What If Smart Contracts Could Trade on ‘Binance’? Introducing a Smart Contract Callable Trading Infrastructure for DeFi on Any Chain

TL;DR

DeFi trading is structurally fragmented. Smart contracts cannot directly call high-performance trading engines like Binance or advanced order-book venues such as Hyperliquid,expressive execution and on-chain programmability have never truly met.

We are building a smart contract callable trading infrastructure that closes this gap. Any contract on any chain can invoke exchange grade trading, including spot markets, perpetual contracts, and advanced order types such as limit and trigger orders, through a verifiable oracle gateway, without bridging assets or switching networks.

Trading positions and execution results become composable on-chain assets, enabling protocols to trade, manage risk, and allocate capital with real execution.

Learn more at https://www.128.trade.

Background and Motivation

Trading and DeFi Never Truly Converged

Decentralized Finance is programmable by design, while trading on the best venues is expressive and performant. Yet over the past decade, these two systems have evolved in parallel without ever truly converging.

Smart contracts today can lend, borrow, swap, stake, and compose increasingly complex financial logic. Yet they cannot directly execute trades on high-performance markets such as Binance or advanced on-chain venues like Hyperliquid. At the same time, the deepest liquidity and most expressive trading engines remain isolated venues, fundamentally inaccessible to on-chain programs.

This separation is often blamed on UX, latency, or throughput. In reality, it reflects a deeper architectural limitation: trading was never designed as a callable component of the DeFi stack.

The Core Limitation Is Callability, Not Performance

Most discussions around DeFi trading focus on gas costs or fragmented liquidity. These issues matter, but they are secondary.

The fundamental limitation is simple: trading engines are not callable by smart contracts. High performance execution systems, including centralized exchanges and order book based DEXs, operate outside DeFi’s programmable environment. They offer spot and perpetual markets, advanced order types, and deep liquidity, but they cannot be invoked as part of on chain logic.

As a result, trading remains an external activity coordinated by users or off-chain bots, rather than a native building block that protocols can depend on directly.

Why Existing DEX Architectures Cannot Close the Gap

DeFi’s existing trading architectures resolve only half of the problem.

Automated market makers are fully programmable and composable, but their execution model is fundamentally limited. They cannot natively express leverage, conditional orders, or active risk management, relying instead on passive liquidity curves.

Order-book and perpetual DEXs offer rich execution semantics comparable to centralized venues, but behave like applications rather than infrastructure. They are typically single-chain, not directly callable by arbitrary smart contracts, and difficult to compose into higher-level protocols.

This creates a persistent trade-off: programmability without expressive execution on one side, and expressive execution without programmability on the other.

A Question That Reframes the Problem

What if this boundary did not exist? What if smart contracts could directly call a high-performance trading engine, with execution semantics comparable to centralized exchanges?

In that world, vaults could execute real trades rather than approximations, lending protocols could manage risk through active execution, strategies could run autonomously across chains, and trading itself could become a composable primitive within DeFi.

This is not about building another exchange. It is about redefining trading as infrastructure, an execution layer that protocols can invoke directly, rather than a venue users must interact with manually.

System Architecture: How Callable Trading Works

Making trading callable by smart contracts is not a simple integration problem. It requires rethinking how execution, correctness, and cross-chain interaction are modeled in the first place. Traditional trading systems are designed as isolated venues, while smart contracts operate within deterministic, verifiable environments. Bridging these two worlds demands a different architectural approach.

At a high level, we separate trading into two tightly coupled layers: a deterministic execution engine and a cross-chain access layer that makes this execution safely callable from smart contracts.

A Deterministic Trading Engine as the Execution Core

At the core of the system is a high-performance trading engine that operates as a deterministic state machine. All trading actions, placing and canceling orders, opening and closing positions, funding payments, margin updates, and liquidations, are processed through a single canonical execution pipeline.

Determinism is a foundational property. Given the same prior state and the same ordered set of requests, the engine always produces the same result. This allows execution to be audited, replayed, and verified independently. It also enables the engine to be run by multiple nodes under consensus, forming the basis for decentralized integrity and future proof systems.

From the engine’s perspective, every action is simply a request. Whether that request originates from a low-latency API client or from a smart contract on another chain is irrelevant once it enters the execution queue. This unification ensures that all consumers share the same liquidity, the same execution logic, and the same state transitions.

Making Execution Callable via an Oracle-Style Gateway

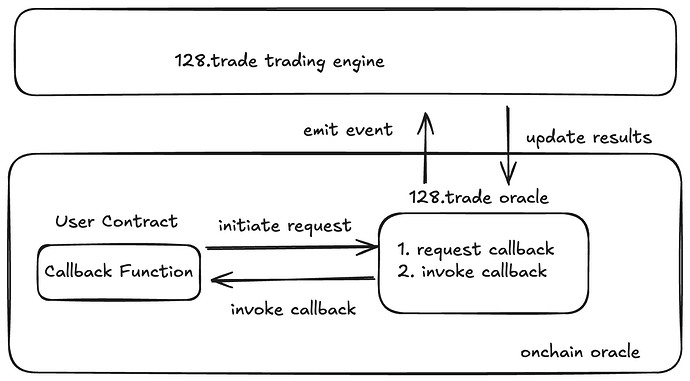

Smart contracts cannot directly interact with off-chain, high-performance trading engines. To make execution callable, we introduce an oracle-style gateway, designed for execution rather than data.

The diagram above illustrates the core execution flow, from on-chain request to verified execution and on-chain settlement. For a more intuitive, end-to-end walkthrough of this process, including how contracts, relayers, and the trading engine interact in practice, we provide a UI/UX demo of the execution workflow at: https://www.128.trade/how-it-works

At a high level, the workflow looks like this:

On-chain Trading Request.

A smart contract calls a gateway function (e.g. place an order, open a position, subscribe to a strategy).

This does not execute a trade on-chain. Instead, it emits a canonical request event that encodes execution intent, parameters, and origin-chain context, along with a unique request ID.Request forwarding.

A decentralized relayer network monitors gateway events, validates their provenance, and forwards authenticated requests to the trading engine.

From the engine’s perspective, these requests are indistinguishable from API-based orders and enter the same deterministic execution queue.Deterministic execution.

The trading engine processes the request by matching orders, updating margin, applying funding, or triggering liquidations, and then produces a deterministic execution result.Proof-backed callback.

The execution result is returned asynchronously to the originating chain via a callback, accompanied by a cryptographic proof bundle (e.g. threshold signatures or execution attestations).

The gateway verifies the proof, enforces idempotency and replay protection, and only then applies the result on-chain.On-chain materialization.

Verified results are materialized as on-chain state: position NFTs, vault shares, balance updates, or contract callbacks.

This architecture allows any smart contract on any supported chain to invoke exchange-grade trading, including spot markets, perpetual contracts, and advanced order types such as limit and trigger orders, without bridging assets, switching networks, or trusting a single operator. Trading execution becomes a callable system primitive, with correctness enforced directly on-chain.

From a builder’s perspective, trading shifts from an external dependency into a callable syscall. Smart contracts express execution intent, the trading engine performs deterministic execution, and verified results materialize back on-chain through callbacks. Protocols no longer integrate with venues; they compose execution directly into their logic.

The example below illustrates how this works in practice. A smart contract can place a perpetual order by calling placePerpOrder, which submits an execution request to the trading engine via the oracle layer. Once the order is executed, the result is returned asynchronously, and developers can handle it inside their own contract logic by implementing the corresponding callback function.

function placePerpOrder(PerpOrderParams calldata params)external payable override returns (bytes32 requestId) {// submit a perpetual order request to the trading engine via the oraclerequestId = oracle.submitRequest{value: value}(params);return requestId;}function onPlacePerpOrderResult(...) external onlyOracle {// handle the execution result of the perpetual order// custom logic defined by the contract developer}One Engine, Two Worlds

The same trading engine simultaneously serves two fundamentally different consumers. On one side, traders, market makers, and automation systems interact through low-latency APIs optimized for performance. On the other, smart contracts and protocols access the engine through a trust-minimized, proof-backed gateway.

Both access paths converge on the same execution layer. They share liquidity, execution semantics, and state transitions. This is what transforms trading from an isolated venue into shared infrastructure.

What This Unlocks for DeFi

Making high-performance trading callable by smart contracts unlocks a set of capabilities DeFi has never had before.

Smart contracts gain direct access to exchange-grade trading.

Contracts can place spot and perpetual trades with Binance-level execution semantics, including limit orders, trigger orders, leverage, and advanced order logic. Trading is no longer an off-chain activity coordinated by users or bots — it becomes a programmable function protocols can call directly.Trading state becomes on-chain and composable.

Exchange-native objects such as spot balances, perpetual positions, subaccounts, and strategy portfolios can be represented as on-chain assets. Positions and subaccounts are no longer locked inside venues — they can be collateralized, lent, staked, or embedded into structured products.Protocols gain active execution and new design space.

Vaults and funds can trade directly instead of relying on approximations. Lending protocols can hedge and manage risk with conditional execution rather than over-collateralization alone. At the same time, entirely new protocol classes become possible — including fully on-chain funds, AMMs with active hedging, and autonomous trading agents managing capital with verifiable guarantees.

The result is not another exchange, but a shift in architecture. Trading becomes shared infrastructure rather than a destination — a core execution layer that protocols compose just like data and liquidity.

Looking Ahead

128.trade is under active development, with our testnet launching soon. As the system matures, smart-contract interfaces and core components will be progressively opened to developers, alongside open-sourced contract code.

For a deeper technical dive into the architecture, trust model, and execution guarantees, the full whitepaper is available at https://www.128.trade/pdf/whitepaper.pdf.

We believe trading should be a programmable primitive, not an isolated venue, and this is the first step toward making that real.