This article is machine translated

Show original

I've been watching a lot of interesting Chinese-language videos lately.

The #preciousmetals market has clearly entered the most intense phase of the battle between bulls and bears.

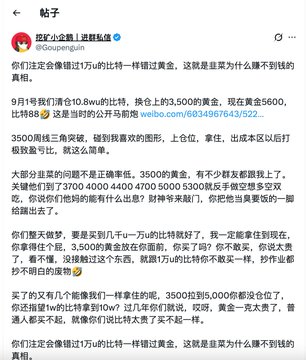

On one side are the #gold bulls: @Goupenguin

This little penguin openly called for a bullish stance on gold as early as the second half of 2025.

The core logic: follow the trend and embrace precious metals.

Against the backdrop of geopolitical uncertainty and strong physical demand, precious metals are being used to replace mainstream positions.

This round of the precious metals cycle will usher in a long bull market measured in quarters or even years, ultimately ending with a top Wall Street institution being wiped out.

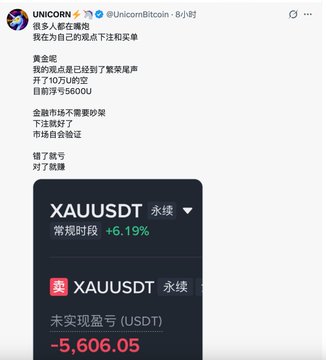

On the other side are the bears: @UnicornBitcoin, who believe that gold has entered the end of its boom. They are betting on a high-level pullback, a cyclical turning point, and a decline in sentiment. Buy when no one cares, sell when everyone is talking.

No one can stay at the peak forever.

#Bitcoin is like that, gold is like that, stocks and real estate are like that too.

There's a force behind it called: cycles, boom-bust-recession-recovery.

Long-term trend vs. cyclical top battle. It's interesting and I love watching it! 🤣

To be honest, the recent price slope and the heated discussion have made me a little uneasy 🥹. Last September, I gave a target price of 48-50 for the first half of this year, and it's already 56 before January is even over! This is terrifying; if it weren't for my low cost basis, I would have run away long ago.

Golden Prophet

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content