Author: Artemis

Compiled by: TechFlow TechFlow

TechFlow Guide:

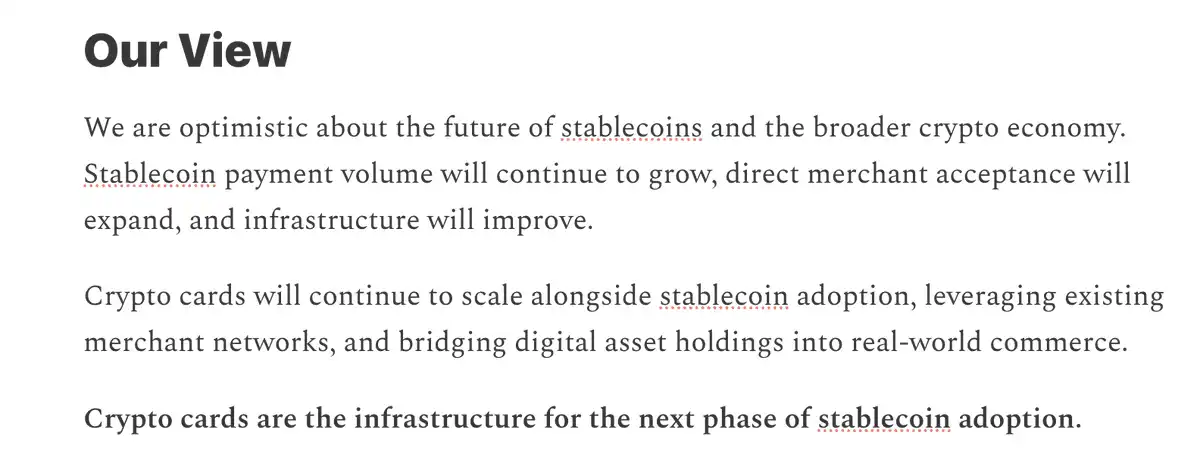

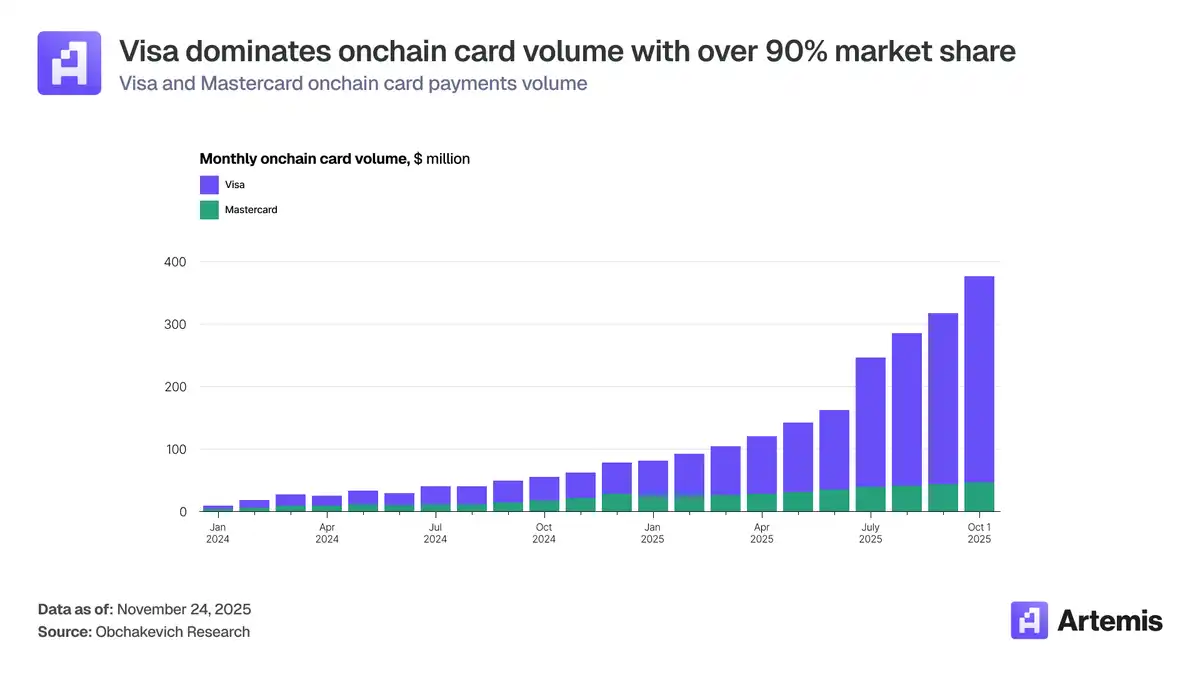

Crypto payments are undergoing a quiet power shift. A new study by Artemis shows that the crypto card market has jumped from the fringes of early 2023 to a behemoth with an annualized value of $18 billion, with monthly transaction volume increasing 15-fold in just two years.

This article delves into the three layers of the crypto payment stack and reveals a surprising figure: Visa accounts for over 90% of on-chain card transactions. More importantly, the industry is undergoing a structural shift towards "full-stack issuance," with companies like Rain and Reap bypassing traditional banks by directly connecting to Visa, fundamentally rewriting the economic model. From crypto-collateralized lending in India to stablecoin everyday payments in Argentina, crypto cards are becoming a key infrastructure for the digital dollar to enter the real world.

The full text is as follows:

Breaking news: We have just released the industry's most comprehensive research report on crypto cards.

This isn't because it's a niche market, but because it has quietly grown into a $18 billion market. In early 2023, monthly transaction volume for crypto cards was only around $100 million. Today, that figure has surpassed $1.5 billion.

To that end, we spent several weeks digging deep into the data, infrastructure, and the companies that actually built this stack. Here are our key findings.

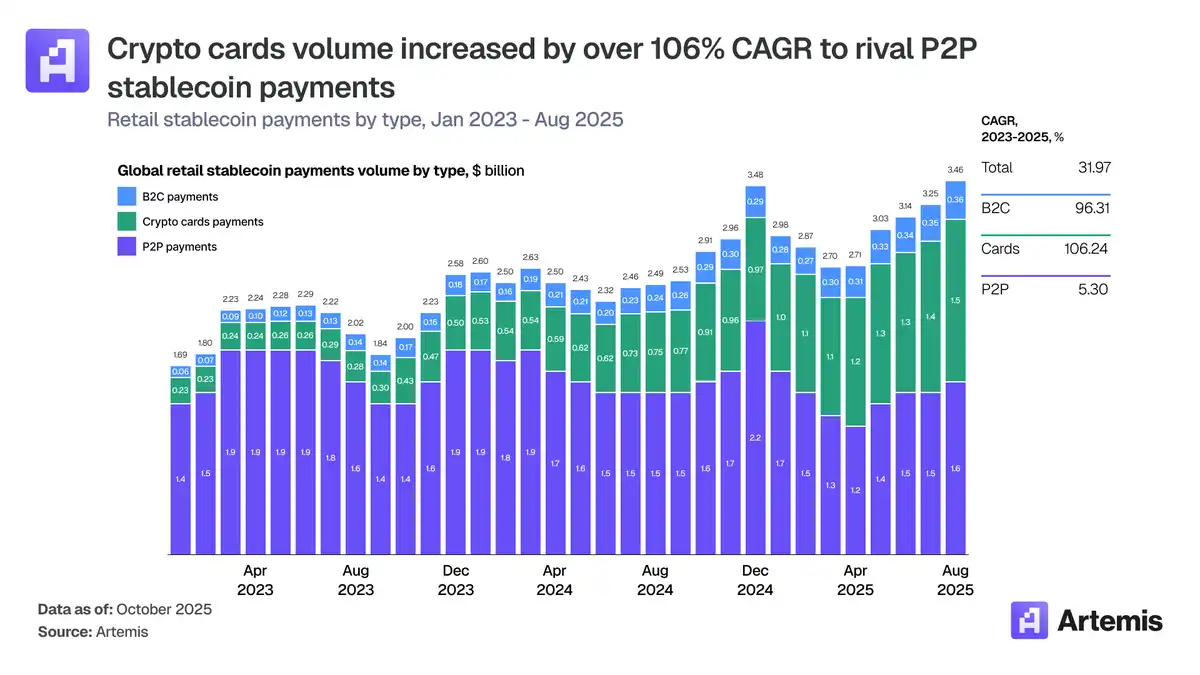

First, let's look at what actually happened. The encrypted card is not intended to replace Visa or Mastercard, but rather to utilize them.

Stablecoins fund transactions, while cards provide the merchant acceptance environment.

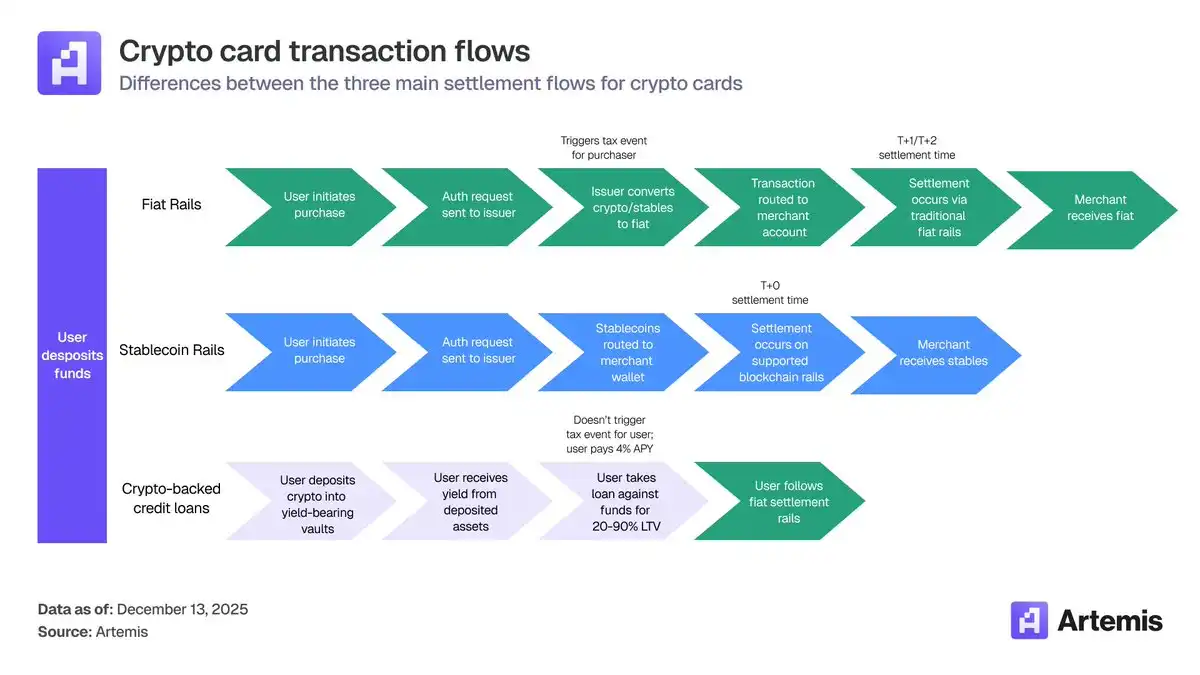

This stack is divided into 3 levels:

- Network layer: Visa, Mastercard

- Issuers & Program Managers: Baanx, Bridge, etc.

- Consumer Application Layer: Wallets, exchanges (such as MetaMask, Phantom)

This is precisely where the power struggle is most intense.

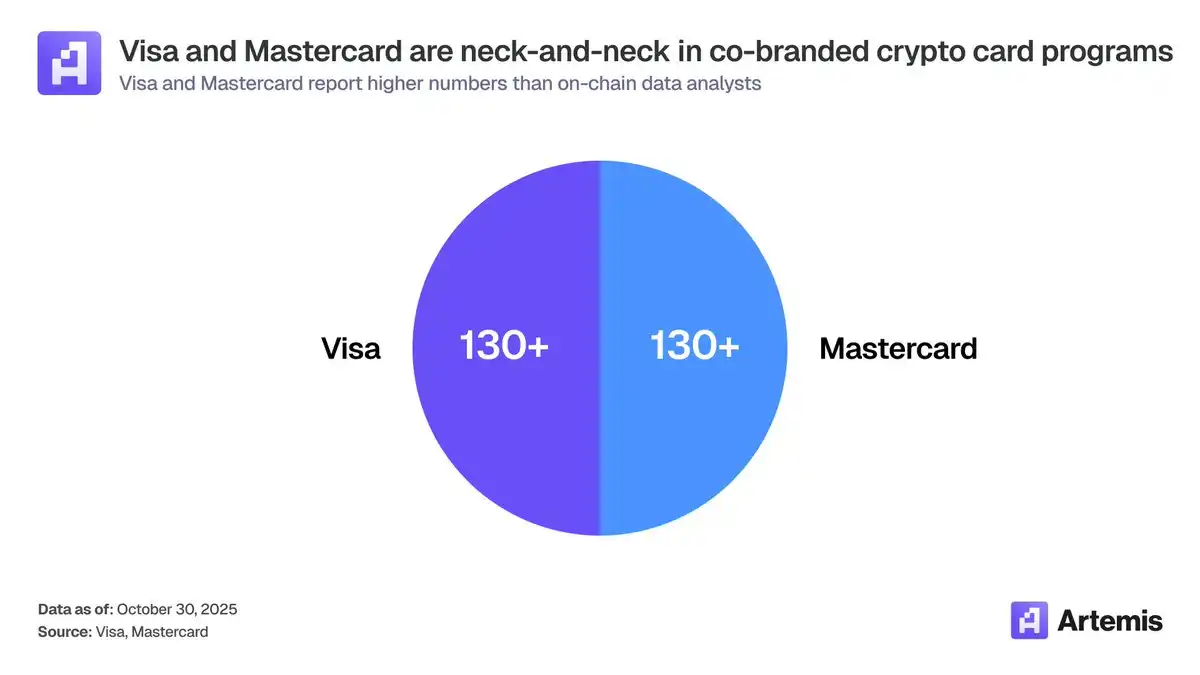

Although both Visa and Mastercard have over 130 crypto partnerships...

However, Visa accounts for over 90% of on-chain card transactions. This is because it established a deep partnership with the infrastructure layer very early on.

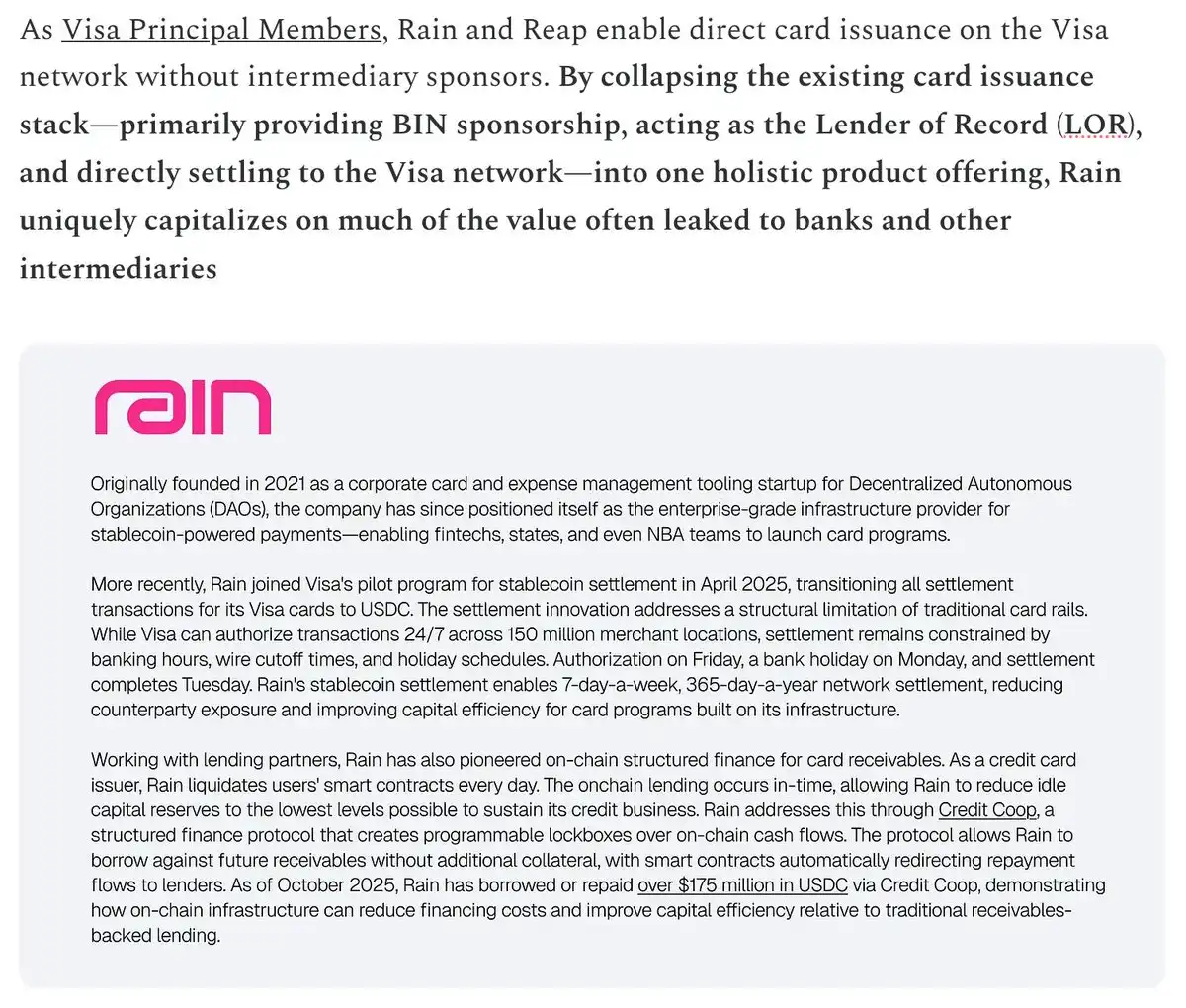

The biggest structural shift: Full-stack issuers.

Companies like Rain and Reap can now issue cards and process payments directly as Visa Principal Members.

No sponsor bank required. Greater control. Greater economic benefits.

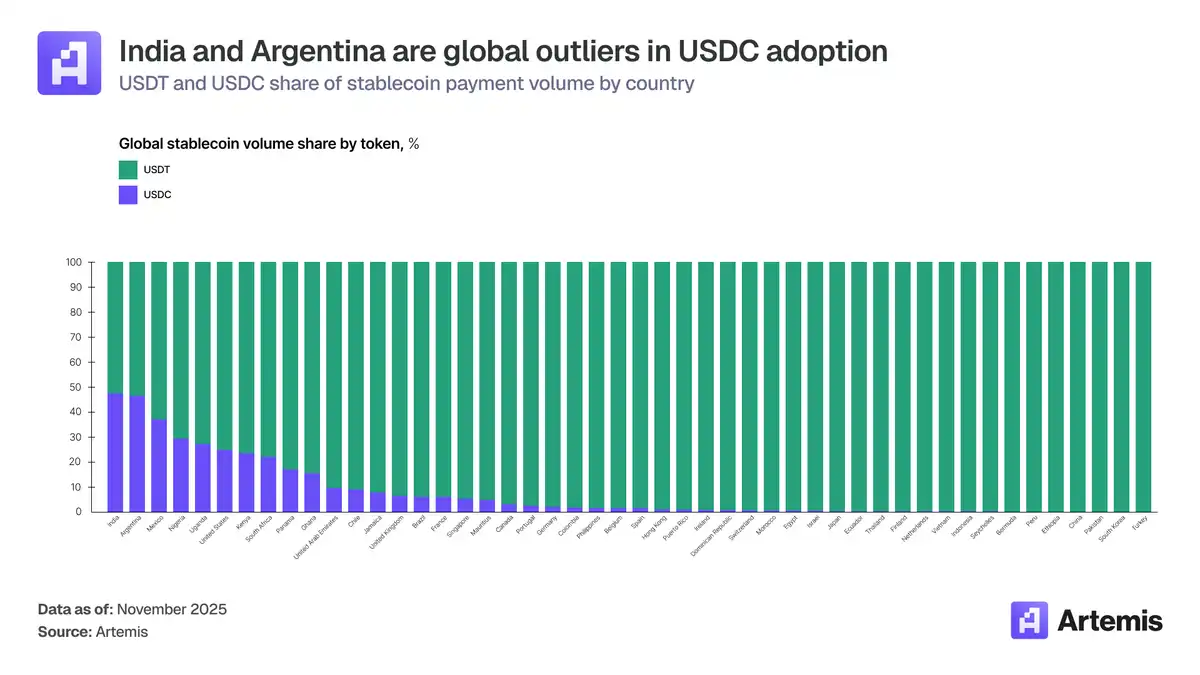

Geographical distribution reveals real-world use cases. India: With $338 billion in cryptocurrency inflows. The opportunity here lies in cryptocurrency-backed lending (as UPI has already triumphed in debit payments). Argentina: The practical application is stablecoin debit cards as an inflation hedge.

In developed country markets, encrypted cards do not address the "essential need".

Their target is a new, high-value user group: those who already hold a large amount of stablecoin balance and want to spend it.

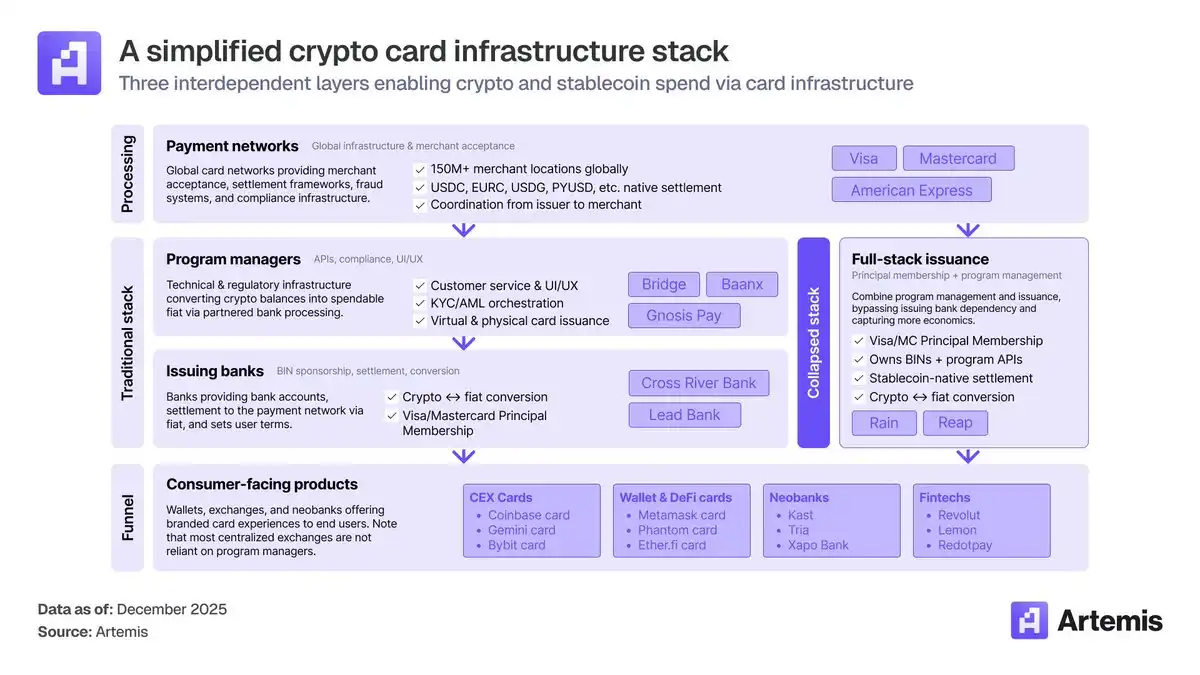

Our view is simple: stablecoins will continue to grow, and crypto cards will scale accordingly.

They are the infrastructure that brings the digital dollar into the real world.

This post is only a summary. Read the full report for a deeper understanding.