The threat of quantum computing to Bitcoin is often XEM and considered distant, but if you look closely, you can see its impact is already beginning to emerge.

Recent studies and actions from financial institutions suggest that time may be passing faster than anticipated.

Quantum computers have begun to influence Bitcoin—but not in the way you might think.

Recently, Bitcoin's weaker performance compared to gold has caused institutional investors to reconsider their positions. However, the reason isn't necessarily due to traditional market factors, but rather the risks posed by quantum computing (QC) – which could one day compromise Bitcoin's security.

Financial strategists are now taking this risk more seriously, adjusting their portfolios and sparking debates about Bitcoin's future safety.

BeInCrypto reports that Jefferies strategist Christopher Wood has removed 10% of Bitcoin from his flagship “Greed & Fear” simulation portfolio, shifting his investments to physical gold and gold mining stocks.

Wood is concerned that quantum computers could break Bitcoin's ECDSA (Elliptic Curve Digital Signature Algorithm) key, impacting Bitcoin's Vai as a store of value.

“Financial advisors read studies like this and keep their clients’ Bitcoin investments low or non-existent because quantum computing is an existential threat. It will be a burden on Bitcoin until this issue is resolved,” wrote batsoupyum, a prominent user on X.

Numerous studies also agree with this caution. According to a 2025 study by Chaincode Labs, it is estimated that approximately 20–50% of circulating Bitcoin addresses are at risk of future quantum attacks due to the reuse of Public key. Nearly 6.26 million BTC, equivalent to a value of $650 billion to $750 billion, could be at risk.

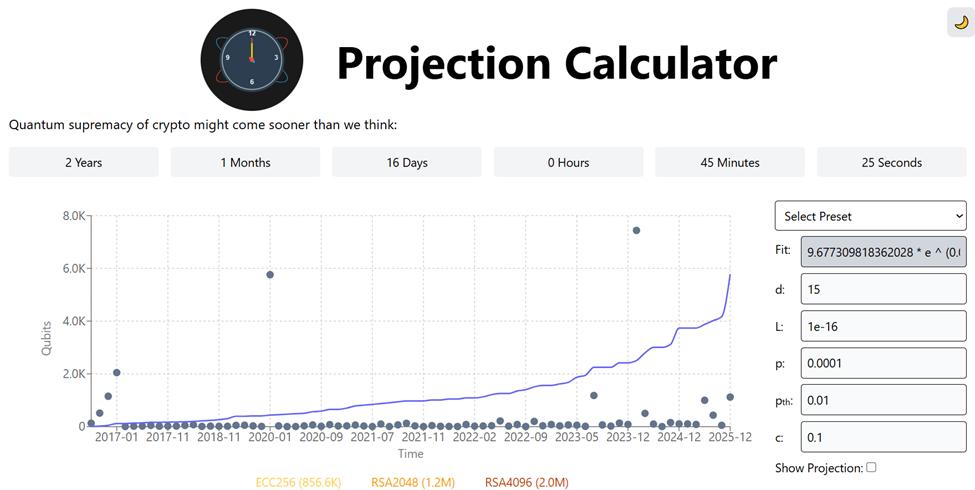

Furthermore, the Projection Calculator's chart also reflects this risk by showing the remarkable development of quantum hardware capabilities over time.

Quantum Doomsday Clock. Source: Projection Calculator

Quantum Doomsday Clock. Source: Projection CalculatorAs the number of qubits in quantum computers increases rapidly, especially after the milestones Google is aiming for in 2025, the possibility of quantum computers truly impacting Cryptology is becoming increasingly apparent.

Bitcoin's decentralized structure makes the problem even more difficult to solve. Unlike traditional banks, which can regulate quantum security upgrades thanks to centralized power, Bitcoin must coordinate changes across its globally distributed network.

There is no governing board, no specific regulations, and no single organization with enough authority to order immediate changes to Bitcoin.

“I used to think the threat of quantum computing to Bitcoin was far-fetched. Now I don’t think so anymore. Many people still argue: ‘Quantum computing hasn’t threatened anything for years, and if it does, the entire financial system is at risk… [Bitcoin] can technically be upgraded. But to do that, it requires complex and slow coordination across a decentralized network. Nobody can say ‘move now’,” Jamie Coutts Chia .

The risks posed by quantum computing are increasingly casting a shadow over Bitcoin's appeal to institutions.

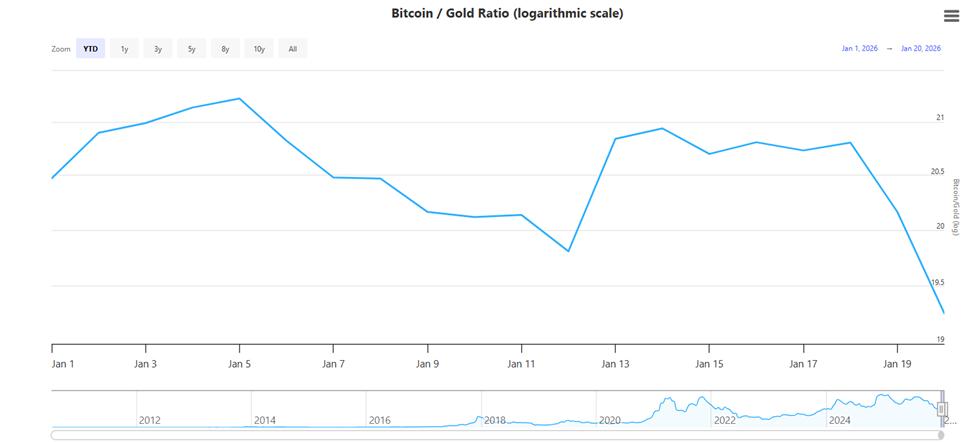

The market has begun to reflect these concerns. In 2026, Bitcoin fell 6.5% against gold while the price of gold rose by as much as 55%. The BTC/gold ratio of 19.26 in January 2026 also shows that financial advisors are becoming more cautious about Bitcoin.

Bitcoin/gold ratio. Source: longtermtrends

Bitcoin/gold ratio. Source: longtermtrendsFinancial institutions, however, have taken different approaches. While Wood reduced its holdings, Harvard University is said to have increased its investment in Bitcoin by nearly 240%.

Similarly, Morgan Stanley has begun advising its asset management clients to allocate up to 4% of their portfolios to digital assets . Even Bank of America allows allocations ranging from 1% to 4% .

This demonstrates that support for Bitcoin hasn't disappeared, but has simply become more scattered, depending on differing risk perceptions in various locations.

However, some experts believe that the risks from quantum computing are low in probability but have a huge impact if they occur. David Duong from Coinbase points out two main risks : quantum computers breaking ECDSA keys and targeting SHA-256, the foundation of Bitcoin's proof-of-work system.

Vulnerable addresses include old Pay-to-Public-Key Script , some multisig wallets , and insecure Taproot configurations.

To mitigate risk, maintaining clean addresses (avoiding reuse of old addresses) and transferring coins to quantum-resistant addresses are XEM crucial solutions.

The post-quantum cryptographic standard published by NIST in 2024 opens a roadmap for securing Bitcoin in the future. However, the process of applying it to Bitcoin remains quite complex.

Charles Hoskinson of Cardano warns that premature adoption of the technology could severely reduce its effectiveness . Meanwhile, DARPA's Quantum Blockchain Initiative suggests that real threats may emerge in the 2030s.

However, the rapidly evolving development forecast chart suggests that this timeline could be shortened, especially if AI is integrated and accelerates quantum development.

The story of quantum computing has moved from theory to a clear impact on investment portfolios. Bitcoin's underperformance not only reflects market cycles but also highlights emerging existential risks, forcing institutions to reconsider Capital allocation and posing an unprecedented technical challenge to the network.

Until Bitcoin's decentralized system can coordinate a full upgrade to be quantum-resistant, the burden on BTC Vai remains.