USD.AI currently resembles more of an early-stage GPU lending experiment attached to a Treasury yield product than a mature AI credit market.

Written by: Pine Analytics

Compiled by: AididiaoJP, Foresight News

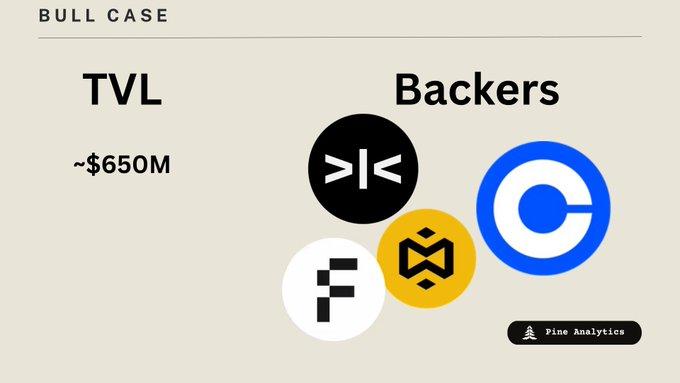

On January 27, 2026, @USDai_Official announced the launch of its governance token CHIP and the establishment of the USDAI Foundation, marking a significant step in the protocol's development. The surface data is impressive: total value locked (TVL) reached $656 million, and token trading volume exceeded $5 billion.

The project's concept is very appealing. USDAI offers an interest-bearing stablecoin (sUSDai) backed not by algorithmic mechanisms or volatile crypto assets, but by loans to AI infrastructure operators who typically need funding to purchase GPUs, servers, and computing resources. Theoretically, it connects two hot sectors: DeFi yields and the competition for AI infrastructure.

The project's funding supply is clearly functioning smoothly. A large influx of deposits has led to rapid growth in locked-up value, and it has secured support from well-known institutions such as Framework Ventures, YZi Labs, and Coinbase Ventures. However, funding supply is only one aspect.

A more crucial issue, and one worth examining before CHIP's launch, is the demand for funds. Who exactly wants to borrow from USDAI? Is the market large enough to support the current hype?

USDAI's operating model

USDAI employs a dual-token system, separating stability from yield.

The base token, USDai, is a stablecoin pegged to $1 and fully backed by US Treasury bonds and cash equivalents via M^0. It aims to provide liquidity and composability to the DeFi ecosystem and can be viewed as a stable and redeemable synthetic dollar with no direct yield.

The interest-bearing version is sUSDai. Users deposit USDai into a vault in exchange for sUSDai, earning two types of returns: the base Treasury bond rate (approximately 4-5%) and interest from loans provided to AI infrastructure operators. Currently, the annualized yield is approximately 6.87%, and the protocol anticipates that the yield will rise to approximately 10.98% as more funds are invested in actual lending.

On the lending side, USDAI uses a system called CALIBER to tokenize physical GPUs and computing hardware as on-chain collateral. This process involves legal structures, warehouse receipts, physical verification, and custodial oversight—a deliberately slowed-down process to ensure that loans are adequately collateralized before disbursement.

The target borrowers are small and medium-sized AI operators, GPU service providers, and DePIN projects, companies that need hardware funding but struggle to access traditional bank financing or venture capital. USDAI's proposition is to fill a gap neglected by traditional finance: providing rapid, non-equity-dilutive debt secured by productive AI infrastructure.

sUSDai's redemptions are subject to a 7-day time lock-in through a queuing system to address potential loan defaults or market stress.

Reasons for being optimistic

To be fair, USDAI has indeed achieved tangible results; this is not just empty talk or simple imitation.

The product already exists and is functioning normally. The locked value exceeds $656 million, and the reserves, packaged in M^0 bonds, are transparently verifiable on-chain. This transparency is crucial given the numerous opaque stablecoin projects that have collapsed.

A conservative strategy is its strength, not its weakness. By investing deposits in government bonds and cautiously pushing forward the tokenization of GPU loans, USDAI has avoided the problems encountered by other aggressive real-asset projects, achieving zero defaults to date. While this prudent pace may disappoint those seeking high returns, it lays the foundation for long-term scaling.

The funding gap for AI infrastructure is real and substantial. Large cloud service providers are investing heavily in AI capital expenditures, but this funding is concentrated at the top. Small and medium-sized operators struggle to access traditional financing: bank processes are slow, they rarely accept GPU collateral, loan thresholds often reach $20 million, and approval takes 60-90 days. USDAI claims that qualified borrowers can obtain loans in just 7 days; this speed advantage alone could open up a huge market.

The backers are trustworthy. Framework Ventures led a $13 million Series A funding round, with participation from Dragonfly, Arbitrum, YZi Labs, Coinbase Ventures, and Bullish. The partnership with PayPal integrates PYUSD into the settlement system and provides $1 billion in liquidity incentives. These are all significant institutional supports.

Loan channels are being established. The foundation announced that it has approved a $1.5 billion funding facility, with $1.2 billion earmarked for QumulusAI, Sharon AI, and Quantum SKK. The first $100 million GPU-secured loan is expected to be disbursed in the first quarter of 2026. Chainlink has become the official oracle service provider. Once some of these channels are finalized, the benefit claims will be validated.

The core logic holds true. Small and medium-sized AI infrastructure operators are indeed underserved by traditional finance. The crypto-native credit market for GPU-secured loans fills a real gap—and USDAI is the first market participant with trusted infrastructure.

Reasons for being bearish

Despite its innovations, USDAI faces several structural issues that challenge the sustainability of its current popularity and the expected valuation of CHIP.

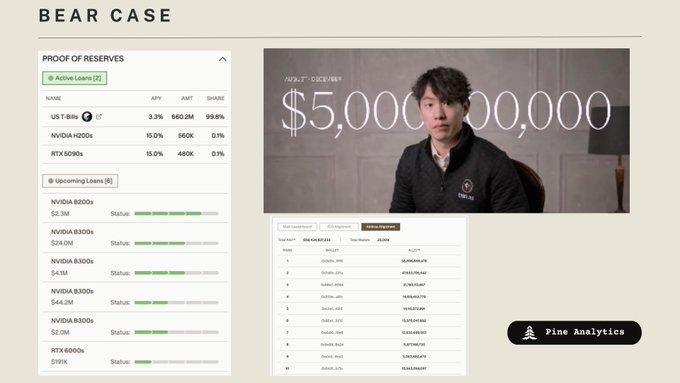

1. Low capital utilization rate

According to the agreement's reserve certificate, the current loan channel only holds approximately $70 million—even if all of it were disbursed, it would only represent about 10% of the $650 million locked value. The remaining approximately 99% of the funds remain in U.S. Treasury bonds.

In reality, users bear the risks of smart contracts and the liquidity constraints of a 7-day redemption period, while earning primarily government bond yields (around 4-5%). The protocol advertises a current annualized yield of nearly 7% and a long-term target of 10-15%, but current returns mainly come from government bonds rather than AI lending.

The $70 million loan pipeline is just the beginning, but it raises questions: If demand is so high, why is the pipeline still limited despite having ample funds? And when will these loans actually be disbursed?

2. The Lock-up Value Driven by Points and Speculative Funds

The significant increase in locked value appears to stem from Allo points mining rather than a genuine demand for AI loan yields. The system offers high incentives, leverage through Pendle's strategy, and repeated liquidity drive activities, strongly encouraging users to deposit funds solely for future CHIP allocations.

History shows that such incentive-driven liquidity is fragile. Once token issuance ends and points stop accumulating, there is typically a 15-30% outflow of funds, sometimes even more. The truly retained "sticky" funds used for sustainable credit intermediation are likely far lower than the surface figure of $650 million.

3. Issuing tokens without verifying the core business.

CHIP was issued at a fully diluted valuation of $300 million, while its core lending business has yet to be validated on a large scale. The protocol bills itself as an "AI infrastructure rate setter," but its mere $70 million lending pipeline makes it difficult to substantially discover or set calculated credit prices. Currently, it primarily packages Treasury exposure with a small amount of experimental lending.

Before this AI-driven lending market proves viable, token trading has already priced in expectations for its future. Any slower-than-expected growth in borrowers or slower loan disbursement could lead to significant price adjustments.

4. Borrower Issues

Global spending on AI infrastructure reaches hundreds of billions of dollars annually, but this funding is primarily raised by large corporations through debt financing at interest rates below 5%. USDAI is not competing with these borrowers. Its actual customer base consists of small and medium-sized GPU operators, DePIN projects, and AI startups unable to access traditional capital markets.

This is a smaller, riskier, and more cyclical group of borrowers compared to what the "AI capital expenditure" narrative suggests. These borrowers are structurally disadvantaged: they have to pay annualized interest rates of 15-20%, while well-funded competitors can finance at only 4-5%. At the same time, GPU collateral depreciates rapidly—in the event of default, the recoverable value could be far less than the outstanding principal.

5. Communication and Narrative Risks

Promotional materials describe the current business as "liquid GPU debt" and claim the protocol is already influencing AI interest rates, even though approximately 99% of the backing assets are still government bonds. This creates a credibility gap between the narrative and on-chain reality—an issue that is particularly sensitive in conjunction with token issuance, as early buyers are essentially paying for product expectations that have not yet materialized.

In short, USDAI currently resembles more of an early-stage GPU lending experiment attached to a government bond yield product than a mature AI lending market. While progress has been made in securing a $70 million lending channel, this is still far from the protocol's claimed vision, compared to over $650 million in deposits. Low utilization, incentive-driven locked-in value, unproven borrower depth, and an over-reliance on narrative positioning mean that the risk-reward profile of USDAI issuance is highly dependent on the rapid and large-scale implementation of actual lending.

Valuation Comparison: USDAI vs. Ethena & Maple Finance

With a fully diluted valuation of $300 million, CHIP is valued higher than established stablecoin protocols with proven product-market fit.

The data speaks for itself: CHIP's valuation multiple (FDV/TVL) is 1.2 times that of Ethena and 2.9 times that of Maple, despite having only $70 million in lending channels and over $650 million in deposits, with only about 10% of its funds being invested in its claimed yield strategy as planned.

@ethena_labs achieved a valuation multiple of 0.38x by implementing a Delta-neutral strategy on its $6.5 billion USDe for over 18 months, navigating multiple volatility events (including a halving and subsequent recovery of locked value after an airdrop). Every dollar deposited was immediately hedged – no idle funds remained in ordinary yield products.

@maplefinance, with $2.55 billion in deposits, over $8 billion in cumulative loans, and a 99% repayment rate despite navigating multiple credit cycles (including a 97% drop in locked value followed by rebuilding in 2022), has a trading valuation multiple of only 0.16x. The protocol generates approximately $30 million in annualized revenue, with 25% used for token buybacks.

In contrast, approximately 99% of USDAI's deposits remain in government bonds—the same yield anyone can access through Ondo, Mountain Protocol, or a brokerage account. The $70 million lending pipeline is progress, but not yet yield-generating credit. Investors are paying a premium for the potential of a largely unproven yield strategy, while similar protocols that have been successfully executed are trading at lower prices.

If CHIP's valuation multiple is compressed to 0.38 times that of Ethena, its fully diluted valuation will drop to approximately $250 million—a 17% decrease from its offering price. If compressed to 0.16 times that of Maple, the valuation will drop to approximately $105 million—a 65% decrease. This is under the assumption that the total value locked after token issuance remains stable, which history shows is difficult to achieve.

Final opinion

The timing of CHIP's release is debatable.

Protocols typically issue tokens at key growth junctures to drive development. USDAI takes a different approach, monetizing market attention before proving its business model viable. While progress has been made on its $70 million lending pipeline, approximately 90% of deposits remain in government bonds, and differentiated products have not yet reached effective scale. The $1.5 billion "approved funding" and $100 million "disbursement in Q1 2026" are still announcements, not on-chain reality.

Communication methods also fail to alleviate concerns. Claims that USDAI is "setting interest rates for AI infrastructure" exaggerate its actual operations. A $70 million lending channel relative to $650 million in deposits cannot "set interest rates" for any market. When narratives are so detached from reality, it's worth considering who will benefit.

Valuation exacerbated concerns. Offering at a fully diluted $300 million valuation, CHIP was valued higher than Ethena and Maple, which have years of operating history and complete strategies. USDAI required investors to buy less value at a higher price.

Could we be wrong? Possibly. The team has reliable backers and solid infrastructure. But the following patterns are hard to ignore: issuing tokens without a proven core business, inflated valuations targeting undeployed capital, exaggerated marketing, and a heavy reliance on locked-up value through airdrop mining. This doesn't look like growth-driving behavior; it looks more like early investors creating liquidity events before the product is put to market testing.

If CHIP rises after its issuance due to narrative momentum and retail investor enthusiasm, we view it as a short opportunity rather than a long-term holding target.