RootData recently launched a survey on crypto exchage listing decisions, collecting 313 valid responses. Participants included Listing Business Development (BD) personnel, researchers, and members of the listing committee. The survey results have been compiled into a research report for reference.

Article author: RootData

Article source: ChainCatcher

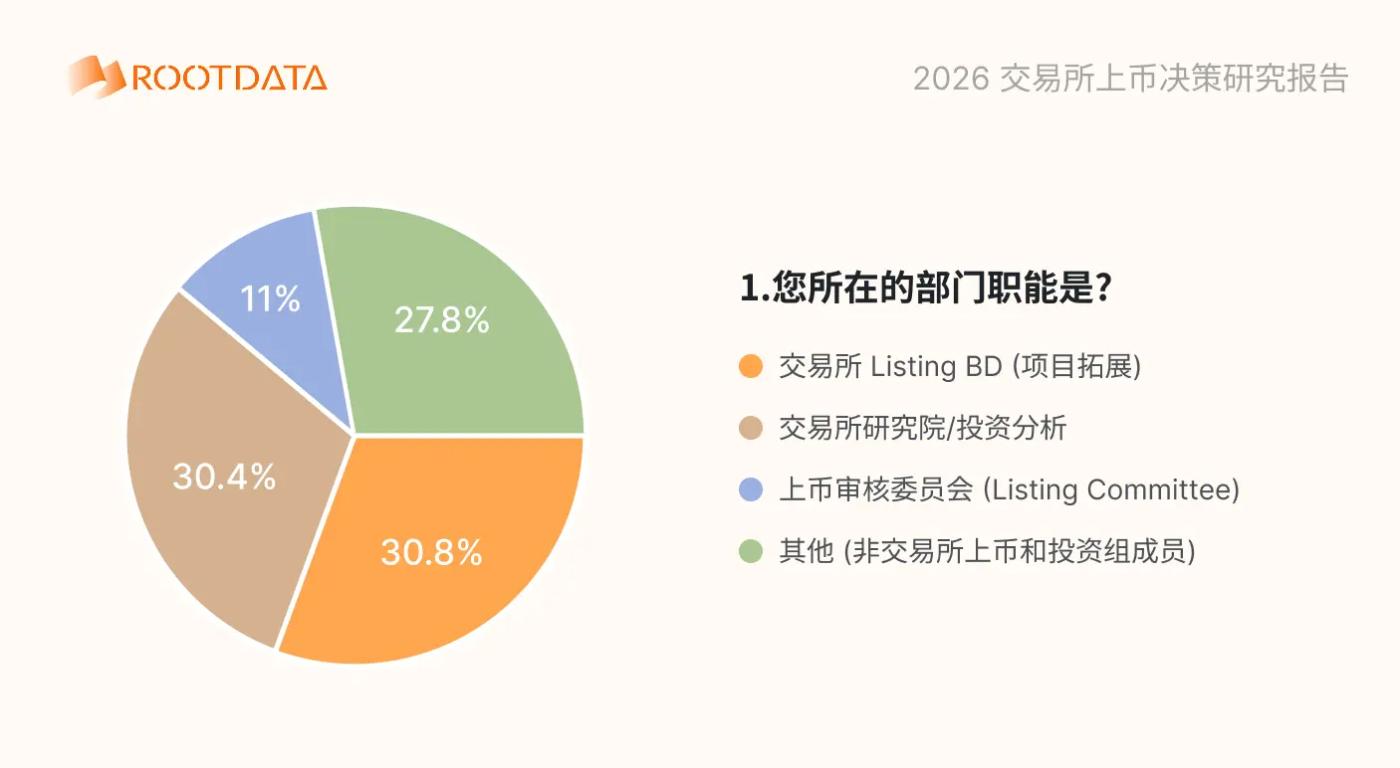

Respondent Profile: Covering frontline practitioners and decision-makers in the listing industry

Over 69% of respondents directly participated in or made decisions regarding listings. The survey participants were mainly concentrated in the exchange's listing business development and research/investment analysis positions. They are the exchange's "value discovery" and "access control" departments, and decision-makers face enormous information processing pressure.

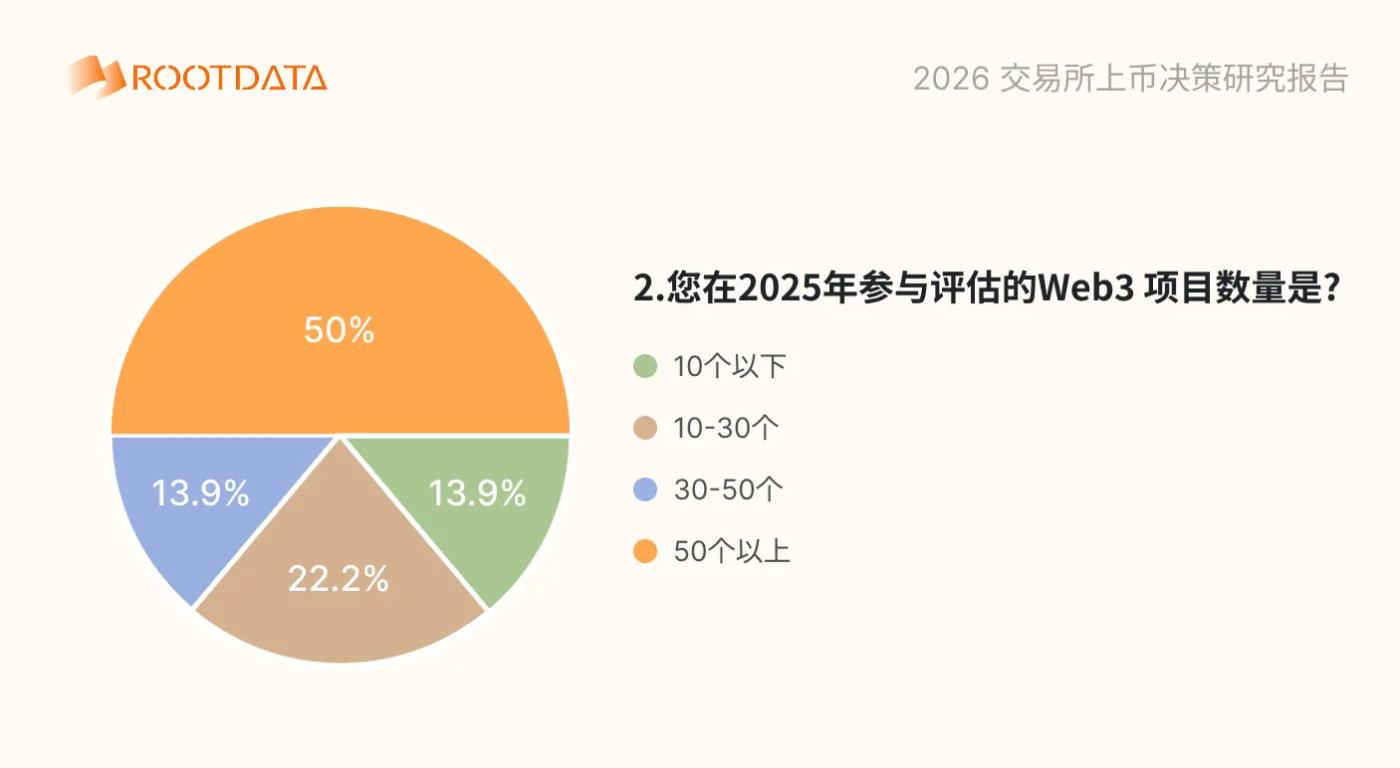

Decision-making pain points: data fragmentation and delayed updates

Approximately 50% of respondents evaluate more than 50 projects annually, indicating a severe "information overload" among decision-makers. Among this massive volume of projects, those offering structured and transparent data significantly reduce the cognitive burden on decision-makers. This also demonstrates that "transparency" has become a crucial indicator for projects to stand out within a very short evaluation window.

Distribution of core job responsibilities

Due diligence and decision-making are highly overlapping functions. This means that data platforms are no longer just auxiliary tools, but are integrated into the decision-making process.

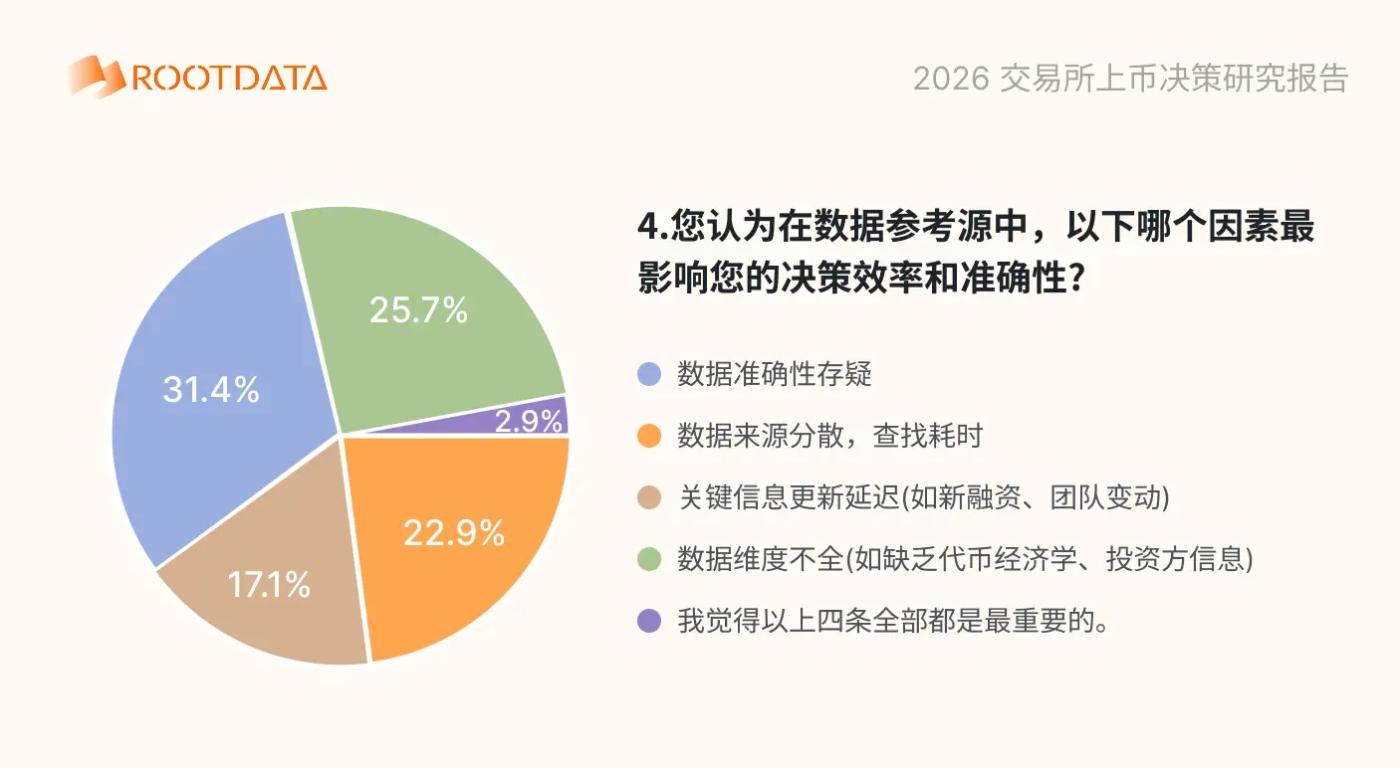

A stumbling block to decision-making efficiency

"Trust cost" is the most expensive hidden cost for exchanges. Data uncertainty leads to repeated backtracking of decision-making processes, and as compliance trends are further strengthened, the accuracy and effectiveness of asset information disclosure will become a crucial factor affecting the listing cycle of exchanges.

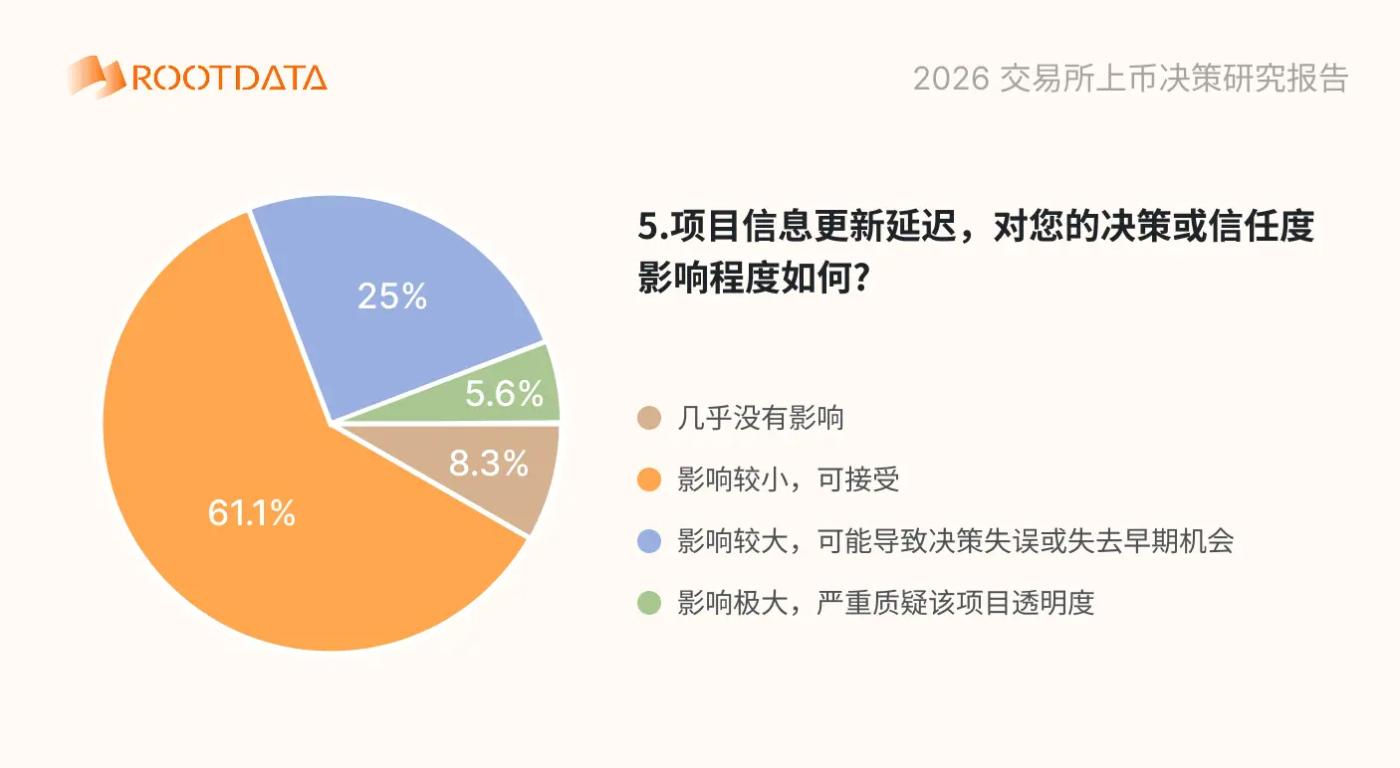

The "hidden penalty" of lagging data

Over 30% of respondents believed the delays had a significant or extremely large impact, potentially leading to flawed decision-making, missed opportunities, or even questioning the project's transparency. Even if 60% of respondents outwardly deemed the delays "acceptable," the lag in project information updates could still negatively impact the listing evaluation.

Outdated information processing methods

50% of respondents indicated that if project data is not transparent, it will trigger "defensive due diligence" by the exchange, which will prolong the review time. 16.7% of respondents explicitly stated that they would stop the review process or even directly reject the application for a project listing.

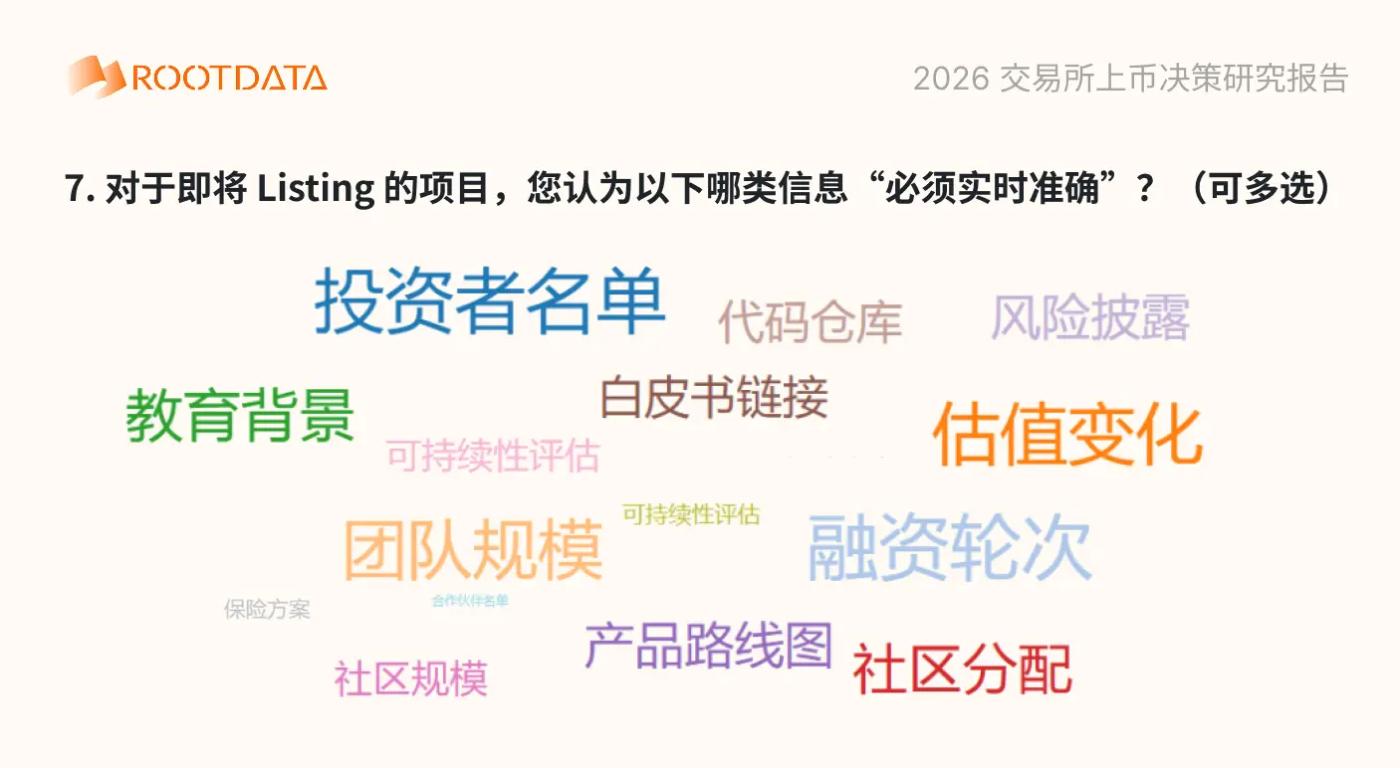

Listing review is a "must-do" course.

Institutional investors, valuations, teams, product roadmaps, and other historical asset developments—these essential dimensions form the cornerstone of credibility for Web3 projects. However, this information is also very easy to falsify, so more than half of the respondents indicated that they desperately need third-party data platforms to help them cross-verify information.

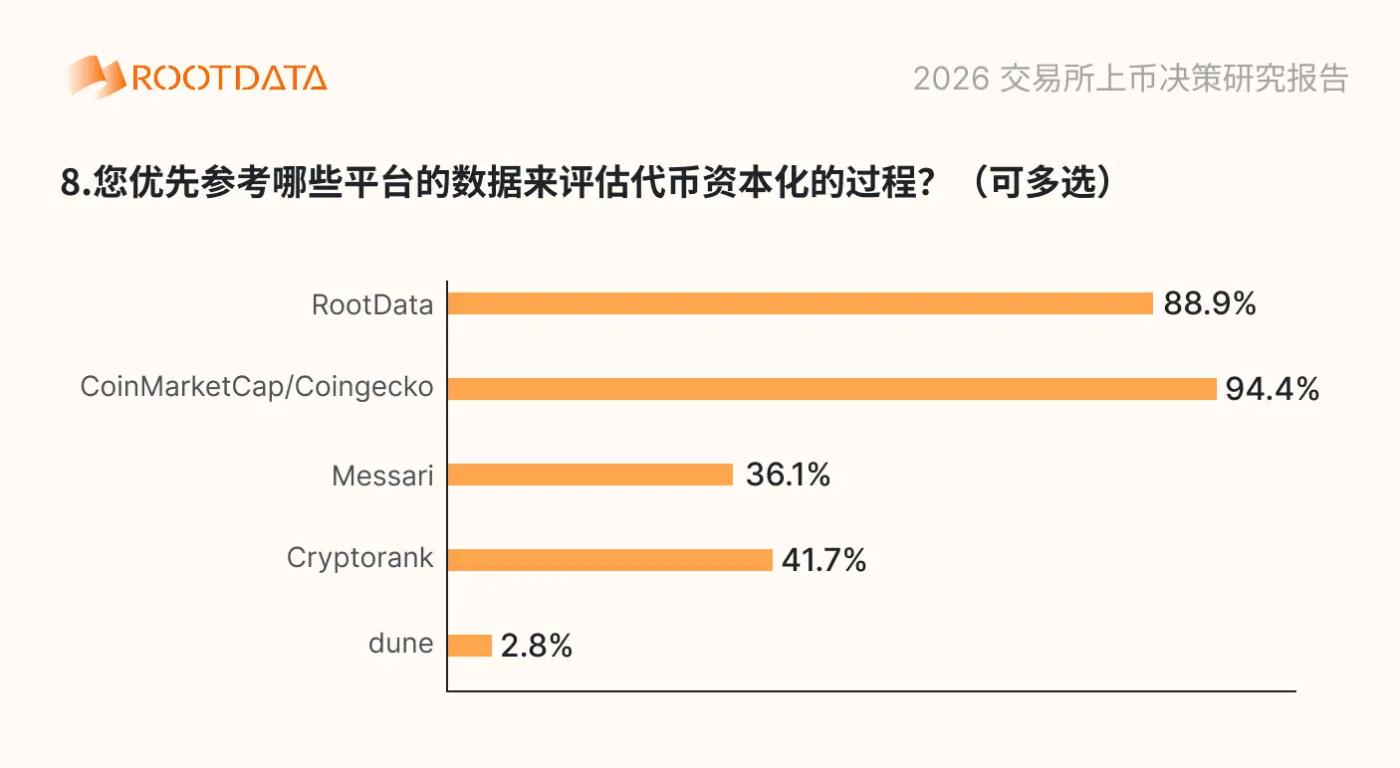

Common data platform preferences

88.9% of respondents indicated they would refer to RootData's data, making it an "essential" tool for exchange listing teams. This is particularly evident for projects with low token capitalization (primarily initial coin offerings (TGEs) or those not yet listed on major global crypto exchanges). This high penetration rate signifies that RootData's Web3 project data structure and quality control are becoming an industry standard. For projects with very high token capitalization, 94.4% of respondents would choose Coingecko or Coinmarketcap for data cross-validation.

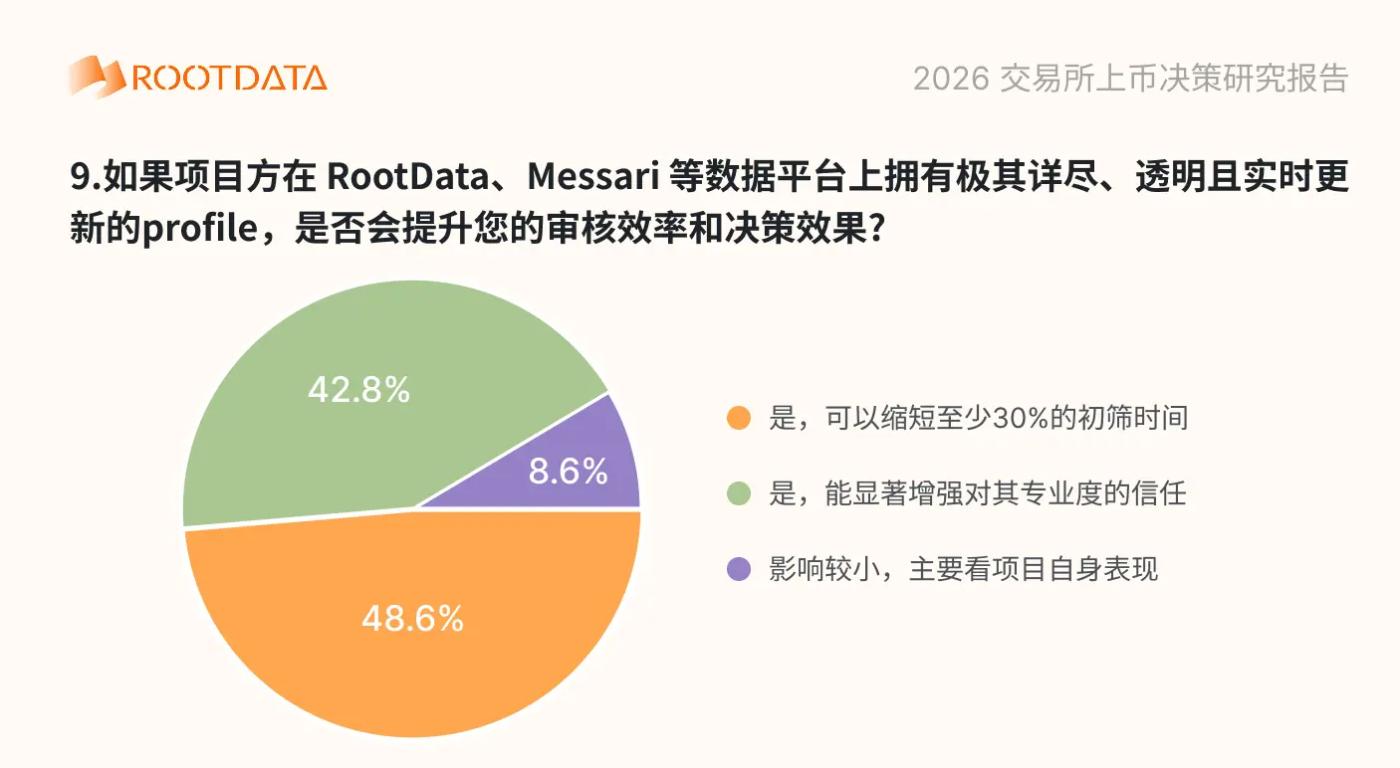

The speed-up effect of detailed project information

91.4% of respondents explicitly stated that having a project included in authoritative third-party data platforms such as RootData and Crunchbas with detailed information would significantly improve listing efficiency and user satisfaction, and could bring at least a 30% improvement in review efficiency.

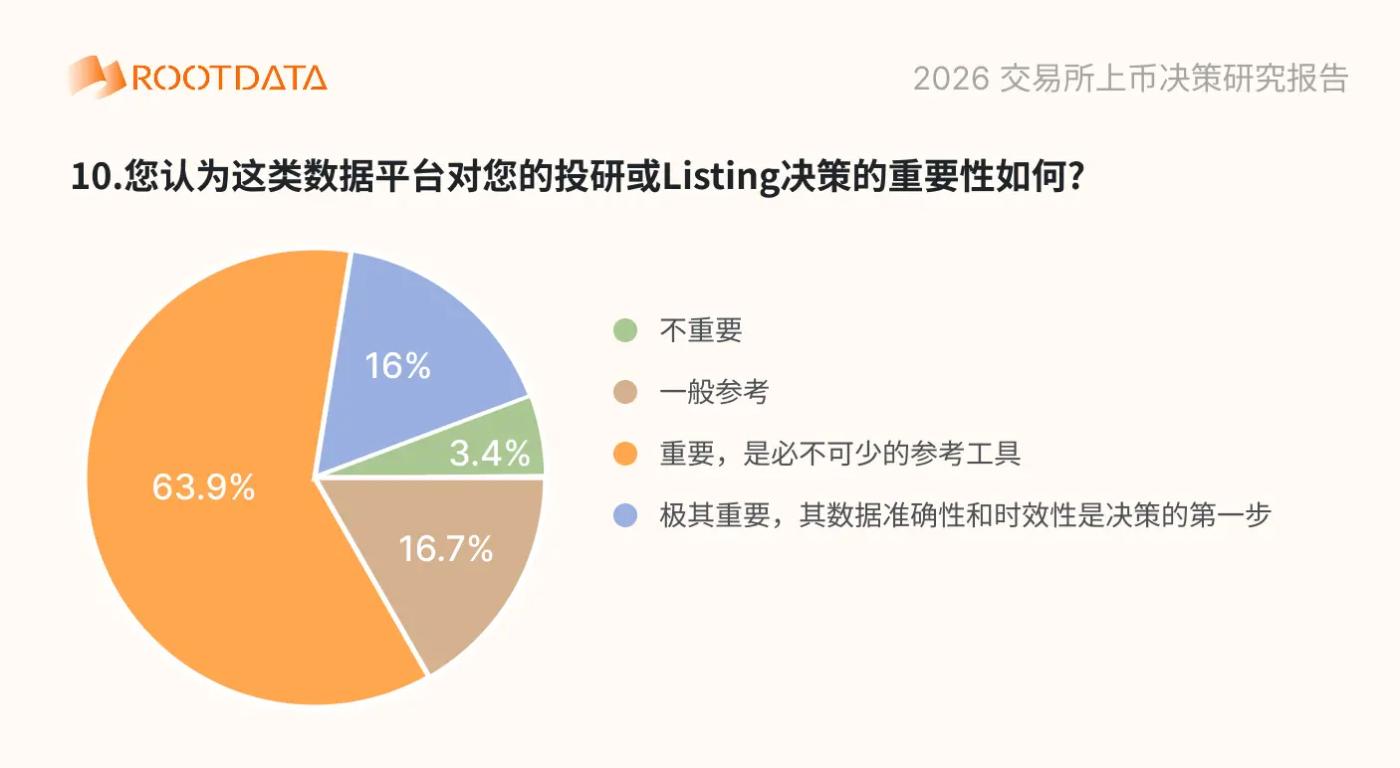

The role of data platforms in the development of Web3

Only 2.7% of respondents believed that projects did not need to focus on data transparency. As the most mysterious part of the industry, listings were recognized by more than 80.6% of users as being very important for their listing decisions. This further indicates that whether a project values data disclosure will directly affect the effectiveness and efficiency of its capitalization.

summary

The survey results show that more than half of the professionals in the listing departments of exchanges regard the transparency of project information as an important part of the listing review process. In particular, information such as institutional investors, valuation, team, and product roadmap can be effectively accelerated by the full transparency of information on third-party data platforms (more than 30%), while the review cycle of projects with low transparency will be lengthened.

In the current state of the industry, many projects are facing the predicament of "coins crashing immediately after issuance," and users have lost trust in the vast majority of crypto projects. This is due to a combination of factors, including the projects' lack of compelling features and reliable business models, as well as the fact that many projects operate in a "black box" state of information asymmetry. The level of disclosure of core project information has become one of the key factors affecting the progress and effectiveness of their capitalization.