A. Market View

1. Macro liquidity

1. Macro liquidity

Monetary liquidity weakened. After the non-farm data released a signal that the labor market was cooling, the market's expectation for the first Fed rate cut has been brought forward from September to November. The April CPI data to be released next week will provide clearer new clues to the US economic outlook. In addition, the Fed will slow down the pace of quantitative tightening from June, reducing the monthly Treasury redemption limit from $65 billion to $25 billion. The US stock market fluctuated sideways, hitting the face left and right. The crypto market followed the US stock market in fluctuations.

2. Market conditions

2. Market conditions

The top 100 companies with the highest market capitalization:

This week, BTC fluctuated sideways, while altcoins rebounded. The main market trend revolved around the Meme and AI sectors, and the leaders of these two sectors were the first to return to the starting point of the decline.

1. EIGEN: The re-pledged Eigenlayer airdrops 15% of the tokens (5% for the first phase and 10% for one year), with a futures price of $17 billion. The TVL of LDO in the same track is twice that of the former, with a market value of only $2 billion. The airdropped tokens are locked and cannot be traded. 2. FRIEND: FRIEND is a social protocol on the Base chain. The economic model design is slightly flawed, and the KOLs who shill have airdrop benefits. 3. PUMP: The revenue of PUMP, the SOL chain Meme coin launch platform, exceeds Uniswap, with an annualized revenue of $150 million. PUMP provides a one-stop service for Meme release and charges a 1% fee.

3. BTC market

3. BTC market

1) On-chain data

BTC prices fell immediately after the halving and recorded the worst halving performance on record. The market trend before and after the fourth halving is very similar to previous cycles.

The market value of stablecoins remains flat, and long-term funding fundamentals remain positive.

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level of 1, and the holders are generally in a loss state. The current indicator is 2.1, entering the middle stage.

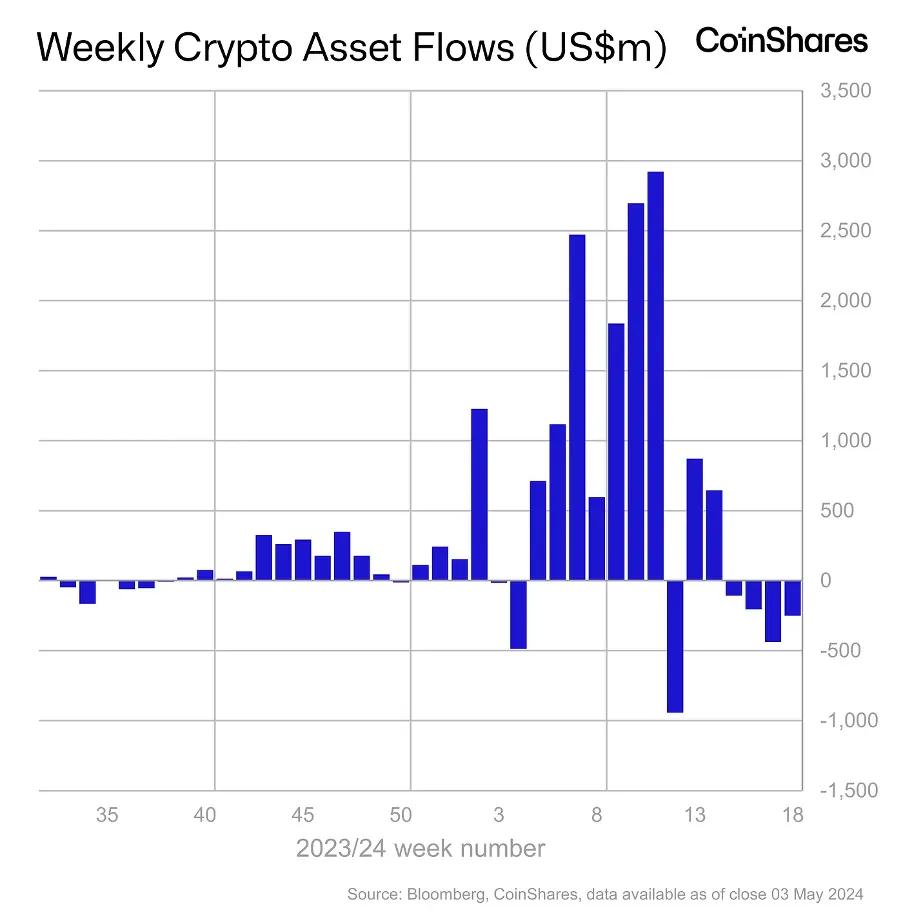

Institutional funds have been experiencing net outflows for four consecutive weeks, with an overall outflow of US$450 million in April.

2) Futures market

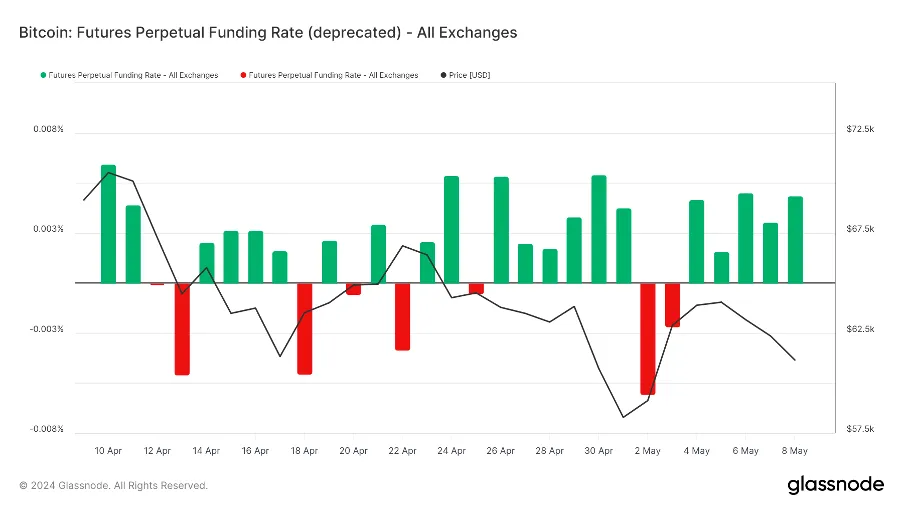

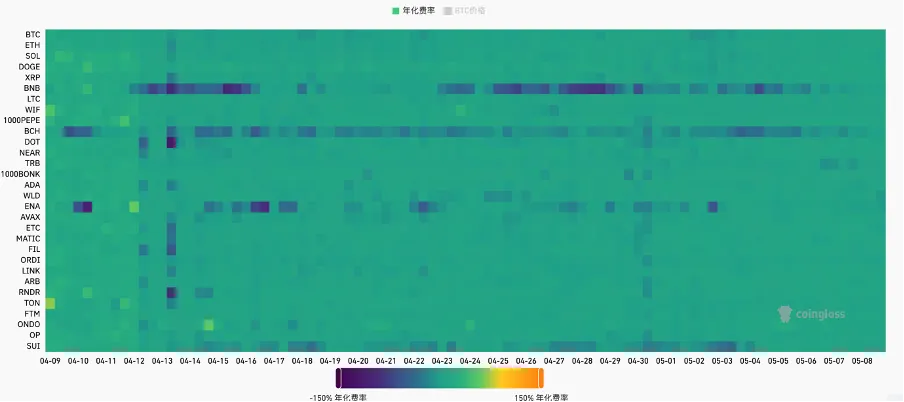

Futures funding rate: This week's rate is close to 0. The rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the rate is -0.1-0%, with more short leverage, which is the short-term bottom of the market.

Futures open interest: BTC open interest remained unchanged this week.

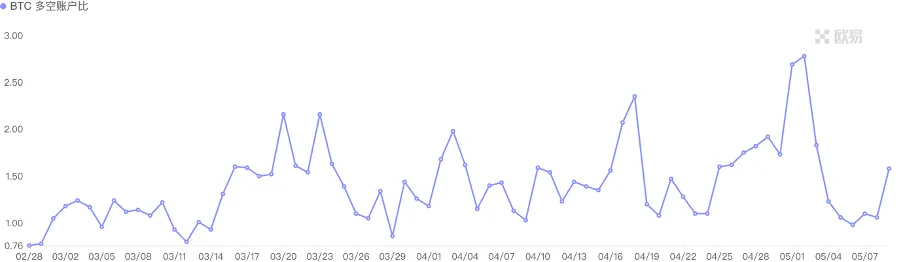

Futures long-short ratio: 1.6, market sentiment is neutral. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, above 2.0 is more greedy. The long-short ratio data fluctuates greatly, and its reference value is weakened.

3) Spot market

BTC fluctuated sideways, fluctuating around the $60,000 mining machine shutdown price. Spot ETF funds continued to outflow, and it is expected to fluctuate widely in the months before the Fed's interest rate cut in September. In history, after the first bull market retracement of BTC, funds flowed out to Altcoin.

B. Market Data

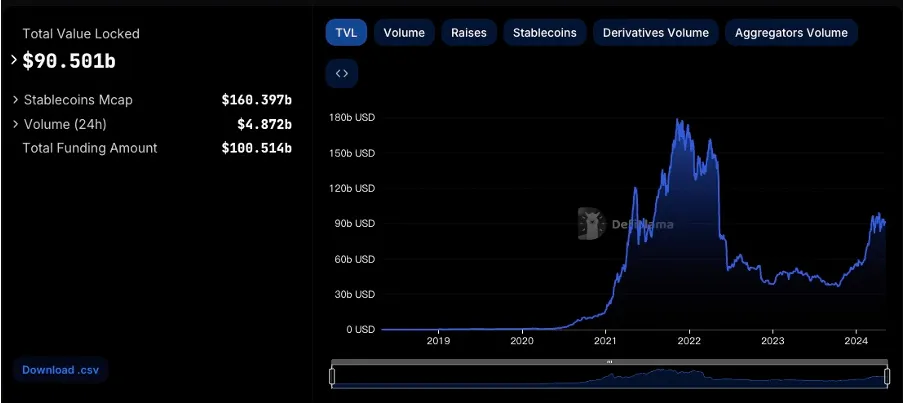

1. Total locked-up amount of public chains

1. Total locked-up amount of public chains

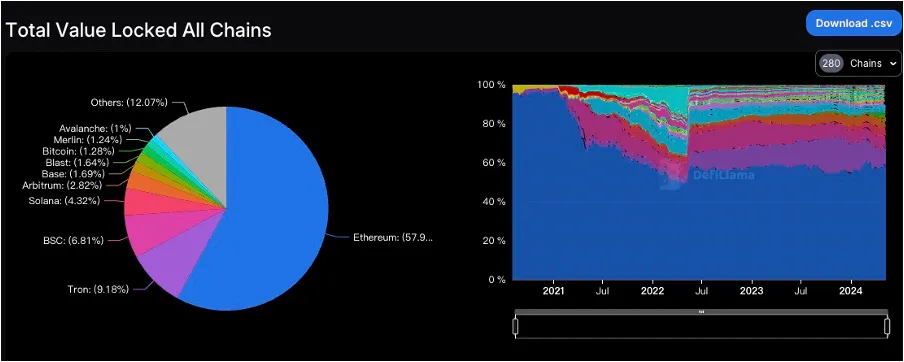

2. TVL Proportion of Each Public Chain

2. TVL Proportion of Each Public Chain

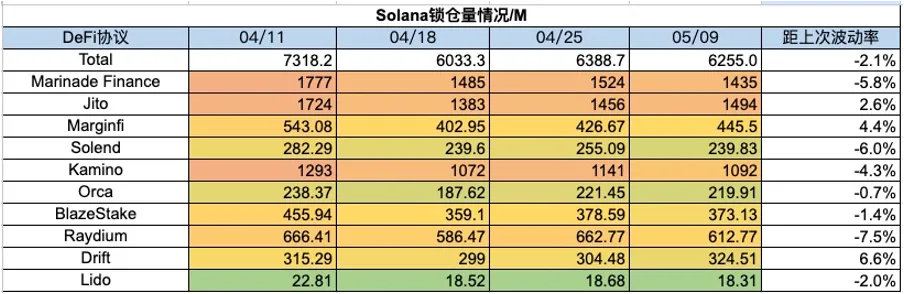

The total TVL this week is around $90.5 billion, down $2.5 billion or 2.7% overall. This week, the TVLs of the mainstream public chains all rose to varying degrees, with ETH up 3%, TRON up 6%, ARB up 3%, BLAST up 2%, BASE up 9%, SOLANA and MERLIN up 10%, and the most outstanding BSC up 20%. The TVLs of Jito, Marinade and Kamino, the three leading projects of the most popular SOLANA chain in this period, all exceeded $1 billion at the same time for the first time, which is also the first time that this has happened to the SOLANA chain recently. As the main public chain leading this bull market, the SOLANA chain has almost become the first choice for the development of Memes projects. We should be able to see more projects exceeding $1 billion on the SOLANA chain in the next few months.

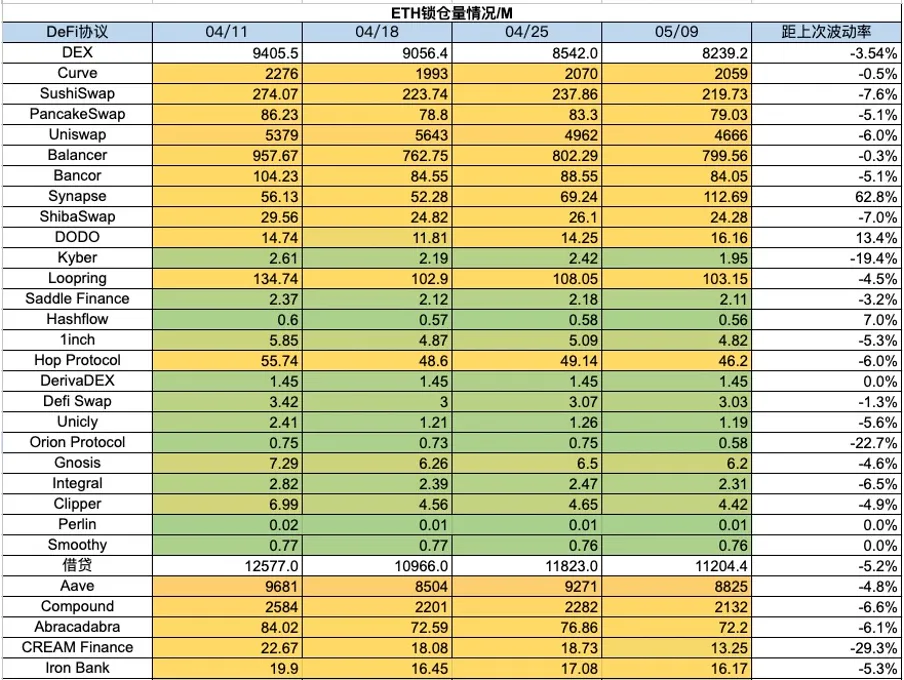

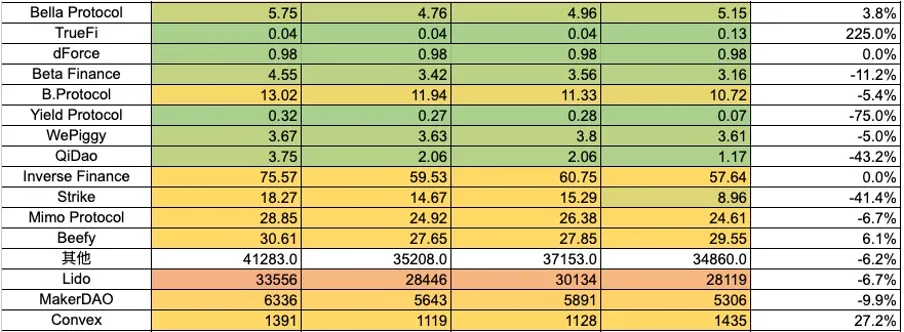

3. Locked Amount of Each Chain Protocol

3. Locked Amount of Each Chain Protocol

1) ETH locked amount

2) BSC locked amount

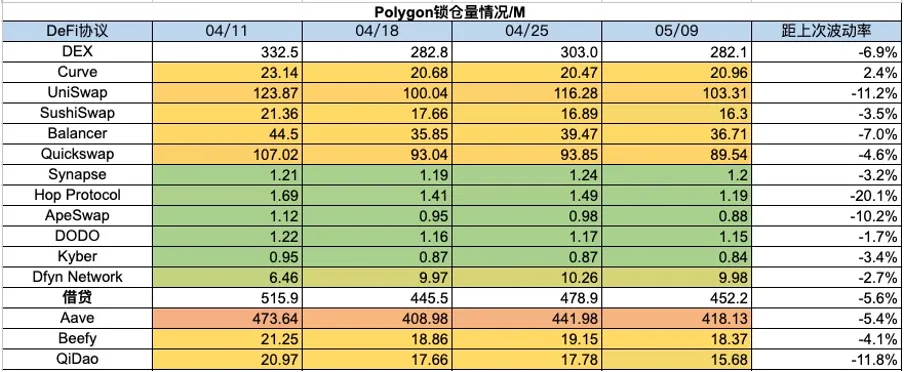

3) Polygon locked-up amount

4) Arbitrum locked amount

5) Optimism locked amount

6) Base lock-up amount

7) Solana locked amount

4. Changes in NFT Market Data

4. Changes in NFT Market Data

1) NFT-500 Index

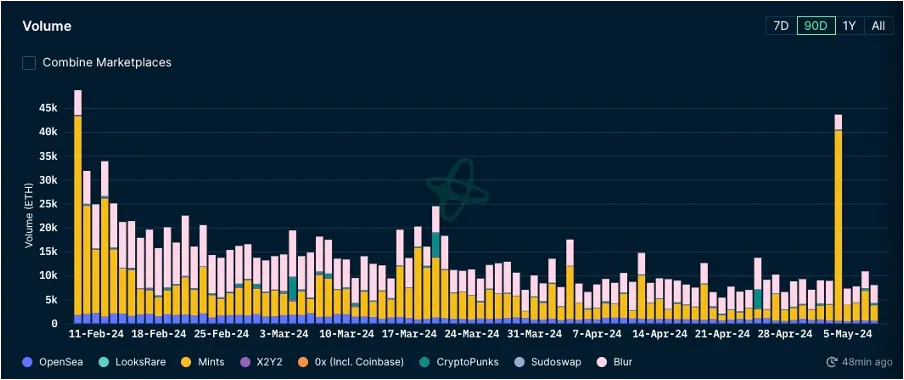

2) NFT market situation

3) NFT trading market share

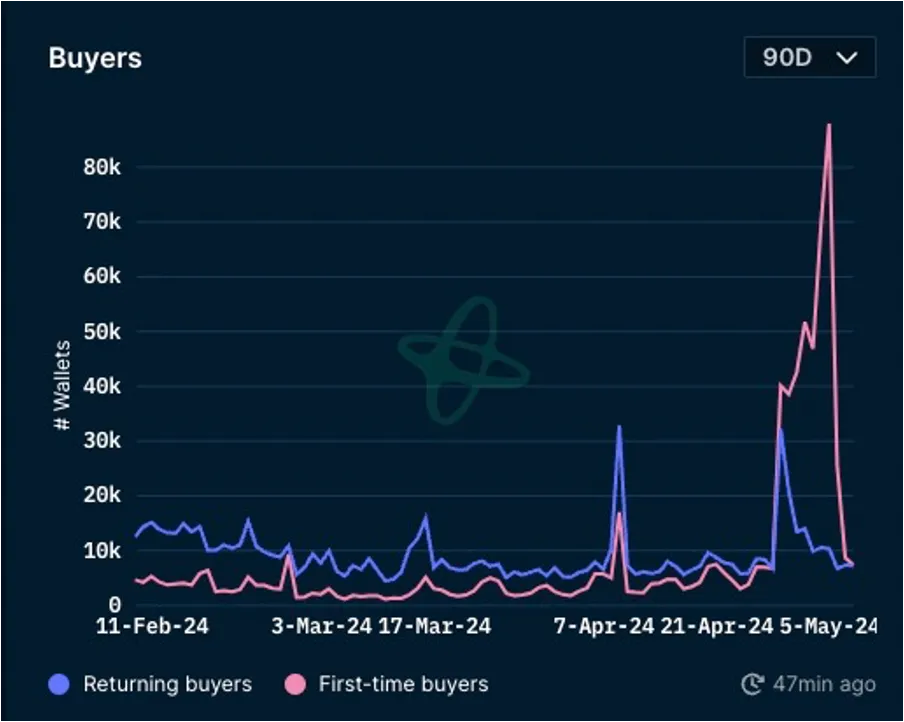

4) NFT Buyer Analysis

This week, the floor prices of blue-chip projects in the NFT market have risen and fallen. The market did not continue to fall. This week, BAYC rose 3%, Pandora soared 32%, Pixelmon rose 22%, and LilPudgys rose 8%. DeFrogs plummeted 39%. There was a slight increase in NFT market transactions, and the number of first-time and repeat buyers has rebounded. There are no hot spots in the NFT market at this stage, and the current sluggish market situation has a certain impact on the confidence of investors and speculators.

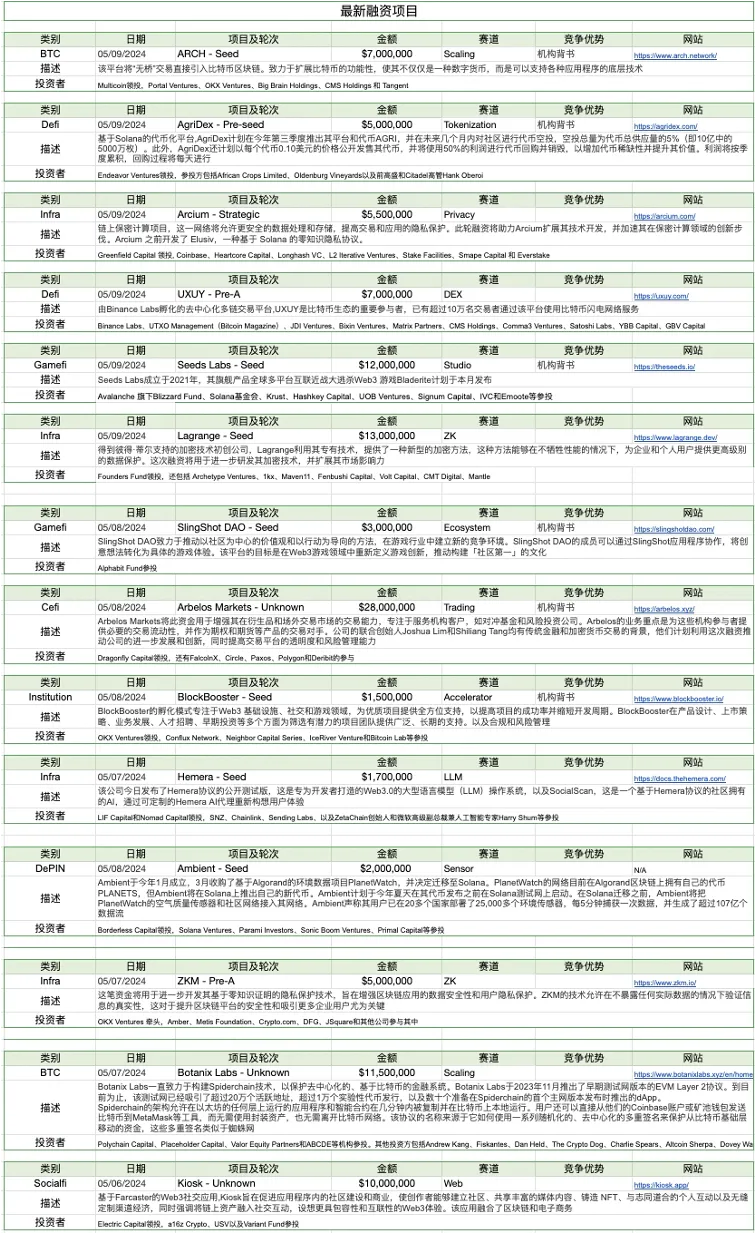

V. Latest project financing situation

6. Post-investment dynamics

1) OLA — ZKVM

Ola will take its first token distribution snapshot at 20:00 on May 11 to reward early users who participated in the mobile ZKP verification network Massive. Ola said that since its launch in April, the number of node registrations has exceeded 200,000. After the first token distribution snapshot, the points of Massive participants will be reset and the second phase will be started to provide users with a relatively fair way to participate. After this snapshot, each terminal still needs to remain active in the Massive network to ensure the final eligibility for tokens.

2) Ultiverse — AI Gaming Platform

Ultiverse Gold Chip NFT announced the winning results. According to Blur data, the floor price of Gold Chip increased from 0.25 ETH to 0.5 ETH, an increase of 100%, and the 1-hour trading volume exceeded 400 ETH. It is currently ranked second on the BLUR transaction list, second only to BAYC.

3) bitSmiley — BTC native stablecoin

Xterio and BNBCHAIN announced a partnership. This important strategic partnership enables us to bring rich AI and Web3 immersive gaming experiences to millions of users and further promote the global application of BNB. bitSmiley's ecological project bitCow was launched on the Bitcoin second layer Bitlayer mainnet on May 1. As of now, the total TVL of bitCow has exceeded 9 million US dollars.

bitCow is an AMM project built by the Bitcoin native stablecoin project bitSmiley around its stablecoin bitUSD. bitSmiley is committed to providing users with a more comprehensive and rich Bitcoin DeFi ecosystem with bitUSD as the core.