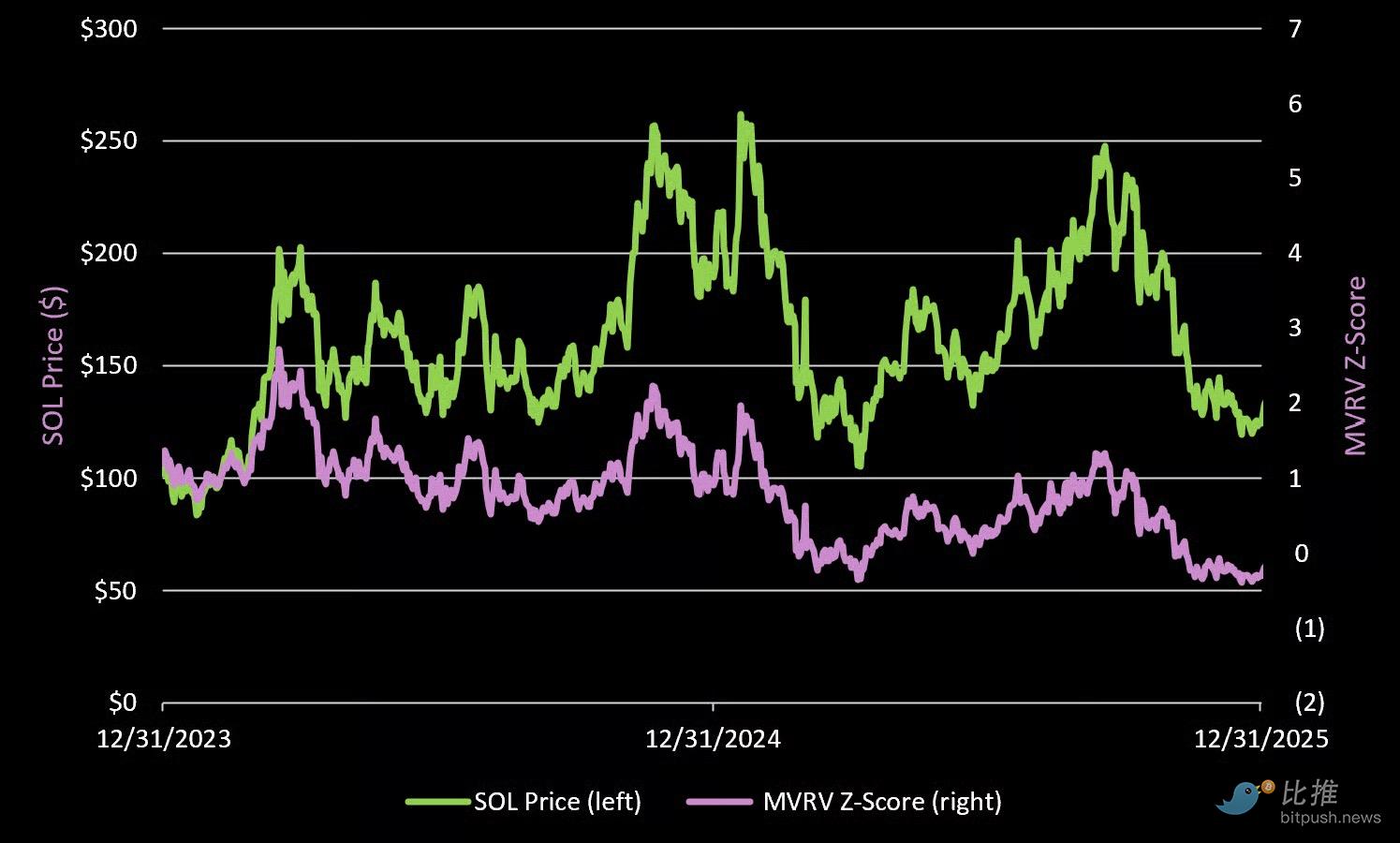

V. Fair Value

From a valuation perspective, SOL's current MVRV is 0.95, meaning its price is lower than its realized price (approximately $145).

From a "fair value" perspective, SOL is currently trading below its realized price (a proxy for the cost of holding all tokens on the network) of $145, with an MVRV of 0.95. At the bottom of the 2022 bear market, SOL fell to 22% of its realized price. While we don't expect a repeat of this cycle, we do believe SOL will at some point be significantly below its realized price, with a target range of $90–$110.

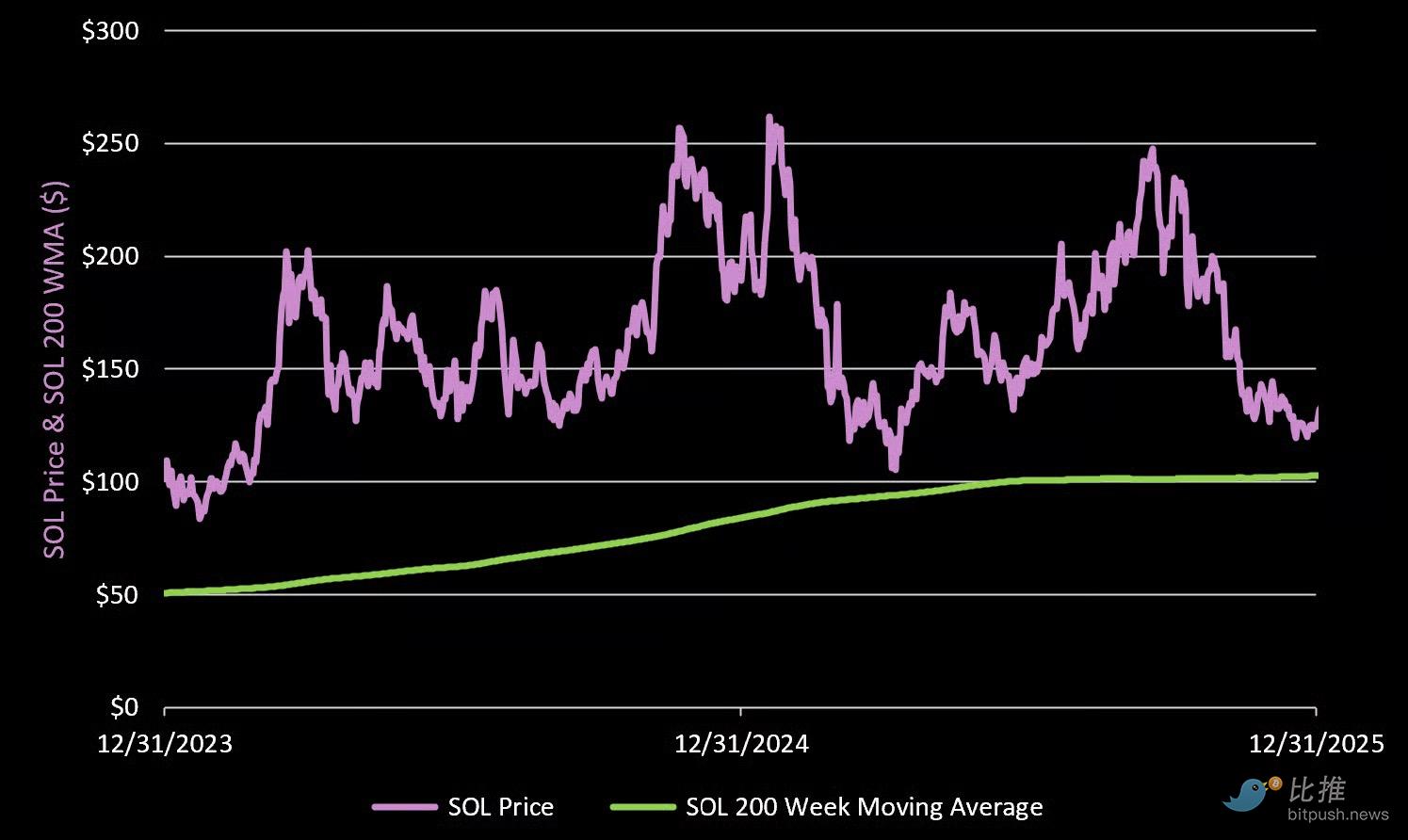

200-week moving average

We also expect SOL to retest its long-term 200-week moving average at some point, which is currently at $103.

VI. Conclusion: Three Keys to Returning to the Top

Solana has weathered the darkest moments of late 2022, proving that it not only survived but has become stronger than ever before. However, to continue maturing, it must accomplish the following three things:

Delving deeper into consumer/retail transactions: Forget about "blockchain games"; the most real "game" in cryptocurrency right now is retail trading. Solana needs to innovate in protecting users from sniping attacks and combating "scam" projects.

Embrace TradFi: Since the goal is to be a “Nasdaq on the blockchain,” real stocks and bonds are required.

Winning the Developer Battle: Continuously providing resources to developers worldwide to maintain a leading edge in technological iteration.

We bought Solana in reverse at the end of 2022/beginning of 2023, establishing a core position at a cost of $15.39, and exited with a profit of more than 10 times by the end of 2024/beginning of 2025.

We are now patiently waiting for the next "perfect hitting spot".

Disclaimer: The above represents the author's personal views only and does not constitute investment advice.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush