This article is machine translated

Show original

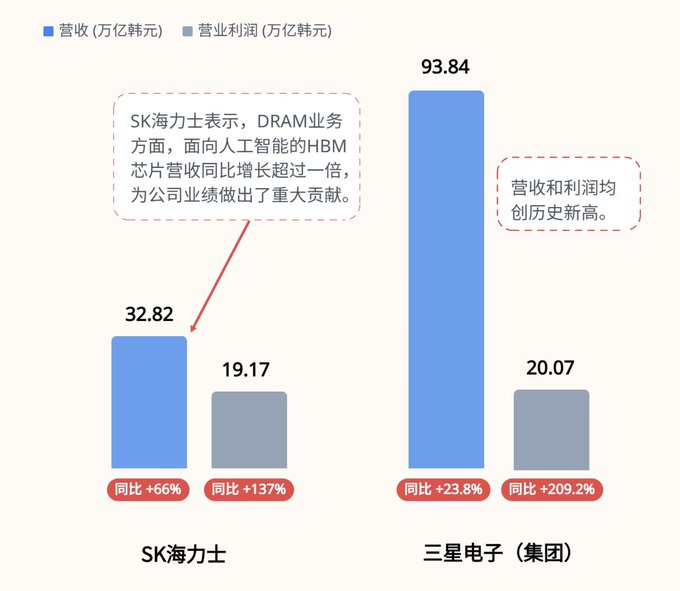

South Korea's two major memory chip giants, Samsung Electronics and SK Hynix, released their "strongest ever" financial reports, with the two companies achieving a combined operating profit of nearly 40 trillion won (approximately US$27.8 billion) in the fourth quarter of 2025, equivalent to a net profit of US$300 million per day. The core driver is the strong demand for HBM (High-Bandwidth Memory), with AI giants such as Nvidia, AMD, Google, and Microsoft lining up to purchase it.

On the other hand, technological barriers exist. Globally, only three companies can produce HBM: SK Hynix holds a 57% market share, Samsung 22%, and Micron only 21%. This results in a single piece of HBM, the size of a fingernail, costing as much as US$400-500, more expensive than its equivalent weight in gold.

Another factor, as discussed a few days ago, is that last year these memory manufacturers suppressed capacity expansion and instead continuously raised prices, leading to soaring profits. However, price increases are ultimately limited, and each company has recently announced capacity expansion plans to cope with the surging demand. However, the expansion plans of various companies remain relatively rational, without any large-scale expansion. This has actually fueled market expectations of both increased volume and price.

Let's see how explosive tonight's flash memory earnings reports will be!

qinbafrank

@qinbafrank

01-25

这位兄弟给美光的目标价炸裂了,$1330。说实话去年8-10月存储是错过了理解不深入。11月份的美股大盘小级别调整、带动存储一波回调也给了上车机会。整体逻辑是:

26年存储来业绩确定性很高,需求强,业绩爆发; x.com/haoflaneur/sta…

Have you boarded the bus?

I bought Micron products in late November during the market correction, and I was also looking at flash memory at the time. I felt Micron had a more comprehensive product line, so I figured I should have bought them all 😂

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content