Original text: " Robinhood's Tokenized Stocks: The Good, The Bad, and The Fix "

Compiled by: Ken, Chaincatcher

Legendary investor Warren Buffett has an almost religious and staunch opposition to the concept of "stock splits".

Berkshire Hathaway's Class A shares traded for over $700,000 per share because Buffett believed that stock splits were merely a formality and did not change the company's fundamental value. In Buffett's world, if you cut a pizza into eight pieces instead of four, you don't get more pizza. You just need to wash more dishes.

While stock splits may not seem like a "big deal" from a valuation perspective, they are a highly regulated activity subject to the U.S. Securities and Exchange Commission and enforced by stock exchanges.

When a company announces a stock split, it must file an 8-K form and give shareholders advance notice before the change takes effect. This critical time window allows transfer agents to adjust the share register, brokerages to update their internal systems, and data providers like Bloomberg to update their data streams—so that a $500 stock, after a 10-for-1 stock split, doesn't appear to have plummeted to $50 overnight.

Stock splits are not the only corporate actions that require this level of coordination. Dividend payouts also introduce similar complexities.

On the ex-dividend date, the stock price will be adjusted downwards based on the dividend amount. Some funds, especially high-yield funds, have taken this practice to the extreme. They frequently distribute dividends, but most of these distributions are principal returns—effectively returning investors' principal rather than paying out investment profits. Although the number of shares remains unchanged, the fund's net asset value will steadily erode over time.

Tracking the performance of these funds requires a clear distinction between price returns and total returns.

Let's say you hold 100 shares of a high-yield ETF, each priced at $100 (an investment of $10,000). The fund pays out $5 per month, 90% of which is returned as principal. After 12 months, you receive $60 per share in cash (a total of $6,000), but the fund's net asset value (NAV) has fallen from $100 to $46. At this point, the total price return is negative $5,400, but the total return is $10,600 ($4,600 remaining NAV plus the $6,000 paid out), a positive return of 6%.

These are precisely the problems that blockchain should be addressing.

A single, shared ledger, capable of atomic updates and simultaneously visible to everyone. If everyone reads data from the same chain, corporate actions such as stock splits and dividends will propagate instantly throughout the system, eliminating the tedious and chaotic reconciliation work currently done between isolated intermediaries.

It was this commitment that led to the enthusiastic market response when Robinhood (@RobinhoodApp) CEO Vlad Tenev announced the launch of his tokenized stock strategy in June 2025.

Six months have passed, Robinhood's token has officially launched, and data continues to flow. Unfortunately, some problems are beginning to surface.

advantage

Robinhood's statement became a catalyst for the market.

Other issuers quickly followed suit by launching competing products. Backed Finance (acquired by Kraken) launched xStocks (@xStocksFi) on Solana, followed by Ondo Global Markets (@OndoFinance) launching its own tokenized stock product.

RWA.xyz data as of January 23, 2026

Tokenized stocks have entered a truly explosive year. In the second half of 2025 alone, the asset class grew by 128%, pushing total asset value to nearly $1 billion.

RWA.xyz data as of January 23, 2026

Robinhood's tokenized U.S. stocks and ETFs are now available to European customers. Each token is issued on the Arbitrum network, fully backed by Robinhood's stock holdings, and offers 24/7 trading with zero commission. Related data is available at RWA.xyz.

But it turns out that accurately capturing metrics for Robinhood's tokenized shares is far more complex than expected.

shortcoming

Most blockchain data platforms assume that tokens follow standard conventions when indexing them. For ERC-20 tokens, this means tracking minting and burning, accumulating the supply from zero, and calculating the market capitalization as the supply multiplied by the price.

This works for thousands of tokens on Ethereum and other EVM networks. However, ERC-20 was not designed for securities that undergo corporate actions. The standard does not natively support stock splits, reverse splits, or benchmark adjustments driven by dividends.

Therefore, Robinhood had to use custom contracts to properly handle these events to ensure the rights of its end users. These tokens functioned correctly within the Robinhood app, but their mechanism was opaque to external data platforms and incompatible with DeFi protocols—both of which presuppose that the objects are ERC-20 compliant tokens.

When we compare the token supply calculated using standard ERC-20 logic with the actual on-chain data, the discrepancies are too large to ignore. For some tokens, the data deviates by a factor of 10, and for others by as much as 100.

Almost all errors can be attributed to two categories of causes: (1) net worth erosion caused by dividends and (2) stock splits.

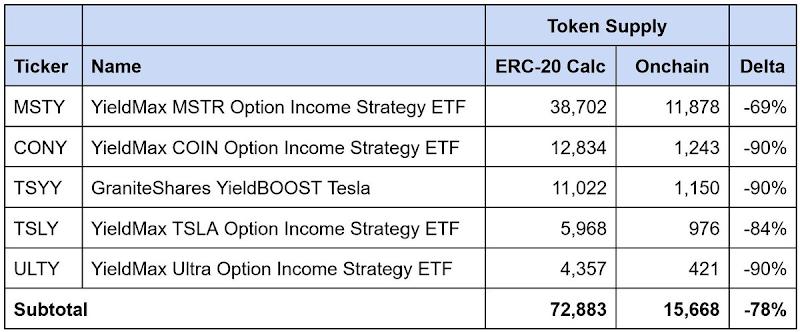

Net asset value erosion due to high-yield ETF dividends

Data as of January 23, 2026

These are high-yield option return ETFs that pay dividends frequently, with 90% or more of the dividends classified as "principal return." Each dividend payout returns cash to investors, but this is primarily a return of principal rather than investment returns. The number of shares remains constant, while the net asset value steadily declines over time.

Robinhood addresses this issue by separating “shares” from “tokens”. The number of shares held by a holder remains constant, but an internal multiplier adjusts the reported token supply downward as principal returns accumulate to reflect the shrinkage of the underlying net worth.

However, data platforms that follow the standard ERC-20 model simply add up the minted and burned amounts. This approach fails to capture this rebasing adjustment, thus overestimating the circulating token supply and consequently overestimating the reported market capitalization.

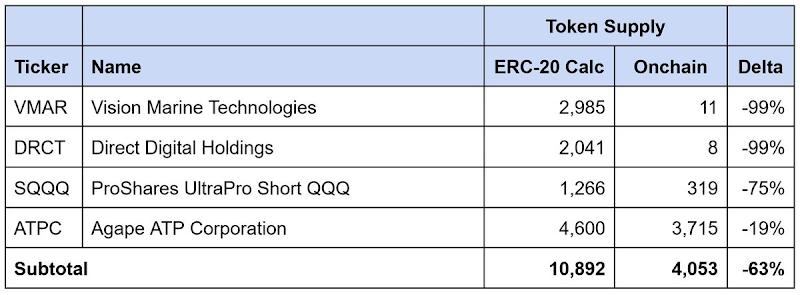

Reverse Stock Split

Data as of January 23, 2026

The same issue arises in reverse stock splits. A reverse stock split increases the price per share by consolidating shares, typically to meet exchange listing requirements. The number of shares decreases proportionally, but the price per share increases proportionally, keeping the total value unchanged.

Similarly, Robinhood's contracts adjust the token supply to reflect the reverse split, while third-party platforms that follow the standard ERC-20 model overestimate the circulating supply and report market capitalization.

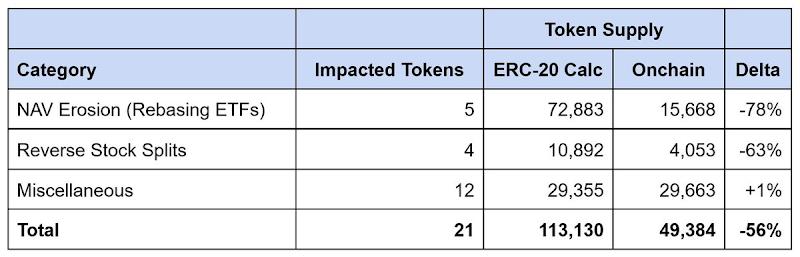

Robinhood's total data discrepancy

Data as of January 23, 2026

Of the 21 tokens with data mismatches we identified, the reported supply was overestimated by approximately 64,000 tokens, a discrepancy of 56%. High-yield ETFs accounted for about 90% of this net asset value erosion, while inverse stock splits explained the remainder.

Any data platform that relies on standard ERC-20 logic to calculate the supply will significantly overvalue the market capitalization of Robinhood's tokenized shares, often by several times.

Solution

Tokenized Stock Taxonomy: Models and Infrastructure

Tokenized stock issuers have taken different approaches to handling corporate behavior. They can be broadly categorized into two types.

Rebasing Models

The benchmark adjustment model maintains spot price parity: that is, one token should always trade at a price close to one share of the underlying stock. When corporate actions occur, token balances are automatically adjusted to maintain this relationship. Issuers using this method fall into two camps based on their relationship with the issuer of the underlying asset:

- Benchmark Adjustment (Third Party): The issuer operates independently of the company whose shares are being tokenized. xStocks (@xStocksFi, affiliated with Backed Finance/Kraken) and Robinhood (@RobinhoodApp) both employ this approach. Tokens are backed by custodied shares, but because they have no direct relationship with the underlying issuer, they merely replicate economic exposure without granting legal ownership.

- Benchmark Adjustment (Direct): The issuer partners with a publicly traded company to tokenize its shares. Superstate's Opening Bell (@SuperstateInc) and Securitize (@Securitize) operate as SEC-registered transfer agents and act as official shareholder registrars. Because the tokens are issued in coordination with the company, they are legal securities in themselves, and holders enjoy actual shareholder rights that cannot be provided by a third-party model.

Both of these structures require multiplier infrastructure to reflect company behavior on-chain.

Solana's Token-2022 standard natively provides a scaling UI for balance extensions. Issuers only need to update a multiplier, which adjusts the balance displayed in the user interface without changing the original token count. For example, a 2-for-1 stock split changes the multiplier from 1.0 to 2.0; the wallet will display double the balance, while the underlying original token count remains unchanged. Because this standard is native to Solana, data platforms can directly query changes to the multiplier.

There is currently no equivalent standard for EVM networks. Issuers like xStocks and Robinhood have had to build their own multiplier mechanisms. While balance adjustments are correct and wallets display prices consistent with spot prices, these implementations are custom-designed. Third parties relying on standard ERC-20 calls cannot detect when the multiplier changes or query its current value. Therefore, each issuer's specific implementation must be understood individually.

For this reason, Chris Ridmann of Superstate and Gilbert Shih of Robinhood co-authored ERC-8056, a draft proposal aimed at introducing standardized “scaled UI amount extensions” for ERC-20 tokens. This would provide a unified interface for data platforms to track corporate behavior across issuers.