Executive Summary: From asset "transfer" to asset "restructuring".

Article author and source: AquaFlux

Looking back at the history of DeFi, it's easy to see that every surge in liquidity stemmed from the successful stripping away and standardization of asset attributes. ERC-20 stripped away the value transfer attribute, giving rise to a universal standard for ICOs and transfers; AMM stripped away the human element of market makers, achieving automated trading.

However, in the RWA (Real-World Asset) sector, the industry remains in the "transfer" stage of RWA 1.0. Current offerings such as Ondo Finance and various government bond tokens are essentially "static mirroring": using SPVs and legal trusts to map offline bonds 1:1 to on-chain ERC-20 tokens. While this model solves the problem of putting assets on-chain, it completely retains the rigidity of traditional finance, with risk and return packaged in an indivisible black box. Users can only passively accept the average risk of the assets and cannot perform customized management.

This research report proposes that the core of RWA 2.0 lies in the on-chain native implementation of Structured Finance. We believe that AquaFlux is not just an RWA protocol, but a universal language for financial engineering.

Just as Solidity is the programming language for smart contracts, AquaFlux is the programming language for asset risk. Through a standardized syntax—P (Principal), C (Coupon), and S (Shield)—it "translates" real-world assets into on-chain, recognizable, programmable, and composable financial primitives. Within this language system, Tri-Token is merely a surface-level form; its core is structured layering (Tranching) and a risk waterfall, enabling DeFi protocols to deconstruct and restructure trillions of dollars worth of traditional assets as easily as handling LEGO bricks.

Chapter 1 The Inevitability of Structure: Breaking RWA's One-Size-Fits-All Approach

1.1 The Dilemma of Static RWA: The Black Box of Risk

The current static RWA model faces the constraints of the "Blockchain Trilemma": high compliance costs, liquidity fragmentation, and lack of risk pricing.

• The Fungible Token Lie: The ERC-20 standard assumes all tokens are fungible. But this is a fatal misconception for RWA. Every corporate bond and every piece of real estate carries different risks. Simply packaging them as fungible tokens actually masks the heterogeneity of the underlying assets.

• Passive responsibility: In the static model, once the underlying asset defaults, on-chain token holders can only passively wait for the off-chain legal process to settle the debt, lacking a native on-chain risk buffer mechanism.

1.2 Definition of AquaFlux: Structured Lego

The essence of AquaFlux is to internalize the construction logic of CLO (Collateralized Loan Obligation) and ABS (Asset-Backed Securities), which are extremely mature in traditional finance, into a set of smart contract standards.

We can liken the AquaFlux protocol to a set of "Structured Finance Legos": the original RWA assets are no longer moved onto the chain as a "whole asset package", but are broken down into three standardized, tradable, and composable building blocks (P, C, S) under the Tri-Token architecture, allowing the market and the protocol to assemble different risk-return structures as needed.

• Input: Any asset that generates cash flow (Yield-bearing Assets, such as government bonds, corporate bonds, and commercial paper).

• Processing End (Flux Engine): A structured layered engine based on smart contract logic that breaks down assets according to the "Tranching + Risk Waterfall" rule.

• Output: Three standardized modules with different risk/return characteristics: P (principal) / C (coupon) / S (risk).

This marks RWA's evolution from an "asset container" to a "financial organism." Through this structuring, AquaFlux transforms the "risk-return" contract of assets from a single setting by the issuer into a dynamic deconstruction based on on-chain market game theory.

Chapter Two: Core Syntax: Risk Waterfall and Layered Logic

The core of the AquaFlux language lies in "decompose" and "recompose". To master this language, you must understand its underlying syntax rules—the Risk Waterfall.

2.1 The Waterfall: The Power of Definition

In financial engineering, the priority of fund repayment determines the properties of an asset. The AquaFlux protocol strictly defines the priority of fund flows on-chain, thereby creating different financial properties through code.

Asset Cashflow → Senior (P) → Mezzanine (C) → Equity / Junior (S)

1. P-Token (Principal) – Senior Tranche:

Definition: On-chain zero-coupon bonds (i.e., asset forms that do not generate interest during the term and only redeem the face value at maturity).

Syntax and Logic: P-Token enjoys the highest level of repayment priority. As long as the underlying default loss does not exceed the thickness of the S-Token, P is absolutely safe. This makes P-Token a perfect collateral (High LTV) in DeFi lending because it greatly mitigates idiosyncratic credit risk through its structured design.

2. C-Token (Coupon) — Mezzanine Tranche:

Definition: A pure cash flow carrier.

Syntax and Logic: C-Token eliminates the cost of capital tied up in principal, making it a highly capital-efficient yield-generating instrument. It is sensitive to interest rate changes and is suitable for investors who not only want returns but also want to trade "expected yields."

3. S-Token (Shield) - Junior/Equity Tranche:

Definition: Risk absorber and excess return capturer.

Syntax and Logic: S-Token is the most complex word in the AquaFlux language. It is located at the bottom layer of the waterfall flow (First-loss capital).

2.2 S-Token: A Dynamic Container for Risk Pricing

S-Token is the core innovation that distinguishes AquaFlux from other protocols. While bearing the risk of uncertainty, it also enjoys corresponding reward incentives, introducing a dual concept: Shield and Surplus.

• Shield Mechanism: When the underlying asset defaults or incurs bad debts, the staked funds in the S-Token pool will be burned/slashed first to buffer the principal loss of P-Tokens/C-Tokens. It is the system's "safety airbag".

• Surplus Mechanism: Risk and reward are commensurate. As compensation for bearing the risk of going to zero, S-Token captures the most substantial excess return (Alpha) in the system:

a. Coupon Share: The risk premium extracted from the returns of the underlying asset.

b. Protocol Fees: Fee revenue generated by the protocol.

c. Incentives: Governance token incentives issued by the system.

This mechanism creates a dynamic equilibrium: when the market perceives increased asset risk, the price of S-Token will fall (because a higher yield is needed to compensate for the risk). This high APY automatically attracts risk-seeking funds to mint S-Tokens, thus automatically increasing the safety cushion. This is AquaFlux's self-regulating language capability.

Chapter 3: Application of Grammar: The Infinite Combinations of Financial Lego

Once assets are standardized into P, C, and S using the AquaFlux language, investors are no longer passive holders but active builders. Because on-chain, "composition" is more important than "holding": you hold modules, you express strategies.

This is also the charm of "language"—using a limited vocabulary, through different combinations, to express infinite intentions. More importantly, these combinations not only serve traders, but also the DeFi protocols themselves: lending protocols, AMMs, and yield aggregators can all directly use P/C/S as callable financial primitives.

3.1 Three modules, three types of "intents"

• P (Principal Module): P has a single cash flow objective (returning the principal upon maturity) and the highest risk level (priority repayment), thus it is closer to the asset type that the chain is willing to accept with a high LTV. It is suitable for collateral and as a "cornerstone asset".

• C (Coupon Module): Focuses on income cash flow and interest rate expectations, suitable for income trading and curve trading.

• S (Risk Module): Focuses on credit risk and risk premium, suitable for risk pricing, absorbing volatility, and earning excess returns.

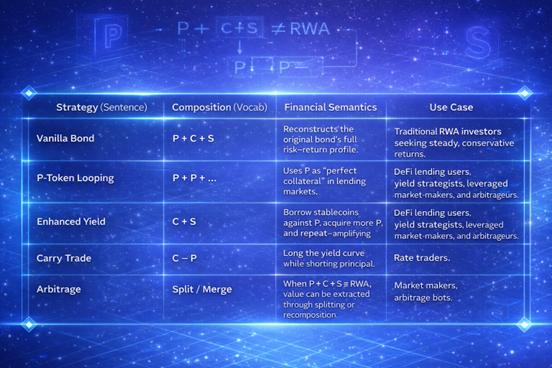

3.2 Combination Strategy

This is the true value of "financial Lego": not inventing new assets, but creating more tradable, hedgeable, and combinable ways to express the same asset.

Chapter 4 The Evolution of Asset Splitting: From Pendle to AquaFlux

In the development of DeFi, "asset splitting" is becoming a prominent trend. We can clearly see an evolution from simple to complex. AquaFlux did not appear out of thin air, but rather stood on the shoulders of giants, completing the final piece of the splitting puzzle.

4.1 Pendle: Separating "Time" from "Interest"

Pendle Finance is a pioneer in the splitting track, and it has been extremely successful in handling interest-bearing assets (especially LSD, such as stETH).

• Split mode: Asset = PT (Principal) + YT (Yield)

• Core Logic: This is an equation about time. PT is the principal that increases over time, and YT is the right to income that decreases over time.

• Limitations: Pendle's model is built on the assumption of "safe principal of underlying assets." This assumption holds true when dealing with stETH. However, in the RWA field, corporate bonds themselves carry significant credit risk. If the Pendle model is directly applied, PT holders will directly suffer losses should the underlying assets default. This makes it difficult for Pendle to directly absorb non-standard RWA assets on a large scale.

4.2 Polymarket: Deconstructing "Probability" and "Outcome"

Polymarket, on the other hand, demonstrates another extreme of splitting in the prediction market field.

• Splitting pattern: Collateral (1) = YES Token + NO Token

• Core logic: This is an equation about probability. YES + NO = 1$.

• Implications: Polymarket demonstrated that by splitting binary outcomes, the market can price the probability of an event occurring with extreme precision. This pricing is not determined by experts, but by real money transactions.

4.3 AquaFlux: Deconstructing “Credit” and “Structure”

AquaFlux combines the best features of both and elevates them to the level of RWA.

• Splitting pattern: RWA = P (Principal) + C (Coupon) + S (Credit Risk)

• The New Paradigm of RWA:

It inherits the P/C logic of Pendle, realizes the separation of principal and interest, and meets the needs of interest rate transactions.

It incorporates the binary game logic of Polymarket and encapsulates it within S-Token. The essence of S-Token is a pricing tool for the "probability of default".

• Evolutionary Point: AquaFlux fills the biggest gap in the RWA field—the tradability of credit risk. Before AquaFlux, if you didn't trust the credit of an RWA, you simply couldn't buy it; after AquaFlux, you can separate credit risk by short S-Tokens or holding only P-Tokens. This is the ultimate form of asset splitting.

Chapter 5: RWA's Liquidity Engine: Matching Risk and Releasing Liquidity

The reason why traditional RWA tokens have poor liquidity is fundamentally because they are too "boring." They simply map offline bonds 1:1 onto the blockchain, forcing everyone to accept the same fixed yield (e.g., 5%) and the same risk. This is like asking everyone, whether whales or retail investors, to buy the same financial product—the result is that no one is satisfied, and no one trades.

AquaFlux's logic is to break down a boring RWA asset into three "DeFi gameplay" familiar to Web3 users. When the asset becomes highly playable Lego bricks, liquidity naturally follows.

5.1 Three types of tokens, corresponding to three types of DeFi players

AquaFlux isn't selling bonds; it's providing the tools that three typical on-chain users want most:

1. P-Token: On-chain "Yu'ebao" / High-quality collateral

• Target users: Whale, DAO treasury members, and stablecoin holders.

• User mindset: "I have a lot of USDT, and I want a slightly higher return than depositing coins on Aave, but I absolutely cannot lose my principal, and I don't want to stare at the trading screen every day."

• Web3 gameplay:

As a "safe haven asset": P-Token has S-Token at the bottom (in case of default, the money in S is lost first), so it is extremely safe, similar to an on-chain "guaranteed redemption" financial product.

Looping: Because P is very safe, lending protocols like Aave offer it a high LTV (Loan-to-Value Ratio). Users can pledge P to borrow U, then buy P again, achieving low-risk "leveraged arbitrage".

2. C-Token: Interest Rate "Long Position" / Pure Yield Token

• Target users: Traders and hedge funds.

• User mindset: "I don't want to tie up a lot of principal in bonds; I just want to bet on changes in yield."

• Web3 gameplay:

Maximizing capital efficiency: Buying C-Token is like using leverage many times over. You don't need to spend 100 yuan to buy bonds to earn 5 yuan in interest; you only need to spend a small amount of money to buy this "right to 5 yuan in returns".

○ Playing the Fed Game: If you believe interest rates will rise, buy C-Tokens. Once interest rate expectations rise, the price of C will skyrocket. This is essentially an interest rate prediction market.

3. S-Token: A leveraged "mining shovel" / Risk capture

• Target users: Yield Farmers and Degen players.

• User mentality: "High risk is okay, as long as the APY (annualized return) is high enough, or there are points (credits/airdrops) to be gained, I'll go for it."

• Web3 gameplay:

High APY Mining: Because S-Token assumes the risk of default, the system allocates most of the "excess returns" to it. This includes: protocol fee dividends + governance token rewards + the premium of the underlying asset.

○ Game Theory Without Default: Buying S-Tokens is essentially betting that "this asset won't collapse." As long as it doesn't collapse, S-Token holders are the highest-profit winners in the entire system.

5.2 The Flywheel Effect: How Speculators Protect Savers

AquaFlux's most ingenious design lies in its use of Web3's speculative nature to build system security. This creates a self-regulating flywheel:

1. Launch: The project team issues RWA assets and splits them into P/C/S.

2. Speculative Entry (Degen Entry): The market saw that the mining yield (APY) of S-Token was very high (including transaction fees and token incentives), so a large number of Yield Farmers entered the market to mint and hold S-Token.

3. Thicker Shield: The larger the S-Token pool, the more funds are available to "back up" it.

4. Principal becomes safe (P becomes Safer): Because of the thick S layer underneath, P-Token becomes indestructible.

5. Whale Entry: Seeing that P-Token is so safe and has stable returns, whale and institutional funds began to buy large amounts of P-Token as national treasury reserves.

6. Scale Explosion: The massive amount of funds held by whale directly increases the total value locked (TVL) of the entire protocol. A higher TVL generates more transaction fees, which in turn drives up the yield of S-Tokens, attracting more Degen tokens…

In AquaFlux, Degen (S holders) who buy low and sell on-chain meme are essentially providing insurance for whale(P holders) seeking stability, and thus receiving high returns. This "mutually beneficial and mutually liquidating" mechanism is the true magic of Web3 financial engineering.

Chapter Six Conclusion: Structured Finance Becomes the New Language of the On-Chain Era

The emergence of AquaFlux marks a shift in the RWA (Real Estate Asset Management) sector, moving from a "noun" to a "verb." We are no longer focusing solely on the asset itself (the noun), but rather on how to manage the asset (the verb – Structuring).

As the "financial engineering language" in the RWA (Real-World Asset Management) field, AquaFlux is setting a new standard for the on-chain integration of real-world assets. Through the term "Tri-Token," AquaFlux breaks down complex, non-standard assets, often burdened with obscure legal terms, into simple and clear P, C, and S financial Lego bricks. This transforms the reallocation of risk and return from a task that previously required weeks of work by Wall Street actuaries into a matter of seconds of on-chain smart contract interaction.

This high degree of composability, structuring, and risk pricing provides a strong foundation for the integration of DeFi with traditional finance. It is foreseeable that as more and more protocols adopt this paradigm, P/C/S will become the universal language of the RWA world, much like ERC-20 is for fungible tokens.

As industry analysts have noted, "When RWA ceases to be merely 'on-chain assets' and becomes the underlying foundation of on-chain finance, a new wave of DeFi boom may be on the horizon." The structured innovation spearheaded by AquaFlux is significant not only for solving current liquidity and risk control challenges but also for establishing a completely new paradigm. When structured finance becomes commonplace in on-chain finance, the boundaries between traditional finance and the blockchain world will be further blurred, potentially ushering in an unprecedentedly prosperous financial ecosystem.