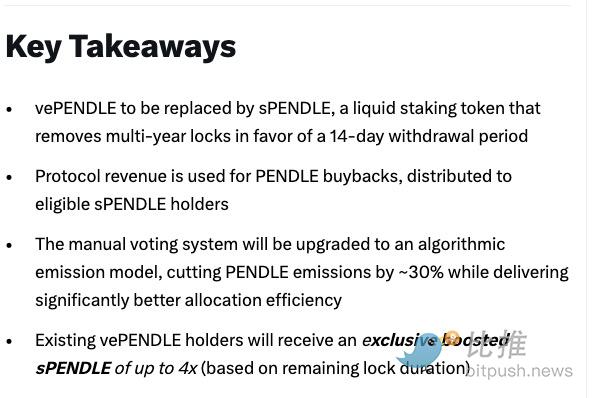

Recently, Pendle , a long-distance runner in the DeFi field, announced a major update: abandoning its veTokenomics (voting custody economic model) which it has been promoting for several years, and switching to the more liquid sPENDLE.

This news quickly sparked heated discussions in the community. Curve founder Michael Egorov immediately posted a message questioning it, stating bluntly that "canceling the ve model was a mistake." However, the market voted with real money—PENDLE's price rose by 11% in response.

As the undisputed leader in the interest rate derivatives sector, Pendle's self-destructive reform is not only about the growth of its $3.5 billion TVL, but also a public trial of the core narrative of DeFi over the past three years: the model of exchanging "lock-up period" for "loyalty" seems to be losing its effectiveness.

Locked Shackles: Governance by a 20% "Minority"

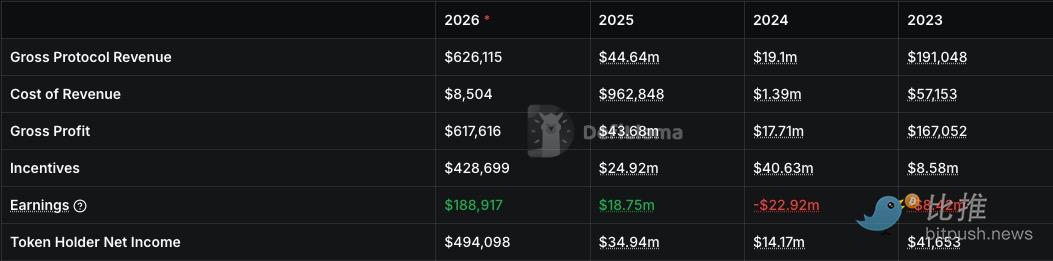

Despite Pendle’s significant revenue growth over the past two years, the performance of its core governance asset, vePENDLE, has consistently failed to keep pace with the protocol’s explosive growth.

The crueler truth is:

The "wealth gap" in rewards: The complex weekly manual voting system is extremely unfriendly to ordinary users, resulting in rewards being concentrated in the hands of a few professional players.

A false prosperity of efficiency: Although Pendle has an excellent annualized cost-effectiveness ratio—annualized expenses of approximately $13.99 million and annualized revenue of approximately $13.83 million—if you break it down to specific pools, you will find that more than 60% of the pools are actually operating at a loss. The protocol has long relied on the profits of a few core high-quality pools (such as Ethena) to subsidize the inefficient pools.

This non-transferability of "locked-up funds disconnect" completely isolates holders from DeFi's most powerful feature: composability.

Algorithms and Buybacks: Switching from "Manual" to "Autopilot"

Pendle's new solution, sPENDLE , essentially transforms the protocol from a "power game" into an "efficiency tool."

The most significant change is the release of liquidity : users no longer face years of lock-up periods, but instead have a 14-day exit period. If funds are urgently needed, they can be redeemed instantly by paying a 5% fee. This "flexible" approach gives greater flexibility to the approximately $127 million (35.51% of market capitalization) of pledged funds.

At the grassroots level of governance, Pendle introduced two key strategies:

Algorithm-driven emissions: Reward allocation, once determined by human voting, is now handled by algorithms. This model will automatically allocate rewards based on the pool's actual contribution, and is expected to reduce overall emissions by approximately 30% .

Substantial Buyback: Up to 80% of the protocol's revenue will be directly used to buy back PENDLE tokens and distribute them to stakers. Currently, the protocol's annualized holder revenue has reached $11.06 million , and total fees have exceeded $64.56 million . The buyback mechanism will allow these revenues to directly impact the token's value.

Change inevitably involves a restructuring of interests. In order to appease those "veteran contributors" who had been locked in for years, Pendle set January 29 as the snapshot date.

According to the plan, existing vePENDLE holders can receive up to 4x sPENDLE bonuses upon conversion. This bonus will decrease linearly based on the original remaining lock-up period, ensuring that long-term users who truly support the protocol still have the strongest voice and profit rights in the early stages of the transition. This design cleverly alleviates long-term users' concerns about "long-term consistency collapse."

This change instantly brought Pendle to life. The market clearly prefers liquid assets that can be withdrawn at any time but still share in the benefits of buybacks, rather than a "long-term meal ticket" with no end in sight.

III. Controversy: Consistency or Liquidity?

However, many industry insiders are not optimistic about this approach.

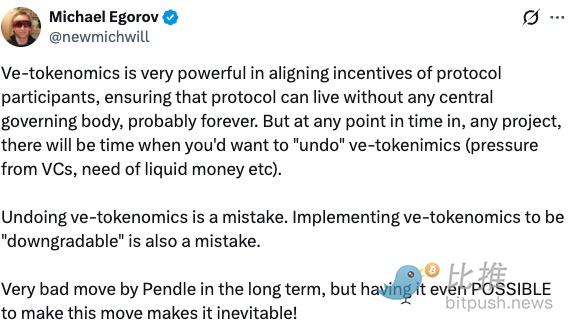

Michael Egorov, founder of Curve (the opposing side):

"The revocation of the voting escrow token economic model was a mistake. And designing it as 'downgradeable' in the first place was also a mistake. In the long run, Pendle's move was terrible—but more importantly, when such an operation was 'mechanically possible,' its occurrence was inevitable."

Maple co-founder and CEO Sid Powell believes that long-term lock-up is essentially "forcibly retaining capital," which often masks the true risks of the protocol and leads to excessive concentration of power. Pendle's approach is to "incentivize retention through rewards rather than forcing loyalty through lock-up."

The essence of this debate is: should the moat of a mature DeFi protocol be the "total value locked" or the "attractiveness of the product itself"?

In fact, Pendle is not an isolated case.

In the DeFi bull and bear cycles of the past few years, a number of established protocols have realized that loyalty gained through "lock-up periods" is essentially mortgaging the protocol's future.

PancakeSwap was one of the pioneers in this transformation. As early as the end of 2023, it began reforming its old system that required users to lock up their staked tokens for up to four years. By introducing veCAKE's flexible revenue share mechanism, PancakeSwap distributed 5% of its protocol fees directly to stakers, eliminating the mandatory lock-up period. By the end of 2025, despite facing competition from multiple blockchains, its TVL (total value added) had steadily recovered and remained around $2.3 billion, successfully attracting a large number of retail investors unwilling to be locked up for extended periods.

Balancer's trajectory is also highly relevant. Its veBAL model faced long-term challenges, with nearly 80% of tokens in an "inactive governance state," meaning the vast majority of holders simply locked their tokens without voting. In 2025, the team completely overhauled the incentive structure in the v3 upgrade: introducing short lock-up options and automated fee adjustments, transforming governance from a "task" into a flexible, participatory tool. Within six months, the protocol's governance participation rate increased by approximately 40%.

A more radical experiment came from the stablecoin protocol Ethena. Last September, it launched a "fee switch," distributing protocol revenue directly to holders of the liquidity token sENA, completely bypassing the complex voting escrow model.

These cases point to a new consensus: DeFi protocols are shifting from "forcing users to bind themselves" to "retaining users with tangible benefits." Locking up data was once a shortcut to maintaining stability, but it also led the ecosystem into a false sense of prosperity. Now, protocols are more inclined to achieve genuine activity by lowering barriers to entry and improving capital efficiency.

The effectiveness of Pendle's transformation will be tested after the vePENDLE lock-up period officially ends on January 29th. But regardless of the outcome, it has sent a clear signal to the industry: in the future DeFi world, excellent products should not turn users into "staking prisoners."

Author: Bootly

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush