Author: XMAQUINA

The future of robots should not be monopolized by institutions.

XMAQUINA is committed to changing the status quo. The RCM protocol goes a step further, outlining the next blueprint for the robotics industry: a shift from a closed market to a more fluid, open, and permissionless ecosystem.

The democratization of the robotics field should not stop at entry barriers; it must be fluid, scalable, and integrated into the broader crypto-economic system.

RCM is this bridge.

The Humanoid Robot Wave is Coming

Humanoid robots are experiencing explosive growth.

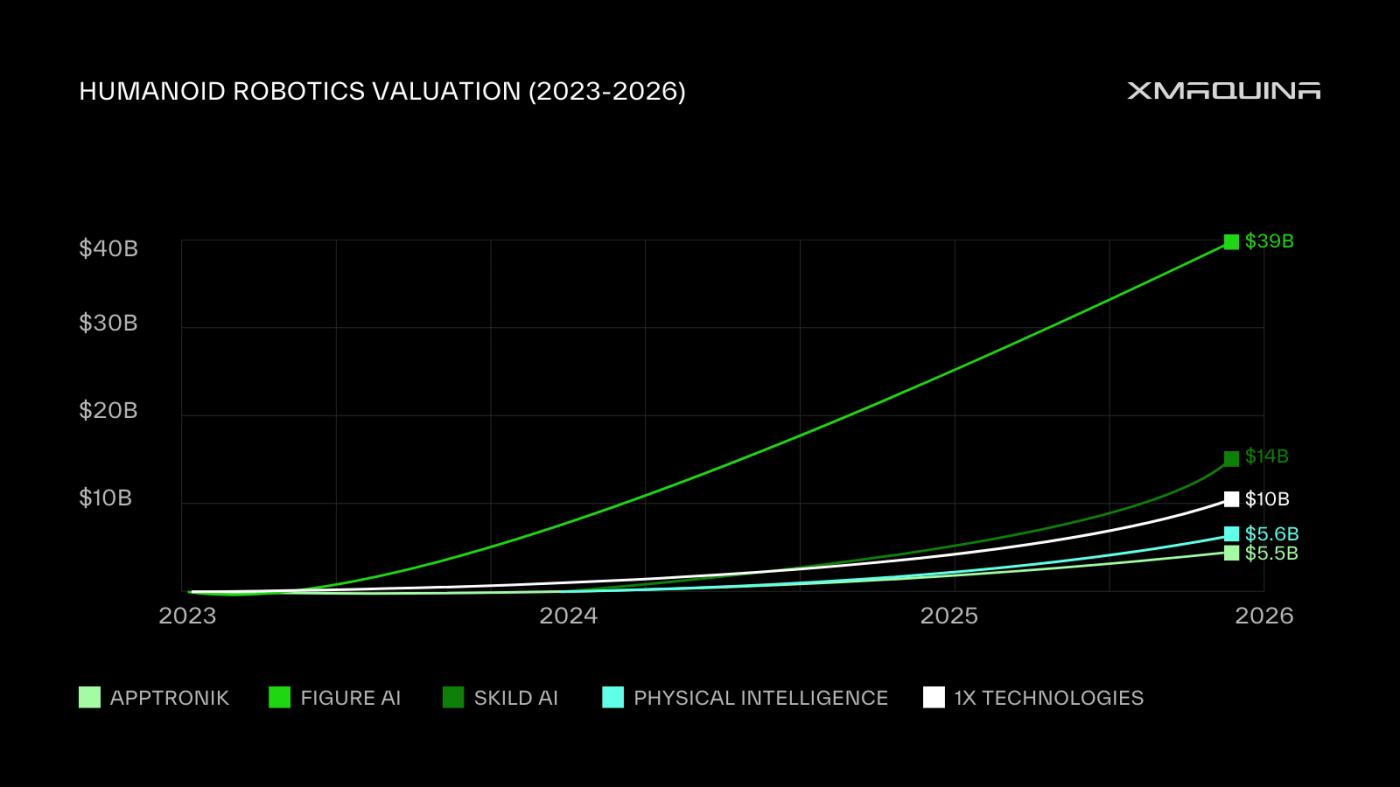

Valuation is soaring, commercialization is progressing rapidly, and funds are pouring in continuously.

Figure AI's valuation grew from $500 million in its Series A funding round in May 2023 to $39 billion in its Series C funding round in September 2025; Skild AI's valuation tripled in just seven months, reaching $14 billion in early 2026; and Physical Intelligence's valuation reached $5.6 billion in less than two years. Meanwhile, 1X Technologies signed an agreement to deploy 10,000 humanoid robots by 2030.

These figures reflect real market performance, not hype. Furthermore, we can see that the commercialization of humanoid robots has already begun: Figure's products will be available in early 2025, and Skild AI achieved $30 million in revenue within months of its release.

However, market access remains restricted, the barriers to entry are still high, retail investors are excluded, the secondary market is fragmented, and resources are mainly concentrated in the hands of a few institutions.

RCM aims to break down this structure and open up the robotics economy to more parts of the world.

Reshaping the Robotics Capital Market

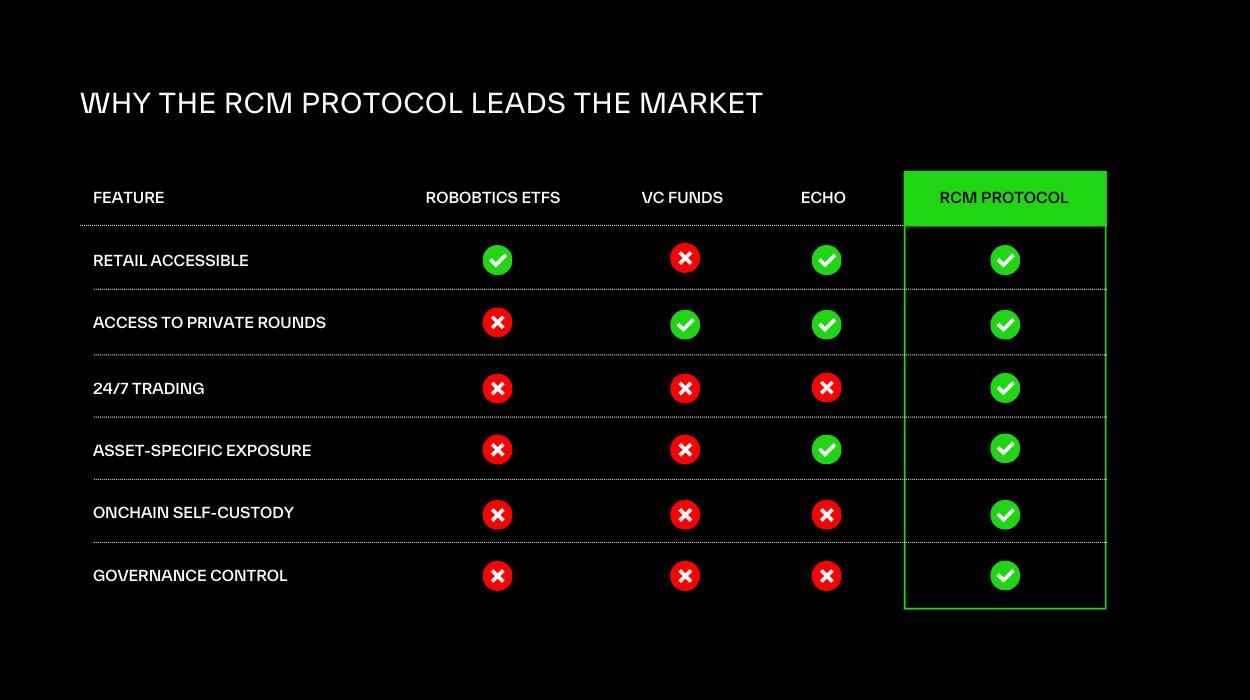

Robotics equity is becoming one of the most sought-after asset classes, but also one of the most difficult to acquire. Due to restrictions such as closed funding rounds, high minimum investment thresholds, and accredited investor requirements, it is difficult for ordinary participants to enter the market. Even when secondary transactions do occur, they are typically highly fragmented, opaque, and primarily confined to the private market.

The RCM protocol aims to change this situation.

RCM aims to create a more liquid and permissionless secondary market, bringing genuine bot equity positions onto the blockchain. Each SPV (Special Purpose Vehicle) holding verified equity in a bot company is represented by a specific SubDAO token corresponding to that asset. These tokens are designed to be traded on DEXs with no minimum investment requirements, accredited investor verification, or intermediaries.

This structure also allows for exposure to specific assets. Investors do not need to participate in mixed funds; instead, they can choose to invest in specific companies they approve of, whether it's general-purpose humanoid robots, automated warehouses, or defense robots.

Each transaction generates fees, which flow into the DAO treasury and are used through governance mechanisms to advance key initiatives, including:

- Acquire more robot equity

- Execute DEUS repurchase

- Funding for DEUS staking incentives

In addition, each SubDAO token will be paired with a DEUS token to form a liquidity pool, thereby increasing the demand and utility of the DEUS token itself.

This will create a virtuous cycle: more transactions mean more fees flowing into the vault, resulting in more bot positions and more value flowing back into the DEUS token.

Built based on Pump.fun and Virtuals

RCM drew inspiration from two protocols that reshaped on-chain value creation.

Pump.fun demonstrated the power of automated liquidity and frictionless token creation, unleashing tremendous engagement and generating over $500 million in trading volume in its first year.

Virtuals Protocol introduces a new market model that focuses more on attention and belief and tokenizes them. The market forms around specific AI agents, and the community can express support and speculate on their future relevance.

RCM applies the groundbreaking innovations from these two agreements to the entirely new field of "robot equity," adding a crucial layer: alignment with the real world.

The design goal of RCM is:

- Liquidity supply of equity positions in automated robotics

- Participation at the level of personal assets is achieved based on belief-driven factors.

- Tokens are pegged to an SPV that holds verified, real-world equity.

RCM is not a token framework, but a capital coordination layer. It is a new architecture that enables people to enter, price, and participate in the private bot market through on-chain infrastructure.

This design paves the way for a new type of token: one that is built on “belief” but based on real exposure.

What is the SubDAO token?

Once a SubDAO robot auction is completed, the funds raised will be used to purchase equity in a specific robot company. This equity will be held in a dedicated SPV for that position. Once the position is confirmed, a unique SubDAO token will be minted to peg the position.

These tokens do not represent equity or ownership, nor do they grant any shares or dividend rights. They allow on-chain participants to express their optimism and engage in and trade around the asset.

With increased regulatory clarity, new mechanisms may be introduced in the future to strengthen the connection between SubDAO tokens and underlying assets.

SubDAO tokens have the following characteristics:

- Asset specificity: Each token corresponds to one SPV and one robotics company.

- Tradability: Designed to provide continuous liquidity on DEXs.

- Anchoring: Backed by real-world equity

They represent a new way of harmonizing beliefs, capital, and community around the robotics market.

Operating methods

1. Project Search

XMAQUINA will explore investment opportunities in top robotics companies.

2. Financing

Communities and organizations fund projects through SubDAO auctions. Projects cannot proceed if the minimum funding requirement is not met.

3. SPV Creation

Once the financing is successful, a dedicated SPV will be established to hold the equity.

4. Token Issuance

Issue SubDAO tokens pegged to specific SPVs and robotics companies.

5. Launch DEX

The token is paired with DEUS and is listed for trading on DEX.

6. Agreement Benefits

Transaction fees flow into the vault and are managed by DEUS holders.

The RCM protocol transforms the DAO from a closed-end fund model into an organization capable of generating continuous revenue and increasing value.

Expanding more possibilities

The structure of the agreement also opens the door to future integration with prediction markets and perpetual contracts.

These integrations will allow people to bet on company milestones, product launches, and broader industry trends, bringing liquidity and transparency to one of the world’s least transparent markets, the robotics industry.

Are you optimistic about the robotics industry? We are too.

XMAQUINA is a decentralized ecosystem that allows the global community to gain early access to participate in trillion-dollar industries before the world’s leading robotics companies disrupt them.

Now, you no longer need to stand on the sidelines and watch; you can seize the opportunities presented by the rise of embodied robots.

Welcome to XMAQUINA's Discord server , where you can interact with thousands of futurists involved in the DAO.

We also welcome you to follow our X platform for the latest updates.