This article is machine translated

Show original

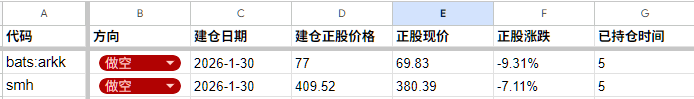

[US Stocks 2.4] Positions at $nvo and $pypl have been closed. Currently, I have four positions, as shown in the screenshot; the green ones are long, and the red ones are short. Regarding the market trend, I believe it's still bearish, but given yesterday's significant losses, I'm going to be more conservative and take it slow. Currently, my long positions are approximately 10%, short positions 15%, and cash 75%.

Currently long$len This trade was quite profitable. I calmly established this position after yesterday's big loss, haha, and made a good profit today. I also long positions in $gis $fisv $igv; and short in$smh $arkk. Currently, I long, 25% short, and 40% cash. Yesterday was a huge blow. My previous position sizes were very reasonable; I had nearly 1/3 short the market, SMH, and Arkk, which would have been very profitable if I had held them. But yesterday I closed most of them.

$nvo I started holding the position on November 7th, entering at a price of 45.39 for the underlying stock, and closed at 47.94 today. During this period, I used options with an average leverage of 5x, frequently adding to and reducing my position. Holding the position for 90 days, I ultimately made a 50% profit. However, $pypl I held the position for 25 days, incurring a 37% loss. Because the position size was slightly larger, these two long trades resulted in a 1.5% loss in my total account. It was a bit of a pity that what should have been a large profit ended in a small loss.

I opened positions on the 30th, short at 77 yuan ($arkk) and 409 yuan ($smh). Now Arkk is at 70 yuan and SMH is at 380 yuan... I didn't take profit on either of these trades, and even added to them... A Twitter user just said I never "chase after a winning position," but that's not true. Actually, I mostly use an "inverted pyramid" approach to adding to positions—for profitable positions, I not only "chase after" them, but often double down on them.

I've figured it out! Whenever I'm making money, my tweets are incredibly quiet because most of my followers have the opposite portfolio holdings. When I profit, they lose. No wonder they call me the "contrarian indicator"—I'm pointing the opposite of what they're doing! 🤣🤣🤣

I remain bullish $nvo and long again. I believe the market has underestimated the power of oral weight-loss drugs—even with competitors. I'm using Leaps, and my current position is small, but I plan to double my position if the price drops by more than 5%. Only once. In short, I plan to hold it long-term (about a quarter).

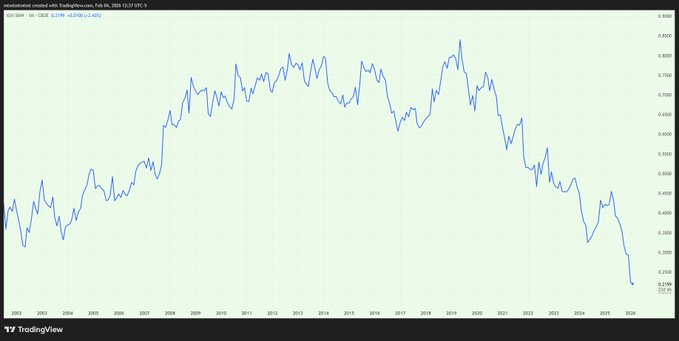

Today I'm going long on software $igv The logic here is: the software/hardware ratio (IGV/SMH) has reached its lowest point in over 20 years—this chart shows 20 years of historical data! So I 'long$igv and short$smh This is a paired trade, betting on the mean reversion of the software/hardware ratio.

Oh, I forgot to mention I bought back the short on South Korea that I closed yesterday $ewy. I'm currently short three stocks: $smh $ewy $arkk. This is actually short chips (memory), Bitcoin, and Tesla.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content