Build a secure, intelligent, and open next-generation contract infrastructure.

Written by: ChandlerZ, Foresight News

The year 2025 is destined to be a year for the brave in the crypto market.

Against the backdrop of a weak spot market narrative and cautious liquidity in innovative assets, global capital's demand for pricing uncertainty has not diminished; instead, it is seeking outlets through leverage and speculation. CryptoQuant data shows that spot trading volume grew by only 9% in 2025, while perpetual contract trading volume surged by 29% to $61.7 trillion.

Even more dramatic data comes from CoinGecko's "2025 Crypto Industry Report." That year, the total trading volume of perpetual contracts on centralized exchanges (CEXs) reached a record high of $86.2 trillion, a year-on-year increase of 47.4%. Meanwhile, on-chain derivatives exchanges (Perp DEXs), represented by Hyperliquid, saw an even more dramatic surge of 346%, with trading volume reaching $6.7 trillion.

It's clear that Perp DEX is rapidly eroding the market share of traditional CEXs by leveraging performance, cost, and on-chain composability. CoinGecko data shows that Hyperliquid and Lighter have entered the top ranks of all perpetual exchanges in terms of annualized market capitalization, reaching $2.9 trillion and $1.3 trillion respectively. For centralized exchanges, the days of reaping profits from user traffic are over; the industry seems to have entered its second phase.

Users are no longer simply chasing subsidies and hype; they are beginning to scrutinize the quality of matchmaking, risk management capabilities, account and fund security, and resilience under extreme market conditions with stricter standards. The competitive landscape among exchanges is gradually shifting from a race for scale to a race for infrastructure value.

In such a red ocean market, a counterintuitive example has attracted market attention.

CoinW, an established exchange with eight years of history, chose not to pursue short-term, cash-burning strategies, but instead delivered an astonishing performance in 2025. The platform's contract trading volume bucked the trend, achieving over 30% growth, with peak daily contract trading volume exceeding $80 billion. It consistently ranked among the top two in CoinGecko's contract rankings, becoming one of the fastest-growing contract trading platforms.

Amidst the rise of DEXs and the competition from giants like Binance and OKX, how exactly did CoinW manage to carve out a niche? By examining its breakthrough path in 2025, we attempt to analyze the growth logic behind this platform's steady progress through three dimensions: core trading performance, security experience, and product iteration.

Image source: CoinW

The battle for efficiency: building an "experience moat" in milliseconds.

The biggest variable in the contract market in 2025 will undoubtedly be the rise of Perp DEX. The emergence of new players like Hyperliquid, through high-performance on-chain matching at the L1 level, will erode the speed advantage that CEXs once prided themselves on.

Faced with the challenges of the on-chain world, centralized exchanges must answer one question: Besides fiat currency channels, why should users stay on CEX trading contracts?

In reality, the first principle of contract trading is quite simple: traders pay for execution quality. Execution quality can be broken down into three key metrics: faster order fulfillment, lower slippage, and more stable availability. For exchanges, these three metrics are amplified or weakened by fee structure, liquidity organization, matching architecture, and risk control mechanisms.

CoinW's answer is to return to the essence of trading and maximize efficiency and cost.

In today's world of increasingly frequent on-chain interactions, we must acknowledge a reality. DEXs win because of transparency, but CEXs still win because of stability. When Solana's on-chain congestion causes transaction failures, or when Ethereum gas fees surge due to volatility, centralized exchanges, by contrast, process orders through their internal matching mechanisms, providing users with a smoother trading experience in specific market conditions.

CoinW clearly understood this. Instead of focusing on fancy on-chain integrations, they poured resources into the most mundane aspects: the matching engine and fee structure. For high-frequency quantitative trading teams, the 0.01% Maker fee not only reduces costs but also means more arbitrage models can be successfully tested during strategy backtesting. This extreme certainty and extremely low transaction costs are the real logic behind CoinW's ability to retain professional traders despite the encirclement of DEXs.

Image source: CoinW

Building upon its solid trading depth, CoinW continues to expand its coverage of diverse cryptocurrencies, constructing a trading ecosystem that combines both depth and breadth. While DEXs have a natural advantage in long-tail assets, CoinW leverages its keen market insight to build a robust matrix encompassing over 155 trading pairs. In 2025 alone, CoinW added nearly one-third of its trading pairs, ensuring users can enjoy top-tier depth on mainstream assets like BTC and ETH, while also being among the first to capture new alpha coins in sectors like Meme and AI.

With this combination of "millisecond-level matching + extremely low fees + comprehensive asset matrix," CoinW has maintained a 20% growth in active users. In the efficiency war, CoinW proves that CEXs still possess irreplaceable high-quality trading barriers.

Trust as the cornerstone, eight years of zero accidents – a testament to the beauty of safety.

If transaction performance determines whether users come or not, then security determines whether users dare to stay.

In 2025, despite a strong bull market, hacker attacks, rug pulls, and system outages due to extreme market conditions remained frequent. At a time when investor confidence was fragile, CoinW's eight years of stable and mature security operations became its most valuable intangible asset.

By examining its security architecture, one can clearly see a dual defense line of technological foundation and financial backing.

On the technical level, CoinW demonstrates an almost obsessive commitment to stability. To cope with the extreme market conditions that occurred multiple times in 2025 (such as Bitcoin's daily volatility exceeding 20%), CoinW constructed multi-layered flow limiting, circuit breaker, and degradation mechanisms. This design ensures that even under peak traffic surges, the core trading system remains smooth and uninterrupted. Just as its technical team adheres to the "stability first" principle, any new feature must withstand the most brutal stress tests of the real market before being launched.

In terms of specific security practices, CoinW did not stop at mere slogans, but instead built a robust protection matrix:

- Cold and hot wallet separation and multi-signature mechanism: Most funds are stored offline through cold wallets, eliminating the possibility of online attacks from a physical perspective; multi-signature wallet management is adopted to effectively prevent the risk of single point of loss of control.

- Comprehensive user-side protection: Provides a full suite of protection tools, including 2FA, anti-phishing codes, and withdrawal whitelists, to equip every account.

- Top-tier external auditing and monitoring: Deep collaboration with security organizations such as Hacken, Beosin, and CertiK, deploying over 100 risk control facilities, from smart contract auditing to real-time on-chain monitoring.

It is through these stringent measures that CoinW can confidently claim that it strictly adheres to and sets new industry standards for security.

Beyond technology, CoinW has gone a step further, making a substantial commitment to protecting user funds. Currently, CoinW has established an internal risk response fund of up to $200 million. In the event of system anomalies or unforeseen events, such as price anomalies or system failures caused by black swan events, the platform will activate this fund. In the Web3 world, where trust is extremely valuable, this continuous investment in risk and transparent handling mechanisms is becoming a crucial foundation for the platform to earn the long-term trust of its users. To date, CoinW's services cover over 20 million users worldwide.

From the arena of competition to the arsenal of weapons, reconstructing transactional relationships with a "non-zero-sum" mindset.

Contract trading is often viewed as a brutal zero-sum game. However, as the industry enters its second phase of competition, those who can address user pain points, provide emotional value, and offer more robust risk management mechanisms will win hearts and minds.

In the contract trading business, CoinW's most notable move in 2025 was undoubtedly its continuously iterating contract margin program, providing users with risk mitigation support. Contract trading is an extreme test of human weaknesses. Most platforms only care about generating trading volume, coldly watching users' accounts liquidate and perish. But from a business perspective, users leaving too early is also a loss for the platform.

To address users' anxiety about liquidation in contract trading, CoinW has launched a regular protection mechanism, with the platform investing at least $500,000 monthly in a protection pool. Users can accumulate personal protection funds through simple actions such as daily trading, check-ins, and referrals, which can be used to offset transaction fees, funding rates, and related trading losses.

When a margin call occurs, this amount can be used directly to "recover losses," with a maximum subsidy of $500 per round. Since its official launch in May 2025, the program has successfully run for nine rounds, with a cumulative investment of over $4.5 million, benefiting more than 120,000 users.

CoinW's contract protection fund program is essentially an experiment in user lifecycle management. It breaks the convention of exchanges only taking a cut and not providing financial support, offering a buffer against irrational user losses. While this may seem to increase operating costs, it actually uses real money to increase user retention and psychological security. In a zero-sum market, this fault-tolerance mechanism is more effective at fostering user stickiness than simple airdrops.

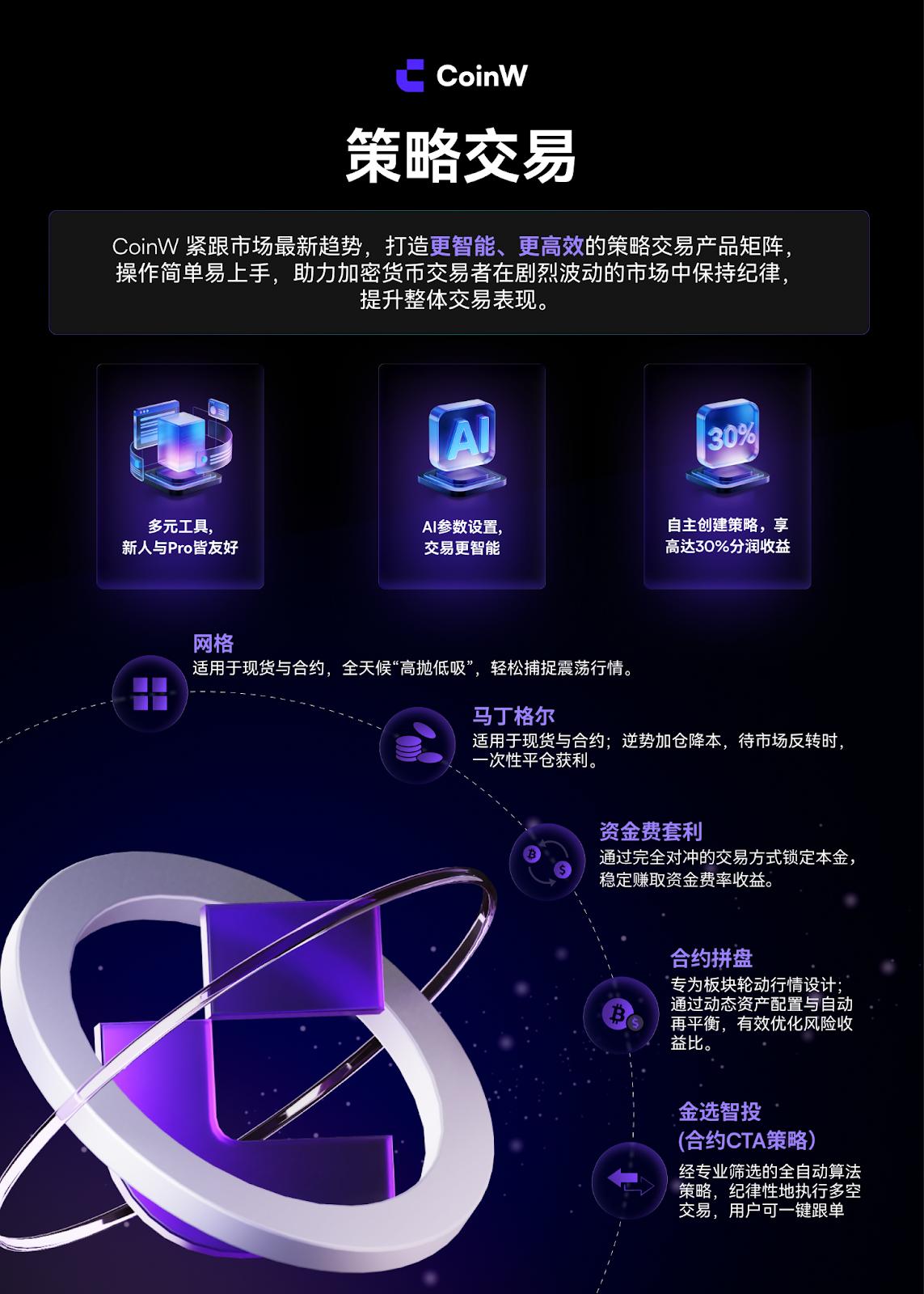

Beyond its defensive capabilities, CoinW has also built a robust strategic ecosystem on the offensive side. Over the past year, CoinW has completed a systematic upgrade of its contract strategy products, launching automated tools such as contract Martingale, movable grids, and CTA strategies, lowering the barrier to entry for professional trading.

Image source: CoinW

In the upcoming year of 2026, CoinW will set its sights on a more advanced "smart money copy trading" feature.

If technical analysis was the trading bible of the past two years, then the alpha of 2026 is clearly hidden in on-chain data. The biggest gap between retail investors and whale is no longer the size of their capital, but the granularity of information capture. Instead of letting users search for a needle in a haystack among massive amounts of on-chain data, it would be better to directly tool and productize the dynamic holdings of whale, delegating institutional-level on-chain auditing capabilities to ordinary retail investors, and using tools to bridge the huge information asymmetry gap. For traders eager to replicate their winning rate in 2026, this may be the lowest-barrier entry point into on-chain trading.

As a key feature meticulously crafted by the platform, Smart Money Copy Trading is another concrete manifestation of CoinW's deep understanding of user needs and commitment to product innovation. This feature tracks the trading dynamics of high-profit addresses and popular traders on-chain in real time, supporting one-click copy trading of spot contracts. In the crypto market, where information is extremely asymmetric, this tool aims to help ordinary users bridge the information gap, allowing retail investors to replicate the win rate and profit potential of whale.

The evolution from a simple trading venue providing matching services to a trading partner offering risk hedging and strategy support represents a crucial shift in logic. The venue focuses solely on generating trading volume, while the partner prioritizes the survival and prosperity of traders. By alleviating loss anxiety through contract margin deposits and increasing the probability of success through smart money copy trading, CoinW is reshaping the relationship between users and the platform with a "non-zero-sum" mindset.

The "Narrow Gate" and the "Wide Road" for Long-Term Thinkers

Looking back at CoinW's breakthrough strategy in 2025, we can perhaps summarize it in three words: precision, stability, and innovation.

- Excellence in efficiency: Leveraging strengths and mitigating weaknesses, centralized exchanges maximize their matching speed and cost advantages to counter the impact of DEXs;

- Solid Foundation: Building trust through eight years of consistent safety record and a real-money risk management fund;

- Innovative Value: Moving beyond a purely traffic-driven mindset, genuinely addressing user pain points, and persisting in product innovation.

Industry narratives may cycle, and fluctuations may recur, but contract users' evaluation criteria for platforms will become increasingly stable: Is the transaction process smooth enough? Are the risks within relatively predictable boundaries? Can the tools improve the win rate?

CoinW chose not to take the shortcut of burning money to gain traffic, but instead invested its resources in three seemingly more difficult "narrow gates": transaction performance, security experience, and product iteration. But as its counter-trend growth in 2025 proved, this is actually a bet that the value of infrastructure will prevail in the second half of the game—a path that gets wider and wider as you go.

As the crypto derivatives market shifts from an early, unregulated competition focused on scale to a more mature competition based on infrastructure value, CoinW is no longer content with simply being an exchange. Instead, it is committed to building a "secure, intelligent, and open next-generation contract infrastructure."

Risk Warning: This article is for general informational purposes only and does not constitute any investment, legal, financial, or trading advice, nor should it be considered a solicitation or offer to trade of any kind. CoinW does not guarantee the legal availability of the services, products, or technologies described herein in all jurisdictions, and the availability of related functions may vary depending on local laws and regulations. Cryptocurrency trading involves high risk; users should fully understand the associated risks and make prudent decisions based on their own circumstances before participating.