With human payment efficiency reaching its peak, stablecoins are evolving from crypto settlement tools into a universal monetary layer that can function for AI agents and the machine economy.

Article author: Kelly Wang, Trainee Analyst, OSL Research

Article source: OSL Research Institute

Statistics for Issue 7 are as of January 29, 2026.

Email: kelly.wang@osl.com

I. Stablecoin Payment Data This Week

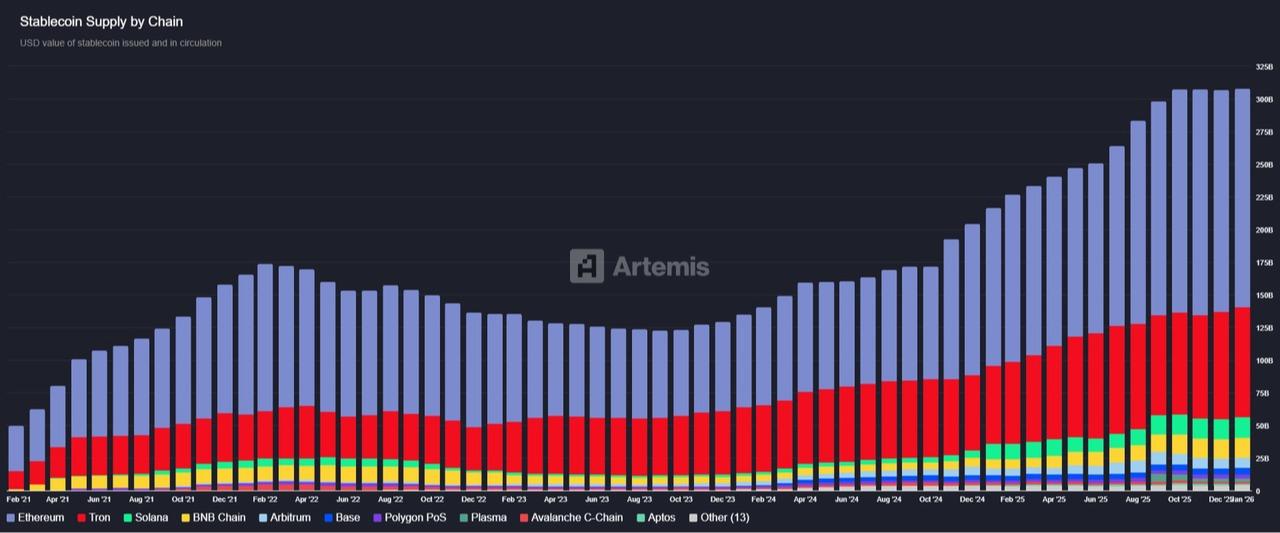

- As of January 29, 2026 (7-day rolling data), the total market capitalization/supply of stablecoins was approximately $308.2 billion , continuing to remain in the $300 billion range.

- Messari's observations show that stablecoin transfers remain active, with a cumulative transfer volume of over $9.20 trillion in the past 30 days , fluctuating between approximately $296 billion and $300 billion per day ; roughly extrapolating from the daily average, the total transfer volume in the past 7 days is still in the range of $1.8 trillion to $2 trillion .

- From the perspective of long-term noise removal structure, the "effective" volume after adjustment by OSL Research (excluding market making, self-trading, bots, etc.) is about one-fifth of the total, corresponding to a range of about 360-400 billion US dollars in the past 7 days .

(Data source: Messari, Artemis, OSL Research)

("Valid" = Adjusted data, excluding noise trading such as market making, self-trading, and bot trading.)

The top three stablecoins (protocols) with the fastest growth in total market capitalization this week are:

- USD1 (+56.98%; turnover amount $16.24B, +66.90%)

- Avant USD (+13.82%; Turnover $105M, +30.13%)

- VNX Gold (+10.75%; Turnover $582.55K, +28.27%)

OSL Research Growth Insights :

1. USD1's market capitalization increased by 56.98% this week, primarily driven by high-yield staking incentives that fueled new coin minting. USD1 employs a 1:1 fiat-backed minting mechanism, with a redemption mechanism allowing for a 1:1 exchange to USD with zero fees, facilitating arbitrage. The core driver of this growth is the approximately 12% APY staking rewards provided by the World Liberty Financial protocol, attracting users to mint large quantities and deposit them into the staking module to earn WLFI token rewards. Data shows that TVL increased from $2.96 billion to $4.45 billion, with Binance holding a significant 76.8%. While settlement volume is high, it is mainly concentrated on exchanges and staking protocols, rather than in everyday payment scenarios.

2. The weekly expansion of Avant USD is driven by DeFi yield demand: avUSD is minted through Avant Protocol's LRT and overcollateralized lending mechanisms, driven by demand from high-yield pools within the Avalanche ecosystem (some pools have an APY of 93%). Data shows a weekly supply increase of 13.82% and TVL increase of approximately 14%. Most of the new funds in the protocol flow into advanced yield strategies rather than basic lending, and are frequently rebalanced between avUSD/savUSD/avUSDx through delta-neutral DeFi strategies (revolving lending, liquidity provision) to pursue optimal returns.

3. VNX Gold's growth is primarily driven by the valuation effect of rising gold prices. VNXG uses a 1:1 gold reserve minting mechanism. This week's growth was mainly driven by the valuation effect of gold prices rising from $4,770 to $5,500 (an increase of over 10%), rather than large-scale new coin minting. Trading is characterized by low frequency and large transactions, with a high average transaction amount but low transaction frequency. Holders tend to hold long-term to hedge against macroeconomic risks, resulting in low on-chain activity.

II. Key News on Stablecoin Payments and Infrastructure This Week

Fidelity issues FIDD stablecoin

News Description: Fidelity Investments announced the launch of the FIDD stablecoin (Fidelity Digital Dollar), based on Ethereum; issued by Fidelity Digital Assets (a federally chartered national bank); reserves consist of cash, cash equivalents, and short-term U.S. Treasury securities, in compliance with the GENIUS Act; supports 24/7 institutional settlement and on-chain retail payments; 1:1 USD redemption on the Fidelity platform; daily disclosure of issuance and reserves, and regular third-party audits.

Source: CoinDesk (2026/01/28)

Observation: Fidelity's issuance of FIDD, precisely aligning with the GENIUS Act regulatory framework, marks the formal entry of another traditional financial institution into the stablecoin arena. It is expected to become a connector between traditional finance and the crypto ecosystem, substantially promoting the institutional penetration of on-chain finance, and confirming that stablecoins are becoming a core infrastructure for traditional financial institutions' deployment of RWA (Real Money Token).

McKinsey report: Stablecoins account for 35 trillion in on-chain settlements, but only 1% are real-world payments.

News Description: A McKinsey & Artemis Analytics report shows that stablecoins settled approximately $35 trillion on-chain last year, but only about 1% of this was for real-world payments. The report estimates that approximately $380 billion of stablecoin transactions were actually used for payments, primarily including B2B settlements ($226 billion), cross-border payroll and remittances ($90 billion), and capital market settlements ($8 billion). The research points out that the majority of stablecoin transactions still originate from crypto transactions, internal transfers, or protocol-level operations, and real-world payments account for less than 0.02% of the global payment market, which exceeds $2 trillion.

Source: CoinDesk (2026/01/24)

Observation: The $35 trillion on-chain settlement volume of stablecoins is mainly supported by transactions and protocol operations within the crypto ecosystem, with real-world payments accounting for a negligible proportion. However, stablecoin payments do exist and are growing, mainly concentrated in B2B, cross-border remittances, and the Asian region. Currently, it is still in its early stages, and its future scaling depends on the replication of application scenarios, regulatory development, and the maturity of infrastructure.

Former UN Under-Secretary-General and economist Vera Songwe: Stablecoins alleviate the dual challenges of remittances and inflation in Africa.

News Description: Former UN Under-Secretary-General and economist Vera Songwe stated at the World Economic Forum in Davos that with high costs for cross-border remittances in Africa, remittances have become "more important than aid" for the continent, and stablecoins are emerging as a faster and cheaper alternative. She pointed out that traditional remittances cost approximately $6 per $100, while stablecoins can reduce settlement times to minutes, and in a context where inflation rates in many countries exceed 20%, they have become a tool for combating inflation and preserving value. The most active users of stablecoins include Egypt, Nigeria, Ethiopia, and South Africa, primarily driven by small and medium-sized enterprises (SMEs), demonstrating their role in financial inclusion.

Source: Cointelegraph (January 24, 2026)

Observation: The underlying inefficiencies in African cross-border finance have directly translated the technological advantages of stablecoins into rigid market demand, representing a precise breakthrough in the traditional cross-border settlement system. Against the backdrop of high inflation, their value storage attributes have been activated, allowing stablecoins to transcend their role as mere payment tools and become a safe-haven asset in emerging markets. The predominantly SME-driven usage pattern confirms that the inclusive nature of stablecoins is highly compatible with the financial infrastructure gaps in developing markets, providing a core model for their globalization.

Tether added another 27 tons of gold to its reserves in Q4, accelerating the goldification of its reserves.

News Description: Stablecoin issuer Tether announced that it increased its gold holdings by approximately 27 tons in the fourth quarter of 2025, a similar amount to the third quarter. Currently, USDT has a circulating supply of approximately $187 billion, with its reserves primarily consisting of US Treasury bonds and gold accounting for about 7%. Meanwhile, Tether's gold-backed stablecoin XAUT is fully backed by physical gold, corresponding to 16.2 tons of gold as of the end of 2025, representing approximately 60% of the global gold stablecoin supply. Tether's CEO stated that its gold investment scale is now comparable to that of some sovereign nations.

Source: Reuters (2026/01/27)

Observation: This is the largest "quasi-sovereign" gold allocation in the crypto space, essentially converting a portion of seigniorage into hard assets that hedge against inflation, further reducing reliance on a single US Treasury bond. Tether is beginning to play the role of a "sovereign wealth fund in the crypto era." Driven by both regulatory arbitrage and asset diversification, its systemic importance and potential tail risks are amplified simultaneously, requiring vigilance regarding liquidity and redemption pressures in extreme scenarios.

Standard Chartered Bank: Stablecoins may draw 500 billion yuan out of bank deposits

News Description: Standard Chartered Bank research indicates that with the accelerated use of stablecoins, developed economies' banking systems may face significant deposit outflow risks. By 2028, up to approximately $500 billion in bank deposits could be transferred to the crypto asset space, with the outflow from US banks estimated at about one-third of the stablecoin market capitalization. Geoff Kendrick, Head of Digital Asset Research at Standard Chartered Bank, stated that the circulating supply of stablecoins has already increased by approximately 40% year-on-year to over $300 billion, and this trend may accelerate further following the advancement of relevant crypto legislation.

Source: Bloomberg (January 28, 2026)

Observation: The core of the predicted 500 billion yuan deposit outflow is the substitution competition of stablecoins for traditional bank low-interest deposits. Regional banks, relying on deposit returns, are the most vulnerable group. The extremely low proportion of bank deposit reserves held by stablecoin issuers also makes it difficult for outflowing funds to flow back, directly amplifying the actual impact of deposit outflows. The implementation of crypto legislation may accelerate the migration of funds, forcing traditional banks to either develop on-chain products or adjust their deposit interest rate system to safeguard their basic funding base.

Stablecoin supply plummeted by 2.24 billion, with funds flowing directly into fiat currency and gold.

News Description: According to a recent report from crypto analytics platform Santiment, the combined market capitalization of the top 12 stablecoins in the crypto market decreased by approximately $2.24 billion over the past 10 days, while the price of Bitcoin fell by about 8% during the same period. The report interprets this as follows: funds may be shifting to traditional safe-haven assets such as gold and silver; some funds did not remain in stablecoins "waiting in the market," but instead directly converted to fiat currency and exited; the contraction in stablecoin supply means a decrease in short-term buying liquidity, and the rebound may be weaker and slower.

Source: Santiment (2026/01/27)

Observation: Stablecoins, as a major source of buying power in the crypto market, are experiencing a supply contraction that directly weakens short-term liquidity. This significantly raises the threshold for incremental funds needed for a rebound, suggesting that weak consolidation may be the dominant trend. With gold and silver hitting record highs, this round of outflows appears more like a systemic risk-averse movement than a simple internal rotation within the crypto market. A strong V-shaped reversal is unlikely in the short term, and close monitoring of stablecoin market capitalization signs of bottoming out and rebounding is necessary.

Tether raised $5.2 billion in 2025, accounting for 41.9% of total revenue from crypto protocols.

News Description: According to CoinGecko Research data, Tether topped the list of crypto protocol revenue in 2025 with approximately $5.2 billion, accounting for 41.9% of the 168 revenue-generating protocols and becoming the absolute mainstay of crypto protocol revenue that year. Among the top ten revenue-generating protocols, stablecoin issuers dominated, with just four stablecoin-related entities contributing 65.7% (approximately $8.3 billion) of revenue, the remainder primarily consisting of trading protocols. The report points out that trading protocol revenue is highly dependent on market conditions: it performed strongly during the active market period in the first quarter, but declined significantly as the market weakened. If public chains are included, Tron's revenue in 2025 was approximately $3.5 billion, ranking second, mainly benefiting from its high usage as the preferred network for USDT transactions.

Source: CoinGecko Research (2026/01/25)

Observation: Tether alone contributes over 40% of protocol revenue. Combined with the other three stablecoin entities, the top four stablecoin issuers have monopolized nearly 66% of the market share, exposing that the crypto "revenue economy" heavily relies on fiat currency anchoring rather than original innovation. Tron, leveraging its dominant position in USDT transfers, secured 3.5 billion in revenue, ranking second. This demonstrates that a low-cost, high-throughput settlement network remains the strongest moat for the large-scale deployment of stablecoins, and regulatory arbitrage and interoperability benefits continue to materialize.

III. Regulatory and Policy Signals This Week

Japan: FSA sets strict standards for yen stablecoin reserves

Japan's Financial Services Agency (FSA) has launched a public consultation on the scope of bonds that can be used as reserve assets for stablecoins, with a deadline of February 27, 2026. This move implements the 2025 revision of the Payment Services Act, clarifying the compliant reserve asset standards for yen-pegged stablecoins issued through trust structures. The draft proposes limiting eligible collateral to high-credit-rating foreign-issued bonds (credit risk level 1-2 and above), with the issuer's outstanding bond balance required to be no less than 100 trillion yen (approximately US$648 billion). Simultaneously, the FSA strengthens disclosure and risk control requirements for banks and their subsidiaries engaged in crypto intermediary business and introduces additional compliance checks for foreign stablecoins.

Source: The Block (January 27, 2026)

Observation: Japan's Financial Services Authority (FSA) sets high creditworthiness and large scale as core thresholds for reserve bonds, deeply embedding traditional financial risk control logic into stablecoin regulation, thus locking in the liquidity and credit risk of reserve assets from the source. Raising the issuance threshold and strengthening compliance verification of overseas stablecoins essentially builds a domestic regulatory moat, benefiting the yen-denominated stablecoin ecosystem dominated by licensed financial institutions. This practical measure not only improves the regulatory loop of the Payment Services Act but also provides a model for stablecoin development under strict regulation for Asian economies.

South Korea: Considering easing restrictions on virtual asset investment, concerned about exchange rate risks behind the Korean won stablecoin.

News Description: Bank of Korea Governor Lee Chang-yong stated at the Asian Financial Forum in Hong Kong that, given market pressure, authorities have allowed South Korean residents to invest in virtual assets issued overseas. Simultaneously, financial regulators are considering establishing a new registration system to allow domestic South Korean institutions to issue virtual assets. Lee Chang-yong stated that won-denominated stablecoins are expected to be primarily used for cross-border transactions, while tokenized deposits are more likely to be used for domestic payments. However, he emphasized that stablecoins remain highly controversial. He expressed concern that won-denominated stablecoins could be used to circumvent capital flow control measures, especially when combined with dollar-denominated stablecoins, where the risk is even higher. He warned that if exchange rate fluctuations trigger market expectations, funds could rapidly flow into dollar-denominated stablecoins, leading to large-scale fund transfers, and the participation of non-bank institutions in issuance would increase regulatory difficulties.

Source: RTHK (January 27, 2026)

Observation: South Korea's relaxation of restrictions on virtual asset investment, while a regulatory compromise under market pressure, exposes the core tension between emerging markets and capital controls. The linkage risk between Korean won stablecoins and US dollar stablecoins is essentially a precise impact of digital assets on sovereign capital control systems; the capital-siphoning effect under exchange rate fluctuations may breach traditional foreign exchange defenses. The regulatory challenges of non-bank issuance are a common constraint on the localization of crypto in emerging markets worldwide.

Russia: Crypto regulatory bill to be voted on and passed in 2027; retail investment capped at $4,000.

News Description: Anatoly Aksakov, Chairman of the Financial Market Committee of the Russian State Duma, stated that the cryptocurrency regulatory bill is expected to be voted on at the end of June. If approved, the bill will take effect on July 1, 2027. The bill includes regulations for exchanges (unregistered entities may face fines or imprisonment); retail investors will need to pass a qualification test with an annual purchase limit of $4,000; central banks will determine the cryptocurrencies that can be purchased (potentially including BTC, ETH, etc.); stablecoins may be used for external economic activities and will only be available through licensed brokers.

Source: DL News (January 29, 2026)

Observation: Russia's cryptocurrency regulatory framework, scheduled for implementation in 2027, represents a strategic balance between navigating external challenges under sanctions and controlling domestic risks. Stablecoins, limited to external economic applications and requiring licensed brokers, precisely address Russia's practical need to bypass traditional settlement systems. The central bank's leadership in approving the list of cryptocurrencies firmly holds regulatory power in state hands; this highly centralized control model highlights the differentiated path chosen by emerging economies in the cryptocurrency wave.

IV. Analyst Commentary: From Clawd Bot to the Machine Economy, Stablecoins Will Become the Core Settlement Method for AI Intelligent Agents

Observer Author: Kelly Wang, Trainee Analyst, OSL Research

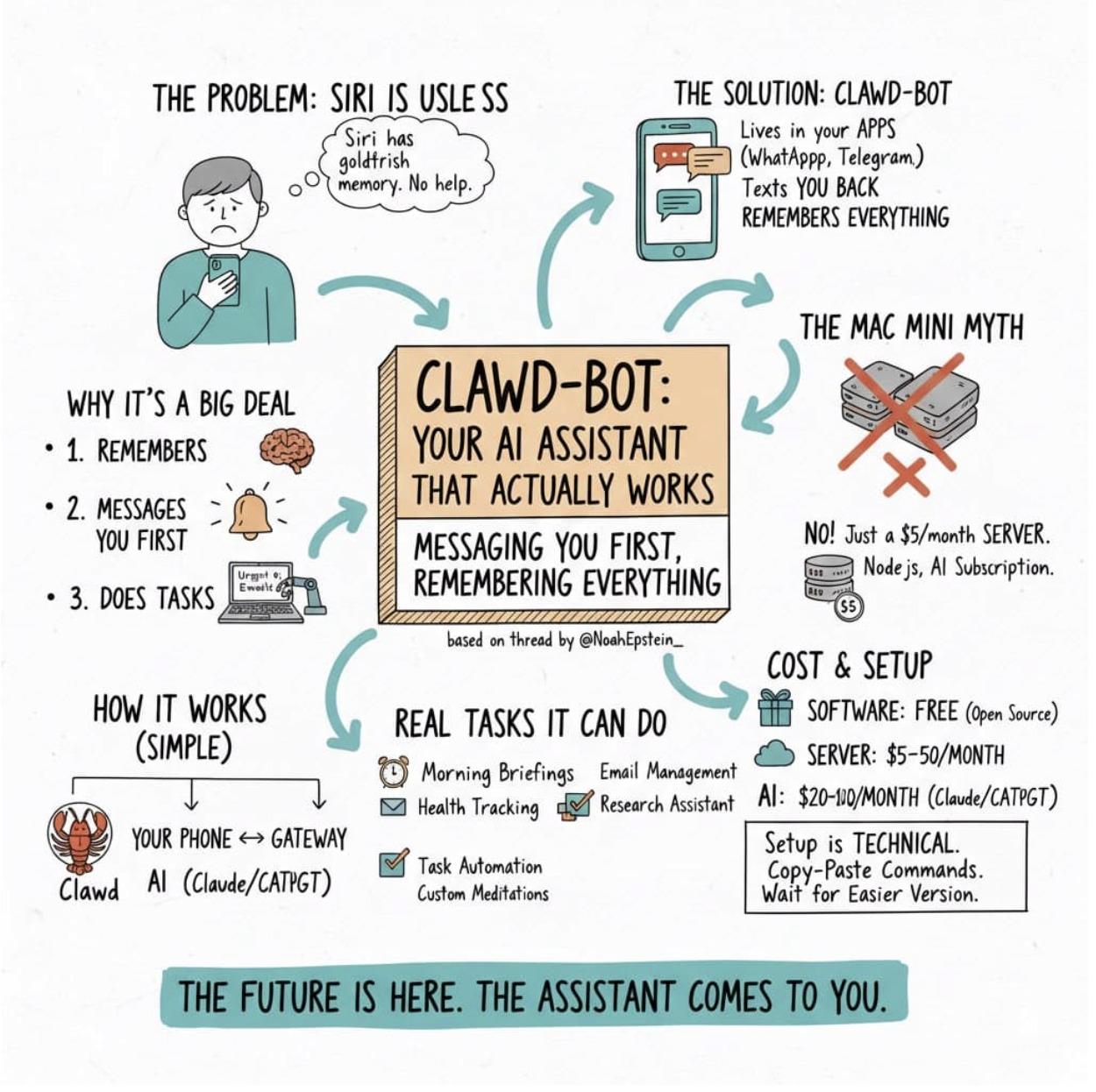

In early 2026, an AI agent called Clawd Bot quickly gained popularity both domestically and internationally. This open-source project attracted tens of millions of active users in just a few months. It is no longer a simple smart assistant, but an intelligent agent capable of autonomously planning complex tasks: customizing personalized travel plans for users, negotiating e-commerce discounts in real time, generating professional-grade content, and even representing users in small investments and cross-border collaborations.

The viral spread of Clawd Bot is no accident, but a vivid illustration of the leap in AI technology from passive response to true "agency." This leap has led people to foresee that when autonomous AI agents expand into economic activities (such as high-frequency micro-transactions), traditional payment systems will face fatal bottlenecks—high transaction fees, long settlement delays, and an inability to adapt to the needs of autonomous machine operation. This is not merely a technical problem, but clearly foreshadows the quiet rise of the AI agent economy, with stablecoins gradually becoming an indispensable monetary pillar supporting this new economy.

The unique payment needs of the AI-driven intelligent economy

This "proxy" nature directly determines the unique payment needs of AI agents in future economic activities: extremely high transaction frequency, often requiring several micro-payments per second; extremely small amounts, perhaps only $0.001 is needed to call an API or purchase data; the decision-making process must be completely autonomous, with AI agents automatically triggering fund flows based on preset intentions without human confirmation; and the activities are highly globalized, requiring 24/7 uninterrupted, frictionless instant settlement.

User feedback from the Clawd Bot community shows that many loyal users are attracted by its seamless autonomous task execution experience, such as independently completing complex workflows while maintaining privacy. If payment infrastructure cannot adapt to this logic of future AI agents in economic transactions, the potential of AI agents will be severely limited, and the AI agent economy will struggle to move from concept to reality.

The introduction of stablecoins is an inevitable evolution from the demand side to the supply side. It can not only solve these pain points, but also usher in a new era of economic collaboration between machines.

Structural defects of traditional payment systems

The shortcomings of traditional payment systems in the face of the AI-driven intelligent agent economy stem from their deeply ingrained "human-centric" design logic. While credit card networks handle trillions of transactions globally, their fee structure (typically 2%-3%) and settlement cycle (at least T+1) are tailored to human consumption habits. Cross-border transfers via the SWIFT system incur fees as high as 6.5%, with delays of several days, making them completely unworkable in high-frequency micro-payment scenarios like Clawd Bot.

A deeper problem lies in the fact that these systems rely on manual authorization, KYC identity verification processes, and centralized risk control, making them unable to support purely machine-to-machine peer-to-peer interactions. Intelligent agents like Clawd Bot cannot "swipe cards" or manually fill out forms like humans, nor can they withstand the time-consuming wait times of manual approval. Furthermore, the peak throughput of traditional networks is only tens of thousands of TPS, while the demands of mature AI agent economies are likely to easily exceed the million TPS threshold. This scale bottleneck will force a complete transformation of the payment paradigm.

Traditional payment systems are essentially a legacy of the industrial age, characterized by centralization, human control, and high costs. In contrast, the AI-driven intelligent agent economy represented by Clawd Bot requires a decentralized, autonomous, and low-friction digital-native paradigm. This paradigm clash is not merely a difference in technical details, but a fundamental shift in economic power and control.

The core advantages of stablecoins

Stablecoins have emerged as a paradigm clash, with their core advantage stemming from the deep integration of blockchain technology and value anchoring mechanisms. They achieve value stability by pegging to fiat currency and maintaining sufficient reserves, while leveraging the technological characteristics of blockchain to adapt to the needs of the smart agent economy.

First, regarding price stability, mainstream stablecoins such as USDC and USDT maintain volatility below 0.1% through ample reserves, providing a precise and predictable foundation for intelligent agents' budget planning and preventing task interruptions due to drastic price fluctuations. Second, in terms of settlement efficiency, stablecoins leverage Layer 2 scaling solutions, resulting in transaction fees of only a few cents and settlement times reduced to minutes. Furthermore, the programmability of stablecoins is highly compatible with the code-driven logic of intelligent agents. Agents can automatically transfer funds when key milestones are achieved through smart contracts. Moreover, cross-chain bridges and interoperability protocols further break down national borders, enabling seamless collaboration among global intelligent agents.

These mechanisms will create a powerful positive feedback loop: the widespread application of popular smart agents in the future will continuously inject liquidity into stablecoins, constantly strengthening their network effect.

Industry Agreements and Implementation Practices

Google's AP2 protocol and Coinbase's x402 standard have established open frameworks for stablecoin payments between AI agents, which have been rapidly adopted, integrated, and optimized by numerous AI agent projects. Meanwhile, Circle is actively promoting the development of standards for machine-to-machine micropayments; PayPal has deeply integrated stablecoins into its AI agent payment product line; and Stripe has provided crucial support to over 700 AI agent startups.

These initiatives fully demonstrate the strategic foresight and forward-looking planning of industry giants regarding the AI agent economy trend. Meanwhile, the continuously rising user demand for autonomous agents is driving the rapid formation of a complete ecosystem, from underlying protocols to upper-layer applications. In the emerging AI agent community, developers are also actively developing dedicated plugins to help agents automatically select the optimal payment path. These practices fully demonstrate that stablecoins will become a core pillar of the new payment track in the era of AI agents.

The combination of AI agents and stablecoins will unlock a multitude of new application scenarios, such as agent-driven real-time content monetization, automated supply chain settlement, and prediction market games. More importantly, this will give rise to a truly large-scale machine economy—billions of agents will autonomously manage the flow of funds, building a machine-dominated market.

Potential challenges and solutions

Despite the promising prospects, we still need to examine the challenges that lie within: the lack of a unified global regulatory framework, the security vulnerabilities and potential fraud risks of open networks, the historical occurrence of stablecoins de-pegging, and the possibility that AI agents may amplify operational errors or malicious behavior.

These challenges are not insurmountable obstacles, but rather an inevitable path for any disruptive technology to mature. Looking ahead, driven by both technological innovation and policy synergy, these potential risks are expected to be gradually and effectively mitigated.

The popularity of Clawd Bot both domestically and internationally is just the tip of the iceberg in the wave of AI agent development. It clearly foreshadows the core capabilities of future AI agents in a way that is intuitively perceptible to users—autonomously undertaking high-frequency trading tasks, adapting to global collaboration scenarios, and efficiently linking various payment and protocol systems to complete a closed loop for implementation. The value of stablecoins will also be fully highlighted as they support the implementation of these future capabilities. Ultimately, this trend will drive a profound restructuring of economic power from a human-centric model to one of machine collaboration.

Looking ahead, we will witness the rise of an ecosystem dominated by billions of intelligent agents, with stablecoins as the universal currency. This is not merely a technological upgrade in the payment sector, but a fundamental transformation of the paradigm of human economic activity—a more intelligent, inclusive, and decentralized era of machine economy has begun. As the regulatory framework becomes clearer and the technological system matures, those who control the stablecoin infrastructure will also grasp the core initiative in the era of AI-driven intelligent agent economy.

Disclaimer and Disclosure

1. Document nature

This document (“this document”) was prepared by OSL internal personnel for informational purposes only and does not constitute investment, legal, tax, or any other professional advice, nor should it be relied upon as such advice. No part of this document may be reproduced, distributed, or transmitted to any third party in any form without OSL’s prior written permission. This document does not constitute an offer, solicitation, marketing material, product disclosure document, or legal document, nor does it form the basis of any binding contract or commitment. This document is intended to present OSL’s observations and strategic insights into the industry and does not represent OSL’s official position, strategy, or decision. The authors are not independent research analysts, and this document does not constitute “investment research” as defined by applicable laws or regulations. Therefore, this document has not been prepared in accordance with regulatory requirements designed to ensure the independence of investment research and is not subject to any pre-publication transaction restrictions.

2. Do not rely on declarations.

The information, opinions, and analyses contained in this document are based on publicly available information and OSL's internal judgment, and do not take into account any recipient's personal goals, financial situation, or needs. This document does not constitute any personal recommendation, nor does it constitute an invitation or solicitation to buy, sell, or conduct any financial instrument, product, or service. Recipients should consult their own independent advisors, taking into account their personal circumstances, goals, experience, and financial resources, before making any investment or other decisions. All investments involve risks; values may fluctuate, and investors may recover less than their initial investment. Past performance is not indicative of future results.

3. Information accuracy, completeness, and limitations

This document is based on information that OSL believes to be reliable, but OSL has not independently verified its accuracy, completeness, or fairness. While reasonable care has been taken to ensure that the content is not false or misleading, OSL makes no express or implied warranty as to the accuracy, completeness, fairness, or reasonableness of the content. OSL assumes no responsibility for any errors, omissions, or reliance on third-party information cited in this document. The performance of any described tools, entities, or strategies may be significantly affected by market, regulatory, technological, or other factors.

4. Forward-looking statements

This document may contain forward-looking statements that involve known and unknown risks, uncertainties, and other factors. Actual results, performance, or effectiveness may differ materially from those expressed or implied. OSL undertakes no obligation to update, revise, or withdraw any forward-looking statements.

5. Disclosure of Conflicts of Interest

OSL, its affiliates, and employees may hold positions in or participate in transactions related to the assets or entities mentioned in this document. The authors of this document or related personnel may receive compensation related to OSL's business performance. OSL has implemented policies and procedures to identify and manage potential conflicts of interest.

6. Intellectual Property Rights and Restrictions on Use

This document is protected by copyright and is for internal use by the designated recipient only. The recipient may store, view, analyze, modify, reformat, and print this document for internal use, but may not: [do anything else] without OSL's prior written consent.

- Resale, redistribution, or commercial use of this document;

- Reverse engineering, extracting, or creating derivative works, including those used to train or apply to machine learning/artificial intelligence systems;

- This document may be published or transmitted to third parties.

7. Limitation of Liability

To the fullest extent permitted by applicable law, OSL and its affiliates, officers, employees and agents shall not be liable for any direct, indirect, incidental, consequential or special damages arising out of or related to the use, reliance on or interpretation of this document, including but not limited to:

- Loss of profit;

- Business interruption;

- Data corruption or loss;

- Reputational damage.

8. Global Distribution Instructions

The recipient is solely responsible for ensuring compliance with applicable local laws. Distribution of this document may be restricted in certain jurisdictions. The recipient must ensure that this document is not distributed to any person or entity that is legally prohibited from receiving it.