After briefly surging above $3,000 yesterday, Ethereum (ETH) has fallen back below that mark due to increased volatility in the cryptocurrency market.

Currently, analysts are searching for a potential Dip for Ethereum. Based on technical analysis, on-chain data, and market cycle theories, several scenarios have been proposed for ETH's next direction.

Analysts predict a bottoming- Dip scenario for Ethereum.

Ethereum's recent price fluctuations reflect the overall instability of the cryptocurrency market, as geopolitical tensions constantly escalate and then subside , causing significant price swings.

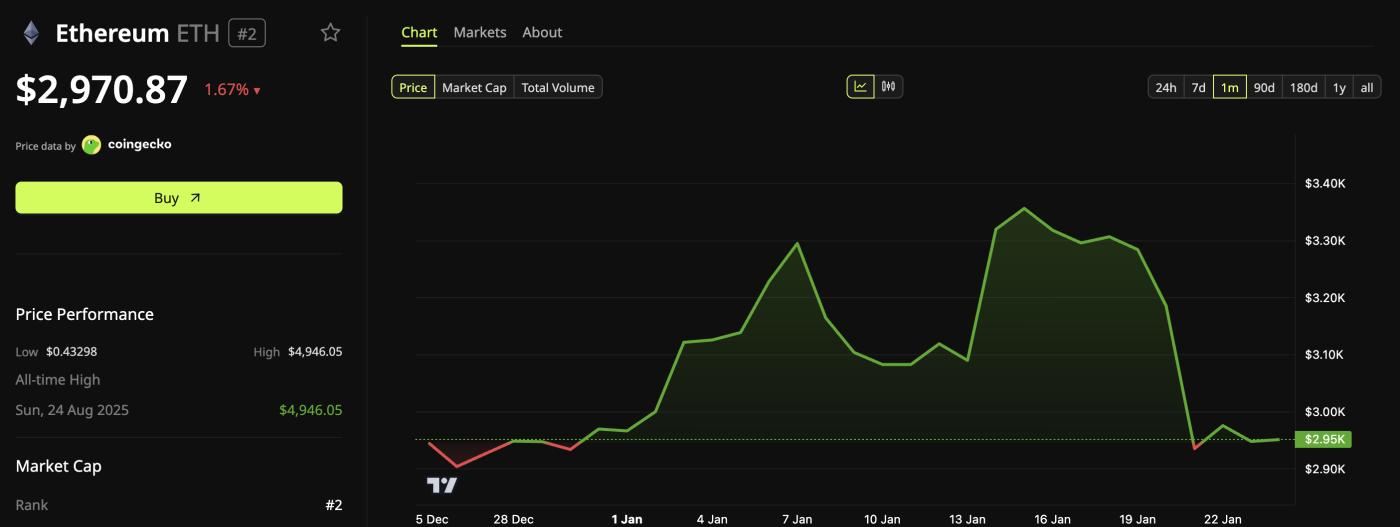

According to BeInCrypto market data, the second-largest cryptocurrency has fallen 1.67% in the last 24 hours. At the time of writing, Ethereum is trading around $2,970.87.

Ethereum (ETH) price chart. Source: BeInCrypto Markets

Ethereum (ETH) price chart. Source: BeInCrypto MarketsAnalyst Ted Pillows believes that if ETH breaks through and sustains above the $3,000-$3,050 range, the price could continue towards the $3,200 area. However, if it fails in this region, Ethereum could face the risk of falling to new lows for the year.

In addition, many experts have also put forward theories about the Dip of Ethereum. CryptoQuant analyst CW8900 observed that the Medium purchase price of ETH accumulation wallets (primarily long-term investors) is still rising and is now approaching the spot price in the market.

This trend suggests that large investors, often referred to as whales, are still continuously accumulating assets and show no signs of withdrawing.

"Furthermore, this Medium purchase price also represents a strong support zone for whales to accumulate," according to the analysis.

The expert added that Ethereum has never traded below this price level, proving that "whales" always defend this price range by aggressively buying whenever the price reaches it. Based on the data, CW predicts that if ETH falls further, the potential Dip could be near $2,720.

"In other words, if the price falls further, the Dip is likely around 2.72k. This is about 7% away from the current price," CW wrote .

From a technical perspective, trader Kamran Asghar observes that ETH has formed a "rounded Dip pattern" on the weekly chart for the third time. The previous two instances of this pattern leading to significant price increases suggest the possibility of further ETH gains in the near future.

On larger timeframes, many other experts have also pointed out similar reversal structures. Bit Bull analyst suggests that ETH is forming a "double Dip" pattern along with an "inverse Vai and Vai " pattern on the monthly chart – both common bullish reversal signals in technical analysis.

"I think ETH will pull off a big surprise in 2026," Bit Bull predicted .

Finally, expert Matthew Hyland looked back at Ethereum's historical cycle. He suggested that Ethereum may be entering a new phase of its market structure.

According to this approach, Ethereum typically follows a cycle of about 3.5 years, unlike Bitcoin's 4-year halving cycle. This expert says the Dip of the next cycle will form in Q4 2025.

“The 3.5-year downturn cycle will last until the 40th–42nd month after reaching a new peak, just like the two previous cycles. The new cycle for ETH has begun,” he Chia .

In summary, expert opinions remain quite divided, but many indicators suggest Ethereum is approaching a decisive moment. While short-term volatility continues, on-chain data, technical structure, and historical cyclical patterns all point to price zones that could attract new demand, laying the groundwork for Ethereum's next direction.