"Smart money" wallets (large wallets) have been consistently accumulating Cardano (ADA) over the past two months, despite the coin's continuously falling price.

Conversely, retail investor wallets have been consistently selling off over the past three weeks. This difference in investor behavior could signal an upcoming turning point for Cardano.

Whales' accumulation of ADA contrasts with selling pressure from retail investors.

Like many other cryptocurrencies on the market, ADA has also experienced significant volatility. In the last two months, the price of this altcoin has fallen by approximately 19%. After a surge at the beginning of 2026, the price of ADA plummeted, erasing most of the gains made since the start of the year.

According to data from BeInCrypto Markets, at the time of writing, ADA is trading at $0.35, up slightly more than 2% in the last 24 hours. This modest recovery is also consistent with the overall market rebound .

Cardano (ADA) price fluctuations. Source: BeInCrypto Markets

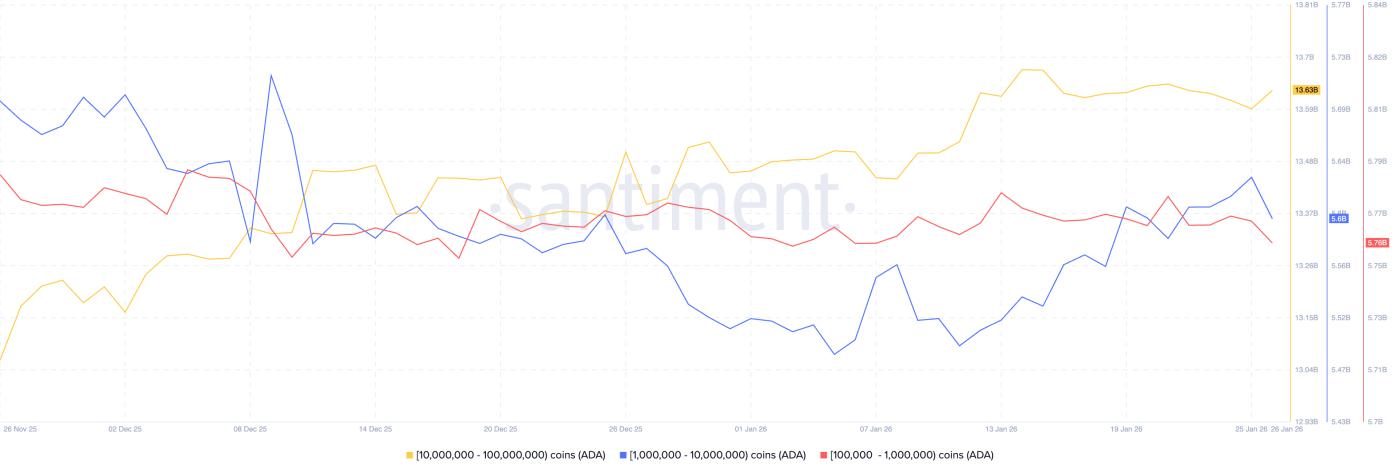

Cardano (ADA) price fluctuations. Source: BeInCrypto MarketsDespite the weakening price, on-chain data shows that large holder remain actively buying. According to blockchain analytics firm Santiment, large Cardano wallets with balances ranging from 100,000 to 100 million ADA have accumulated an additional 454.7 million ADA in the past two months.

The recent purchase of $161.42 million worth of ADA by whales shows that the confidence of large investors remains very strong.

A closer analysis of wallet data reveals that addresses holding between 10 million and 100 million ADA continue to increase their ADA holdings.

Meanwhile, wallets holding between 1 million and 10 million ADA and the group holding between 100,000 and 1 million ADA experienced a temporary slowdown in buying, but resumed accumulating from January 2026.

ADA whales accumulate. Source: Santiment

ADA whales accumulate. Source: SantimentMeanwhile, retail investors continued to sell off. Those holding less than 100 ADA sold a total of 22,000 ADA, worth nearly $7,810, over the past three weeks.

Santiment believes that the accumulation of ADA by whales while retail investors sell off is often a positive sign for a potential recovery after the market stabilizes.

"When whales buy and retail investors sell off, this is often a good opportunity for a rebound as the crypto market begins to stabilize," the post stated.

In addition, ADA 's user base continues to grow steadily. According to AdaStat , the number of ADA wallets increased from 3.17 million in November to 3.228 million, an increase of over 50,000 wallets. This demonstrates sustained interest in the Cardano ecosystem.

Cardano 's DeFi ecosystem is also quite stable. According to defillama , the TVL across Cardano 's DeFi protocols is currently at $161.87 million, up 1.53% in the last 24 hours.

TVL has remained around 460 million ADA since October, indicating that Capital flows remain stable despite the price drop.

ADA Technical Perspective: Where will the price go next?

The big question now is: Will the user growth and the amount of ADA accumulated by whales be enough to help the price surge again?

From a technical perspective , some experts see early signs of a trend reversal. A recent analysis on X indicates that ADA is accumulating in a historically strong demand zone, where accumulation phases are very clear.

According to this expert, the fact that the price has consistently reacted within this price range increases the likelihood that ADA is about to reverse and move upwards. Three bullish targets have been given: $0.6386, $0.9358, and $1.3285.

"Risk remains under control as long as the price stays above the support zone," the expert added .

However, buyers still face several challenges in the short term. Another analyst points out that ADA is still trading below key resistance levels, along with the appearance of two large " Sell Wall" on the price chart.

A " Sell Wall" appears when a series of sell orders are placed at a certain price level, creating pressure that prevents the price from rising. If buying pressure is not strong enough to absorb them, the price of ADA may continue to stagnate or fall again.

Therefore, while the accumulated data and platform acceptance levels support a long-term bullish outlook, ADA still needs to overcome these resistance zones if it wants to establish sustainable upward momentum.