The report "The Rise of Prediction Markets: From Edge Game to Mainstream Financial Infrastructure," jointly released by Keyrock and Dune, systematically elaborates on the current state of prediction markets, their core value, and future trends.

Article by: Starbase Crew

Source: Starbase Accelerator

Report Content Overview

The book "Prediction Markets: The Next Frontier of Financial Markets," jointly released by Keyrock, a leading global market maker, and Dune, an on-chain data platform, systematically elevates "prediction markets" from a niche experiment in the crypto world to a strategic level as a next-generation financial infrastructure.

This report, based on real on-chain and centralized platform transaction data (covering major platforms such as Polymarket, Kalshi, and Crypto.com), reveals for the first time in quantitative terms:

The prediction market is experiencing an exponential boom—since the beginning of 2024, monthly nominal trading volume has surged from less than $100 million to over $13 billion, a 130-fold increase.

Starbase will break down the core insights for you from the following four dimensions to help you grasp this paradigm shift of "information as an asset":

Leap in scale: the prediction market has transcended its "gambling" attributes and become a liquidity pool comparable to traditional derivatives;

Institutional entry: From hedging IPO risks to predicting macroeconomic turning points, market forecasting is being incorporated into the professional risk control toolbox;

Outperforming in accuracy: In complex events such as politics and economics, its price signals are significantly better than those of public opinion polls and expert judgments;

Four key drivers—liquidity, user retention, regulatory compliance, and ecosystem integration—will jointly determine the outcome of the next phase.

Original research report: https://dune.com/prediction-markets-report

Market Size and Structure: Non-sports events drive growth, user behavior becomes more rational

Although prediction markets initially focused on political and sporting events, the latest data shows that their use cases are rapidly shifting towards high-value real-world risks.

In 2025, trading volume for economic events increased tenfold year-on-year, while trading volume for technology and science events increased seventeenfold, making them the two fastest-growing sectors. Meanwhile, open interest in economic events increased sevenfold, and in social and cultural events it increased sixfold, reflecting that users are not only trading frequently but also have a stronger willingness to hold positions.

In terms of platform distribution, structural differences have become more prominent:

On Kalshi, the combined open interest in the three major categories of politics, elections, and economics is 2.5 times that of the sports category;

In Polymarket, political transactions were projected to exceed sports transactions by 400% by 2025.

More noteworthy is the user's risk appetite: despite the large number of long-tail "black swan" events (accounting for 31% of the total market), they only attract 3% of the trading volume; conversely, high-probability events (probability of occurrence >80%), while only accounting for 14% of the total market, contribute 35% of the trading volume. This indicates that mainstream users are not chasing high-odds speculation, but rather using the prediction market as a risk management tool for low-volatility, high-certainty events.

Predictive effectiveness verification: Price signals significantly outperform traditional methods

The report validated the information efficiency of the forecasting market using multiple statistical indicators. Data shows that Polymarket's final prediction accuracy for event outcomes remained stable between 90% and 95%, and as the event approached and liquidity increased, prices continued to converge, with the error significantly narrowing.

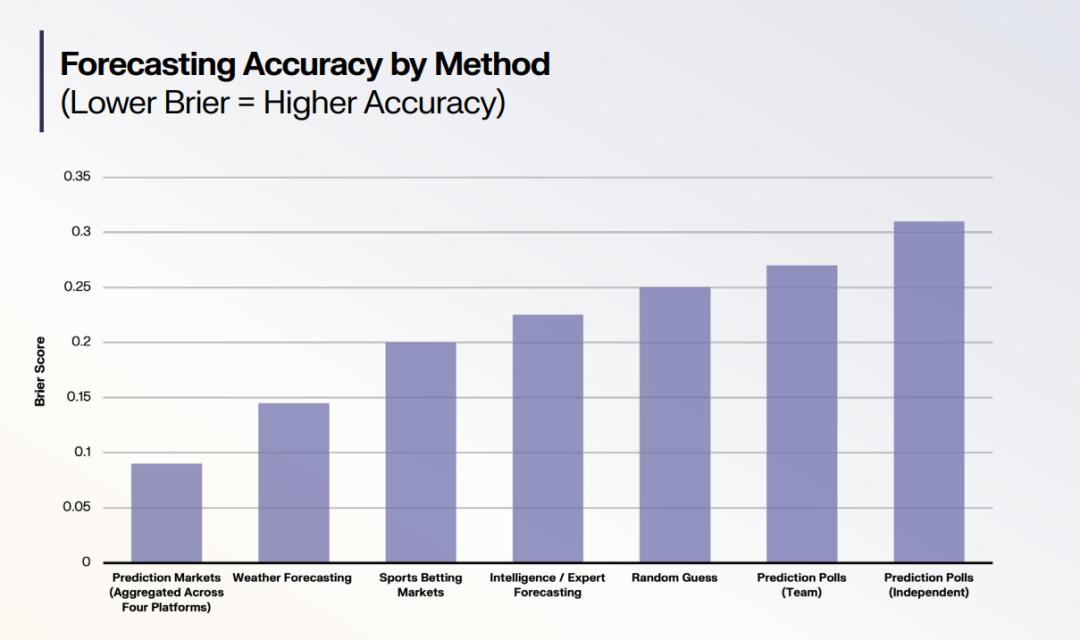

On the Brier Score (lower is better), which measures the accuracy of predictions, the average for prediction markets remains around 0.09. In contrast, the typical Brier Score for US election polls is 0.15–0.20, and expert judgments tend to perform worse in complex geopolitical events.

Evolution of Participants: From Retail Game Theory to Institutional-Level Risk Management Tools

1. Institutional investors: Treat the "event itself" as a hedging target.

The report emphasizes that prediction markets are being viewed by institutions as a "new type of option"—the underlying asset is not asset price, but whether an event will occur. For example:

A private equity fund established a contrarian position before a technology company's IPO by predicting the "probability of the share price falling below the issue price on the first day" in the market.

Crypto projects use market testing and community consensus to value their tokens before a token public offering (TGE).

Macro hedge funds directly trade events such as "the Federal Reserve raising interest rates by 75 basis points" or "the EU passing a digital bill," avoiding the noise interference of proxy variables.

This ability to "hedge against events rather than their proxies" makes prediction markets a complementary tool that traditional derivatives cannot replace.

2. Web3 Protocols and Enterprises: Embedded Governance and Decision Support

DAO and protocol teams have begun using prediction markets for governance simulations and roadmap validation. For example, before officially launching a governance vote, a "probability of proposal approval" market is set up; if the probability is below a threshold, the process is temporarily suspended to avoid wasting governance resources. Some startups are even using it for internal KPI predictions, such as product launch dates or user growth target achievement rates.

3. Retail users: A new financial group with high retention and high rationality.

Dune's comparative analysis of 275 crypto protocols shows that Polymarket's 30-day user retention rate surpasses that of 85% of the other projects. This data indicates that prediction markets have developed stable user habits, rather than relying on short-term traffic generated by trending events. Combined with their trading preferences (concentrated on high-probability events), it can be concluded that this group possesses strong financial literacy and risk management awareness.

Key to the Next Stage of Development: Four Structural Drivers

The reporting system identifies four core variables that determine whether the forecasting market can achieve sustainable expansion:

First, liquidity needs to be deepened. Currently, the $13 billion monthly trading volume is highly concentrated on top events, and insufficient depth in the long-tail market leads to high slippage. In the future, it is necessary to introduce professional market makers (such as Keyrock itself), automated liquidity protocols, and cross-platform order aggregation mechanisms.

Second, user retention mechanisms. Although current retention performance is excellent, it largely depends on cyclical events such as elections and policy announcements. To achieve daily use, deep integration with wallets (such as MetaMask), news platforms (such as Flipside), and DeFi protocols is necessary, embedding it into the user workflow.

Third, regulatory compliance pathways. Kalshi has received approval from the US CFTC, and Polymarket is accelerating its KYC and AML framework implementation. The report points out that the ability to access compliant stablecoin settlements (such as USDC and PYUSD) will be a key hurdle for platforms to enter mainstream financial channels.

Fourth, the depth of ecosystem integration. Currently, the prediction market has not yet entered mainstream financial data terminals. If it can become a native data source for Bloomberg, TradingView, or CoinGecko, its influence will expand from the crypto community to global institutional decision-making levels.

Strategic Outlook: Prediction markets will become the underlying protocol for "information pricing".

In summary, this report conveys a clear conclusion: the prediction market has moved beyond its early experimental stage and is systematically evolving into a native financial layer for pricing information risk.

Its core value lies not in reconstructing payment or settlement processes, but in transforming real-world uncertainties into measurable, composable, and hedgeable state variables on the blockchain. By encoding event outcomes into standardized contracts, the prediction market achieves an explicit expression of the "implicit risk exposure" in traditional finance—this not only fills the gap in the existing derivatives system's coverage of discontinuous and nonlinear events, but also constructs a new consensus-driven price discovery mechanism.

For Web3 ecosystem participants, this evolution means that future protocol designs need to embed "event awareness capabilities," asset management needs to incorporate "belief risk exposure," and infrastructure construction should support the paradigm shift from asset pricing to state pricing. Prediction markets will no longer be just end-user applications, but will become a key semantic layer connecting off-chain reality and on-chain financial logic.