Locking in a 5% fixed interest rate for a $100 million, one-month loan requires only $416,000 to hedge spread risk, achieving an inherent leverage of 240 times.

Written by: Nico

Compiled by: AididiaoJP, Foresight News

Current on-chain money market protocols (such as Aave, Morpho, Kamino, and Euler) perform well in serving lenders, but they cannot serve a broader borrower base, especially institutions, due to the lack of fixed borrowing costs. Growth has stagnated because only lenders are being served.

Peer-to-peer fixed rates are a natural solution from the perspective of money market agreements, while interest rate markets offer an alternative that is 240-500 times more capital efficient.

Peer-to-peer fixed rates and the interest rate market are complementary and essential to each other's prosperity.

The common direction of all headline agreements: to provide borrowers with fixed interest rates.

Looking at the roadmaps of leading protocols at the beginning of the year can provide insights into industry trends.

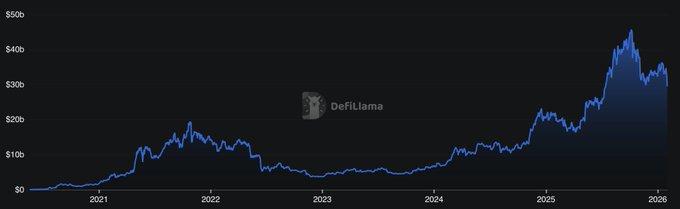

@Morpho, @kamino, and @eulerfinance are currently the leading projects in the on-chain money market, with a total value locked (TVL) of $10 billion. Looking at their roadmaps for 2026, a common theme is remarkably clear: fixed interest rates.

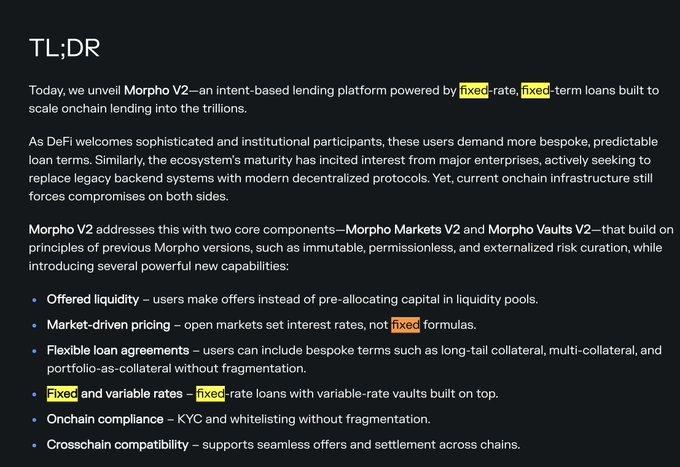

From Morpho: [1] Morpho V2 Briefing

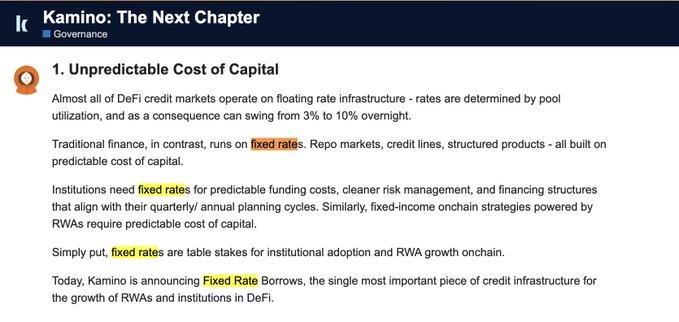

From Kamino: [2] Kamino 2026 Plan

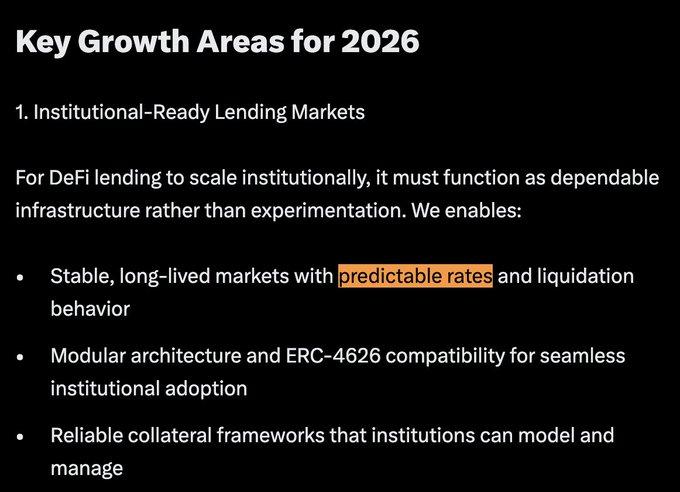

From Euler: [3] Euler 2026 Roadmap

In their 2026 announcements, the phrase "fixed rate" or "predictable rate" appeared 37 times. This is the most frequently repeated term and is listed as a priority in all roadmaps.

Other frequently used terms include: institutions, real-world assets, and credit.

What happened behind the scenes?

Early DeFi: Borrowers didn't care about fixed interest rates

Early DeFi was a paradise for builders, but for users, it could be summed up in two words: rampant speculation and frequent hacking attacks.

Frenzied Speculation (2018-2024):

DeFi is like a "Martian casino"[4], out of touch with the real world. Liquidity is driven by early retail investors and speculation, with everyone chasing triple-digit annualized yields. Nobody cares about fixed-rate borrowing.

Market volatility is extreme, liquidity comes and goes quickly, and TVL fluctuates wildly with market sentiment. There's not only little demand for fixed-rate borrowing, but even less demand for fixed-rate lending – lenders need the flexibility to withdraw funds at any time; nobody wants to lock up their money.

Frequent hacker attacks (2020-2022):

Frequent hacking incidents, including one that cost even blue-chip protocols like Compound tens of millions of dollars due to a governance vulnerability in 2021, have exacerbated institutional concerns about the risks of smart contracts. DeFi vulnerabilities during this period resulted in losses totaling billions of dollars.

As a result, institutions and the wealthy turned to off-chain channels such as Celsius, BlockFi, Genesis, and Maple Finance for borrowing to mitigate on-chain risks. At that time, there was no such thing as "using Aave directly".

A turning point has arrived: pain points become apparent, and products improve.

While existing agreements favor serving lenders, change requires either "pain points" or "progress" to drive it. Over the past year and a half, both have been addressed.

User pain point 1: Frustration with fixed-income revolving strategies

Traditional finance offers many fixed-income products, but DeFi only saw similar products emerge in 2024 through protocols like Pendle.

However, when using these fixed-income tokens in a recurring strategy, volatile borrowing rates become a fatal flaw, often eroding the expected 30-50% annualized return. Frequent strategy adjustments also incur multiple layers of fees, frequently resulting in negative returns. This suggests that fixed interest rates are essential when private lending, which relies more on certainty, is brought to the blockchain.

User pain point 2: Widening premium between off-chain fixed interest rates and on-chain floating interest rates

Lending protocol services for lenders are very successful (flexible withdrawals, no KYC, easy to program), and on-chain lending liquidity continues to grow, leading to a decrease in floating borrowing rates[5].

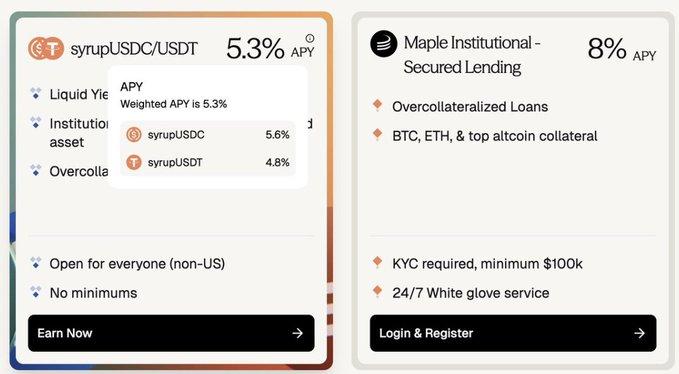

But this is not the case for institutions, who prefer fixed rates and pay a high premium for them. For example, the fixed rate of off-chain Maple Finance (about 8%) is about 180-400 basis points higher than the floating rate of on-chain Aave (about 3.5%)[6]. Institutions are paying a premium of 60-100% for "certainty".

At the same time, with more lenders than borrowers, on-chain lending revenue is compressed, and protocol growth hits its ceiling.

Product advancements: DeFi becomes the default lending layer

On the other hand, the foundation for DeFi lending has been solidified: Morpho has become a major source of revenue for Coinbase, and Aave has become the core of numerous protocol treasuries and stablecoin applications. Liquidity continues to flow in.

As TVL increases and revenue declines, various agreements are beginning to consider how to also become excellent "borrowing agreements" to serve borrowers and balance the bilateral market.

At the same time, protocol design is becoming more modular (led by Morpho, Kamino, and Euler), allowing for customized loans based on parameters such as collateral and LTV. This paves the way for new collateral such as Pendle PT, private credit, and real-world assets to be on-chain, further fueling the demand for fixed interest rates.

The way out for mature DeFi: Money Market + Interest Rate Market

Core market gaps:

- The borrower has a strong preference for a fixed interest rate (currently satisfied off-chain).

- Lenders strongly prefer floating interest rates plus instant withdrawals (currently satisfied on-chain).

Without bridging this gap, the on-chain money market will be unable to expand into the broader credit market. There are two complementary paths:

Path 1: Peer-to-peer (P2P) fixed-rate loans operated by professional managers

It's very simple: a fixed-rate loan needs an equal, locked-in fixed-rate loan to match. Clean, but requires a 1:1 liquidity match.

The problem is that retail investors are unwilling to participate directly: they want flexibility but lack the time to assess numerous markets. Therefore, only pooled funds managed by professional risk managers can participate, and even then, only partially, as they too must meet depositors' immediate withdrawal needs.

This presents a thorny problem: when withdrawals surge and vaults become illiquid due to locked funds, there is no good mechanism to regulate the situation (unlike the utilization curve in the money market). Being forced to sell fixed-rate loans at a discount in the secondary market could trigger a solvency crisis.

To address this issue, risk managers, like traditional banks, use the interest rate swap market to exchange fixed rates for floating rates, thereby hedging the risk.

Path Two: Interest Rate Market Based on Money Market (King of Capital Efficiency)

This method does not directly match borrowers and lenders. Instead, it matches borrowers with the capital willing to bear the risk of the spread between fixed and floating interest rates.

Its capital efficiency is extremely high: for example, to lock in a fixed interest rate of 5% for a $100 million, one-month loan, only about $416,000 of capital is needed to hedge the spread risk, achieving an inherent leverage of 240 times.

While there is theoretically a risk of forced liquidation for hedging positions in extreme market conditions, this has never happened in Aave/Morpho's three-year history. Through multi-layered risk control (margin, insurance fund), the risk is manageable.

The trade-off is tempting: borrowers can access funds from tried-and-tested, highly liquid markets like Aave, while enjoying capital efficiency 240-500 times higher than the P2P model. This mimics traditional finance: the $18 trillion in interest rate swaps traded daily form the cornerstone of real-world lending.

Future Outlook: Connecting Markets, Expanding Credit

If you've made it this far, it's time to look forward to an even more exciting future:

The interest rate market will become just as important as lending agreements.

It connects off-chain borrowing demand with on-chain lending supply, completing the market puzzle and becoming an indispensable part of the on-chain money market.

Interest rate markets are a pillar of institutional credit expansion.

Institutional lending (especially under-collateralized/uncollateralized lending) requires extremely high certainty regarding the cost of capital. When private lending and real-world assets are brought onto the blockchain, the interest rate market will become a crucial bridge connecting off-chain yields with on-chain capital. Follow @capmoney_ to learn about the forefront of this field.

"Borrowing for consumption" will become mainstream.

Selling assets involves taxes, so the wealthy are "borrowing to consume" rather than "selling to consume." In the future, asset issuers and exchanges will be incentivized to issue credit cards that allow users to borrow money to use their assets as collateral. A decentralized interest rate market is essential to realize this fully self-custodied process.

@EtherFi's card business grew 525% last year, with a peak daily processing volume of $1.2 million, and is leading the way in collateral-based consumer credit. Worth a try!

at last

Fixed interest rates are far from the only catalyst for growth, and the money market faces many challenges (such as off-chain collateral oracles). The road ahead is long, but the opportunity is here.

References:

[1] Morpho v2: https://morpho.org/blog/morpho-v2-liberating-the-potential-of-onchain-loans/

[2] Kamino The Next Chapter: https://gov.kamino.finance/t/kamino-the-next-chapter/864

[3] Euler's 2026 Roadmap: https://x.com/0xJHan/status/2014754594253848955

[4] Casino on Mars: https://www.paradigm.xyz/2023/09/casino-on-mars

[5] DefiLlama: Aave TVL https://defillama.com/protocol/aave

[6] Maple Finance Yield: https://maple.finance/app