After struggling to break through the $61,500 resistance level for two consecutive days, the price of Bitcoin rebounded today. According to Bitpush data, shortly after the opening of the U.S. stock market on Monday, the intraday price of BTC once reached $63,269. As of press time, it was $62,907, up 2% in the past 24 hours.

Markets await inflation data

Market participants are awaiting U.S. inflation data to help determine whether the Federal Reserve will cut interest rates in 2024. The U.S. Producer Price Index (PPI) is expected to be released on May 14 local time, followed by the Consumer Price Index (CPI) on May 15.

According to CME 's FedWatch tool, market analysts are pricing in a 72% chance of interest rates remaining unchanged at the July Federal Open Market Committee ( FOMC ) meeting, while the odds of a rate cut later this year have been pushed up to a 48.6% chance at the September meeting, with traders pricing in a 91.1% chance of interest rates remaining unchanged at the June meeting.

Nearly two-thirds of economists polled by Reuters from May 7 to 13 (70 of 108) predict the federal funds rate will be cut for the first time in September, by 5.00%-5.25%. When surveyed last month, just over half expected a rate cut in September. Only 11 predicted a rate cut in July, and none said a rate cut in June, compared with 26 in the April survey, and four in June.

Commenting on this week's market dynamics, analyst Tedtalksmacro said, "Inflation data is in focus and volatility is expected. However, this is the first time in a while that we may see a slowdown in inflation data."

The analyst explained that lower inflation would be “good for risk assets like Bitcoin,” putting the market on the “edge of moving higher.”

Analyst Seth shared the chart below in a post by X, saying that the relative strength index (RSI) has broken above its falling trendline on the daily time frame.

The analyst admitted that this week’s “CPI, core CPI, PPI and FED Chairman’s speech” may affect the direction of BTC prices. He said: “Jerome Powell may help us regain confidence. The US economy is not as strong as the data shows. The real unemployment rate announced by the Ludwig Institute is 24.2%, while the real unemployment rate reported by the US Department of Labor is 3.8%.”

Bitcoin price could rebound if Coinbase premium turns negative

Bitcoin has been in a long downtrend since reaching an all-time high of $73,835 on March 14. The Coinbase Premium Index, which reflects BTC’s price action, has fallen from $0.08 to near zero over the same period, according to data from CryptoQuant.

The Coinbase Premium Index represents the percentage difference between the BTC/ USDT pair on Binance and the BTC/USD pair on Coinbase Pro.

Analysts at CryptoQuant explained that the Coinbase Premium Index is an important “leading” indicator that can be used to predict BTC price movements.

Historically, if this indicator turns negative and reverses from a downtrend to an uptrend, the BTC price always rebounds, as shown in the chart below.

The analyst added that the Coinbase Premium Index, while currently positive, is “close to zero” at press time, “if historical patterns repeat themselves, we may have a better chance of success if we wait a little longer and invest in a rebound after the trend turns negative.”

Cryptocurrency trader Mustache expressed optimism, arguing that the current move should lead to more sustained gains like previous halving cycles.

In a May 13 post by X, he commented: “Before BTC can rise to $80,000, the Weak Hand needs to be washed out of the market. It has always been like this in the past. The structure is the same, just the price is different.”

Short-term holders may influence the trend

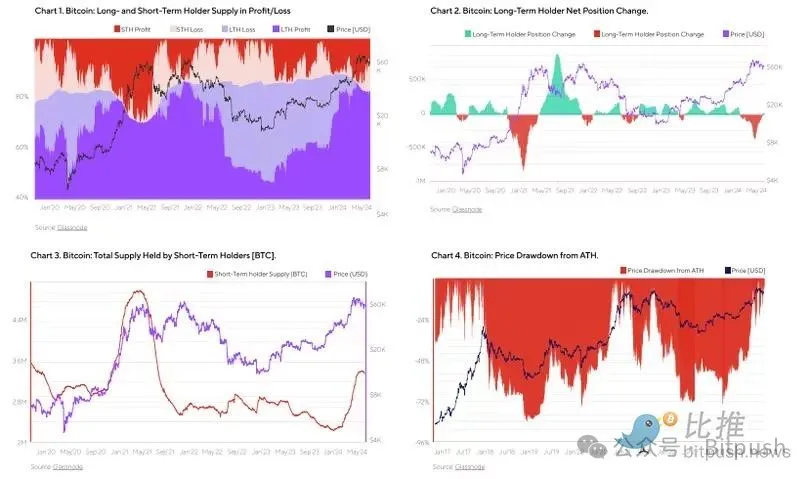

On the other hand, analysts at cryptocurrency investment firm Ryze Labs said in a weekly report that the behavior of short-term Bitcoin holders (or those who hold coins for less than 155 days) may greatly affect the market in the coming months.

Ryze Labs says 94% of long- and short-term Bitcoin holders were profitable in three instances: from mid-November 2017 to mid-April 2017, from mid-February to mid-April 2021, and most recently, from late February to early April 2024.

The value of Bitcoin held by short-term investors peaked at $117.8 billion in 2017 and reached $289.9 billion in 2021. During this period, long-term holders and miners sold Bitcoin to short-term holders who held it for less than 155 days.

However, after these peaks, losses for short-term holders increased rapidly, leading to a reversal of the cycle where short-term sellers sold to long-term holders. The team observed that historically, this shift led to a significant drop in Bitcoin prices within the next four to six months.

Analysts said: "During the most recent cycle, short-term holders held $218.9 billion worth of Bitcoin. While most initially made a profit, they began to sell actively. About a month after this period, the maximum price drop from the high of the period was about 6%. The current cycle may differ from previous cycles due to institutional demand supported by improving macroeconomic conditions. However, if these supporting factors weaken, Bitcoin prices may experience a decline similar to past cycles."

FxPro trader Alex Kuptsikevich said in a note on Monday that the price action was characterized by a series of lower lows and lower highs, a sign that investors were selling as prices rose.

Kuptsikevich believes that a drop below $60,000 could trigger panic selling, but at present it is more likely that prices will rise above $65,000, and the 50-day moving average in early May is a technical level worth paying attention to.