Hedera price continues its downward trend as selling pressure persists, making the market outlook negative. HBAR has been stuck in a prolonged decline, making recovery attempts very difficult.

Recent data suggests that sellers are in control of the market, pushing HBAR closer to key support levels as confidence among short-term and leveraged investors weakens.

Hedera retail investors are selling off their holdings.

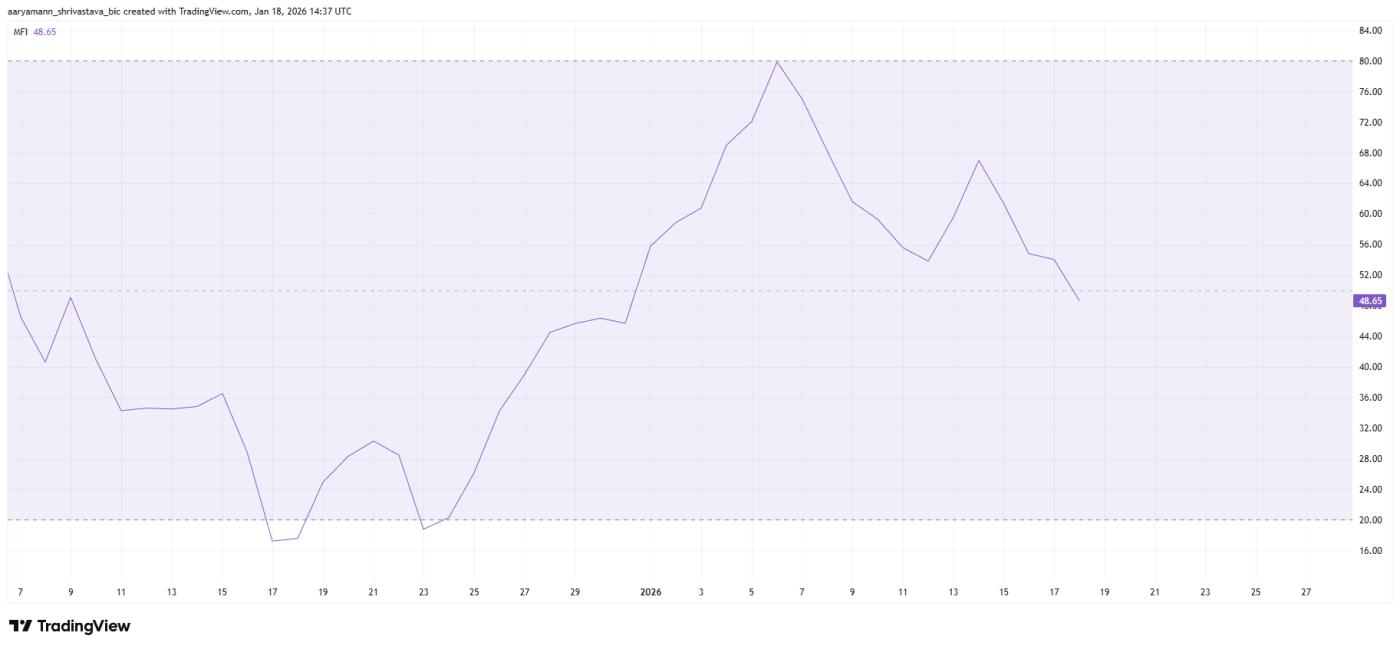

Market sentiment surrounding HBAR remains very negative. The Money Flow Index indicator shows that selling pressure has dominated in recent sessions.

This index has fallen below the neutral threshold of 50.0 and is now in negative territory, signaling that outflows are exceeding inflows.

This suggests that investors remain skeptical about the prospects for a short-term recovery.

Furthermore, when the MFI remains low, this reflects reduced buying demand and weak risk sentiment. Typically, such conditions signal that prices may continue to fall, especially when the upward momentum is not strong enough to transition into a consolidation phase.

Want to stay updated on Token? Sign up for editor Harsh Notariya's daily Crypto newsletter here .

HBAR's MFI index. Source: TradingView

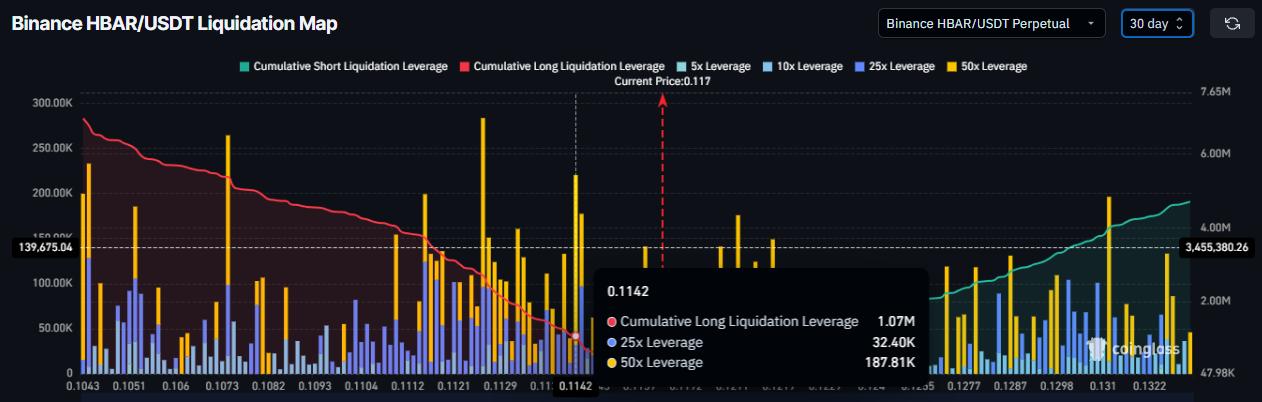

HBAR's MFI index. Source: TradingViewMacroeconomic data also reinforces downside risk for Hedera. Liquidation maps show increasing vulnerability in Longing positions.

However, if HBAR breaks below the nearest support level at $0.114, approximately $1.07 million in Longing positions could be liquidated. This would significantly increase selling pressure.

If prices continue to fall, the negative impact will be even greater. A break below $0.112 could result in the liquidation of over $2.71 million in Longing positions. This mass liquidation would further exacerbate market tension, increase selling momentum, and discourage investors from placing new buy orders.

HBAR price analysis. Source: TradingView

HBAR price analysis. Source: TradingViewHBAR prices remain in a downward trend.

HBAR price has remained in a clear downtrend for nearly two months. At the time of writing, the Token is trading around $0.117. The price remains slightly above the $0.114 support level, which also acts as a temporary stop-loss to prevent further price drops.

Given the current dominant downward momentum, the likelihood of losing this support is quite high. If HBAR price falls below $0.114, the predicted liquidation risk is very likely. In that case, the price could head towards the $0.109 region, consolidating the short-term downtrend.

HBAR price analysis. Source: TradingView

HBAR price analysis. Source: TradingViewNevertheless, a recovery scenario remains. If buying pressure returns and selling pressure eases, HBAR price could rebound. Breaking above $0.120 would boost market sentiment. Furthermore, if HBAR breaks strongly above $0.125, the short-term downtrend will be broken, and the market could reverse to an uptrend in the short term.