Written by: Bruce

Foreword

In this age of information overload, we are encountering an unprecedented form of visual deception. Just as the filtered beautiful scenery on Xiaohongshu (a Chinese social media platform) often turns out to be garbage dumps upon actual visit, traffic on social media no longer represents authenticity, and authenticity often doesn't generate traffic. When truth becomes scarce in the fog of algorithms, how can we cut through the fog and make informed decisions?

Imagine if every turning point in international affairs, every verbal battle between tech giants, could be quantified into real odds and traded publicly—would the world become clearer or crazier? In a recent in-depth discussion on Day1Gobal, the guests revealed a cruel yet fascinating reality: prediction markets are far more than simple gambling tools; they represent a complete subversion of existing information distribution and trading logic.

Here are five investment principles about truth that emerged from this conversation.

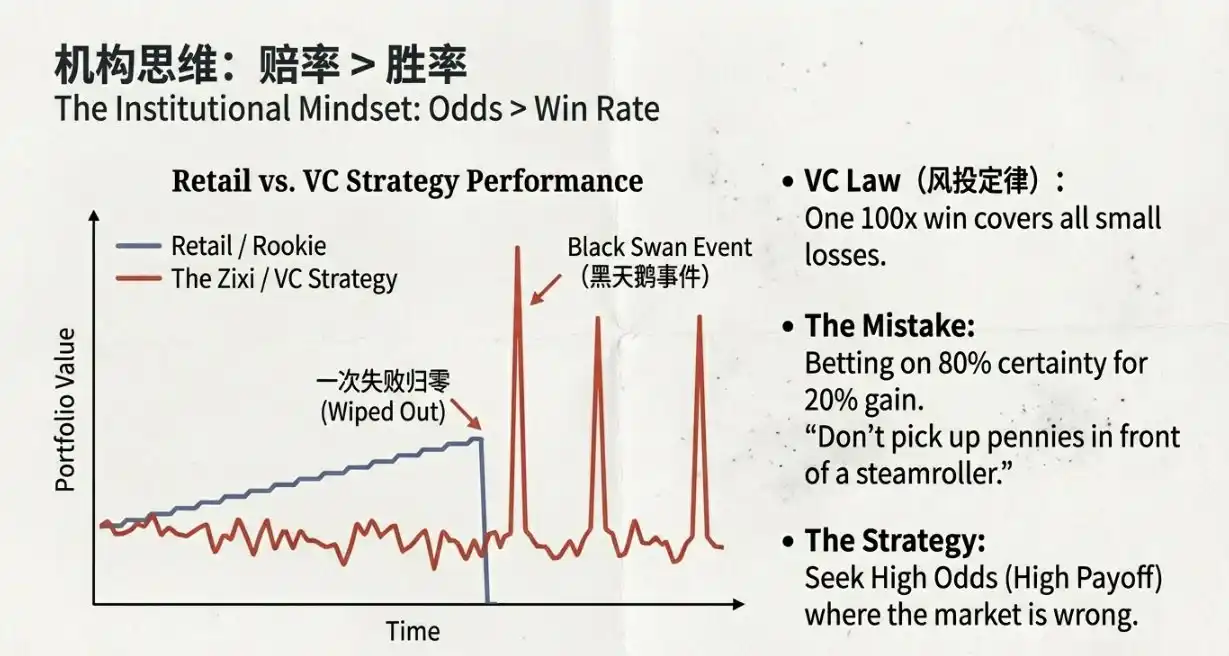

Don't be fooled by a 90% win rate; the odds are the key to asymmetric opportunities.

For the average investor, chasing projects with an 80%-90% win rate is a natural instinct for risk aversion. However, in the eyes of seasoned investors, this is often a prime area for exploiting gullible investors.

Market predictions don't follow a perfect normal distribution; they more closely resemble a power-law distribution or the long-tail law. Many people are keen to buy in the 90% win rate range, believing it's a get-rich-quick scheme. But Zixi offers a highly cautionary perspective: the focus of betting isn't on the win rate, but on the odds.

Those seemingly sure-win projects can wipe out all your profits overnight if a black swan event (such as a sudden geopolitical reversal) occurs. True professional players seek asymmetric opportunities: for example, Chess saw Manchester City playing away against a little-known Norwegian team in the Champions League, bet on a game with extremely low odds of winning, and ultimately won $700 on a $100 investment. This logic aligns perfectly with venture capital investment in the primary market: aiming for high odds rather than focusing on small profit margins.

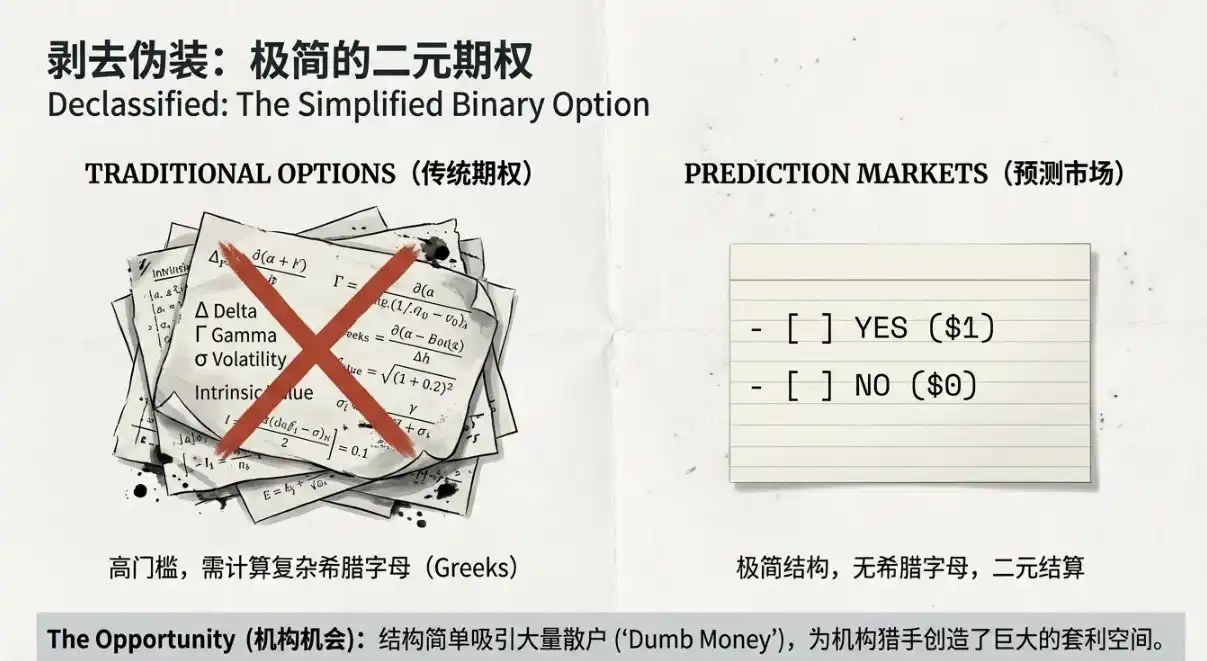

The triumph of binary options: Predicting the market is the hedge for your assets.

In practical finance, prediction markets are essentially a type of binary option that is more intuitive and has a shorter reaction time than traditional options.

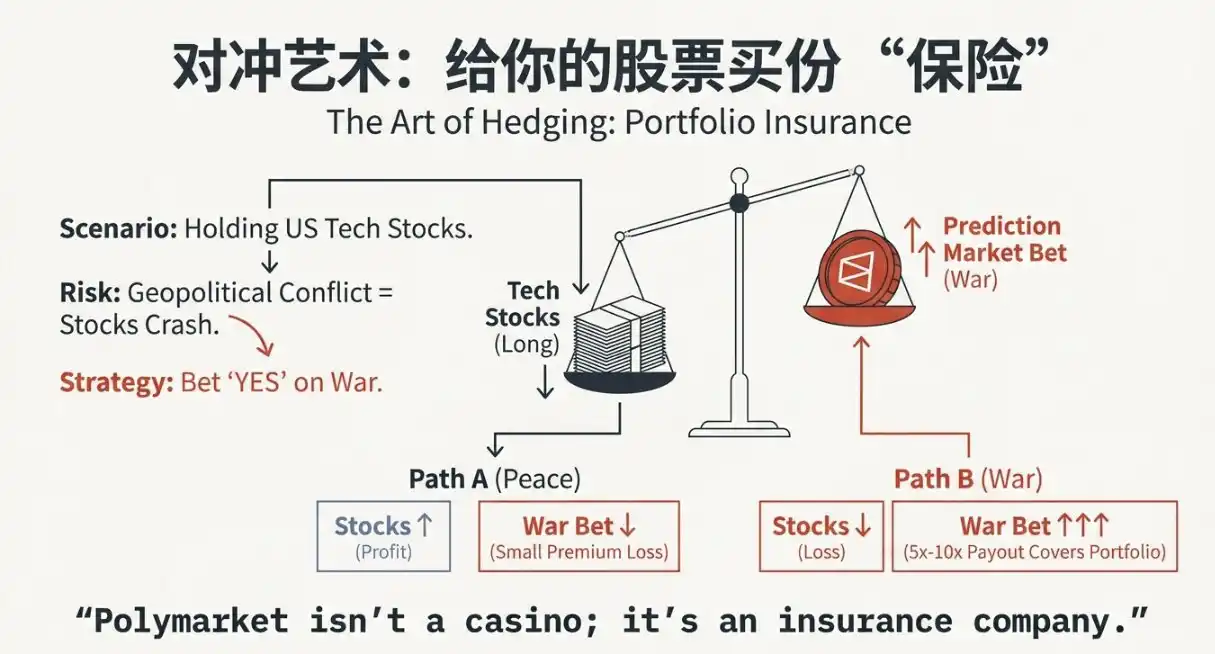

For those holding significant amounts of US stocks or digital assets, geopolitical turmoil translates into substantial drawdown risks. Zixi shared his real-world example: during a period of heightened tensions with Iran, he invested $3,200 betting on whether the US would take action. The logic behind this strategy wasn't simply to profit, but rather as a hedge.

- If a conflict breaks out: the stock account incurs losses, but the position in the market prediction doubles, achieving break-even.

- If nothing happens: predict that small amounts of capital in the market will go to zero (premiums), but large assets will steadily increase in value in the stock market.

This win-win logic allows investors to maintain a calm mindset in volatile markets. Compared to traditional options that require calculating implied volatility (Greeks), the forecasting market simplifies complex financial models into a black-and-white game, greatly lowering the barrier for ordinary people to participate in risk management.

When Radar Becomes an Oracle: Physical Data Precedes Press Releases

The core competition in prediction markets is essentially an arms race of information asymmetry. While the rest of the world is refreshing social media and waiting for news releases, professional players are using the laws of physics to uncover the truth.

Zixi revealed details of its profits from the Iranian situation: skilled individuals ignored diplomatic rhetoric and instead monitored FlightRadar24 in real time. The truth became clear when all commercial flights over Iran suddenly disappeared, or when a strange Russian military aircraft was observed flying directly from Israel to Russia.

Even more valuable were the exit signals: when Zixi observed the reappearance of commercial flights over Iran, he realized the risk of conflict had subsided, and immediately closed his position. Ultimately, this $3,200 bet yielded $8,000 (a net profit of $4,875), a return of 150%-250%. In the prediction market, physical data (satellites, flight paths, weather) may be the true oracles because they cannot be forged.

Looking at the cost of faith through JJ Lin's app: It's not just gambling, but also an emotional outlet.

Why has market prediction become a cultural phenomenon? Because it serves as a means for adults to express their social needs and discover their beliefs.

Star mentioned an interesting comparison: Lin Junjie's fan app charges 300 RMB for entry. This shows that people are willing to pay for faith and emotion. Predictive markets have transformed this psychology into a tool for information discovery.

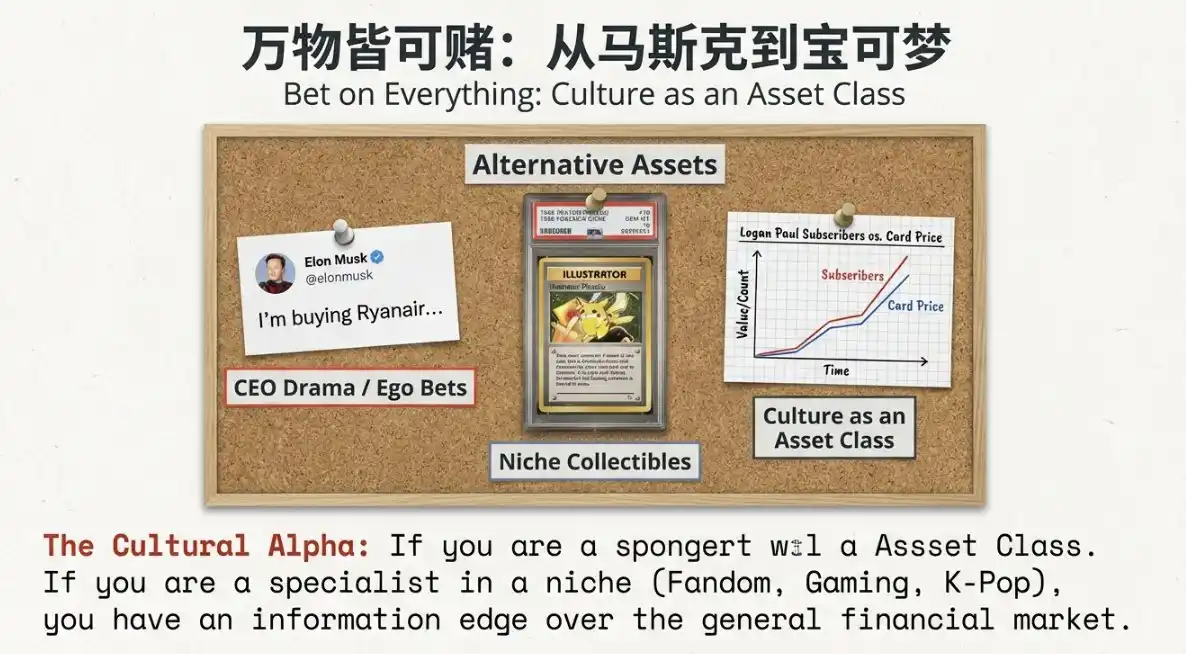

Whether it's Taylor Swift's chart performance, whether Elon Musk will buy Ryanair, or the Oscar winners, prediction markets offer a low-cost opportunity to participate in grand narratives or entertainment gossip. It turns fan support into a form of real-money logical validation. Winning proves your judgment; losing provides cheap catharsis. This healthy form of catharsis is becoming a new social currency for stressed-out modern people.

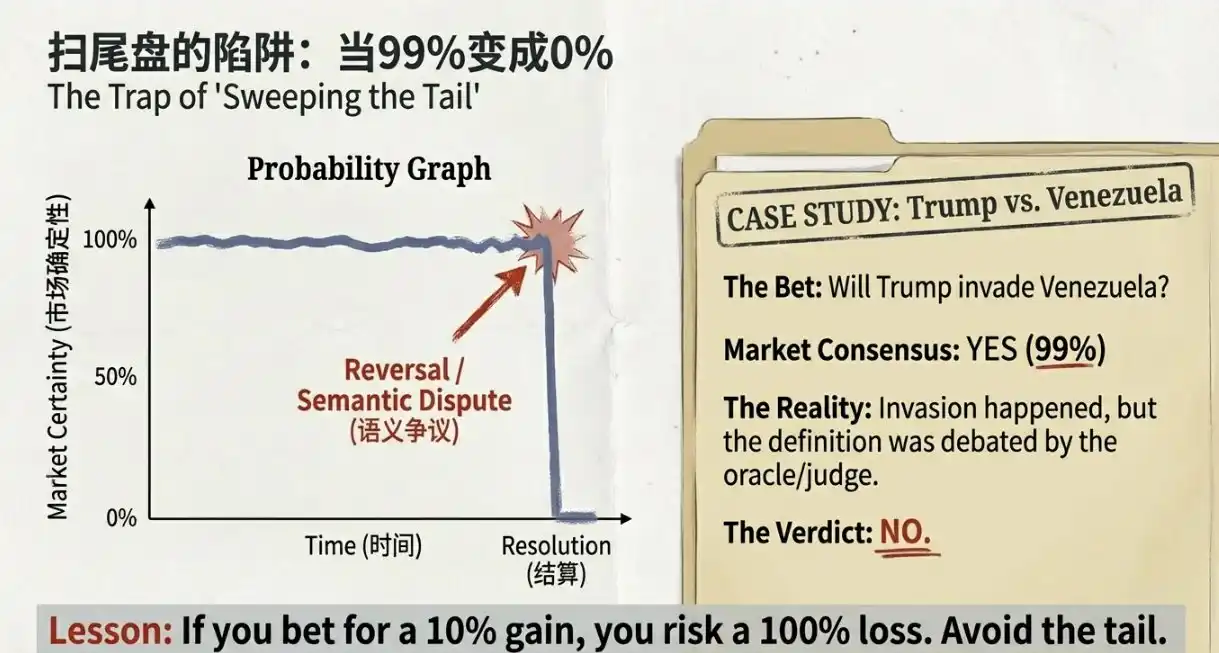

Beware of the black hole of defining power: Don't try to sweep the end of the game when you have a 99% win rate.

In prediction markets, the most hidden risk you face is not logical error, but the risk of the power of definition.

Professional institutions have already entered the market. SIG (Susquehanna International), a top global options market maker, is deeply involved on platforms such as Polymarket. These heavily armed competitors are even purchasing high-resolution satellite imagery to monitor oil production, aiming for absolute dominance over the order book.

Even more dangerous is the subjectivity of the judgment. Zixi gave the example of the Trump-era ruling on whether to invade Venezuela. Even if the military was mobilized, if the judge subjectively defined it as a special military operation rather than an invasion, a bet with a 99% win rate could instantly be wiped out. Remember: the house not only wins, but the house can also define what constitutes a win. Never blindly buy at the end of an event, because you never know how that last 1% of subjective judgment can destroy your position.

The world will ultimately be a grand game of prediction.

Prediction markets are reshaping our interaction with reality. They require every participant to move from empty talk to investing in knowledge as a form of leverage.

In the traditional AMM (Automated Market Maker) logic, we assume that liquidity follows a normal distribution; however, in prediction markets, we need to deal with the long tail of extreme events. If every opinion you express in the future must be accompanied by a bet amount, would you still easily believe the news you see?

In this world where probability and metaphysics coexist, predicting the market may be the only shortcut to the truth. Because it understands that money, more than traffic, can make people speak the truth.