By 2025, the decentralized Derivative sector had become a vital part of DeFi, with DYDX holding its position as one of the most influential platforms. With over $1.5 trillion in accumulated volume and an improved tokenomics model designed to successfully integrate the protocol with Token holder , DYDX was no longer just a DEX – it was evolving into a complete market infrastructure layer.

2025 will be Mnemonics as a milestone in which decentralized finance (DeFi) transforms from an experimental phase to a sustainable playing field with the participation of large institutions. According to the newly released DYDX Ecosystem Report 2025 , the protocol has successfully shifted from seeking transient volatility to building stable, long-term, and clearly programmable liquidation .

As global perpetual on-chain volume approaches $10 trillion, DYDX 's strategic moves to deepen integration, upgrade the professional experience, and build a robust buyback model are proving that the idea of a "decentralized Wall Street" is gradually becoming a reality.

Key numbers: $1.55 trillion and the recovery story.

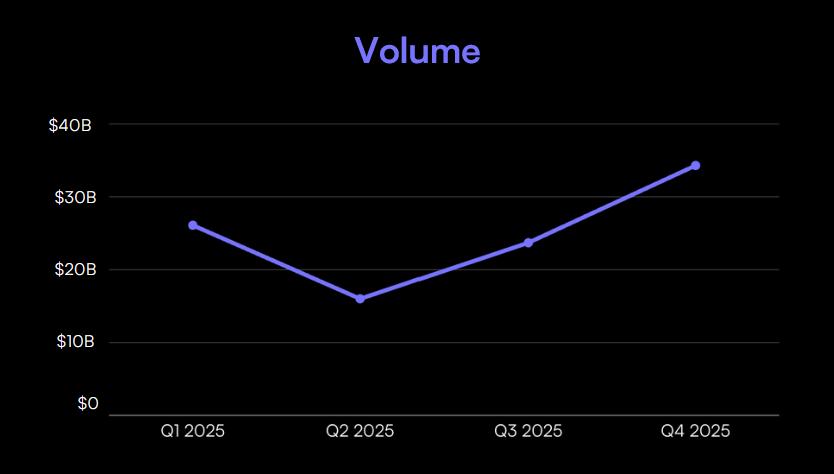

The protocol recorded a total volume of $1.55 trillion across all versions. Additionally, the report also indicated a U-shaped recovery trend over the past year.

After a quiet second quarter with trading volume reaching only $16 billion amidst a sideways market, DYDX accelerated sharply towards the end of the year. The fourth quarter of 2025 recorded volume of up to $34.3 billion, becoming the most active quarter of the year.

This recovery is not simply due to market growth, but also stems from the launch of the community-led Market Mapper and Free Trading programs, helping key assets like BTC-USD and SOL-USD achieve liquidation on par with leading centralized exchanges (CEXs).

Key protocol metrics for 2025 include:

- Protocol revenue: $64.7 million in transaction fees since the launch of DYDX v4.

- Staking security: $48 million in rewards have been distributed to participants securing the DYDX Chain network.

- Market expansion: The number of markets increased to 386, equivalent to a 200% increase in listed assets.

- User adoption: The number of addresses holding DYDX has increased by nearly 85% year-on-year, now exceeding 98,100 individual wallets.

Tokenomics 2.0: The Token repurchase cycle is now operational.

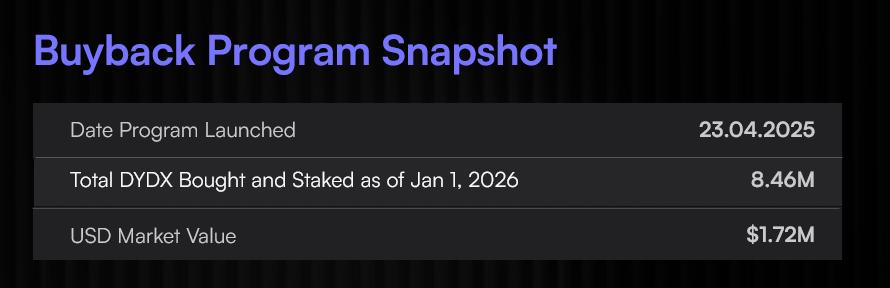

For years, the usefulness of DeFi Governance Token has been a subject of debate. In 2025, DYDX provided a clear answer by expanding its DYDX Buyback Program . From a pilot project, this buyback program has evolved into a protocol-level buyback mechanism, tightly governed by the Treasury SubDAO.

Through governance upgrades, most notably Proposal #313 , the community voted to allocate 75% of the protocol's accumulated net revenue to buy back DYDX on the open market. These Token are not only burned but also Staking to increase decentralization and security for the network, creating a ripple effect:

- Increased volume generates more fees.

- Higher fees lead to larger Token buybacks.

- Token buybacks increase the amount of DYDX Staking, enhancing network security while reducing the circulating supply.

As of January 2026, the program had repurchased and Staking 8.46 million DYDX with a total market value of $1.72 million at the time of writing. This mechanism contributes to maintaining a stable Medium Staking yield of 3.3% – creating a predictable income stream for long-term holder amidst volatile market conditions.

Solana Spot and user experience are disconnected.

One of the most notable technological advancements in 2025 is the integration of Solana's native spot trading. Previously, DYDX was only notable for perpetual trading, but with the expansion to Spot Trading, the protocol can now serve a variety of institutional strategies such as hedging between markets and cash-and-carry trading.

The report also highlights a significant shift in how users access DYDX thanks to Pocket Pro Bot – a trading tool directly on Telegram. By directly reaching traders through the social media platform, DYDX has significantly lowered the barrier to entry. This approach allows users to manage positions, monitor charts, and execute orders at any time without leaving their familiar social media app.

Furthermore, the Market Mapper initiative empowers the community to propose new assets instead of waiting for board approval. As a result, DYDX can quickly take the lead in listing promising new Token , becoming the preferred platform for emerging Token .

Standard organizational infrastructure: bridging the gap

To compete with centralized exchanges (CEXs), processing speed and fairness in order placement, ideally under 1 second, are essential. The 2025 report notes a major upgrade in DYDX's infrastructure.

Thanks to the deployment of Order Entry Gateway Services (OEGS) and Designated Proposers , the block creation times between transactions have become significantly more consistent. Simultaneously, by moving critical infrastructure to bare-metal physical servers, Ops SubDAO reduced monthly operating costs from $35,000 to just $6,000, while also minimizing latency for high-frequency traders.

The increasing participation of large institutions is driven by deep integration with professional tools such as CoinRoutes, CCXT , and Foxify Trade. These integrations allow investment funds and market makers to XEM DYDX as a flexible connection point, enabling them to seamlessly transfer trading orders between centralized and decentralized exchanges.

Governance and the SubDAO Era: A Self-Governing Machine

In 2025, the ecosystem processed a record 135 governance proposals, demonstrating a level of community involvement rarely seen in DeFi. The SubDAO model is now fully operational, with departments responsible for different areas of the protocol:

- DYDX Foundation: Focused on strategic coordination and legal transparency. In 2025, the Foundation published a whitepaper in accordance with MiCA standards, outlining compliance considerations in the context of changing European regulations.

- Operations SubDAO: Responsible for technical support of the DYDX Chain, managing protocol upgrades (v8.1) and the public dashboard for validators.

- Treasury SubDAO: Manages the expansion of Treasury assets from 45 million to over 85 million DYDX, while also overseeing the Token repurchase program.

- DYDX Grants Ltd: Relaunching operations with 13.1 million DYDX to fund research, development tools, and impactful ecosystem development programs.

DYDX surges: Driven by $20 million.

To kick off the new year, the ecosystem has launched DYDX Surge – a large-scale trading competition with a total prize pool of up to $20 million. Unlike traditional competitions that often prioritize "whales," Surge aims to encourage sustainable liquidation and consistent trading activity across multiple markets.

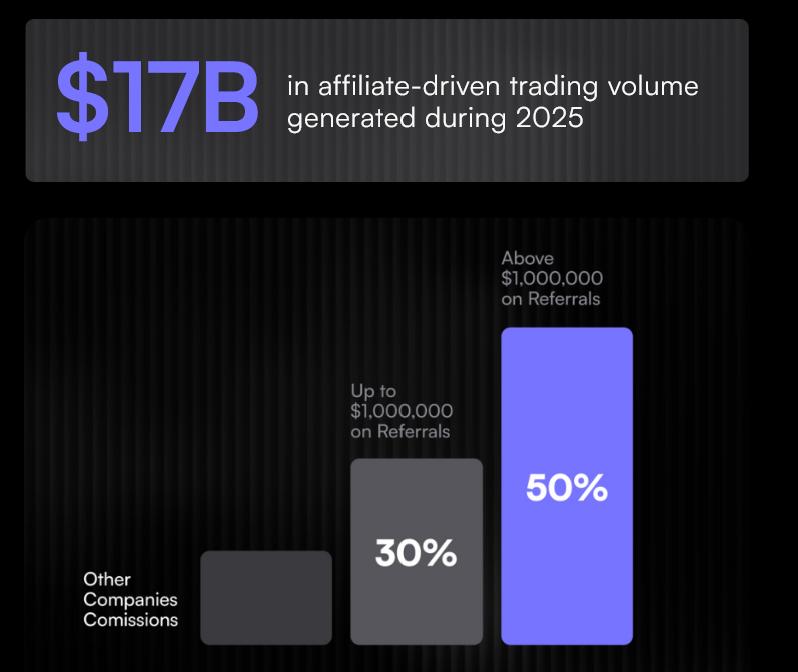

The program has been a resounding success, with the affiliate channel alone contributing an additional $17 billion in volume. By the end of 2025, the Affiliate Program will also be improved, offering top partners the opportunity to share up to 50% of revenue, ensuring that the protocol's growth will be Chia with the platforms and influencers who contributed to building the system.

Looking ahead to 2026, the DYDX Foundation reaffirms its message: the priority is shifting from “growth at all costs” to “sustainably maintaining market position.”

With on-chain perp volume projected to exceed $10 trillion next year, DYDX continues to expand its distribution strategy: promoting mobile bot trading solutions, increasing API support for institutions, and emphasizing legal compliance. Entering 2026, DYDX boasts a lean cost structure, a more efficient Token distribution model, and technological infrastructure approaching the performance of large centralized exchanges. For those following the “ DeFi vs. CeFi battle,” the 2025 report clearly shows that on-chain advantage is now a reality, reaching a scale of $1.5 trillion – no longer just theory.