The 2025 crypto cycle will not only be shaped by Bitcoin reaching new highs, but also by a year of structural innovation. As Capital flows strongly between on-chain platforms and centralized exchanges (CEXs), industry attention has shifted to how these platforms select and price new assets.

A new comprehensive audit report by Gate Research , tracking 447 spot listings throughout 2025, has revealed a stark difference in performance between fast-follow project-based Token and primary launch projects. The data shows that Gate made a significant impact in its specific listing segment, particularly in the proprietary project group, where prices surged immediately upon launch, delivering median returns of nearly 81% within the first 30 minutes of trading.

Notably, approximately 80% of these exclusive properties launched with immediate upward price momentum, indicating very high demand from the outset.

Key driver: 71% of the initial supply is released to the market.

In 2025, Gate focuses on Vai as a "nursery" for the supply of new assets. Of the 447 assets analyzed, 318 (equivalent to 71%) are initial public offerings, meaning Gate is the first major exchange to support price discovery for these Token .

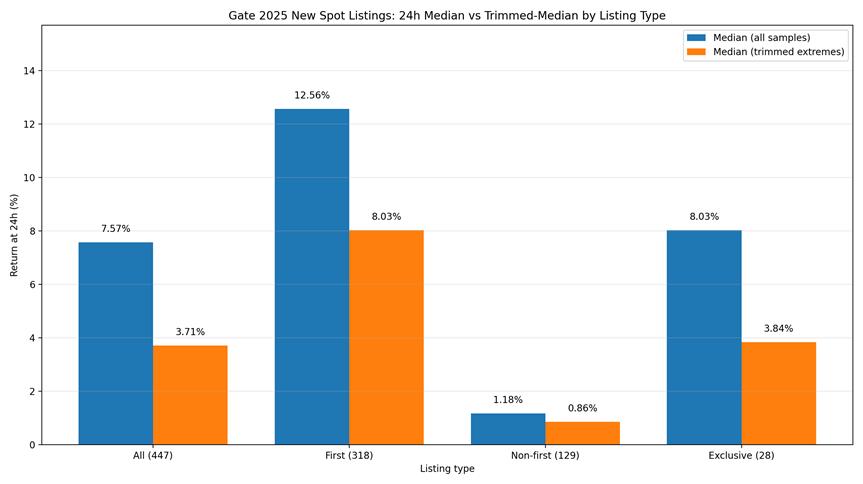

Data shows that early market entry offers a clear advantage. In the first 24 hours:

- Projects listed for the first time have a median return of 12.56%.

- Sublistings (Token previously listed on other exchanges) only yielded a median return of approximately 1.18%.

This disparity shows that Gate is able to capture the initial "buzz" of a project, when the market is volatile and demand is at its highest. Although the Medium 24-hour return of rising stocks reached 635%, the median across the entire data sample (including declining projects) was 7.57%, reflecting that while the "long-term team" won big, the overall ecosystem still offered a more stable valuation environment for assets.

Special program "30 Minutes of Speed Up"

The strongest returns came from the group of projects exclusively listed on Gate – 28 carefully selected projects. These assets not only grew but also exploded upon listing:

- Median Profit: In just 30 minutes, the median increase for exclusive projects reached approximately 81%, reflecting the most active and opportunity-filled pricing phase.

- Success rate: This performance was fairly consistent, with nearly 80% (22/28 projects) trading at the listed price within half an hour.

- Asset impact: Over one-third of the exclusive projects yielded returns exceeding 100% within half an hour of listing.

This demonstrates that Gate's exclusive project selection process has been very closely aligned with market needs, successfully identifying Token with the potential to generate a strong upward surge immediately upon launch.

"The 72-Hour Reversal": A roadmap for traders.

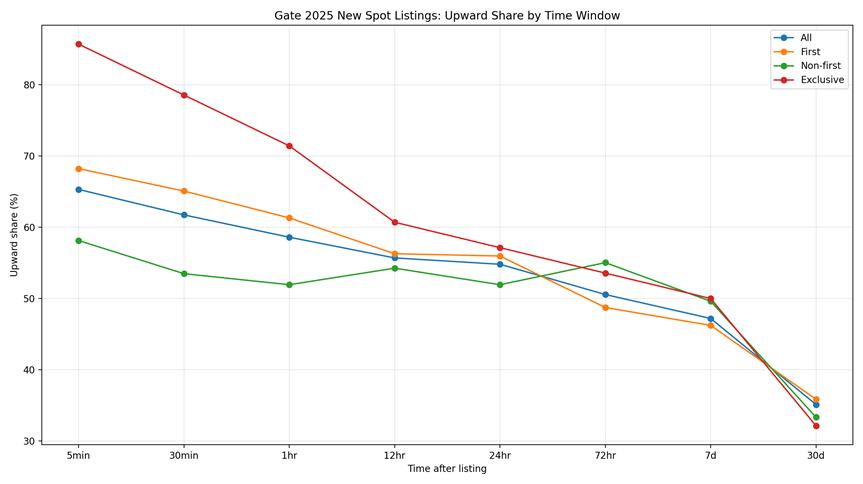

The report also provides a detailed analysis of the Token lifecycle after listing, highlighting sensitive periods for retail investors.

By the 72-hour mark, the strong upward trend seen at the time of listing gradually weakened, and the market entered a phase where only a few projects maintained their upward momentum, with many Token beginning to decline in price. The median return after 30 days dropped to -25%, indicating that the biggest impact on asset value is typically concentrated in the first three days after listing.

From AI infrastructure to community culture

Gate's strategy for 2025 doesn't focus on market manipulation but rather on specific themes. The exchange's journey is built on three major thematic groups:

Traffic gateways (e.g., Pi Network)

Projects like Pi Network (PI) have demonstrated Gate's ability to handle massive community traffic. Immediately after listing, PI surged nearly 60-fold in just seven days, showing that Gate's liquidation layer is strong enough to meet the needs of millions of users without disrupting the price discovery process.

AI infrastructure & x402 storytelling (e.g., Unibase)

As the AI landscape shifts from simple applications to core infrastructure, Gate has consistently adapted quickly. Unibase (UB), a project within the x402 narrative, demonstrated remarkable resilience despite the volatile market conditions in October. UB surged to a high of $0.086, a 500% increase from its opening price, proving the long-term potential of technology-driven Token .

Attention-grabbing economies (e.g., Mubarak & Useless)

In the meme world, speed is of the essence. Gate was quick to list Mubarak (MUBARAK) right when it was trending, helping the community reap a 120% increase in just one day. This move demonstrates that the exchange created opportunities for users to capitalize on the explosive growth of community cultural trends.

Conclusion: A platform for actionable lists

Data from the past year has confirmed Gate's transformation into a strategic "launchpad" for emerging assets. Focusing on exclusive listing projects allows the exchange to optimize its Vai in the early stages of the market cycle.

As we enter 2026, maintaining a strategy of listing multiple projects will remain key if Gate wants to maintain its competitive position in terms of liquidation and attract users.