Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is attracting widespread attention from the market, and analysts are closely monitoring its potential future trends.

According to the latest data from CryptoQuant, the market dynamics of Ethereum show accumulation behavior and inflows into Exchange Traded Funds (ETFs). However, the data also indicates that in the current market cycle, Ethereum's performance has been relatively weaker compared to Bitcoin. This relative weakness may be due to the market's capital flowing more into Bitcoin, and the continued dominance of institutional investor interest in Bitcoin ETFs over the market sentiment.

Nevertheless, analysts point out that Ethereum still has strong fundamental support, and as market sentiment and capital flows change, it may present new growth opportunities in the future.

Analyzing Accumulation and ETF Inflow Trends

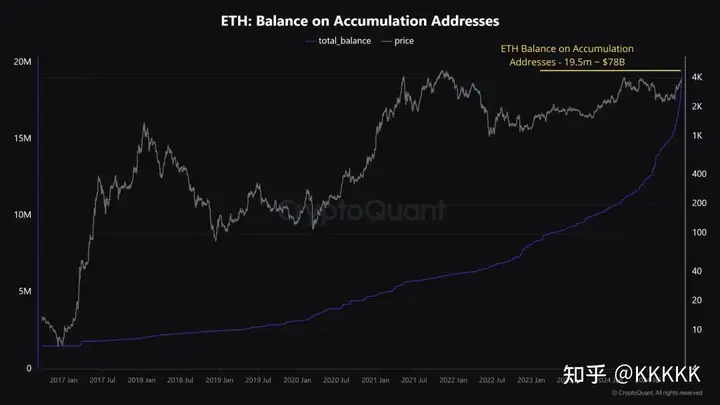

In a series of posts on the social media platform X, CryptoQuant analysts dissected Ethereum's key metrics. One prominent observation is the accumulation of Ethereum addresses. These addresses now hold around 19.5 million ETH, worth approximately $78 billion.

In comparison, the accumulation addresses for Bitcoin currently hold around 2.8 million BTC, worth a staggering $280 billion. Although the held value in US dollars is four times that of Ethereum, this ratio is consistent with the difference in their market capitalizations, reflecting the investment behavior patterns in these two assets.

Furthermore, the steady inflows into Ethereum Exchange Traded Funds (ETFs) have become a focus of market attention. The inflow volumes on certain key dates were particularly significant, such as $1.1 billion on November 11 and $839 million on December 4, 2024. This continuous inflow reflects the strong market interest in Ethereum.

According to CryptoQuant's analysis, these capital inflows not only indicate the buying interest of institutional investors in Ethereum but also highlight the increasing appeal of Ethereum among large investors. This trend may further solidify Ethereum's market position as a leading crypto asset and provide support for future price growth.

While the demand for Ethereum ETFs remains strong, its price performance has been relatively muted compared to Bitcoin's in the current cycle. Historically, Ethereum's price peaks have typically lagged behind Bitcoin, a pattern that was particularly evident in the 2021 bull market.

At that time, Bitcoin reached a new all-time high (ATH) in March, with a cumulative gain of 480%. Ethereum, on the other hand, reached its peak a few months later, with a staggering 1,114% increase. However, in the current cycle, Ethereum's performance has not been as strong as in the past. This divergence may suggest that market dynamics are undergoing significant changes or that investors' focus is shifting from the traditional historical patterns to new market drivers.

Recipient Numbers and Potential Growth

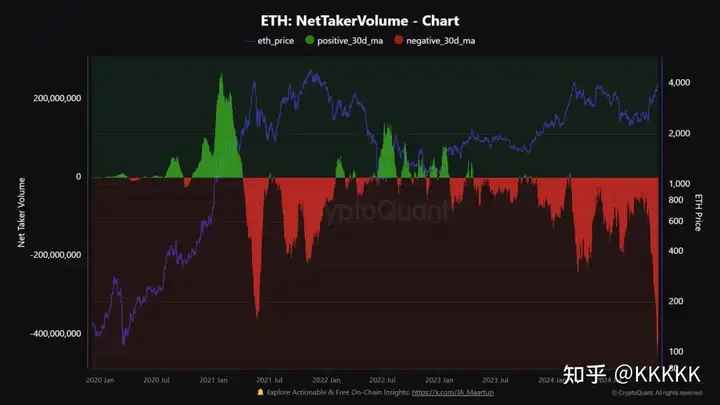

Additionally, one important area highlighted by the analysts is the number of Ethereum recipients, which reflects market sentiment through the comparison of active buying and selling activities.

CryptoQuant's report indicates that Ethereum's buy-sell volume has reached a historic low of -$400 million. This aggressive selling activity is reminiscent of the patterns observed before Ethereum reached its all-time high in 2021. While the current selling pressure may appear bearish, it could also signal an impending critical turning point in the market.

Analysts emphasize that Ethereum's underperformance in the current cycle does not rule out the possibility of significant growth.

The interplay between the accumulation patterns, ETF inflows, and recipient numbers suggests that Ethereum still has upside potential.