Tác giả: TechFlow

Ông Justin Sun không thể ngồi yên được.

Trong những ngày gần đây, CZ và He Yi đã trực tiếp tham gia tương tác với cộng đồng, mang lại cho hệ sinh thái BSC những Meme mới và lưu lượng khổng lồ, toàn bộ hệ sinh thái BSC gần như đều đang tăng, cộng đồng rất phấn khích.

Về việc ảnh hưởng cá nhân mang lại lưu lượng cho hệ sinh thái, ông Sun là người thành thạo nhất.

Nhìn thấy sự sôi nổi của Meme trên BSC, ông Sun @justinsuntron cũng bắt đầu một lần nữa "bán hàng" thị trường Meme Tron của ông.

Lưu ý: Giá của các token Meme biến động mạnh, có rủi ro cao, nhà đầu tư cần đánh giá đầy đủ rủi ro và tham gia thận trọng. Bài viết chỉ chia sẻ thông tin dựa trên các điểm nóng thị trường, tác giả và nền tảng không đảm bảo tính đầy đủ và chính xác của nội dung, đồng thời không đưa ra bất kỳ lời khuyên đầu tư nào.

Điểm nóng mới xuất hiện, mùa Meme Tron sẽ quay trở lại?

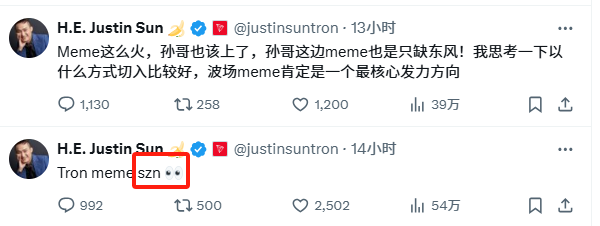

Tối nay, ông Sun bắt đầu nhắc đến chủ đề liên quan đến Meme Tron thường xuyên, trước tiên đăng tweet nhắc đến "Tron meme szn👀" (Mùa Meme Tron).

Từ khóa "szn" trong tweet cũng nhanh chóng được cộng đồng bắt lấy và phát hành token $szn, sau đó giá trị vốn hóa thị trường của $szn đạt gần 17 triệu USD vào sáng sớm. Sau đó có thể do các Meme Tron khác phân tán lưu lượng, giá trị vốn hóa thị trường đã giảm mạnh, về khoảng 1,7 triệu USD.

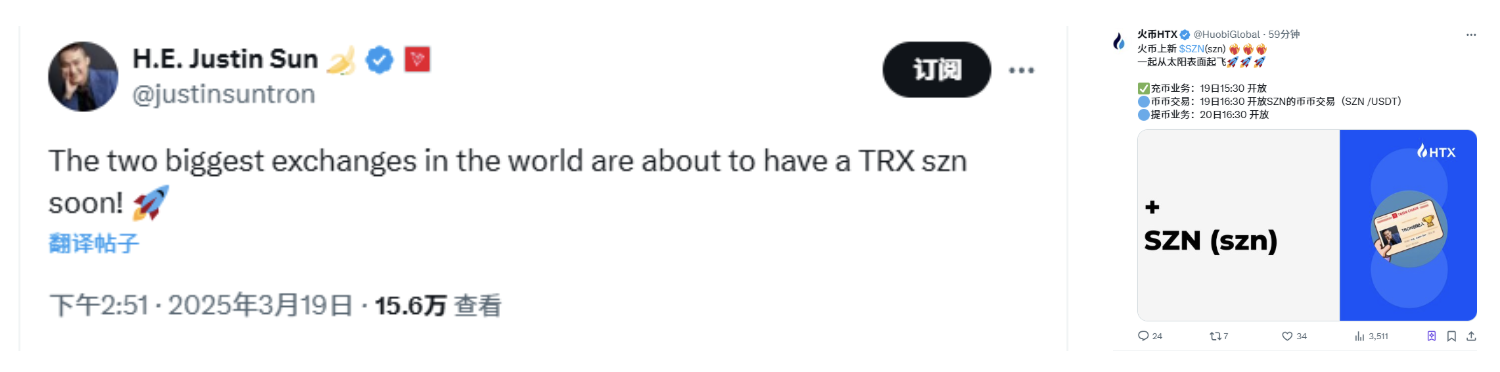

Lúc 14:51, ông Sun lại tweet rằng: "Hai sàn giao dịch lớn nhất thế giới sắp niêm yết TRX szn". Dù động thái này có ẩn ý $szn mới sẽ được niêm yết hay không, cộng đồng vẫn chọn mua vào. Sau đó, sàn giao dịch HTX @HuobiGlobal đã thông báo niêm yết $szn giao dịch spot, giá $szn nhanh chóng tăng trở lại, đạt mức giá trị vốn hóa thị trường gần 13 triệu USD.

Sau một số biến động lớn, hiện tại giá trị vốn hóa thị trường của $szn ở mức khoảng 9 triệu USD, giá có biến động lớn.

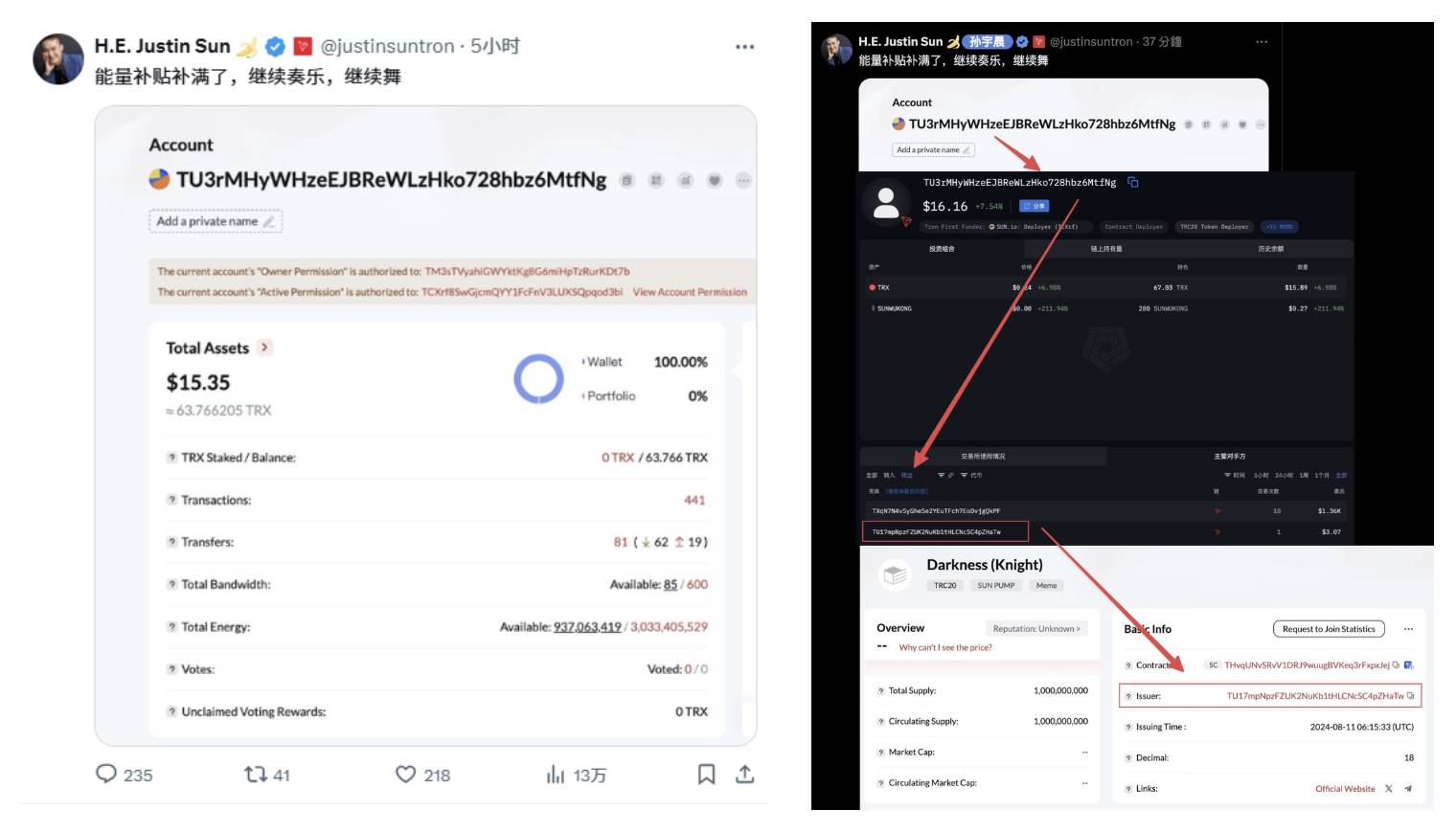

Sau khi $snz gây được nhiệt độ, ông Sun cũng tích cực bước vào "xây dựng". Ông thông báo cung cấp trợ cấp năng lượng TRX (miễn phí giao dịch cho người dùng) và đăng địa chỉ nạp năng lượng:

TU3rMHyWHzeEJBReWLzHko728hbz6MtfNg

Cộng đồng giải mã địa chỉ này là của chính ông Sun. Và phát hiện ra địa chỉ này 221 ngày trước đã chuyển 24,2 $TRX đến một địa chỉ khác

TU17mpNpzFZUK2NuKb1tHLCNcSC4pZHaTw

Và địa chỉ ví kết thúc bằng 4pZHaTw này đã phát hành một token $Knight(DARKNESS)

THvqUNvSRvV1DRJ9wuugBVKeq3rFxpxJej

Vâng, đến giai đoạn phân tán lưu lượng quen thuộc của các nhà chơi Meme rồi. Phát hiện này giúp những người không thể tham gia $szn kịp thời tìm được cơ hội mới. Giá $Knight đã tăng nhanh, đạt mức giá trị vốn hóa thị trường 8,88 triệu USD, tăng gần 100 lần. Sau đó ông Sun cũng tương tác với tweet có hình ảnh $Knight, tất nhiên cũng thu hút một phần lưu lượng từ $snz, đây cũng là một trong những lý do $snz giảm giá như đề cập ở trên.

Những Meme từng nóng hổi giờ ra sao?

Về câu chuyện nhiệt độ Meme luân phiên, cơ bản giống hệt với mùa hè năm ngoái. Chỉ là lúc đó là Meme Tron của ông Sun trước tiên bùng nổ, tạo ra các Meme mới như $SUN, $SUNDOG, $SUNWUKONG.

Hôm nay, nhiệt độ Meme Tron quay trở lại, những Meme hàng đầu của đợt trước thì sao rồi?

$SUNDOG (Sundog)

Địa chỉ hợp đồng:

TXL6rJbvmjD46zeN1JssfgxvSo99qC8MRT

Khối lượng giao dịch 24H: 1,4 triệu USD

Giá trị vốn hóa hiện tại: 61 triệu USD

Giá trị vốn hóa cao nhất: 380 triệu USD

$SUNWUKONG (SunWukong)

Địa chỉ hợp đồng:

TP3prcvQknVthrVnn281cKST56eWiLgJJM

Khối lượng giao dịch 24H: 1,1 triệu USD

Giá trị vốn hóa hiện tại: 1,26 triệu USD

Giá trị vốn hóa cao nhất: 38 triệu USD

$TBULL (Tron Bull)

Địa chỉ hợp đồng:

TPeoxx1VhUMnAUyjwWfximDYFDQaxNQQ45

Khối lượng giao dịch 24H: 950.000 USD

Giá trị vốn hóa hiện tại: 4 triệu USD

Giá trị vốn hóa cao nhất: 31 triệu USD

Kết luận

Xét về giá cả, những Meme nóng hổi trước đây đều có biểu hiện trung bình, chỉ là một đợt tăng theo xu hướng, và vẫn còn cách rất xa so với mức giá trị vốn hóa cao nhất trước đây. Hiện tại, nhiệt độ Meme Tron vẫn còn hạn chế, chưa đủ để làm toàn bộ hệ sinh thái nóng lên. Liệu đây chỉ là khởi đầu của một đợt nóng hổi mới hay lại là một cơn sốt tạm thời rồi lại nguội lạnh, điều này có liên quan mật thiết đến các hoạt động tiếp theo của ông Sun - trung tâm nhiệt độ của Tron.

Đồng thời, cách thức mà ông Sun thông qua tương tác cộng đồng → "giải mã quá mức" của cộng đồng → thúc đẩy nhiệt độ của hai Meme này cũng để lại ấn tượng sâu sắc với các nhà chơi Meme.

Trước những điểm nóng thay đổi nhanh nhưng nền tảng đồng thuận còn mong manh, nếu bỏ lỡ cơ hội tham gia sớm, có lẽ "nhìn nhiều, làm ít" là cách vận hành tốt nhất sau này.

Hy vọng lần này ông Justin Sun có thể mang lại nhiệt độ, và trong những màn trình diễn hoa mỹ, không làm tổn thương những người nông dân, mang lại cho thị trường niềm tin để tiếp tục chơi.