Written by: Nikka, WolfDAO

Part 1: In-depth Analysis of Cryptocurrency Hoarding Behavior

1.1 Strategy (MSTR): Leveraged Belief Injection

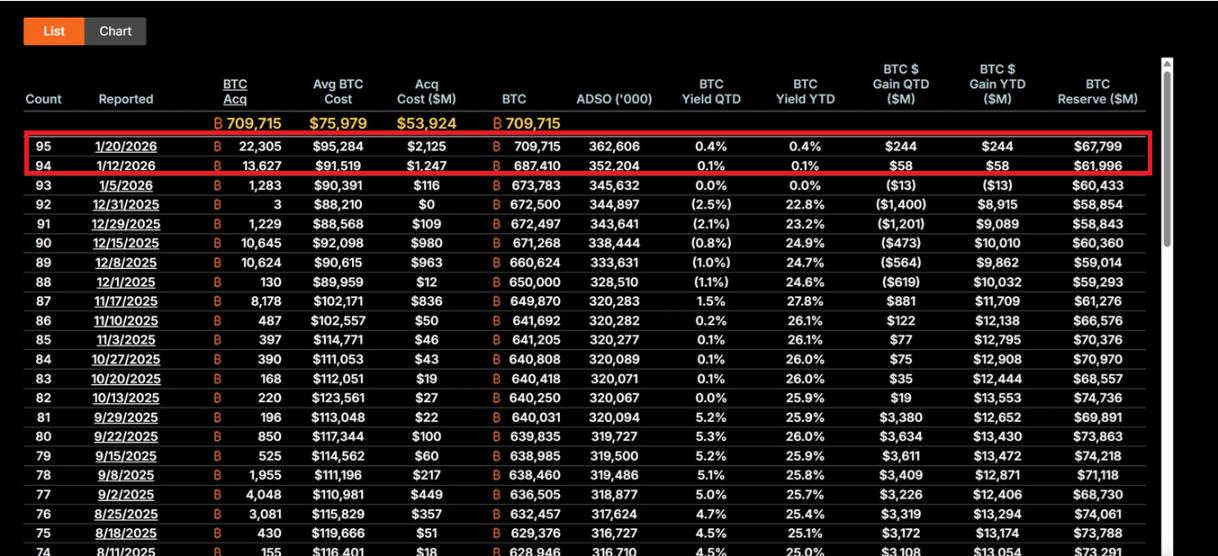

Under CEO Michael Saylor's leadership, Strategy has fully transformed itself into a Bitcoin holding vehicle. Between January 12th and 19th, 2026, the company purchased 22,305 BTC at an average price of approximately $95,500, for a total value of $2.13 billion, marking its largest single purchase in the past nine months. As of now, MSTR holds a total of 709,715 Bitcoins, with an average cost of $75,979 and a total investment of nearly $53.92 billion.

Its core strategy is built on the "21/21 Plan," which involves raising $21 billion each through equity financing and fixed-income instruments to continuously purchase Bitcoin. This model does not rely on operating cash flow but instead leverages the "leverage effect" of the capital markets—converting fiat currency debt into deflationary digital assets through the issuance of stocks, convertible bonds, and ATM (At-The-Market) instruments. This strategy makes MSTR's stock price volatility typically 2-3 times that of Bitcoin's price fluctuations, making it the most aggressive "BTC proxy" tool on the market.

Saylor's investment philosophy is rooted in his extreme confidence in Bitcoin's scarcity. He views BTC as "digital gold" and an inflation hedge, and this contrarian investment demonstrates institutional-level long-termism in the current environment of macroeconomic uncertainty (including the Fed's fluctuating interest rate policy, tariff wars, and geopolitical risks). Even though the company's stock price has retreated 62% from its peak, MSTR is still seen by value investors as a buying opportunity at an "extreme discount."

If the price of Bitcoin rebounds to $150,000, MSTR's holdings will exceed $106.4 billion, and the stock price could experience a 5-10x rebound due to the leverage effect. However, the converse risks are equally significant: if BTC falls below $80,000, debt costs (annualized interest rates of 5-7%) could trigger liquidity pressures, forcing the company to adjust its strategy or even face liquidation risks.

1.2 Bitmine Immersion Technologies (BMNR): Staking-Driven Productivity Model

Under Tom Lee's leadership, BMNR has taken a drastically different path. Positioning itself as the "world's largest Ethereum Treasury," the company held 4.203 million ETH as of January 19th, worth approximately $13.45 billion. More importantly, 1,838,003 of these ETH are staked, generating approximately $590 million in cash flow annually at the current 4-5% annualized yield.

This "staking-first" strategy provides BMNR with an intrinsic value buffer. Unlike MSTR's pure price exposure, BMNR generates continuous returns through network participation, similar to holding high-yield bonds with the added benefit of Ethereum ecosystem growth. The company added 581,920 ETH to its stake between Q4 2025 and Q1 2026, demonstrating its continued commitment to the network's long-term value.

BMNR's ecosystem expansion strategy is also noteworthy. The company plans to launch the MAVAN staking solution in Q1 2026, providing ETH management services to institutional investors and building an "ETH per share" growth model. Furthermore, the $200 million investment in Beast Industries on January 15th and the shareholder-approved share limit expansion pave the way for potential mergers and acquisitions, such as acquiring smaller ETH-holding companies. The company also holds 193 BTC and a $22 million stake in Eightco Holdings, bringing its total crypto and cash assets to $14.5 billion.

From a risk management perspective, BMNR's staking yield provides downside protection. Even if the ETH price fluctuates within the $3,000 range, the staking yield can still cover some opportunity costs. However, if ETH network activity remains low, leading to a decline in staking APY, or if the price falls below key support levels, the company's NAV discount could widen further (currently around $28.85, down more than 50% from its peak).

1.3 Strategy Comparison and Evolution

These two companies represent two typical paradigms of corporate cryptocurrency hoarding. MSTR is an aggressive, high-risk, high-return leveraged model that relies entirely on Bitcoin price appreciation to realize shareholder value. Its success is built on the belief in the long-term scarcity of BTC supply and the macroeconomic trend of currency depreciation. BMNR, on the other hand, is a defensive, yield-oriented ecosystem model that builds diversified revenue streams through staking and services, reducing its dependence on single price fluctuations.

It's worth noting that both have learned from the lessons of 2025 and are shifting towards more sustainable financing models. MSTR avoids excessive equity dilution, while BMNR reduces its reliance on external financing through staking yields. This evolution reflects a shift in corporate cryptocurrency hoarding from an "experimental allocation" to a "core financial strategy," and also marks the arrival of an era of "institutional dominance rather than retail FOMO" in 2026.

Second: Multi-dimensional impact on the market

2.1 Short-term impact: Bottom signals and sentiment recovery

MSTR's massive purchases are often interpreted by the market as confirmation of a Bitcoin bottom. A $2.13 billion buy in mid-January drove a single-day inflow of $8.44 into the Bitcoin ETF, indicating that institutional funds are following the trend of corporate hoarding. This "corporate anchoring" effect is particularly important during periods of fragile retail investor confidence—when the Fear & Greed Index shows "extreme fear," MSTR's continued buying provides psychological support to the market.

BMNR's Ethereum accumulation also has a catalytic effect. The company's strategy echoes the optimism of traditional financial giants like BlackRock regarding Ethereum's dominance in the RWA (Real-World Asset) tokenization space. This could trigger a "second wave of the ETH Treasury," with companies like SharpLink Gaming and Bit Digital already following suit, accelerating staking adoption and ecosystem mergers and acquisitions.

Investor sentiment is shifting from panic to cautious optimism. This sentiment recovery has a self-reinforcing nature in the crypto market and could sow the seeds for the next upward cycle.

2.2 Medium-term impact: Amplified volatility and narrative divergence

However, the leverage inherent in corporate cryptocurrency holdings also amplifies market risks. MSTR's high-leverage model could trigger a chain reaction if Bitcoin experiences further pullback. Because its stock price beta is more than twice that of BTC, any price decline will be amplified, potentially leading to forced selling or a liquidity crisis. This "leverage transmission" effect triggered a similar wave of liquidations in 2025, when multiple leveraged holders were forced to liquidate their positions during a rapid decline.

While BMNR has a staking yield buffer, it also faces challenges. Low Ethereum network activity could lead to a decline in staking APY, weakening its "productivity asset" advantage. Furthermore, a continued weak ETH/BTC ratio could exacerbate BMNR's NAV discount, creating a negative feedback loop.

A deeper impact lies in the divergence of narratives. MSTR reinforces Bitcoin's positioning as a "scarce safe-haven asset," attracting conservative investors seeking macroeconomic hedging. BMNR, on the other hand, promotes Ethereum's narrative as a "productivity platform," highlighting its application value in DeFi, staking, and tokenization. This divergence could lead to a decoupling of BTC and ETH performance under different macroeconomic scenarios—for example, in a liquidity crunch, BTC may outperform due to its "digital gold" attributes; while during a technological innovation cycle, ETH may gain a premium due to ecosystem expansion.

2.3 Long-term impact: Financial paradigm reshaping and regulatory adaptation

From a long-term perspective, the actions of MSTR and BMNR could reshape corporate financial management paradigms. If the US Clarity Act is successfully enacted, clarifying the accounting treatment and regulatory classification of digital assets, it will significantly reduce the compliance costs for companies allocating crypto assets. This act could drive Fortune 500 companies to allocate over $1 trillion in digital assets, shifting corporate balance sheets from the traditional "cash + bonds" combination to "digital productivity assets."

MSTR has become a textbook case study of "BTC proxying," with its market capitalization-to-net-asset (NAV) premium mechanism known as the "reflex flywheel"—issuing shares at a premium to buy more Bitcoin, increasing the amount of BTC held per share, and thus driving up the stock price, creating a positive feedback loop. BMNR, on the other hand, provides a replicable template for the ETH Treasury, demonstrating how staking rewards can create sustainable value for shareholders.

This could also trigger a wave of industry consolidation. BMNR has received shareholder approval for a share expansion for mergers and acquisitions, potentially allowing it to acquire smaller ETH-holding companies and form a "treasury giant." Weaker ETH-holding companies may be forced to sell or be acquired under macroeconomic pressures, leading to a "survival of the fittest" market dynamic. This marks a structural shift in the crypto market from "retail-driven" to "institutionally-driven."

However, this process is not without risks. If the regulatory environment deteriorates (e.g., the SEC takes a hard line on digital asset classification) or the macroeconomy unexpectedly worsens (e.g., the Fed raises interest rates due to a rebound in inflation), corporate cryptocurrency hoarding could transform from a "paradigm shift" into a "leverage trap." Historically, similar financial innovations have often led to systemic crises when faced with regulatory crackdowns or market reversals.

Part Three: Discussion of Core Issues

3.1 Corporate Cryptocurrency Hoarding: A New Golden Age or a Leveraged Bubble?

The answer to this question depends on the perspective and time scale. From the perspective of institutional investors, corporate cryptocurrency hoarding represents a rational evolution of capital allocation. Against the backdrop of global debt inflation and escalating concerns about currency devaluation, allocating a portion of assets to scarce digital assets is strategically rational. MSTR's "smart leverage" is not gambling, but rather using capital market tools to transform equity premiums into digital asset accumulation, which is sustainable when the equity market fully recognizes its strategy.

BMNR's staking model further demonstrates the "productivity" attribute of digital assets. The annualized staking yield of $590 million not only provides cash flow but also enables the company to remain financially sound amidst price volatility. This is similar to holding high-yield bonds with attached network growth dividends, showcasing the potential of crypto assets to transcend being "purely speculative instruments."

However, critics' concerns are not unfounded. Current corporate cryptocurrency hoarding is indeed at historically high leverage levels, with $9.48 billion in debt and $3.35 billion in preferred stock financing potentially becoming a burden under macroeconomic headwinds. The lessons of the 2021 retail bubble are still fresh in our minds—many highly leveraged participants suffered heavy losses during the rapid deleveraging. If the current wave of corporate cryptocurrency hoarding merely shifts leverage from retail investors to the corporate level without fundamentally changing the risk structure, the ultimate outcome could be equally disastrous.

A more balanced view holds that corporate cryptocurrency hoarding is in a "transitional period of institutionalization." This is neither a simple bubble (because it has fundamental support and a long-term logic), nor an immediate golden age (because regulatory, macroeconomic, and technological risks still exist). The key lies in execution—can sufficient market acceptance be established before regulatory clarity? Can financial discipline be maintained under macroeconomic pressure? Can the long-term value of digital assets be demonstrated through technological and ecosystem innovation?

Conclusions and Outlook

The hoarding activities of MSTR and BMNR mark a new phase in the crypto market. This is no longer a retail-driven speculative frenzy, but rather a rational allocation by institutions based on long-term strategies. Although the two companies have taken very different paths—MSTR's leveraged belief-driven approach and BMNR's staking-driven productivity model—both demonstrate a commitment to the long-term value of digital assets.

Corporate cryptocurrency hoarding is essentially a high-stakes gamble on "time." It's a gamble that regulatory clarity will outpace liquidity depletion, that price increases will precede debt maturities, and that market confidence will outweigh macroeconomic headwinds. There's no middle ground in this game—either it proves that digital asset allocation is a paradigm shift in 21st-century corporate finance, or it becomes yet another cautionary tale of over-financialization.

The market is at a crossroads. To the left lies a mature market dominated by institutions; to the right, a liquidation abyss of leverage collapse. The answer will be revealed in the next 12-24 months, and we are all witnesses to this experiment.