Author: Shisi Jun

Original link: https://mp.weixin.qq.com/s/g0C9dZjMyq9RaM5rwZbRUg

Disclaimer: This article is a reprint. Readers can obtain more information through the original link. If the author has any objection to the reprint format, please contact us and we will modify it according to the author's request. This reprint is for information sharing only and does not constitute any investment advice, nor does it represent Wu Blockchain views or positions.

On February 6, 2026, the People's Bank of China, together with eight other departments, issued document No. 42 of 2026. The market has already provided many interpretations of this document. This article aims to provide a more in-depth analysis by combining RWA with the current state of the on-chain market.

1. How to understand Document No. 42?

In my view, the original text, when considered in conjunction with the attached document "Regulatory Guidelines on the Issuance of Asset-Backed Securities Tokens Overseas by Domestic Assets," reveals a clear understanding. The core point is that because Document No. 42 devotes considerable space to defining and regulating "Real-World Asset Tokenization" (RWA), this effectively signifies the regulators' formal recognition of RWA as a business model and provides a path for compliant application and registration.

The key is three pieces of information, which I will present in the original text and then interpret in terms of context.

First, RWA was accurately characterized:

"Real-world asset tokenization refers to the activity of using cryptographic technology and distributed ledger or similar technologies to convert the ownership and income rights of assets into tokens or other rights and debt certificates with token characteristics, and then issuing and trading them."

Having defined it, how do we apply it? Therefore, the following sentence continues:

"Except for relevant business activities carried out based on specific financial infrastructure with the consent of the competent business authority in accordance with laws and regulations."

So who exactly can participate? Therefore, there are clear procedures for applying for and using RWA assets:

The domestic entity that needs to actually control the underlying assets must file with the China Securities Regulatory Commission (CSRC) and submit a filing report, a complete set of overseas issuance documents, and other materials, fully explaining the information of the domestic filing entity, the underlying assets, the token issuance plan, and other relevant details.

Therefore, in my opinion, the combination of the two clearly separates RWA assets from the originally strictly cracked virtual currencies, and the two are not compatible with the same management approach.

2. Evolution of RWA Global Standards

With the regulatory framework established in mainland China, how is the global RWA market developing now? Once regulatory issues are alleviated, the subsequent applications become a pressing practical problem that needs to be addressed.

In fact, the current market has long been in an era of chaotic battles over token standards.

This complexity has created a dilemma for industry-level compatible RWAs, so let's take a closer look at the current mainstream RWA token application standards.

This article will begin with HK ABT (asset-backed token) in 2022, then move on to ERC-3525 and ERC-3475 surrounding bonds, then to AAVE's Atoken, stETH, and AMPL in the DeFi era, and finally to how the latest leading on-chain stock platforms Ondo and xStock are addressing the characteristics of stock tokenization.

2.1 HK and ABT

The Hong Kong government’s Policy Declaration on the Development of Virtual Assets in Hong Kong, issued on October 31, 2022, highlighted asset-backed tokens (ABTs).

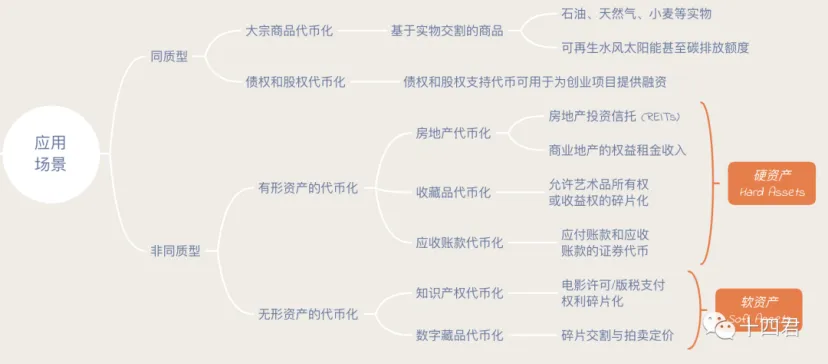

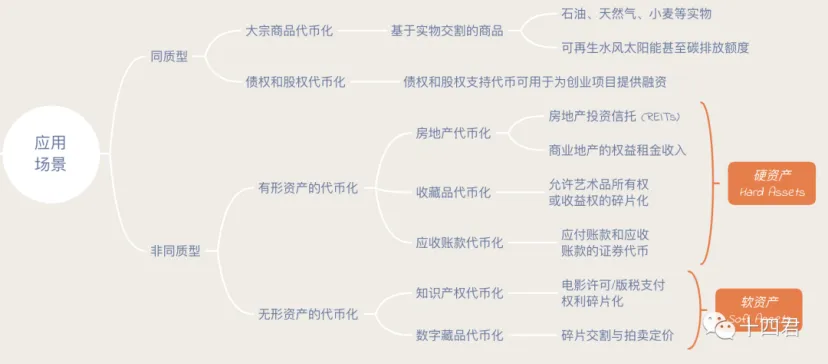

Generally speaking, tokens are divided into four main types, distinguished by their purpose and source of value.

In fact, the thinking behind the current mainland documents and the practices that Hong Kong has carried out are a continuation of the same approach, both of which inevitably involve off-chain physical assets or rights as the value target.

In this way, through compliant tokenization, the on-chain characteristics of assets gain an advantage:

Fragmentation: refers to dividing property rights into several smaller pieces for the purpose of sale, making them easier to trade, price, and circulate.

Liquidity: Liquidity is defined by the speed at which assets can be converted into cash, and is shared via on-chain broadcasting of the order book.

Cost-effectiveness: In blockchain-based smart contract transactions, the costs of these external third parties will be eliminated or significantly reduced.

Automation: Blockchain-based smart contracts eliminate the need for these manual interactions, providing a trustworthy technological foundation.

Transparency: One of the most significant features of on-chain transactions is the immutable record-keeping.

From the audience's perspective

For institutions, splitting and converting large orders brings efficiency and cost benefits through fragmented liquidity.

For users, having a trustworthy environment with transparency and automation is crucial to protecting their rights.

The most intuitive and practical applications right now are stocks and bonds, because both perfectly fit the aforementioned advantages of liquidity, automation, and fragmentation.

3. Bond Scenario Standards: ERC-3525 and ERC-3475

This type of asset saw significant growth before and after the HK ABT, with ERC-3525 and ERC-3475 becoming industry standards.

ERC-3525 focuses on the management of semi-fungible tokens, improving the numerical aspects of asset portfolio splitting, and emphasizing the on-chaining of traditional financial assets.

ERC-3475 focuses on the definition of semi-fungible tokens, provides a more standardized definition for contracts with low standardization, and emphasizes the on-chaining of traditional commercial contracts.

Objectively speaking, neither standard is actually widely used because they were developed before business applications arose, rather than being based on existing business needs. Therefore, their actual adoption has been declining (far less than Atoken and stEth, which will be discussed later).

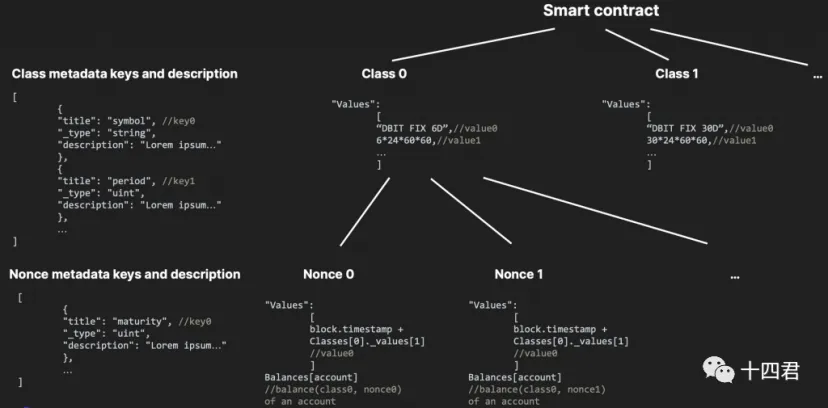

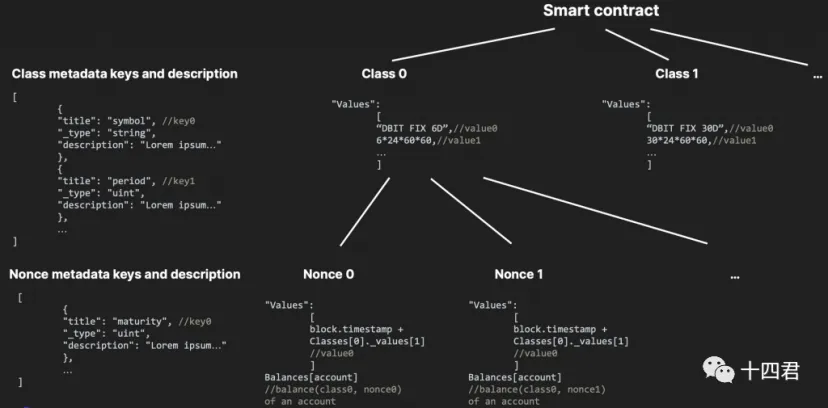

In my opinion, this is because the original intention of such design standards is to be comprehensive and all-encompassing. For example, ERC-3475 (as shown in the figure below) is a representative of all-encompassing standards, which directly leads to a high barrier to entry for users to understand it and for apps to adapt to it.

Ultimately, they took too big a step, writing about everything was essentially the same as not writing anything at all, so it's no surprise that there were no applications in the market.

For a detailed analysis, see: A Review of Five Token Standards: Are They Sufficient to Support Hong Kong's Web3 Development Pilot Program?

4. Bond Application Scenarios: AToken & seEth

Instead of standardizing first and then applying types, let's look at a model of applying first and then standardizing.

4.1 Real-time compound interest model: AAve's Atoken

Aave is a leading DeFi infrastructure in the web3 industry, providing on-chain asset staking and lending services for interest income. Atoken is the staking certificate, with the following core functions:

Proof of deposit: Holding aToken is equivalent to a user owning a corresponding amount of assets in the Aave protocol, and these assets automatically accrue interest over time.

Lending Mechanism: aToken can be used to assess a user's deposit amount and determine the loan amount a user can borrow.

Automatic interest distribution: The number of aTokens will automatically increase based on the current deposit interest rate.

Transferability and liquidity: Users can transfer or stake aToken in other protocols to earn more yield or use it in other DeFi products.

From this perspective, each of these points represents a path that RWA will take in the future.

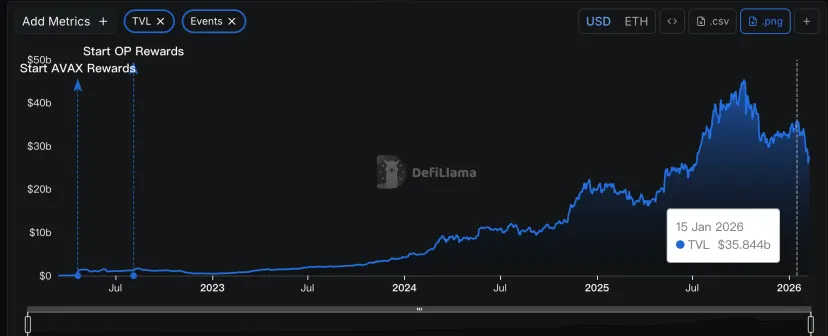

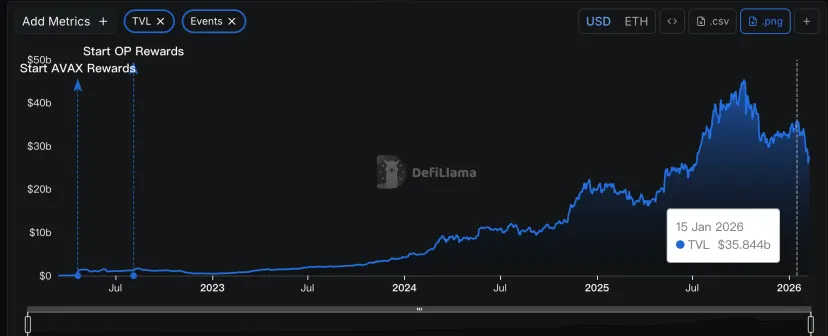

Looking at its current market situation, it is also thriving, with Atoken's total assets reaching around 30 billion US dollars.

Why is Atoken so successful?

Clearly, a growth rate of almost 100% every year can be considered a model of success.

Ultimately, it's because Atoken is already very well-suited to the existing market. After all, it originated from Aave, and they understand very well that adaptability is a key path for development in the blockchain market. The two standards mentioned above are ultimately stuck on adaptability, as existing asset dashboards and wallets are not very good at integrating this type of asset.

Adaptation is not a simple term, because there is a key issue to be addressed: if on-chain assets cannot generate interest, then their practical significance is greatly diminished.

But if interest is to be generated, how should this interest be given to the user?

After all, the pledging period varies for each person, and the pledging interest rate also varies for each period. The market demand for different assets is different, and the corresponding lending spread is also different.

If the project simply transfers interest to users over a period of time, the project owner's costs and management complexity will obviously increase significantly, and ultimately the cost will be borne by the users themselves.

Some people say that this is an on-chain performance issue, so they have created new high-performance public chains to rival the server performance of Web2, but they are then stuck on the cost of user migration.

aave's answer is to hide interest within users' daily transactions.

AToken essentially uses a scaled balance mechanism to calculate the user's actual balance:

Liquidity Index = Initial Index × (1 + Interest Rate × Time)

This logic causes interest to be automatically calculated and accumulated during transfers (whether sending or receiving), triggering new minting events during the transfer to increase the amount of money issued.

For the project team, this means reducing one dividend payment transaction, and the user's interest is seen without their knowledge. Even if it is not seen, it can be calculated in the next transaction, so there will be no loss.

This ingenious design, using only a few lines of code, demonstrates a strong native-like mindset.

Moreover, this approach paved the way for the inheritance and evolution of subsequent on-chain asset standards such as seEth, ondo, and xStock.

4.2 Rebase Model: lido's seETH

seEth, building upon its previous interest rates, simplifies the logic of pledging and withdrawals from accumulating interest plus time to a single share.

stETH = Amount of ETH staked by the user * (Total protocol assets / Total internal share)

You might find it strange that he doesn't receive interest. It's all about earning interest through pledging. If someone else deposits for a year and I deposit for a day, shouldn't the amount be different?

This is due to Lido's daily automatic rebase mechanism, for example...

If I bought 1 ETH a year ago and added it to a total of 100 ETH in staking, my share would be 1%.

Lido receives staking rewards daily from the Ethereum Beacon Chain and then performs a rebase on the protocol.

So when I withdraw the money a year later, I will naturally receive 4%.

If I were to purchase this 1% share on the last day, it would be based on a share that has accumulated over 364 days and is almost at 104% of the cost, meaning I would only benefit from one rebase.

Why was it designed this way?

Its greatest advantage lies in making stETH earnings automatically credited daily, requiring neither waiting nor manual withdrawal.

The previous Atoken required a transaction to cash out, while this one can automatically update the balance daily, making it easily compatible with various wallets.

Only then can users see the increase in interest on their account, which aligns with our usual concept of saving money, with interest automatically credited to their account every day, giving them peace of mind.

Ultimately, the difference between the two lies in the context.

Aave is a lending platform with highly volatile interest rates in real time. During periods of high interest rates, a single day's interest can be equivalent to a month's interest. In contrast, Lido, which offers fixed-income loans, provides a stable and smoother rate, and is less concerned about daily interest, thus allowing for further optimization of the user experience.

Are these two standard methods for depositing tokens in the RWA era?

I believe neither is suitable, but they can be used as a reference. Let's look at today's final protagonist: the on-chain stock model.

5. On-chain stock RWA scenario

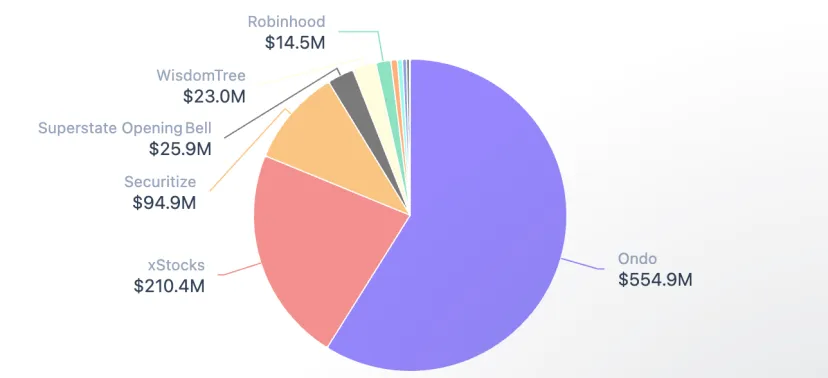

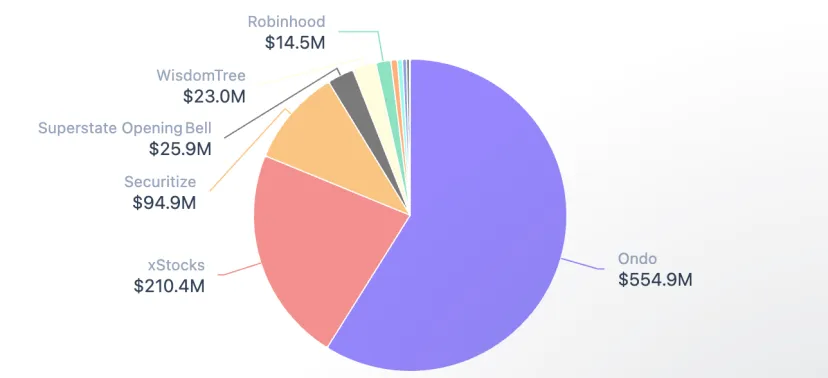

Although it is not large in the overall RWA market (900M vs 27B), due to the characteristics of stocks, it is one of the scenarios with the highest trading liquidity and the most promising on-chain applications.

The main players here are: Ondo and xStock.

We can see that over the past six months, some of the top DEX and wallet platforms have been investing in this area. Objectively speaking, these leading platforms seem to have a surprisingly consistent view on future trends.

1. On July 1, 2025, Jupipter supported xStock trading and began large-scale promotion.

2. On September 25, 2025, Solana officially launched a new RWA Twitter account.

3. On January 22, 2026, Jupiter partnered with Ondo Finance to launch over 200 tokenized stocks.

4. On January 24, 2026, Binance Wallet added support for Ondo asset trading in professional mode.

5. On February 3, 2026, MetaMask launched tokenized US stocks and ETFs, stating that the market was shifting to on-chain.

Their rebase model is actually based on a share, which is a rebase mechanism of "on-chain share + multiplier scaling".

On the Solana chain, this mechanism is an extension of its mainstream token 2022 standard. Each token can be set by the project team with a multiplier , and the balance that the user receives is called the raw amount, which means share.

Then, if the project team performs stock splits, dividend distributions, or other similar scenarios, they will dynamically adjust the Multiplier parameter in the token to modify the displayed amount multiplier.

This creates a dividing line: users using wallets that don't support this parameter will feel something is wrong with their assets. Those that do support it will see the UI amount, the amount displayed on the client.

6. Summary and Reflection

The previous article, which was already over four thousand words long, reviewed the leading players and evolution paths of mainstream on-chain asset tokenization and real-world asset tokenization.

Various localized considerations have been mentioned in each module, so now we need to return to the core issue of "cool-headed thinking".

Because if you look at it over a longer period of time, RWA has actually been around for almost 10 years.

1. Early exploration, 2016-2019: The experimental stage of asset on-chaining mainly involved stablecoins.

2. Early stage of the institution, 2020-2022: RWA entered the DeFi lending field, specifically with BN/FTX tokens attempting Tokenized Stocks, which were shut down shortly afterward.

3. Compliance Phase, 2023-Present: Compliance has become clearer/some RWA assets have expanded rapidly (stablecoins, US Treasury bonds, etc.), and new asset types and platforms have shown promise.

Therefore, in my opinion, the mainland's characterization of RWA is objectively a positive development, but not entirely positive . It can even be described as a belated notification. Moreover, Hong Kong once introduced a similar system, ABT, but did it take off?

Clearly, compared to the situation in the other hemisphere, there hasn't been much improvement, which is closely related to Hong Kong's extremely cautious management of licenses. Whether to proceed with sweeping changes from the outset or to gradually test and constrain the market, the choice between the two will likely scare away many aspiring platform providers.

The new system is more open, but what is open may not necessarily be what users actually want to use or what the market needs.

We can see that Aave's Atoken is very successful because it addresses the issue of how to use idle on-chain assets, allowing users to lend them out.

seETH is also great because it solves the problem of opening up the path to POS (Proof-of-Stake). Although there is a risk of Lido accumulating too much amount (stake), it solidly provides stable returns for staking. Similarly, you can read my article on Jito, which is another staking model.

They all care deeply about user experience and are adept at handling every detail of compatibility and project costs.

Therefore, the issuance itself is not the goal; the value lies in applying on-chain liquidity, fragmentation, transparency, and automation to the token.

It's not about defining a perfect standard right away, but about respecting the rules and consensus, and leveraging existing strengths step by step.

Just like regular stocks, exchanges don't operate 24/7, but on-chain exchanges do.

Gold in different markets has its own opening hours, but not on the blockchain.

This time gap is where the true value of the blockchain lies, because it solves the problem of value discovery in markets without transactions. Compared to pre-market trading, it is more sensitive; compared to cross-exchange price discrepancies, it has less wear and tear. Moreover, global liquidity represents a completely different perspective on value discovery. In the future, company pricing may not be based on the current on-chain reliance on the NYSE, but rather the NYSE might first check the on-chain data before listing.

Original link: https://mp.weixin.qq.com/s/g0C9dZjMyq9RaM5rwZbRUg

Disclaimer: This article is a reprint. Readers can obtain more information through the original link. If the author has any objection to the reprint format, please contact us and we will modify it according to the author's request. This reprint is for information sharing only and does not constitute any investment advice, nor does it represent Wu Blockchain views or positions.

On February 6, 2026, the People's Bank of China, together with eight other departments, issued document No. 42 of 2026. The market has already provided many interpretations of this document. This article aims to provide a more in-depth analysis by combining RWA with the current state of the on-chain market.

1. How to understand Document No. 42?

In my view, the original text, when considered in conjunction with the attached document "Regulatory Guidelines on the Issuance of Asset-Backed Securities Tokens Overseas by Domestic Assets," reveals a clear understanding. The core point is that because Document No. 42 devotes considerable space to defining and regulating "Real-World Asset Tokenization" (RWA), this effectively signifies the regulators' formal recognition of RWA as a business model and provides a path for compliant application and registration.

The key is three pieces of information, which I will present in the original text and then interpret in terms of context.

First, RWA was accurately characterized:

"Real-world asset tokenization refers to the activity of using cryptographic technology and distributed ledger or similar technologies to convert the ownership and income rights of assets into tokens or other rights and debt certificates with token characteristics, and then issuing and trading them."

Having defined it, how do we apply it? Therefore, the following sentence continues:

"Except for relevant business activities carried out based on specific financial infrastructure with the consent of the competent business authority in accordance with laws and regulations."

So who exactly can participate? Therefore, there are clear procedures for applying for and using RWA assets:

The domestic entity that needs to actually control the underlying assets must file with the China Securities Regulatory Commission (CSRC) and submit a filing report, a complete set of overseas issuance documents, and other materials, fully explaining the information of the domestic filing entity, the underlying assets, the token issuance plan, and other relevant details.

Therefore, in my opinion, the combination of the two clearly separates RWA assets from the originally strictly cracked virtual currencies, and the two are not compatible with the same management approach.

2. Evolution of RWA Global Standards

With the regulatory framework established in mainland China, how is the global RWA market developing now? Once regulatory issues are alleviated, the subsequent applications become a pressing practical problem that needs to be addressed.

In fact, the current market has long been in an era of chaotic battles over token standards.

This complexity has created a dilemma for industry-level compatible RWAs, so let's take a closer look at the current mainstream RWA token application standards.

This article will begin with HK ABT (asset-backed token) in 2022, then move on to ERC-3525 and ERC-3475 surrounding bonds, then to AAVE's Atoken, stETH, and AMPL in the DeFi era, and finally to how the latest leading on-chain stock platforms Ondo and xStock are addressing the characteristics of stock tokenization.

2.1 HK and ABT

The Hong Kong government’s Policy Declaration on the Development of Virtual Assets in Hong Kong, issued on October 31, 2022, highlighted asset-backed tokens (ABTs).

Generally speaking, tokens are divided into four main types, distinguished by their purpose and source of value.

In fact, the thinking behind the current mainland documents and the practices that Hong Kong has carried out are a continuation of the same approach, both of which inevitably involve off-chain physical assets or rights as the value target.

In this way, through compliant tokenization, the on-chain characteristics of assets gain an advantage:

Fragmentation: refers to dividing property rights into several smaller pieces for the purpose of sale, making them easier to trade, price, and circulate.

Liquidity: Liquidity is defined by the speed at which assets can be converted into cash, and is shared via on-chain broadcasting of the order book.

Cost-effectiveness: In blockchain-based smart contract transactions, the costs of these external third parties will be eliminated or significantly reduced.

Automation: Blockchain-based smart contracts eliminate the need for these manual interactions, providing a trustworthy technological foundation.

Transparency: One of the most significant features of on-chain transactions is the immutable record-keeping.

From the audience's perspective

For institutions, splitting and converting large orders brings efficiency and cost benefits through fragmented liquidity.

For users, having a trustworthy environment with transparency and automation is crucial to protecting their rights.

The most intuitive and practical applications right now are stocks and bonds, because both perfectly fit the aforementioned advantages of liquidity, automation, and fragmentation.

3. Bond Scenario Standards: ERC-3525 and ERC-3475

This type of asset saw significant growth before and after the HK ABT, with ERC-3525 and ERC-3475 becoming industry standards.

ERC-3525 focuses on the management of semi-fungible tokens, improving the numerical aspects of asset portfolio splitting, and emphasizing the on-chaining of traditional financial assets.

ERC-3475 focuses on the definition of semi-fungible tokens, provides a more standardized definition for contracts with low standardization, and emphasizes the on-chaining of traditional commercial contracts.

Objectively speaking, neither standard is actually widely used because they were developed before business applications arose, rather than being based on existing business needs. Therefore, their actual adoption has been declining (far less than Atoken and stEth, which will be discussed later).

In my opinion, this is because the original intention of such design standards is to be comprehensive and all-encompassing. For example, ERC-3475 (as shown in the figure below) is a representative of all-encompassing standards, which directly leads to a high barrier to entry for users to understand it and for apps to adapt to it.

Ultimately, they took too big a step, writing about everything was essentially the same as not writing anything at all, so it's no surprise that there were no applications in the market.

For a detailed analysis, see: A Review of Five Token Standards: Are They Sufficient to Support Hong Kong's Web3 Development Pilot Program?

4. Bond Application Scenarios: AToken & seEth

Instead of standardizing first and then applying types, let's look at a model of applying first and then standardizing.

4.1 Real-time compound interest model: AAve's Atoken

Aave is a leading DeFi infrastructure in the web3 industry, providing on-chain asset staking and lending services for interest income. Atoken is the staking certificate, with the following core functions:

Proof of deposit: Holding aToken is equivalent to a user owning a corresponding amount of assets in the Aave protocol, and these assets automatically accrue interest over time.

Lending Mechanism: aToken can be used to assess a user's deposit amount and determine the loan amount a user can borrow.

Automatic interest distribution: The number of aTokens will automatically increase based on the current deposit interest rate.

Transferability and liquidity: Users can transfer or stake aToken in other protocols to earn more yield or use it in other DeFi products.

From this perspective, each of these points represents a path that RWA will take in the future.

Looking at its current market situation, it is also thriving, with Atoken's total assets reaching around 30 billion US dollars.

Why is Atoken so successful?

Clearly, a growth rate of almost 100% every year can be considered a model of success.

Ultimately, it's because Atoken is already very well-suited to the existing market. After all, it originated from Aave, and they understand very well that adaptability is a key path for development in the blockchain market. The two standards mentioned above are ultimately stuck on adaptability, as existing asset dashboards and wallets are not very good at integrating this type of asset.

Adaptation is not a simple term, because there is a key issue to be addressed: if on-chain assets cannot generate interest, then their practical significance is greatly diminished.

But if interest is to be generated, how should this interest be given to the user?

After all, the pledging period varies for each person, and the pledging interest rate also varies for each period. The market demand for different assets is different, and the corresponding lending spread is also different.

If the project simply transfers interest to users over a period of time, the project owner's costs and management complexity will obviously increase significantly, and ultimately the cost will be borne by the users themselves.

Some people say that this is an on-chain performance issue, so they have created new high-performance public chains to rival the server performance of Web2, but they are then stuck on the cost of user migration.

aave's answer is to hide interest within users' daily transactions.

AToken essentially uses a scaled balance mechanism to calculate the user's actual balance:

Liquidity Index = Initial Index × (1 + Interest Rate × Time)

This logic causes interest to be automatically calculated and accumulated during transfers (whether sending or receiving), triggering new minting events during the transfer to increase the amount of money issued.

For the project team, this means reducing one dividend payment transaction, and the user's interest is seen without their knowledge. Even if it is not seen, it can be calculated in the next transaction, so there will be no loss.

This ingenious design, using only a few lines of code, demonstrates a strong native-like mindset.

Moreover, this approach paved the way for the inheritance and evolution of subsequent on-chain asset standards such as seEth, ondo, and xStock.

4.2 Rebase Model: lido's seETH

seEth, building upon its previous interest rates, simplifies the logic of pledging and withdrawals from accumulating interest plus time to a single share.

stETH = Amount of ETH staked by the user * (Total protocol assets / Total internal share)

You might find it strange that he doesn't receive interest. It's all about earning interest through pledging. If someone else deposits for a year and I deposit for a day, shouldn't the amount be different?

This is due to Lido's daily automatic rebase mechanism, for example...

If I bought 1 ETH a year ago and added it to a total of 100 ETH in staking, my share would be 1%.

Lido receives staking rewards daily from the Ethereum Beacon Chain and then performs a rebase on the protocol.

So when I withdraw the money a year later, I will naturally receive 4%.

If I were to purchase this 1% share on the last day, it would be based on a share that has accumulated over 364 days and is almost at 104% of the cost, meaning I would only benefit from one rebase.

Why was it designed this way?

Its greatest advantage lies in making stETH earnings automatically credited daily, requiring neither waiting nor manual withdrawal.

The previous Atoken required a transaction to cash out, while this one can automatically update the balance daily, making it easily compatible with various wallets.

Only then can users see the increase in interest on their account, which aligns with our usual concept of saving money, with interest automatically credited to their account every day, giving them peace of mind.

Ultimately, the difference between the two lies in the context.

Aave is a lending platform with highly volatile interest rates in real time. During periods of high interest rates, a single day's interest can be equivalent to a month's interest. In contrast, Lido, which offers fixed-income loans, provides a stable and smoother rate, and is less concerned about daily interest, thus allowing for further optimization of the user experience.

Are these two standard methods for depositing tokens in the RWA era?

I believe neither is suitable, but they can be used as a reference. Let's look at today's final protagonist: the on-chain stock model.

5. On-chain stock RWA scenario

Although it is not large in the overall RWA market (900M vs 27B), due to the characteristics of stocks, it is one of the scenarios with the highest trading liquidity and the most promising on-chain applications.

The main players here are: Ondo and xStock.

We can see that over the past six months, some of the top DEX and wallet platforms have been investing in this area. Objectively speaking, these leading platforms seem to have a surprisingly consistent view on future trends.

1. On July 1, 2025, Jupipter supported xStock trading and began large-scale promotion.

2. On September 25, 2025, Solana officially launched a new RWA Twitter account.

3. On January 22, 2026, Jupiter partnered with Ondo Finance to launch over 200 tokenized stocks.

4. On January 24, 2026, Binance Wallet added support for Ondo asset trading in professional mode.

5. On February 3, 2026, MetaMask launched tokenized US stocks and ETFs, stating that the market was shifting to on-chain.

Their rebase model is actually based on a share, which is a rebase mechanism of "on-chain share + multiplier scaling".

On the Solana chain, this mechanism is an extension of its mainstream token 2022 standard. Each token can be set by the project team with a multiplier , and the balance that the user receives is called the raw amount, which means share.

Then, if the project team performs stock splits, dividend distributions, or other similar scenarios, they will dynamically adjust the Multiplier parameter in the token to modify the displayed amount multiplier.

This creates a dividing line: users using wallets that don't support this parameter will feel something is wrong with their assets. Those that do support it will see the UI amount, the amount displayed on the client.

6. Summary and Reflection

The previous article, which was already over four thousand words long, reviewed the leading players and evolution paths of mainstream on-chain asset tokenization and real-world asset tokenization.

Various localized considerations have been mentioned in each module, so now we need to return to the core issue of "cool-headed thinking".

Because if you look at it over a longer period of time, RWA has actually been around for almost 10 years.

1. Early exploration, 2016-2019: The experimental stage of asset on-chaining mainly involved stablecoins.

2. Early stage of the institution, 2020-2022: RWA entered the DeFi lending field, specifically with BN/FTX tokens attempting Tokenized Stocks, which were shut down shortly afterward.

3. Compliance Phase, 2023-Present: Compliance has become clearer/some RWA assets have expanded rapidly (stablecoins, US Treasury bonds, etc.), and new asset types and platforms have shown promise.

Therefore, in my opinion, the mainland's characterization of RWA is objectively a positive development, but not entirely positive . It can even be described as a belated notification. Moreover, Hong Kong once introduced a similar system, ABT, but did it take off?

Clearly, compared to the situation in the other hemisphere, there hasn't been much improvement, which is closely related to Hong Kong's extremely cautious management of licenses. Whether to proceed with sweeping changes from the outset or to gradually test and constrain the market, the choice between the two will likely scare away many aspiring platform providers.

The new system is more open, but what is open may not necessarily be what users actually want to use or what the market needs.

We can see that Aave's Atoken is very successful because it addresses the issue of how to use idle on-chain assets, allowing users to lend them out.

seETH is also great because it solves the problem of opening up the path to POS (Proof-of-Stake). Although there is a risk of Lido accumulating too much amount (stake), it solidly provides stable returns for staking. Similarly, you can read my article on Jito, which is another staking model.

They all care deeply about user experience and are adept at handling every detail of compatibility and project costs.

Therefore, the issuance itself is not the goal; the value lies in applying on-chain liquidity, fragmentation, transparency, and automation to the token.

It's not about defining a perfect standard right away, but about respecting the rules and consensus, and leveraging existing strengths step by step.

Just like regular stocks, exchanges don't operate 24/7, but on-chain exchanges do.

Gold in different markets has its own opening hours, but not on the blockchain.

This time gap is where the true value of the blockchain lies, because it solves the problem of value discovery in markets without transactions. Compared to pre-market trading, it is more sensitive; compared to cross-exchange price discrepancies, it has less wear and tear. Moreover, global liquidity represents a completely different perspective on value discovery. In the future, company pricing may not be based on the current on-chain reliance on the NYSE, but rather the NYSE might first check the on-chain data before listing.