Author: danny

Original title:

Why do the memes you buy only depreciate? — Deconstructing the growth spiral and volume of memes using first principles

To most people, Memecoin is an irrational frenzy, a gambling game of the greater fool theory. But from a mathematical perspective, the birth of every 10,000x myth is not accidental; it is actually a middle school spatial geometry application problem.

This article presents a disruptive perspective: Meme's market capitalization wasn't "increased," but rather "inflated." Meme's value can be calculated!

We are accustomed to focusing on the fluctuations of the Z-axis (price height), but we overlook the fact that what determines life and death is the radius of the base constructed by X (narrative density) and Y (communication nodes). A meme with only height but no base is just an extremely thin "needle," easily blown over by the wind; only an ever-expanding radius of consensus can support a stable, geometrically growing cone of wealth under the gravity of capital.

Note: This article is a popular science article on "financial physics" rather than a rigorous econometrics paper, and is intended to give you a fresh perspective on memes.

1. The Beginning of the Theory: The Three-Dimensional Coordinate System of a Meme

In the current cryptocurrency market, Meme Coin is often seen as part of an irrational frenzy. But is that really the case?

If we strip away emotional noise, KOL shill, and community hype, we'll find that the birth and demise of every phenomenal meme follows a rigorous mathematical logic.

Meme coin is essentially the tokenization of the attention economy. Its market value is not determined by the traditional discounted cash flow (DCF), but by the breadth of the narrative, the resonance of the community, and the explosive power of funds.

For better discussion, we define these factors as the XYZ three-dimensional growing spiral model.

These three axes are not just independent variables; they exhibit strong reflexivity—that is, a change in one variable can reinforce another, creating a positive feedback loop.

Let's explain these parameters:

X-axis: Narrative density and cultural memes

Definition: The "genes" of a meme. This includes core memes (such as Doge), origin stories (such as CZ's pet name), cultural symbols (such as Pepe's sad frog), and the richness of community-created content.

Key metrics: narrative originality, replicability, and emotional resonance.

Y-axis: Propagation potential and node network

Definition: The information transmission pipeline. From the top-level node (CZ, Elon Musk) to the secondary nodes (Alpha Callers, KOLs), and then to the end nodes (ordinary retail investors).

Key metrics: node weight, propagation coverage, and frequency of shill.

Z-axis: Fund flow and liquidity carrier

Definition: The monetization of attention. This includes on-chain fund inflows and liquidity depth—that is, the value held or the total amount of sell orders that can be absorbed.

Key metrics: market capitalization, trading volume, turnover rate, and liquidity (the most important metric).

2. Graph illustrating the growth curve of the interaction between the XYZ axes

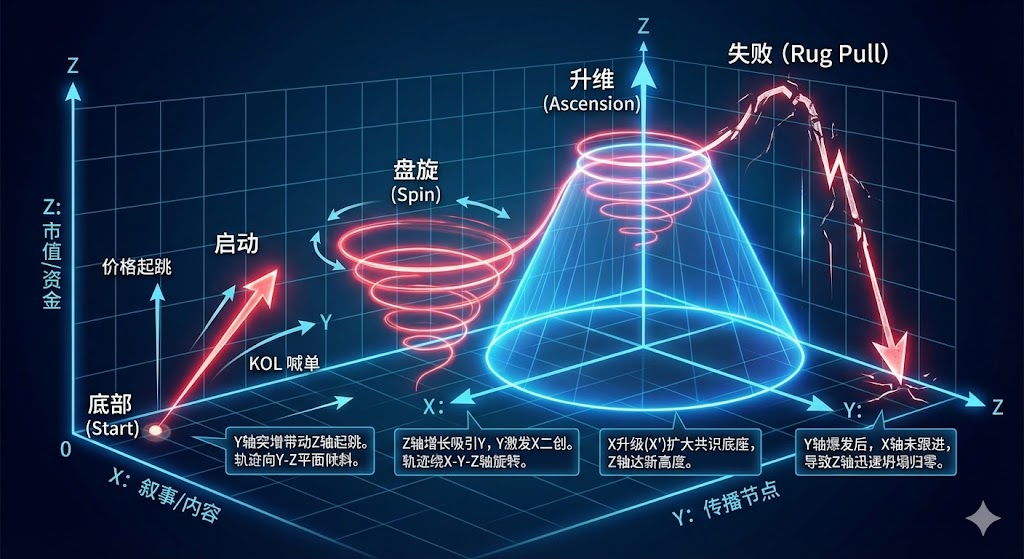

If we plot these three axes in three-dimensional space, a successful meme growth trajectory will generally show a spiral upward trend: (as shown in the figure below)

Bottom (Start): X, Y, and Z are all close to zero.

Ignition: A sudden surge in the Y-axis (KOL's shill) drives a jump in the Z-axis (price). The trajectory line slopes towards the YZ plane.

Spin: Growth along the Z-axis attracts more Y (more discussion), and Y inspires further creation in X (richer content). The trajectory line begins to rotate around the XYZ axes.

Ascension: As X is upgraded (X'), the base area of the cone expands (the consensus range becomes wider), and the Z-axis (market capitalization) reaches a new height.

A failed meme (Rug Pull): This usually manifests as a burst on the Y-axis followed by a brief rise on the Z-axis, but the X-axis fails to follow suit (lack of narrative), causing the Z-axis to collapse rapidly to zero, with the trajectory line falling in an inverted V-shape.

3. Evolution of the growth curve: a spiral ascent in four stages.

As we learned in the previous section, the lifecycle of a meme is not linear, but rather a vortex that expands continuously around the Z-axis (the flow of funds). In this section, we will analyze the meme based on its four development stages.

The following diagram shows its standard evolutionary path: (I was also stunned; the AI drew it so coolly?!)