Seeker's SKR Token experienced a turbulent launch following Solana Mobile's Airdrop. On January 21, 2024, Solana Mobile distributed 2 billion SKR Token, worth nearly $26.6 million at launch, to Seeker phone users and developers.

The Airdrop event immediately attracted the attention of traders, causing the Token price to fluctuate sharply from the start. However, after the initial price surge subsided, SKR entered a rather unpredictable price-testing phase, and selling pressure emerged quite quickly after the initial wave of excitement.

Seeker holders have started selling.

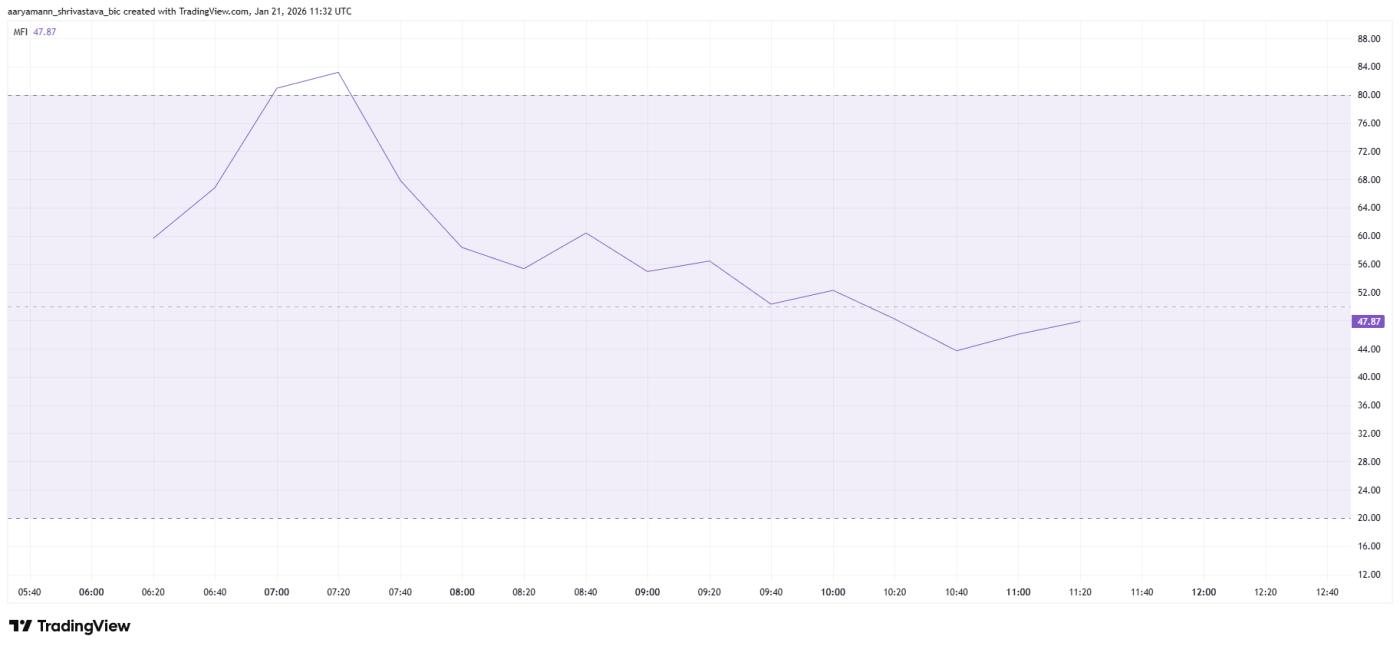

Short-term signals suggest momentum is weakening despite SKR's impressive start. On the 15-minute chart, the Money Flow Index (MFI) has been trending downward since SKR peaked early. As a volume based momentum indicator, the MFI falling below the neutral 50.0 mark indicates that sellers are gaining the upper hand.

A continuously declining MFI (Moving Average Fiscal Index) usually signals weakening buying demand rather than just random fluctuations. In the case of SKR, this indicates that early Airdrop recipients are taking advantage of the opportunity to Token Sale and lock in profits. This is a common practice when a new Token is listed, but it's a negative sign if market momentum hasn't returned to a positive state.

Want to stay updated on Token? Sign up for Editor Harsh Notariya's daily Crypto newsletter here .

SKR MFI. Source: TradingView

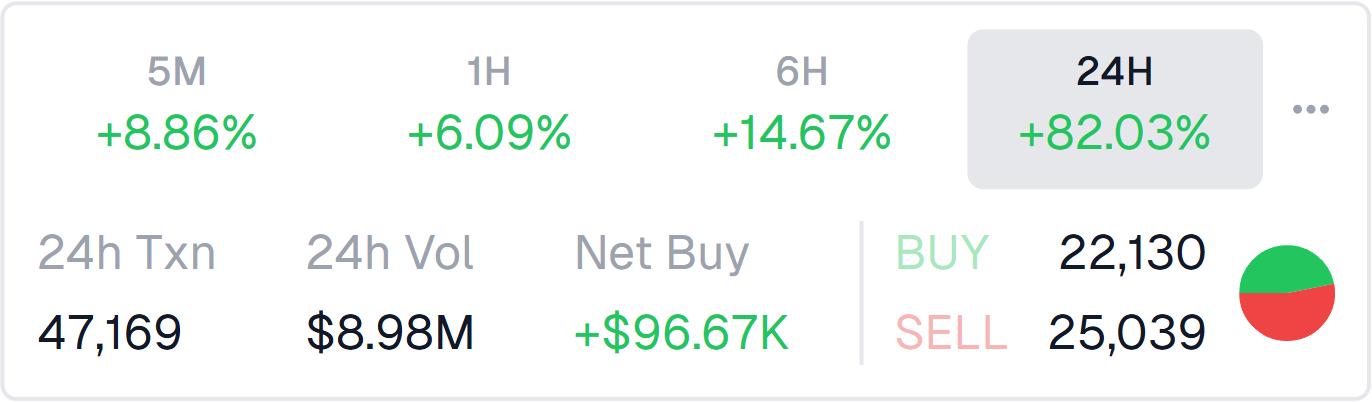

SKR MFI. Source: TradingViewon-chain transaction data also supports this view. Since listing, approximately 22,130 buy transactions have been recorded compared to around 25,039 sell transactions. This disparity indicates that Token distribution is outweighing accumulation buying, further reinforcing the short-term bearish trend.

This reflects the caution of traders after the sharp upward price movement at the opening. Although interest in SKR remains high, most people are tending to take profits rather than accumulate more. Unless there is a significant buying influx, downward pressure may continue.

Seeker bid/ask spread. Source: GeckoTerminal

Seeker bid/ask spread. Source: GeckoTerminalSKR price faces risk of further decline.

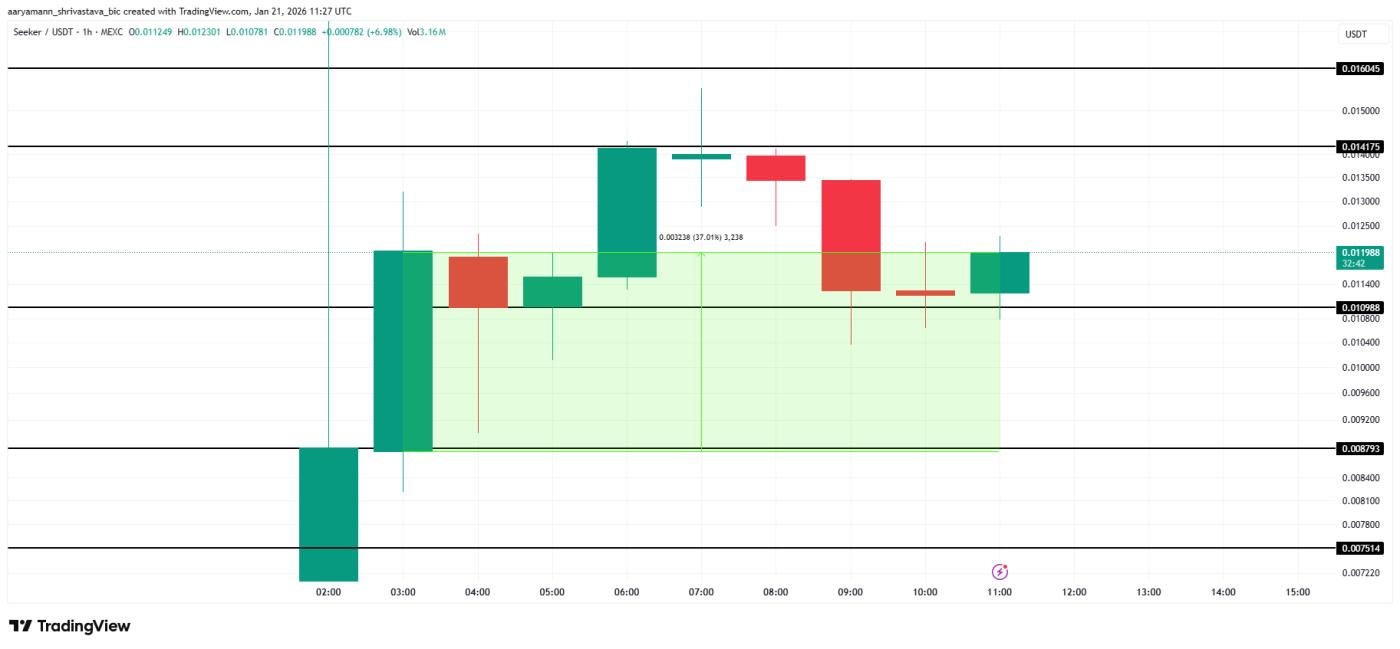

Seeker (SKR) is still up about 37% from its opening price, trading around $0.01198 at the time of writing. However, after peaking at $0.01553, the price has reversed and corrected, indicating that the initial enthusiasm has subsided as market liquidation has stabilized.

If selling pressure continues, SKR could lose the support zone of $0.01098. If the price falls sharply below this level, the downtrend could accelerate, with $0.00879 as the next target. A further decline could even see the price drop to $0.00754, erasing almost all of the gains achieved on the first day of trading.

SKR price analysis. Source: TradingView

SKR price analysis. Source: TradingViewIn the short term, maintaining above the $0.01098 support level will be crucial for SKR to stabilize. If this level is held, the likelihood of the price forming a new base will increase. Conversely, if SKR breaks above $0.01417, market momentum could turn positive and strengthen buyer confidence.