Author: Andy, Founder of The Rollup

Compiled by: Felix, PANews

Andy, founder of The Rollup, recently published an article discussing the 2026 Neo Finance market landscape, pointing out that Neo Finance will become the fastest-growing sector in the global financial system. Details are as follows.

The new financial sector will give birth to more true "billion-dollar unicorn" companies than ever before. It is poised to become the fastest-growing sector in the global financial system for years and decades to come.

The following is a map of the new financial market in 2026, covering nine sub-sectors and encompassing over 100 ecosystem projects:

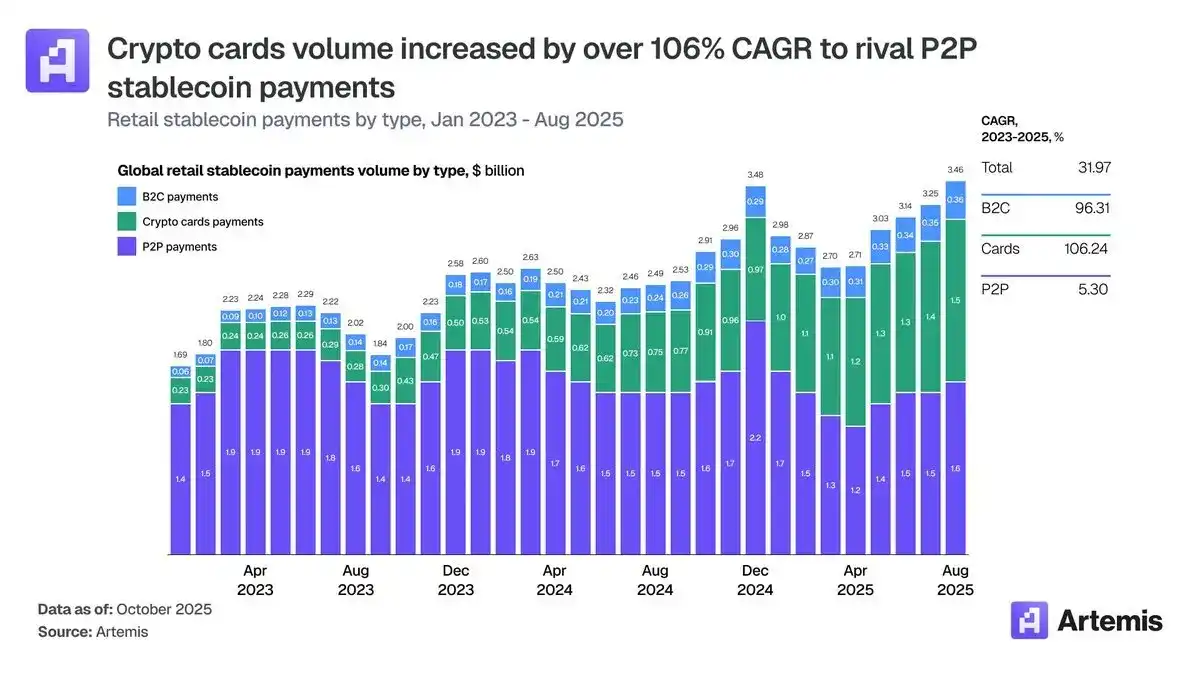

The combination of a consumer-grade user experience on the front end and an efficient DeFi infrastructure on the back end will bring users a "bank-like experience" that is both familiar and far superior to that of traditional banks.

Users' savings can be traded and transferred globally, and are available 24/7. For example, a user's "current account" can earn an annual interest rate of 5%, instead of the traditional bank's 0.25%.

A new financial market, driven by collaborative efforts from teams focused on different aspects of the technology stack, has the potential to fundamentally change the way the world interacts with money.

Next, let's take a look at some key areas in the market map.

Tokenization

Tokenization is the process of putting real-world assets (such as government bonds, stocks, commodities, credit, money markets, etc.) on a blockchain.

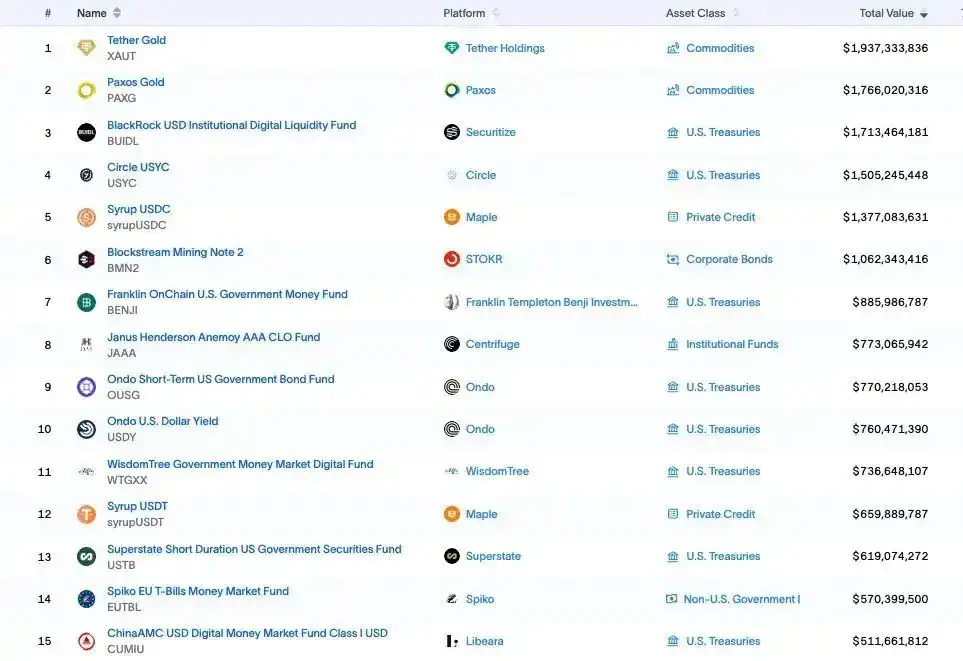

The infrastructure and tokenized proxy layer includes: Figure, Ondo Finance, Paxos, Centrifuge, Superstate Inc., Midas, Grove Finance, Nest, Dinari, Securitize, and other companies.

Tokenization has been discussed for years, but 2025 is the year it will truly begin to be widely adopted.

Stablecoins

Stablecoins are by far the most successful crypto product, with 90% of emerging financial clients choosing stablecoins as their first step into cryptocurrency.

The stablecoin issuer sector is booming, with numerous companies emerging, such as Circle, Paxos, Tether, and Sky.

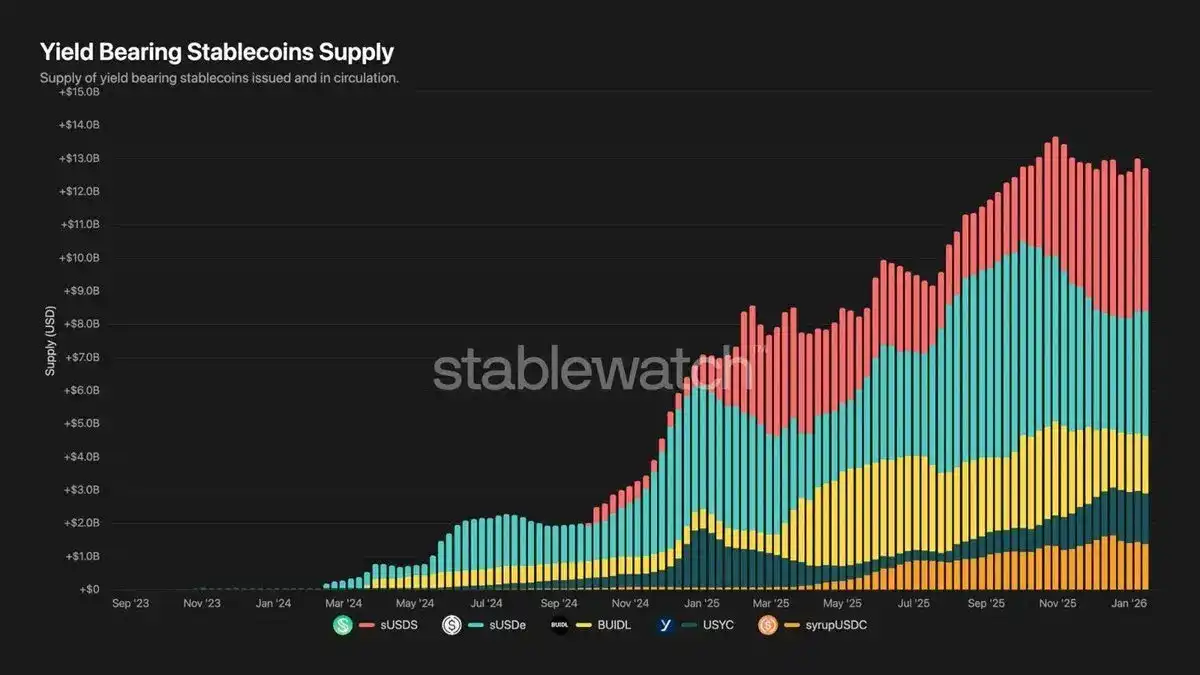

Meanwhile, yield stablecoins (or "yield coins") such as $sUSDS, $sUSDe, $BUIDL, $USYC, and $syrupUSDC have experienced exponential growth over the past 18 months, with a supply exceeding $13 billion.

Unlike in the CeDeFi space from 2020 to 2022, users no longer need to choose between stability and returns; they can now have both.

Emerging Bank

In the emerging banking sector, many other teams have sprung up, such as ether.fi, KAST, Tuyo, and Galaxy. These teams are using DeFi backends to build consumer-facing "banking" experiences from scratch.

Remember the “DeFi Mutant”? ( PANews note: This refers to a platform that uses a user-friendly TradFi interface on the front end and DeFi underlying technology on the back end.) It still exists, and the data supports this.

Tokenization, stablecoins, and emerging banks are the three key areas of focus, expected to see the greatest growth in 2026 and beyond.

In addition, the crypto market is facing a harsh reality: old strategies are becoming ineffective.

High FDV, low circulation issuance for dumping to retail investors; protocols lacking value growth pathways; fake DEXs on "ghost" chains; venture capital-backed projects where founders cashed out hundreds of millions of dollars without any PMF (product-market fit).

All of these ways of playing are outdated, and this will continue to be the case.

In fact, I got into cryptocurrency after reading "The Truth Machine" in 2017. At that time, I was almost certain that this technology would reshape finance. Somehow, it feels like we've strayed from our original mission. Nine years later, we are closer than ever to the moment when that dream comes true.

Everything is ready, and the opportunity is at hand. Welcome to the new era of finance.

Related reading: Nihilism and a vicious cycle: Why should we oppose excessive financialization?