Derive is a decentralized Derivative protocol specializing in options and perpetual markets on Ethereum. The project stands out for building a high-performance trading ecosystem based on a separate Layer 2 platform to optimize the user experience. Let's explore this project further in the article below.

What is Drive? Learn about the decentralized options trading platform for BTC and ETH.

What is Drive? Learn about the decentralized options trading platform for BTC and ETH.

What is Drive?

Derive is a DEX focused on Derivative products for Bitcoin and Ethereum. Derive's predecessor was Lyra Finance , one of the pioneering protocols in on-chain options market. After development, the project rebranded as Derive to reflect its broader vision of becoming a comprehensive infrastructure for options, perp, and spot trading.

What is Drive?

What is Drive?

Derive products

The Derive ecosystem is comprised of three core products, playing a Vai from the infrastructure layer to the application layer:

Drive Chain

This is the settlement Settlement Layer for all transactions in the ecosystem. The Derive Chain is an open-source project built using the OP Stack toolkit and secured by Ethereum. All governance activities of this layer are decided by the Derive DAO.

Drive Protocol

Derive Protocol is a settlement protocol that allows authorizationless margin trading and gives users full control over their assets (self- Custodial). This protocol supports a variety of products including perpetual contracts, options, and spot trading. Derive Protocol is deployed directly on the Derive Chain and is also governed by the Derive DAO.

Drive Exchange

This is the user interface layer, operating as a centralized orderbook. The Derive Exchange's Vai is to efficiently match user orders, then push the matched orders down to the Derive Protocol for settlement on the chain.

Development team

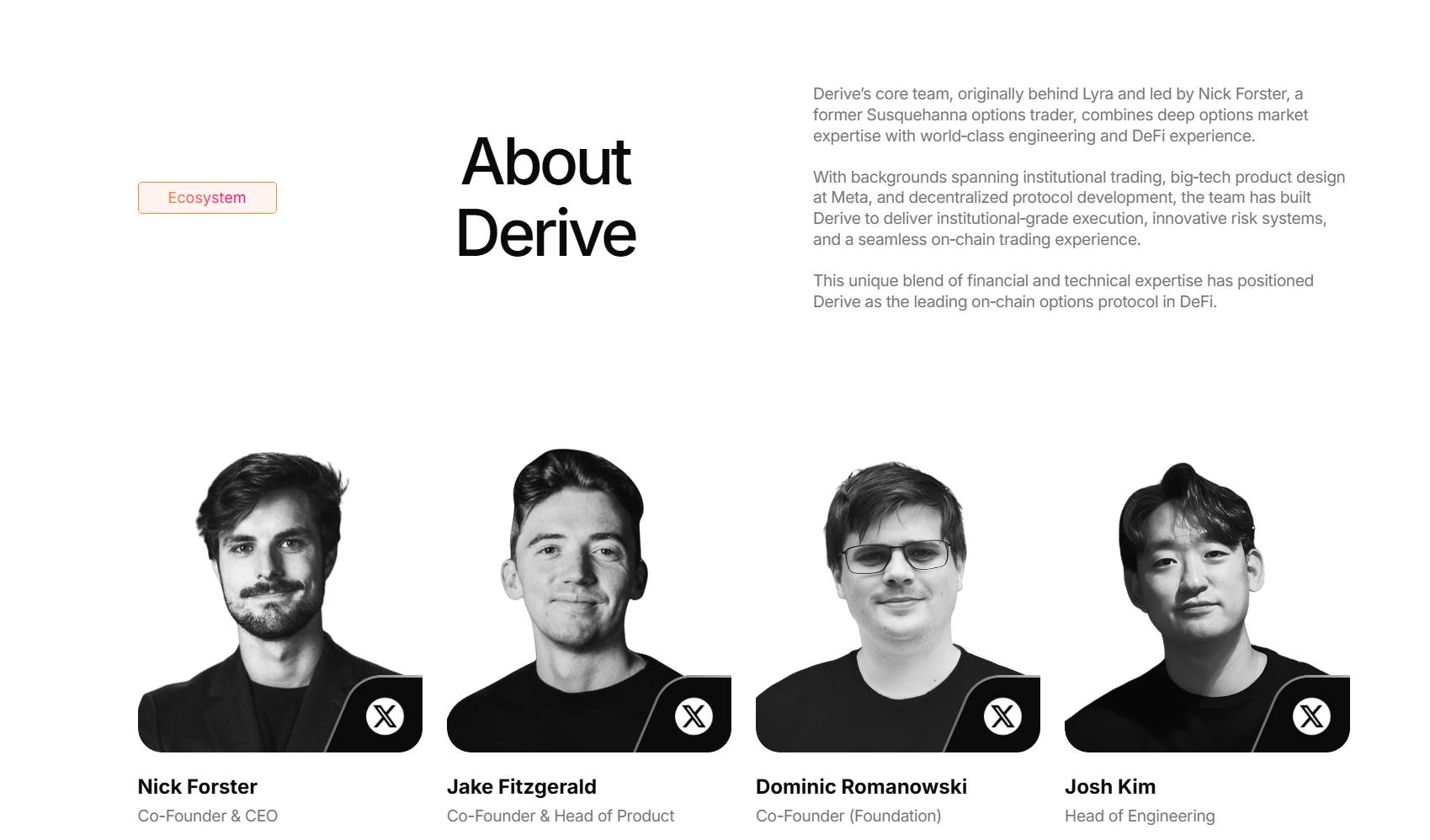

Derive development team

Derive development team

The Drive development team includes the following members:

- Nick Forster (Co-Founder & CEO) : Former professional options trader at Susquehanna International Group (SIG).

- Jake Fitzgerald (Co-Founder & Head of Product) : Previously worked at AirTree Ventures and Meta. He graduated from the University of New South Wales in Sydney and New York University in the United States.

Investors

The project has raised approximately $12.3 million from Capital rounds. Notable investors include: Framework Ventures, GSR, ParaFi Capital, Coinbase Ventures, Hopun, and Apollo Capital.

Tokenomics

Project name | Drive |

Token symbol | DRV |

Calcium | Drive Chain |

Contract | Updating... |

Total supply | 1,000,000,000 |

Token Use Case

Vote on Derive DAO decisions regarding the Derive Chain and Protocol.

Staking to receive a Chia of transaction fees and rewards.

Reduce transaction fees when using products within the Drive ecosystem.

Weekly buyback.

Summary

Above is all the information about the Derive project. Coin68 hopes that readers will grasp the basic information to better understand the project and how it works. We wish you more useful knowledge!

Note: The information in this article is for informational purposes only and is a compilation of publicly available information about the project; it is not investment advice. Coin68 is not responsible for any financial decisions you make.