Two meme coins, Ralph Wiggum Price (RALPH) and Gas Town (GAS), have experienced sharp double-digit declines in the past 24 hours, causing a significant drop in their market value.

This development has raised concerns about the sustainability of the recently emerging innovative economic model. Many questions remain as to whether this new form of Capital will deliver long-term value, or simply repeat short-term price surges similar to previous cryptocurrency trends.

RALPH Token plummets after developer sells off large quantity of Token.

Created on Solana's BAGS app, the RALPH Token recognizes the Ralph Wiggum technology developed by Geoffrey Huntley. While Huntley did not create or Token Issuance , he later voiced his support for RALPH.

He also stated that he would transfer all profits and fees received to purchase more meme coins . In addition, Huntley will be allocated 99% of the royalties, paid in installments according to a schedule.

This Token once experienced a sharp increase, with its market Capital reaching a peak of $58.74 million on January 21, 2024. However, the price of RALPH plummeted after information emerged on the chain that the developer had sold off a large quantity of Token.

Lookonchain discovered that Huntley's wallet, 5f2Qj9, sold 7.68 million RALPH, earning 1,888 SOL, equivalent to approximately $245,000, across three transactions. The post added that another wallet linked to Huntley, 2mvtNn, still holds 19.61 million RALPH.

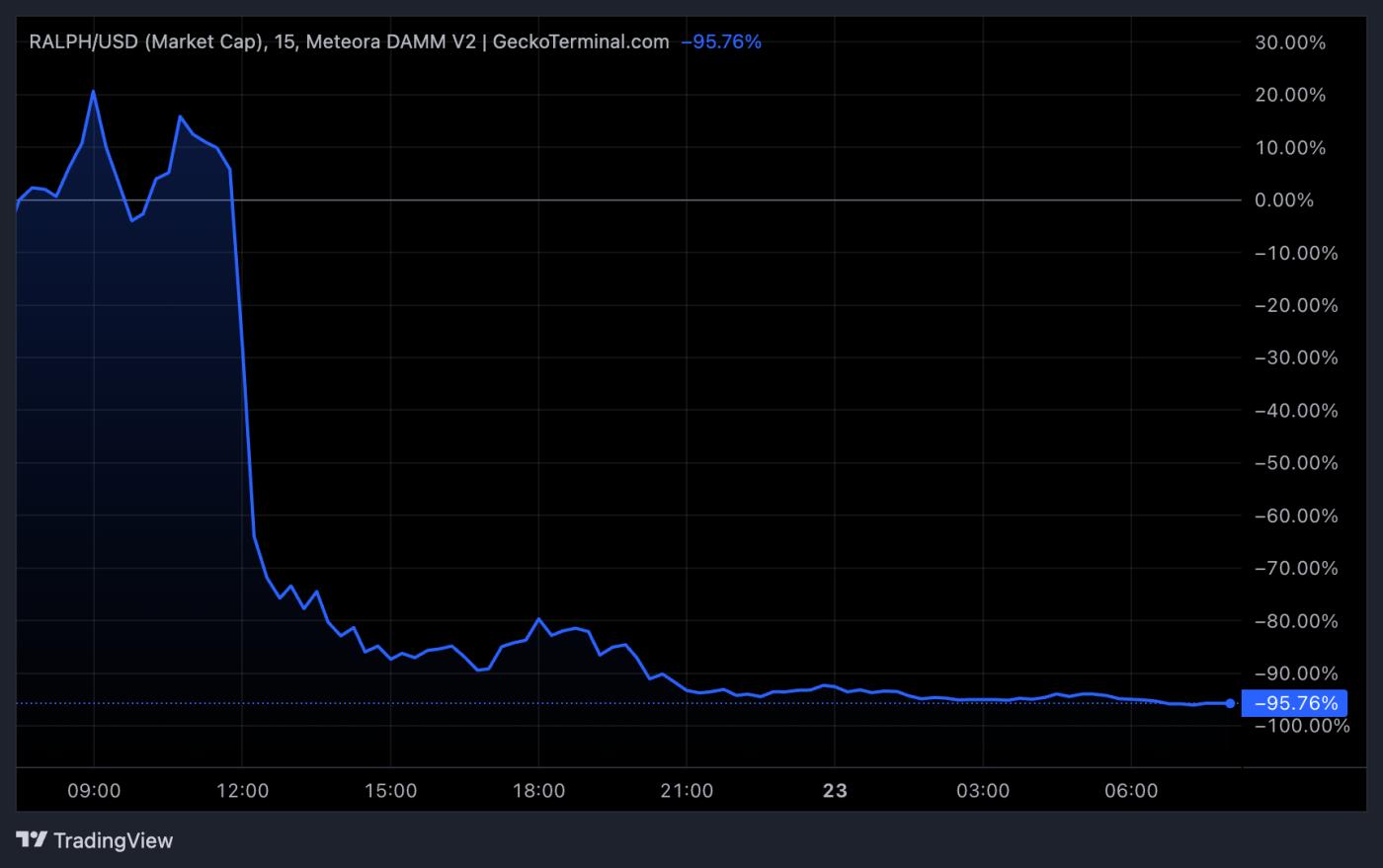

This news caused the Token price to plummet. RALPH lost 95.76% of its value in just the last 24 hours. According to market data, its market Capital is now only $1.5 million, with each Token priced at $0.0016.

RALPH Token price drops sharply. Source: GeckoTerminal

RALPH Token price drops sharply. Source: GeckoTerminalMeanwhile, Huntley also acknowledged the sale, stating that it was a "risk reduction" measure.

“I still hold Ralph,” he Chia . “The last two weeks have been really interesting with many people making millions of dollars trading this coin back and forth. The transaction fees are good, but I also need to reduce the risk on my investment. There’s a long way to go. This is the easiest way for me to think long-term without signing strange, risky, and binding sponsorship contracts.”

GAS Token price drops amid numerous questions from the community.

The GAS Token, associated with the Gas Town project, an open-source AI orchestration platform founded by Steve Yegge, also saw a sharp price drop. Just last week, BeInCrypto reported that the Token had surged by 500%.

However, GAS reversed course. This is believed to be due to Yegge's Chia at the time, which altered market sentiment and led to a reversal in trading behavior.

“Hello community $GAS and CT. I love this community, however I am the sole founder and maintainer of Gas Town, and this project is gaining a lot of attention. This is a huge burden and requires me to dedicate almost all of my time (and money). That’s why I can’t engage with CT as much. I will still occasionally Chia blog posts, participate in streams or podcasts, but right now I have to devote myself entirely to Gas Town. Hope you understand! This is the life of a creative entrepreneur,” he wrote .

However, it should also be noted that recent geopolitical tensions – which negatively impact risky assets in general – have also contributed to the sell-off . According to GeckoTerminal, GAS has fallen 47.8% in the last 24 hours. GAS 's market Capital is currently around $508,000, a significant drop from its peak of $57.69 million on January 16, 2026.

GAS Token price movement. Source: GeckoTerminal

GAS Token price movement. Source: GeckoTerminalWhat happened to RALPH and GAS creator coins?

The rapid decline of RALPH and GAS has raised doubts about the "creator economy" trend – the trend of raising Capital for developers through the crypto sector. One crypto analyst believes that core structural issues are the reason for the repeated failures of many projects.

“The RALPH and GAS stories are a clear lesson showing that no coin should be dependent on a single point, especially if that weakness comes from outside the CT community. ICM cannot be effective if its sole purpose is to collect fees. If developers only care about transaction fees, they won't think about long-term value, development direction, or the health of the community,” boot Chia .

This expert also compared it to Non-Fungible Token launches, where the majority of revenue is generated upfront, often leading to a short-term investment mentality. The article further points out that when a Token reaches a market Capital of $50 million, developers or project owners holding 2% to 3% are often tempted to sell to take profits.

Another market expert argues that the failure of GAS and RALPH doesn't stem entirely from the developers, but rather from supply manipulation and closely coordinated interests by the Token Issuance. According to this analysis, the incident shows signs of market manipulation rather than a developer-led "Rug Pull."

RALPH and GAS are also prominent examples of the trend shifting towards a model where small investors contribute Capital to support project development . The use of decentralized Token to replace Venture Capital Capital has potential, but the recent downturn shows that creating a clear connection between founders and Token holders is crucial.

In the coming period, the market will test XEM the creator economy model is strong enough to develop and adapt, or whether it will become another failed crypto trend of the past.