Pump.fun's price surged earlier this week, signaling a potential breakout and a return to an uptrend. This surge has led many to expect PUMP to continue its upward movement.

However, prices subsequently fell slightly, raising uncertainty as investor behavior showed mixed signs. This left many wondering whether the pump could maintain its upward momentum.

Those holding PUMP exhibit contradictory behavior.

Market sentiment is currently Chia , however, the activity of large investors (also known as smart money) is providing some support. Smart money is a term referring to Capital held by seasoned investors, institutions, Venture Capital , and large whale wallets. They often shape price trends by strategically buying when the market is uncertain.

In the case of PUMP , smart money wallets purchased approximately 48 million additional Token last week, increasing their total holdings by 5.8%. This accumulation suggests they still believe the price can continue to rise. If these large investors continue buying, PUMP could stabilize and reduce the risk of a sharp decline.

Want to read more about Token like this? Sign up for the daily Crypto Newsletter from editor Harsh Notariya here .

Smart Money data from PUMP. Source: Nansen

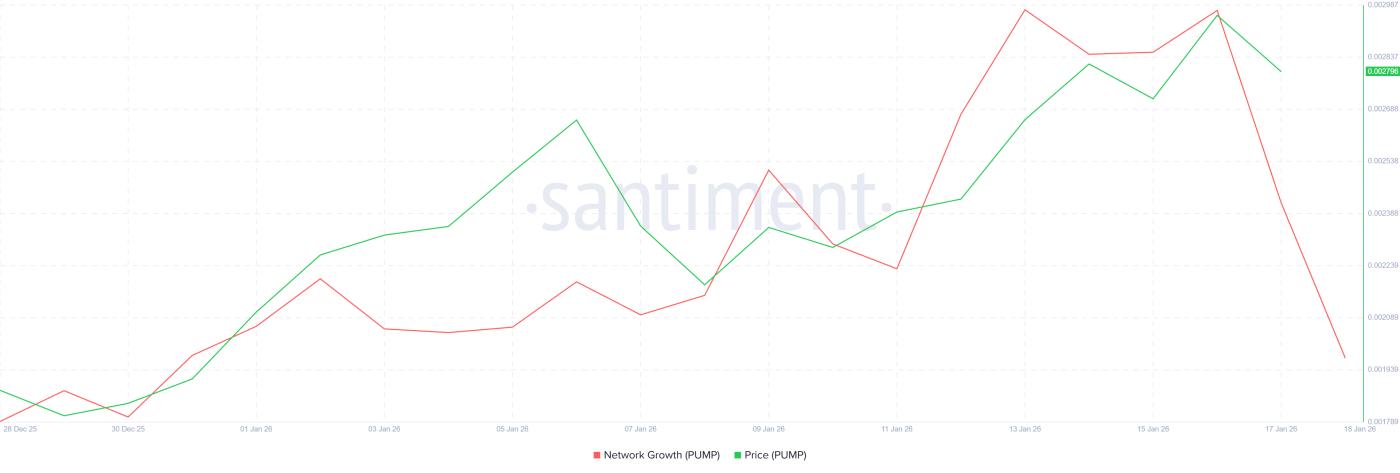

Smart Money data from PUMP. Source: NansenDespite the accumulation of smart money wallets, the overall market momentum still signals caution. According to network data, the number of new PUMP addresses is declining sharply.

In just 48 hours, the number of new wallets dropped from 8,570 to 2,201, meaning the number of new participants decreased by 74%.

This decline indicates a decrease in retail investor interest, meaning that new money flowing into the market is also weakening. New investors are crucial in sustaining price rallies, especially for emerging altcoins like PUMP.

Without stronger participation from new investors, maintaining price momentum will become increasingly difficult, even with support from whales.

The number of new PUMP addresses. Source: Santiment

The number of new PUMP addresses. Source: SantimentWill the price pump be successful in this breakout?

Recently, the PUMP price has broken out of a cup and saucer pattern, which typically signals a continuation of the uptrend. This breakout is expected to increase by 57% from $0.00264, heading towards $0.00420.

However, the price failed to maintain its momentum, indicating that buying pressure was not yet decisive.

Several conflicting signals suggest that the pump may continue to trade sideways around the support zone of $0.00264. If this zone holds, the bullish structure remains intact.

If the price can break through the resistance level of $0.00278 and turn it into support, the upward momentum is likely to resume and the pump could recover more strongly.

PUMP price analysis. Source: TradingView

PUMP price analysis. Source: TradingViewConversely, if the inflow of funds continues to decrease, the downside risk will increase. If the $0.00264 level is not held, the pump could slide to the $0.00242 support level. If the price continues to weaken, the bullish scenario will no longer be valid.

If selling pressure continues, the PUMP price could even fall further to the $0.00212 region, confirming a short-term downtrend.